Powell disappoints markets again by brushing off repo mess

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

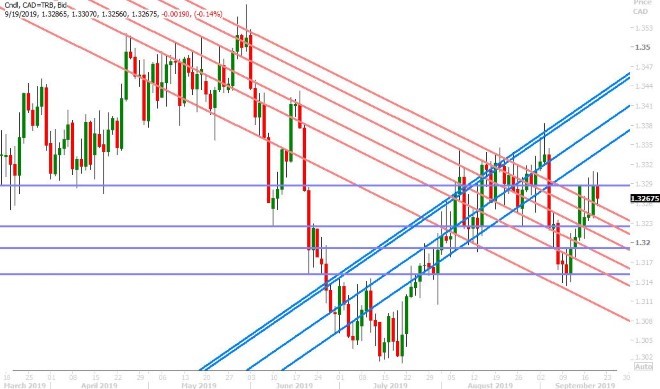

USDCAD

Dollar/CAD is backing off the 1.3300 this morning as crude oil prices rally 2% and the “Fed rate cut trade” comes to its senses after yesterday’s less dovish than expected 25bp rate cut from the FOMC.

We think it’s safe to say that the chaos we’ve observed in repo markets so far this week, and the NY Fed’s need to step with 128bln USD of emergency liquidity for US banks, got the rate cutting doves a little too excited heading yesterday’s FOMC meeting; and when Jerome Powell completely brushed off these concerns in his press conference the knee jerk reaction was to cover (and in the case of the FX markets, buy the USD broadly). However, we think the markets are coming to their senses here this morning. What’s happening in repo is not normal, not seasonal, and the Fed did not see this coming. The NY Fed has lost control of the effective fed funds rate as a result because banks are (for some reason) scrambling for liquidity and if push comes to shove, they’ll go into the unsecured fed funds market. Jerome Powell wants us to believe that the Fed has everything under control, but his admission that they’ll do as many temporary open market repo operations “as necessary” and that there is “certainly a possibility we will have to raise the balance sheet earlier than thought” is not comforting to hear the more we think about it…and we think that’s why the USD has gone offered again here. The NY Fed has just completed another 75blnUSD injection into repo markets this morning, but this time the operation was oversubscribed by 9bln ($84bln tendered), and while EEF dropped 5bp today to 2.30%, it’s now trading at a record 45bp spread to IOER!. Something’s not right here folks, but it seems we’re not going to get Jerome Powell to admit it.

There’s also talk in the oil markets this morning that Saudi Arabia reached out to Iraq to 20mln barrels of crude to plug gaps in its own production, according to the WSJ (Aramco now denying it). US Secretary of State Pompeo also called the Saudi attacks “an act of war” and said it’s “abundantly clear Iran attacked Saudi oil”, which then prompted a stern response from Iran’s foreign minister that it would defend its territory. The October WTI contract started filling its historic Sunday opening gap yesterday after President Trump showed restraint with regard to striking Iran (and imposed further sanctions instead). However, this morning’s headline driven move in oil back above the 58.70s is technically positive for the commodity, and won’t help USDCAD in our opinion should it hold.

We think USDCAD is at risk of further selling pressure here should it remain below the 1.3280s. Support today comes in at the 1.3230-50s. The Philly Fed Business Index for September marginally beat expectations this morning (12.0 vs 11.0) but the Canadian ADP employment report for August beat even more (+49.3k vs -30.6 expected). So net-net, negative fundamental data points for USDCAD as NY trade gets underway today.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar has climbed all the way back to familiar chart resistance in the 1.1060s in overnight trade after markets have had a chance to digest Powell’s latest puppet show. We also think some massive option expiries above the market for 10amET are have a magnetic affect (2.6blnEUR from 1.1050-1.1085). The ECB’s Rehn said this morning that “the data points to a muted inflation outlook for a long time”. We still think a NY close above the 1.1060s would be a bullish technical development for price action.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling has had a very choppy overnight session, but ultimately hasn’t gone anywhere. The broad USD buying that followed the Fed decision knocked GBPUSD down to trend-line support in the 1.2440s but another positive Brexit headline from the Northern Irish DUP party (during Powell’s press conference) helped the market recover. GBPUSD rallied oddly after some weaker than expected August UK Retail Sales data this morning, but then got smashed back down in the 1.2440s again. Buyers are returning again now however as the Bank of England announced a unanimous 9-0 decision to keep UK interest rates on hold at 0.75%. While this decision was expected by markets, we think traders are taking solace from the fact that the BOE is still assuming a smooth Brexit scenario and didn’t make any overtly negative comments about the monetary policy outlook. The UK Supreme Court will be hearing final arguments today in the government’s appeal case that hopes to overrule a Scottish court’s ruling which found Boris Johnson’s prorogation of parliament unlawful. We think traders need to be an guard once again here for a possible bullish breakout above the 1.2500-1.2510 level in GBPUSD.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is the only G7 currency that couldn’t recover from yesterday’s Fed meeting in the overnight session, and it appears last night’s Australian employment report for August was the reason why. While headline job growth exceeded expectations last month (+34.7k vs +10k), everybody appears to be freaking out over the details (-15.5k full time jobs vs +50.2k part-time jobs) and the unexpected MoM uptick in the unemployment rate from 5.2% to 5.3% (which the RBA watches closely). The OIS market is now pricing in an 80% chance of a 25bp rate cut from the Reserve Bank of Australia on Oct 1st. AUDUSD is recovering a little bit now nonetheless because of EURUSD strength we feel and because of the magnetic effect of some large option expiries this morning between 0.6790 and 0.6805 (1.1blnAUD).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen spiked higher to the 108.40s with the rally in US yields that followed the Fed’s less dovish than expected hold to interest rates yesterday, but the market has since reversed lower as the “Fed rate cut trade” recovers. US 10s are trading back down to their pre-Fed yield levels, December gold prices have regained 2/3 of their losses yesterday, and the USD has reversed lower against the EUR, GBP and CAD. The Bank of Japan kept all its accommodative monetary policy measures in place last night (-0.1% overnight rate at least through Spring 2020, 0.00% JGB yield control target +/- 20bp, asset purchases of 80T JPY per year), and while it hinted it’s more inclined towards easing than at its last meeting, the BOJ said it needs to re-examine prices more closely and will revisit the matter at its October meeting. We think this BOJ meeting was a non-event for markets as usual. So go US yields, so goes the USDJPY. We think the market’s recent positive momentum requires a NY close back above 108.10 level today, otherwise we expect another wave of sellers to show up.

USDJPY DAILY

USDJPY HOURLY

JAPAN 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

.png?version=2.7.2)