Markets hopeful that Thursday's coronavirus spike in China was a "one-off" event

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders largely shrug off last night’s continued uptrend in Chinese coronavirus cases/deaths.

- Moderate risk-on from Asia deteriorates in early European trade though. US yields tick lower.

- US reports slightly weaker than expected Retail Sales and Industrial Production for January.

- US yields and USD downtick again post US data. Fed’s Mester up next at 11:45amET.

- Spike in March crude oil above 51.80 helps CAD outperform, but 1.3240 in USDCAD still holding.

- Buyers fail twice at 1.3040-50 resistance in GBPUSD over the last 24hrs.

- Canadian and US markets closed on Monday for Family Day and President’s Day holidays.

ANALYSIS

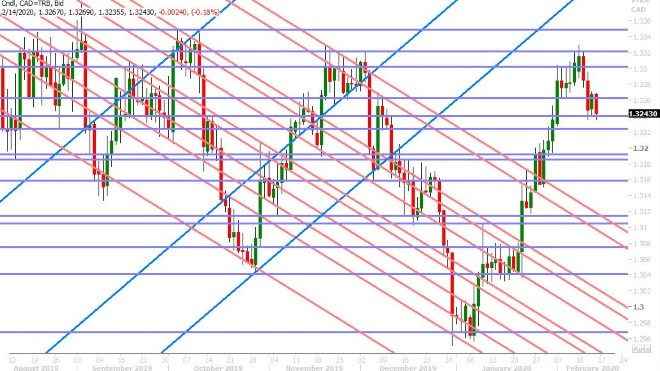

USDCAD

Dollar/CAD slumped back to the bottom end of the 1.3240-60 support zone overnight as global markets largely shrugged off China’s latest update on the coronavirus case/death count. While China’s National Health Commission confirmed 5,090 new infections and 120 more deaths (which is a higher daily increase versus Tuesday and Wednesday), there seems to be mild relief that Thursday’s 15k spike looks like it was a “one-off” event.

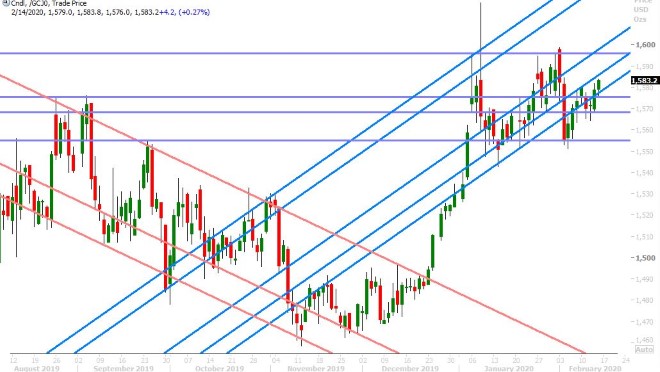

The tone has shifted a little negative now into the NY open, and we’re seeing this mainly through a slightly weaker US 10yr yield, Chinese yuan and Australian dollar. The March crude oil market appears to have tripped some buy stop orders above chart resistance in the 51.80s this morning, which is why we think the Canadian dollar mildly outperformed during the London AM.

Traders are now digesting the US Retail Sales report for January, which met expectations of +0.3% MoM for both the headline figure and the ex-autos measure. The control group measure missed estimates however (flat vs +0.3% expected) and December’s headline figure was revised down by 0.1%, and we think this is what’s driving some mild USD selling here. US Industrial Production for January also just narrowly missed expectations (-0.3% MoM vs -0.2%).

The Fed’s Loreta Mester will be speaking at 11:45amET this morning but we think traders will quickly focus on how they want to be positioned ahead of another uncertain weekend of coronavirus updates. It will be a long weekend in North America, with both Canadian and US markets closed on Monday for the Family Day and President’s Day holidays. This will make for illiquid market conditions on Sunday night/Monday morning should we get any surprises out of China over the weekend.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

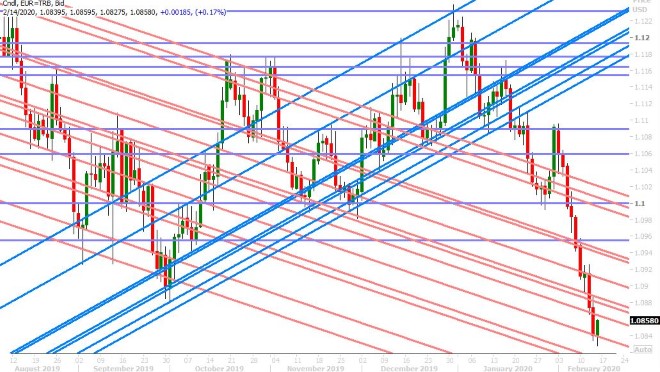

Euro/dollar caught a mild bid in overnight trade today, and we think this was a combination of Asia’s coronavirus optimism wearing off a little bit plus relief that German growth didn’t officially contract in Q4 2019. Germany reported flat GDP for the last quarter versus expectations of +0.1% QoQ, but at least the number wasn’t negative.

Market chatter has reached a consensus that this morning’s US Retail Sales report for January was a weak one on balance, which is why we think EURUSD is now trading above its London highs. We think any further broad USD selling momentum, whether that come from coronavirus optimism or something dovish out of Mester, could propel the market to the 1.0870s (where over 1.1blnEUR in options expire today).

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling succumbed to the weight of technical selling earlier today as chart resistance in the 1.3040-50s proved formidable once again in London trade. We’ve now seen buyers fail twice at this level over the last 24hrs, which we think helps explain this morning's drop. One could argue yesterday’s stimulative UK budget speculation also seemed a little bit overdone. The morning’s desire to sell USD broadly after the US Retail Sales report is now seeing GBPUSD bounce back up a bit.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

It’s been a choppy 24hrs of trade for the Australian dollar. Yesterday’s brief foray into the 0.6740s for AUDUSD was met with stiff resistance after the US administration went on record about how it “does not have high confidence in the information coming out of China”. Last night’s press conference from China’s National Health Commission then brought about some mild buying when everybody saw USDCNH tick lower. Europe’s desire to buy USD once again today led AUDUSD lower once again but we now have a market that doesn’t like the US Retail Sales results for January.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

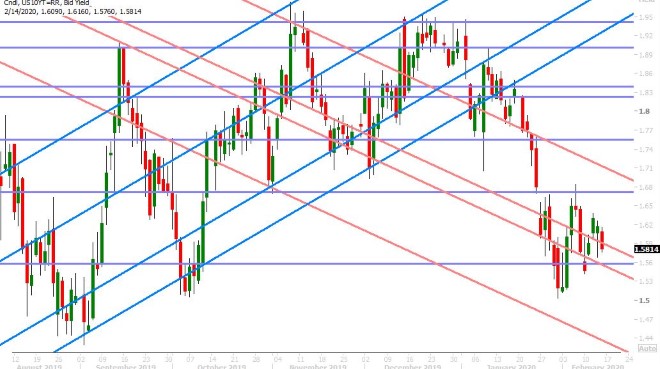

So it appears the markets gave the Chinese authorities the benefit of the doubt again today when they reported their latest conoravirus statistics. US bond traders appear to be a little more skeptical as they dragged US yields lower into European trade today. The weaker than expected control group measure in the US Retail Sales report is now leading to another down-tick in US 10s. Dollar/yen is following US yields as usual, but with less volatility, and so the market still remains arguably stuck in the 109.60-1.1000 range.

USDJPY DAILY

USDJPY HOURLY

US 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com