Poloz turns cautious. Powell maintains stubborn optimism, but bond market not falling for it.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD surged higher yesterday as a perfect storm of USD positive and CAD negative headlines came together. It all started with a better than expected US Advance GDP number for Q3. Then came the shock, which was a surprisingly dovish hold to interest rates from the Bank of Canada. While the central bank talked positively about Canadian employment, housing and consumer consumption, it is now suddenly more concerned about the “worsening global situation” and how “the resilience of the Canadian economy will be increasingly tested as trade conflicts and uncertainty persist”. This saw USDCAD shoot up to the 1.3150s. A surprise build in oil inventories for the weekly EIA report (+5.702M vs +494k expected) then added some fuel to the fire, as did the headlines about the cancellation of next month’s APEC summit and the fact that China’s US agricultural purchase commitments will “take some time to scale up” . Add to this Stephen Poloz’s post meeting press conference, which was downright gloomy in our opinion, and we had USDCAD suddenly testing chart resistance in the 1.3180s. The OIS market started pricing in a 21% chance that the Bank of Canada cuts rates by 25bp on December 4th, and those odds have now increased to 30% as of this morning.

The FOMC then delivered the hawkish 25bp rate cut that everybody was expecting. The press release was rather cryptic as usual and so the focus turned to Jerome Powell’s press conference. We would say that Powell’s tone was very optimistic (hawkish) and we think this part in parcel explained the initial moves higher in 10yr yields and the USD. However, the markets started to reverse when two reporters asked some tough questions: the first about whether the Fed was done or not, and the second about the repo markets. We think he fudged his way through those answers and traders didn’t appreciate it. Then came a peculiar discussion about rate hikes (which should have no relevance during these times) but Powell revealed that significant inflation would need to occur before the Fed would even consider rate hikes. With bond traders knowing that the US inflation outlook is not a good one, they took this as a queue that is the Fed is really not done with easing (as Powell attempted to claim). They smashed US yields lower towards the end of the press conference, which then led to bearish technical reversals for the USD across many pairs. USDCAD, in particular, firmly rejected the 1.3200 handle and pulled back to the 1.3150s.

We saw some follow-up USD selling in the overnight session as Asia and Europe caught up, but all this is being thrown upside down now after Bloomberg released an article claiming the Chinese are casting doubts about reaching a comprehensive trade deal with the US. More here. This morning’s market chatter is not being nice to these Bloomberg reporters though, as they quote “people familiar with the matter” and the story contradicts with Chinese Global Times editor Hu Xijin and “what he knows”. He tweeted earlier today that “the talks are progressing smoothly and will move forward as planned”. Larry Kudlow has also been out this morning saying the US-China talks are “going smoothly”. The Bloomberg headline unleashed a little bit of USD supportive, risk-off flows but this is now dissipating as NY trade gets underway. Traders largely ignored this morning’s slightly weaker than expected Canadian GDP print for August (+0.1% MoM vs +0.2% expected)

The negative technical outlook for USDCAD has muddied a bit over the last 24hrs to say the least, but we think the market’s firm rejection of the 1.32s and a possible NY close today below the 1.3160s will provide comfort to the funds (who remain net short). From a fundamental perspective, we’re inclined to believe the US bond market post Fed (there will be more rate cuts if the market demands it, regardless of what the Fed says and this will be USD negative), but we must admit that the Bank of Canada’s sudden dovishness adds a wrinkle here (as this is CAD negative). What does Poloz see that Powell doesn’t see? Both described the US/China trade war differently yesterday, or do will simply have a case here of Poloz being on tape delay? (where was the mention of the worsening global situation at the September Bank of Canada meeting, when it was arguably worse?).

USDCAD DAILY

USDCAD HOURLY

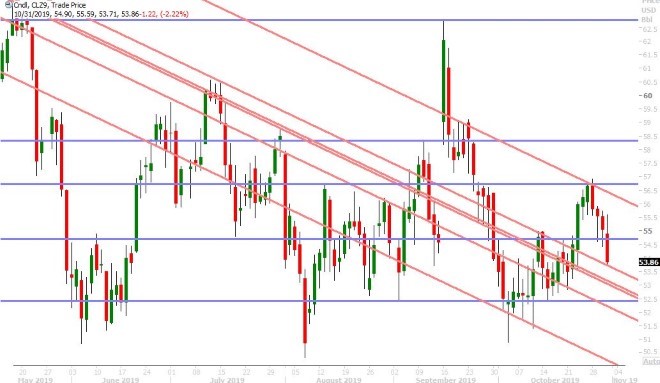

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar reversed higher towards the end of Jerome Powell’s press conference yesterday and it looked like the bulls were about to take charge after the market broke above the 1.1160s in overnight trade. However, the negative US/China article from Bloomberg has ruined this upward momentum and it appears talk of a massive 3blnEUR 1.1150 option expiry for tomorrow is adding some weight to prices too. Germany reported slightly weaker than expected Retail Sales growth for September earlier this morning (+0.1% MoM vs +0.2%) and the Eurozone flash GDP figures for Q3 came in slightly higher than expectations (+0.2% QoQ vs +0.1%), but neither of these headlines got much attention from traders. We think a NY close above the 1.1160s is needed to keep this week’s EURUSD uptrend intact. Buyers will not want to see a close below the 1.1140s as it will invite sellers to completely reverse the move from yesterday's Fed meeting.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is holding on to the bulk of its post Fed gains from yesterday and it appears some bullish UK election momentum for the Tory party is contributing to the optimism. Boris Johnson’s Conservative party has gained 8 percentage points in the latest IpsosMori poll and it's now expected to win 41% of the popular vote. We have also seen reports that Nigel Farage’s Brexit party may pull candidates in certain ridings to boost support for the Tories. Reuters is now reporting a very large option expiry in GBPUSD for the 1.2950 strike tomorrow morning as well, which is interesting to note. We think the 1.2950s will be the pivot for GBPUSD price action heading into the US employment report tomorrow. A move below could invite some profit taking back into the post Fed range, whereas defense of this level could invite more buyers to push for a run at the psychological 1.3000 level.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar broke out to the upside in Asian trade last night, after the market closed NY trade with a bullish reversal above the 0.6890s post Fed. Some better than expected Australian Building Approval data for September added some fuel to the fire (+7.6% MoM vs +0.5%, but we’d caution that this is a very volatile data set. The negative US/China trade headline from Bloomberg this morning has derailed the upside momentum in AUDUSD however and we now have traders fighting to hold the 0.6890s. We think a NY close below this level would be very disappointing for the bulls.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen was the biggest victim from yesterday’s post FOMC meeting press conference. The market was positioned for something hawkish and was on the cusp of a significant upside breakout, but while we’d argue that market got that initially from Jerome Powell, we think the bond market gave the Fed chairman a collective middle finger when he dodged a question from CNBC about whether the Fed was done or not with easing, when he completely downplayed what’s going in repo once again, and more importantly when he said significant inflation would need to occur before any rate hike. To us this sounded like a Fed that is very far away from normalizing monetary policy and will cut rates again if the markets (ie. their outlook) force them to. We're not inclined to believe anything Powell said yesterday to suggest that things are moving in a “positive direction”, that the current stance of monetary policy is “likely to remain appropriate” and that it will take “a material reassessment in the outlook for the Fed to change its policy stance”. We’re inclined to believe the bond and money markets, which continue to be right and continue to force the Fed’s hand. These market participants with real money on the line (the biggest players of which are the global banks) will continue to do what they do and price risk accordingly, and the Fed will continue to struggle to catch up and understand what the heck is going on.

The Bank of Japan meeting was largely a non-event for markets last night. The Japanese central bank kept interest rates, yield curve control and its quantitative easing program on hold, but it did remove its on-hold rate guidance of spring 2020 and replaced it with keeping rates lower “as long as needed”. Governor Kuroda reiterated that the risk is to the downside for prices (inflation) and that the BOJ won’t hesitate to add easing if the risks rise. This is nothing new here in our opinion.

What is new however is the bearish reversal we’ve seen in USDJPY over the last 24hrs. The funds, who flipped to net long the market a couple weeks ago, are probably bailing and we now have a US 10yr yield that is re-pricing for more Fed rate cuts again this morning. Today's negative US/China headline from Bloomberg is not helping the overall risk mood, nor is the Chicago PMI print for October (which just disappointed big time and plunged to a new 4-year low…43.2 vs 48.0 expected). USDJPY is now testing chart support at the 108.00 level as US 10yr yields attack the 1.70% level with strong downside momentum.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com