Positive Brexit comments from Angela Merkel leads to broad USD sales yesterday. FOMC Minutes on deck.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

It was a tug of war for USDCAD traders at familiar trend-line resistance in the 1.3330s yesterday. Some selling in the stock and oil markets ignited some broad USD buying early on, but a positive sounding Brexit headline from Germany’s Angela Merkel lit a fire under the British pound and caused the broader USD to screech lower after that. The USDCAD market put in a technically weak NY close by falling below this aforementioned trend-line and the overnight session saw some follow-through selling after October crude oil prices burst above chart resistance in the 56.50s. Oil traders are feeling a bit more optimistic this morning following last night’s larger than expected return to inventory draws in the weekly API report (-3.5M barrels vs -3.1M expected). There’s also a hint of broad “risk-on” flows in the marketplace this morning as global bond yields tick higher ahead of today FOMC Minutes release at 2pmET. Canada has just released its CPI report for the month of July and the numbers beat expectations (+0.5% MoM vs +0.2% exp and +2.0% vs +1.7% exp). Traders are now taking USDCAD lower to test familiar trend-line support in the 1.3250-70s as this news technically gives reason for the Bank of Canada to be less dovish than expected when it meets next on September 4th. The question in our minds is -- is the Bank of Canada really data dependent anymore? The Fed certainly is not, and we’re curious to see if the Canadian central bank decides to follow global bond markets here, which continue to price in increasing money market liquidity risks in our opinion. Next up is the weekly EIA oil inventory report at 10:30amET, where traders are expecting a 1.8M barrel draw. We think USDCAD continues to trade with a choppy, directionless tone until we see a firm NY close above the 1.3330s or below the 1.3250s.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

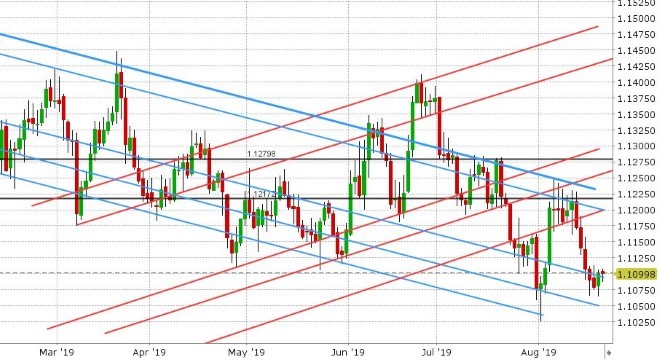

Sterling’s explosive rally following yesterday’s Brexit headlines from Angela Merkel rescued the EURUSD market in our opinion. The market was on course to test the next major support area in the 1.1050s, but then the German Chancellor said “we will think about practical solutions” [when speaking about the Irish backstop] and that “we have made our offer to work closely” [with the UK], and with that the market shot up and regained familiar, downward sloping, trend-line support (now in the 1.1090s). The positive momentum has stalled though in overnight trade today following some negative Brexit comments from other German officials. Germany’s President Steinmeier said “I don’t think it is likely that negotiations regarding the backstop will get going again” and Germany’s Finance minister said “we have a Brexit deal and no one should expect changes to that”. The market is also digesting a poor German 30yr bond auction today. Germany auctioned off the world’s first negative yielding 30yr bond at -0.11%, but unsurprisingly only managed to sell 824M EUR of the 2bln EUR targeted, as so bond traders have been calling this a failed auction for all tense and purposes this morning. Negative developments on the Italian political front are also on traders minds this morning (although not to a significant extent) following yesterday’s resignation of Italian Prime Minister Giuseppe Conte. The Italian President Mattarella will now meet with the leaders of the major political parties to see if a new coalition government can be formed, and if that fails he’ll be forced to dissolve parliament and call for new elections (mostly likely in the fall). We think the 1.1090s remains the pivot for near term price action in EURUSD, and we think we might get another catalyst at 2pmET today, when the FOMC releases the Minutes from its last policy meeting.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Are UK and EU officials actually talking? Is the EU actually willing to talk about the Irish backstop? A whole bout of confusion has entered the marketplace following yesterday’s positive sounding comments from Germany’s Angela Merkel. Fund shorts appeared to rush for the exits in GBPUSD during NY trade yesterday, taking the market above Monday and Tuesday’s trend-line resistance level in the 1.2150s, but they’ve appeared to regain their confidence this morning following comments from other German officials that suggest nothing has really changed. While yesterday’s NY close was positive technically, we think the lack of follow-through higher today and the market’s inability to take out last Friday’s highs in the 1.2170s should keep the fund shorts in charge for the time being. We see chart support today at the 1.2110s, but there's not much else beneath there until the 1.2040-60s in our opinion.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar managed to close above yesterday’s price pivot in the 0.6770s, and with that we’ve seen some buyers emerge in overnight trade. The broader markets have a positive tone to them this morning as yields, stocks and oil prices all trade higher. Some trend-line resistance in the 0.6790s is now stalling the gains for AUDUSD. September copper prices are not going along for the “risk-on” ride this morning however following yesterday puke back below the 2.60 level. While we think AUDUSD has some positive technical price momentum here, we’re growing warry of a copper market that just can’t seem to reverse its downward trend. We think a break to new lows on copper could derail the Aussie’s attempt at a bottoming process.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

The chop continues for USDJPY today, but from slightly higher levels compared to yesterday’s NY open. The broader markets are in a good mood today, but event risk looms at 2pmET today (FOMC Minutes) and traders have well defined chart resistance in the 106.50s to trade against.

USDJPY DAILY

USDJPY HOURLY

SEP S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com