Fed under pressure today to cave to market's demand for rate cuts later this year

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

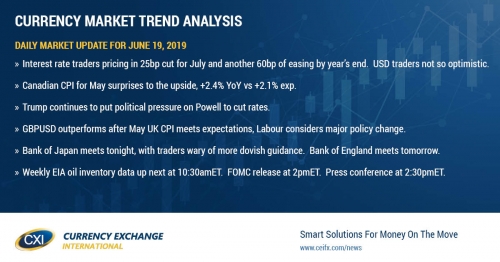

Dollar/CAD was trading steady above chart support in the 1.3370s this morning as the broader markets go into a lull ahead of the FOMC meeting later today. Yesterday’s move lower off the 1.34 handle was Trump inspired, after the President confirmed he would be meeting with China’s Xi at the G20 next week. This led to a 4% rally in oil prices and broad USD selling against commodity currencies, which in turn saw USDCAD pull back to test the trend-line resistance level it broke through on Friday. Canada just reported its CPI numbers for May and they impressively beat expectations (+2.4% YoY vs +2.1% on the headline and +2.1% YoY vs +1.2% on the core measure), and with that the market has shot lower to test the next support level in the 1.3330s. Next up are the weekly EIA oil inventory numbers at 10:30amET, where traders are expecting a draw of 2.9M barrels after the weekly API report showed a decline of 0.812M barrels last night. However, the highlight for today’s session will be the FOMC decision at 2pmET and Jerome Powell’s press conference at 2:30pmET. Interest rate traders are expecting the Fed to cave to the market’s demand for a 25bp rate cut as early as July and they’re still expecting around 60bp of additional easing by the end of 2019. US dollar traders, on the other hand, have tempered back these expectations for almost a week now, as they’ve digested a resolution to the US/Mexico tariff threat and some arguably decent US economic data (retail sales, industrial production, stable CPI, and upward revisions to Q2 GDP from the Atlanta Fed). Adding to the stakes for Jerome Powell today is incessant political pressure from President Trump for the Fed to cut interest rates, and we found the timing of yesterday’s report from Bloomberg and the Kudlow/Trump response about possibly demoting the Fed chairman back in February as more than just coincidental. We think interest rate traders have set a very high bar for the Fed to deliver a dovish surprise later today and therefore we think there’s a good chance the Fed will disappoint markets today. Should this happen, we would expect US yields to pop higher and the USD to follow suit.

USDCAD DAILY

USDCAD HOURLY

AUG CRUDE OIL DAILY

EURUSD

Euro/dollar is hovering around the 1.1200 mark as over 5blnEUR in options expire within 10pts of the figure this morning. Yesterday’s dovish tones from the ECB’s Mario Draghi appear to be having some effect on interest rates markets as both the Euro 5y5y inflation swap forward and German bund yields have bounced today off their all-time record lows. It’s hard to extrapolate much from this move yet, plus we think those who are long bonds (which is very crowded trade at this point) are likely lightening up on positioning ahead of the FOMC announcement later today.

EURUSD DAILY

EURUSD HOURLY

AUG GOLD DAILY

GBPUSD

Sterling is outperforming its G7 peers this morning after the UK reported in-line CPI figures for the month of May this morning. The reads were +0.3% MoM and +2.0% YoY and while these figures weren’t hot by any means, they’re not trending down like inflation expectations for the rest of Europe. Reports are also making the rounds today that Labour leader Jeremy Corbyn will formally announce that the party will change its Brexit policy to support a 2nd referendum (which we’d argue is GBP positive). GBPUSD has recouped Friday’s trend-line support level in the 1.2580s and the EURGBP cross continues to struggle after yesterday’s bearish “cloud cover” candle on the daily chart. All eyes are now on the Fed to see if the US central bank drops their patient stance on monetary policy and delivers aggressively dovish forward guidance. The funds have rushed to get net-short the market again in the last few weeks. Boris Johnson continues to come out on top of the Tory leadership board after a second round of votes were cast by MPs yesterday (126 votes received vs 114 in the 1st round). The Bank of England meets tomorrow to announce its latest interest rate decision, and while it’s widely expected they’ll stand pat due to Brexit uncertainty, we think there’s a risk of some hawkish (GBP positive) comments from governor Mark Carney given today’s CPI data and some recent comments from his fellow BOE members.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar rallied handsomely yesterday after a tweet from President Trump confirmed that US/China trade negotiators are re-engaging and that both leaders (Trump & Xi) will meet at the G20 summit in Japan next week. Chart resistance turned support, around the 0.6870 level, has given way at the start of NY trade today however, and we think this now makes the market vulnerable to the downside once again.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is trading with a range-bound tone this morning as traders await the Fed decision later today. Yesterday’s spike lows off the Japanese earthquake headlines quickly reversed into a market rally following Trump’s tweet, but all that got derailed after Bloomberg released a report about how the Trump administration debated demoting Fed chairman Powell back in February. Large option expiries this morning around 108.30-40 are keeping USDJPY stuck to current levels, but we think there’s a risk USDJPY shoots to the upside should bond markets be disappointed with the Fed’s decision later today. The funds remain net long USDJPY, but their position is less than 50% of what it was just a month ago. The Bank of Japan meets tonight to announce its latest decision on monetary policy and we think USDJPY longs are a little optimistic heading into this, given recent concerns from governor Kuroda about contracting global growth.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com