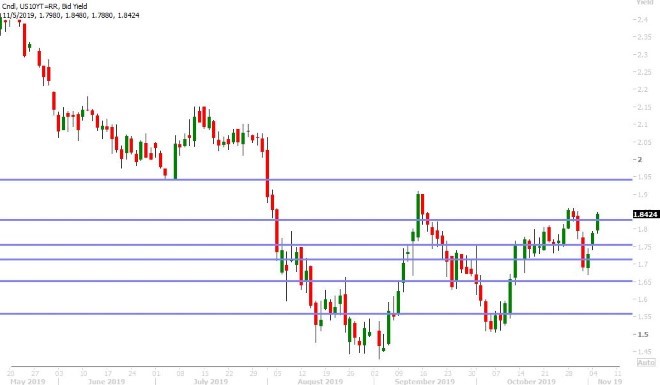

It's "risk-on" again for global markets, with US 10yr yields now cracking above 1.83%

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

It was “risk-on” again for global markets in the overnight session today. It all started with a report from the Financial Times that claimed the US is considering dropping some tariffs on China. The PBOC then added some fuel to the fire by cutting the rate on its 1-yr medium-term lending facility (MLF) by 5bp to 3.25%, which then saw USDCNH fall below the 7.00 level. We think the RBA’s hold to interest rates last night and their reiteration that the Australian economy has reached a “gentle turning point” was also supportive for risk. All this led to broad USD sales against commodity currencies in Asia and early European trade, but we saw some of this optimism get dialed back following a tweet from Global Times editor Hu Xijin around the 6amET hour:

“Based on what I know, Beijing will insist that the US proportionally remove existing additional tariffs simultaneously with China. The US keeping all tariffs, only suspending new tariff threat, in exchange for major concessions from China, China won’t accept such a phase 1 deal”.

This caused some mild, risk-off, USD buying but this widely followed mouthpiece for the Chinese government has since deleted his tweet and replaced it with the something a little less negative sounding:

“To reach a deal, China and the US must simultaneously remove the existing additional tariffs at the same ratio, which means that tariffs to be removed should be in proportion to how much agreement has been reached”

This positive turn has seen US 10yr yields crack above the 1.83% level, and this now seems to be driving broader USD strength ahead of today’s key US Non-Manufacturing (Services) ISM report for October out at 10amET. Traders are expecting a read of 53.5 versus 52.6 previously. We’ll also be hearing from Fed members Barkin (8amET), Kaplan (12:40pmET) and known dove Kashkari (6pmET).

USDCAD DAILY

USDCAD HOURLY

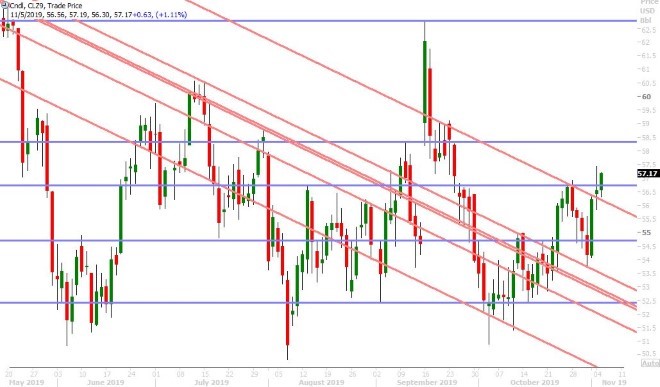

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar traders are in depressed mood this morning. While we chalk up some of the weakness due to the Hu Xijin tweet and the mild “risk-off” flows it caused during the 6amET hour, we’d argue that the market has been in a funk ever since falling below trend-line support in the 1.1140s yesterday afternoon. Market chatter blamed it on dovish repositioning ahead of Christine Lagarde’s first speech as ECB President, but she didn’t touch on monetary policy whatsoever. EURUSD tried to regain the 1.1140s in early European trade amid the “risk-on” rally that appeared to lift all boats, but this move ultimately failed. Combine this with the fact that US 10yr yields have now completely reversed last week’s down move post Fed and that Fed funds futures are now pricing in just a 5% chance of a 25bp rate cut on Dec 11th versus 27% post Fed, and we think we have EURUSD longs that are frustrated with not seeing more negative US news. Chart support at the 1.1110s has since given way this morning, and we think this exposes the market to further losses (possibly to the 1.1080s should the US Non-Manufacturing (Services) ISM beat expectations.

EURUSD DAILY

EURUSD HOURLY

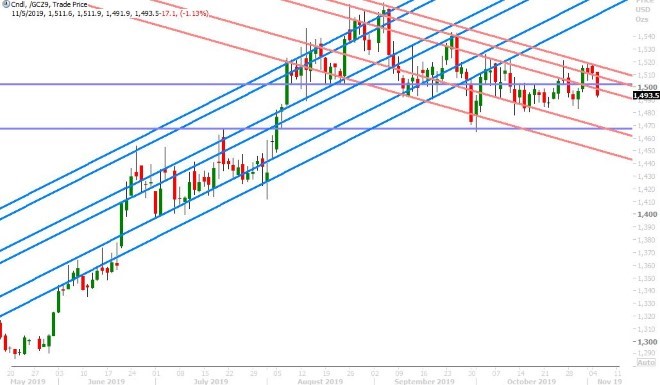

DEC GOLD DAILY

GBPUSD

Sterling sales continued in NY trade yesterday, but it stopped at the next GBPUSD support level in the 1.2870s. The focus since then has been on the better than expected UK Services PMI for October (GBP positive), the YouGov election poll that showed the Tories slipping 1% to 38% while the Brexit Party gained 4% (GBP negative), and of course the broader US/China-driven risk tone (which has whipsawed the broader USD). A large 1.5blnGBP option expiry at the 1.2900 strike will be the feature for early NY trade, and so odds are the market sits tight here ahead of the US Non-Manufacturing (Services) ISM at 10amET.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie indeed succumbed to further selling in NY trade yesterday but chart support at the 0.6880s provided support ahead of the RBA meeting. The Reserve Bank of Australia then kept interest rates on hold last night (as expected) but very much focused on domestic positives, versus negatives from abroad, in its statement. Full press release here. We think their reiteration of the Australian economy reaching a “gentle turning point” and that “the easing of monetary policy since June is supporting employment and income growth in Australia and a return of inflation to the medium-term target range” were taken a signals that the RBA is done cutting rates for now. Combine this with last night’s positive sounding US/China trade headlines and we had the recipe for AUDUSD to re-challenge its recent highs in the 0.6920s. This chart level has proven as resistance once again however and we’ve seen AUD pull back with commodity currencies following the negative Hu Xijin tweet. Over 1.5blnAUD in options expire at the 0.6900-05 strikes this morning at 10amET, which is likely adding some weight to the market here as well.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Japanese traders returned from their long weekend today and continued to bid USDJPY higher in overnight trade following a strong NY close above 108.50. Growing trade deal optimism continues to be the driver behind rising US 10yr yields this week and we think this morning’s move above 1.83% is getting the fund longs excited about a breakout move higher into the 109s (a move that got derailed after the Fed meeting last week). Markets seem to be slowly shaking off Hu Xijin’s negative tweet from the 6amET hour (because of his re-tweet) and all eyes appear to now be on US and German 10yr yields, which both look like they want to break higher. A better than expected US Non-Manufacturing (Services) ISM number at 10amET could be the catalyst for that.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com