FOMC Minutes stoke confusion, but "Fed rate cut trade" unwinds a bit further.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

The FOMC Minutes released yesterday afternoon had something in it for both sides of the Fed rate cut debate in our opinion. A couple of Fed members (Bullard and Kashkari) wanted the committee to cut interest rates by 50bp at the July 31st meeting, but a number of them didn’t want any rate cuts as at all given the “absence of clarity” on risks to the outlook. A number of participants were still concerned about trade uncertainty, but most saw the 25bp rate cut as a “mid-cycle adjustment” which was “prudent from a risk-management perspective”, and not the start of a new monetary easing cycle. The Fed still believes the economy is “in a good place, bolstered by confident consumers, a strong job market, and a low rate of unemployment”, but continues to acknowledge that inflation is running persistently below the committee’s 2% objective. Finally (and we had a good laugh over this one) the Fed padded itself in the back for how it now has an improved understanding of how quantitative easing (QE) works and that “as a result, the committee would proceed more confidently and preemptively is using these tools in the future if economic circumstances warranted”. Did they just tell us that they wished they would have done more QE over the last decade, and that we’ll get a whole heck more of it sooner next time around? The bottom line, in our opinion, is that the Fed either still doesn’t know what it’s doing or it knows full well what’s going on in the global money markets and needs to deliberately cause confusion so that these markets don’t panic. All this being said and after some initial gyration following the release of the FOMC Minutes yesterday, market participants voted to unwind the “Fed rate cut trade” a little further ahead of tomorrow’s speech from Jerome Powell at Jackson Hole. Bond, Eurodollar and gold futures moved lower into the overnight session and the USD traded broadly higher. USDCAD, in particular, was able to regain trend-line chart support in the 1.3270s and rally above the 1.33 handle into early European trade. However, some better than expected August Manufacturing PMI data out of Germany (released around the 3amET hour) has derailed the upside momentum. Canada just reported its Wholesale Sales figures for the month of June and the numbers beat expectations (+0.6% MoM vs -0.2% expected). On the surface this sounds like another good Canadian data item (and so USDCAD has ticked lower some more), but this report comes on the heels of a dismal Wholesale Sales report for May and the report also showed a 10th consecutive monthly climb in inventories (which is a little bit worrisome).

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

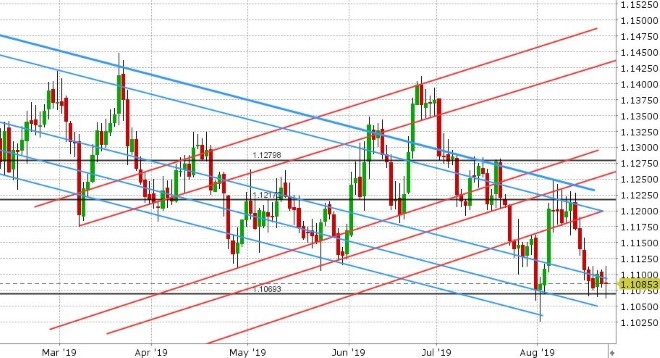

EURUSD

Euro/dollar has been all over the map so far today. It fell below yesterday’s price pivot in the 1.1090s amidst the broad USD buying that followed the release of the FOMC Minutes, closed NY trading below this level, and this in turn led to further selling in Asia. The better than expected August Manufacturing PMI out of Germany (43.6 vs 43.0 exp) then shocked some life into the market which saw EURUSD shoot above the 1.1090s. However, traders had a good look at the internals of the report afterwards it appears there was a bit of lipstick on this pig and so EURUSD scurried back lower (New orders fell at the fastest rate since April 2013, while business confidence was negative for the first time since November 2012). More here from IHS Markit, who issues the monthly PMI report. The market now sits above yesterday’s NY lows in the 1.1060s (new horizontal chart support), but with not much momentum in either direction. Today’s NY session features the release of the US Markit PMIs at 9:45amET, with traders expecting 50.5 for Manufacturing and 52.8 for Services.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling traders are trying the upside today after yesterday's post FOMC Minutes demand for USD failed to push GBPUSD below trend-line support in the 1.2110s. This allowed the market to follow EURUSD higher in early European trade in our opinion following the release of the better than expected August Manufacturing PMI out of Germany. Euro/dollar’s reversal lower seemed to affect GBPUSD as well, but sterling continued to find buyers on the dip. Traders appeared to be comforted by the positive tone in today’s joint press conference from both UK PM Johnson and French President Macron regarding Brexit. Germany’s Angela Merkel is back at again this morning too with yet some more positive Brexit comments: “We can find a solution to the backstop by October 31…we can work on finding a regime that keeps the Good Friday Agreement and also ensures the integrity of the single market”. With these headlines, GBPUSD is now exploding higher past chart resistance in the 1.2170s. If this breakout higher holds into the NY close today, we think we could see some further short covering from the fund community which could take the market all the way up to the mid-1.23s (given the very large price range for July 29th).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is struggling today and, like EURUSD, it really got started with the broad USD buying that followed the FOMC Minutes yesterday. This put pressure on trend-line chart support at the 0.6770s into Asian trade overnight and the market gyrated above and below this level pretty much in lock-stop with EURUSD following the release of the PMIs out of Germany earlier. The market currently sits below the level and it looks like traders might attempt another foray above it should EURUSD trying to regain the 1.1090s.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen closed NY trade yesterday above trend-line resistance in the 106.50s, and while this was technically positive in our opinion, buyers didn’t seem convinced and instead took the market back lower with last night’s bid to bond prices (a move which tried to shake off the initial weakness following the FOMC Minutes). Bond prices have resumed lower since however (yields rising) and this has allowed USDJPY to recover into NY trade today. We think the market could take another stab at breaking above the 106.50s today, but we feel it might need another fundamental catalyst to help it (ie. another headline that would knock the Fed rate cut trade). Japan reported its August Manufacturing PMI last night and it missed expectations (49.5 vs 49.8).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com