Repo goes berserko

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD is trading with a range-bound tone this morning as oil markets eagerly await a 1:15pmET press conference today from Saudi energy minister Prince Abdulaziz. President Trump chose not to add fuel to fire yesterday by saying he was in no rush to respond to the attacks that knocked out 50% of Saudi Arabian oil production over the weekend. October WTI crude oil prices couldn’t take out the Sunday opening high late in NY trade yesterday, but they seem to be finding support around 61.50 level since then. USDCAD is now probing the upper end of the 1.3240-1.3260s range we talked about yesterday because Canada has just released a weaker than expected Manufacturing Sales report for the month of July (-1.3% MoM vs -0.2%) and the US just released a better than expected US Industrial Production figure for August (+0.6% MoM vs +0.2%). We think the market could run higher to fully fill its Sunday opening gap (1.3270-1.3285) here but then we think the market returns its focus on Prince Abdulaziz’s comments this afternoon.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

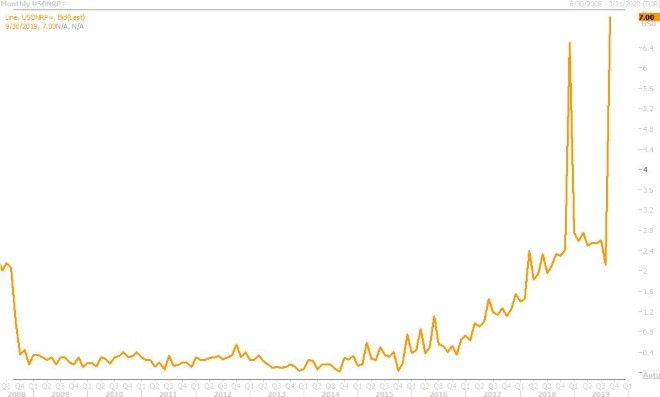

Euro/dollar is bouncing a tad off chart support in the 1.0990-1.1000 this morning as traders appear glued on some hefty option expiries going off today at 1.1025-30 (1blnEUR) and 1.1040-50 (1blnEUR). The forward looking Economic Sentiment portion of Germany’s ZEW survey for September came in above expectations this morning (-22.5 vs -37.0) and so some are cheering this as a mild positive considering the steep decline this sentiment index has gone through since the beginning of 2018. Everybody’s talking about US treasury repo markets this morning and how funding costs have shot through the roof since early yesterday (see chart below). Nobody really knows what’s going on here because these are shadowy interbank markets, but liquidity fears are rising and it begs the question…who is in desperate need of USD funding? We’re frankly surprised how US treasuries aren’t exploding higher in price here (because treasuries are the highest quality funding collateral in repo). We think Jerome Powell might have a real problem on his hands tomorrow. The ECB’s move last week has seen the Fed funds market now even doubt the chances of a 25bp cut on Wednesday (odds reduced to just 70%), but the USD wholesale money markets are now screaming for help.

EURUSD DAILY

EURUSD HOURLY

US OVERNIGHT REPO RATE MONTHLY

GBPUSD

Sterling is not doing much this morning, but the market continues to hold yesterday’s NY lows just below the 1.2400 figure. Yesterday’s visit by Boris Johnson to Luxembourg was deemed a disappointment by the UK press and by the GBPUSD market. The UK PM had to cancel the post meeting press conference because of booing from protesters that gathered outside the meeting venue. More here from the NY Post. The UK reports its August CPI data tomorrow morning at 4:30amET.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

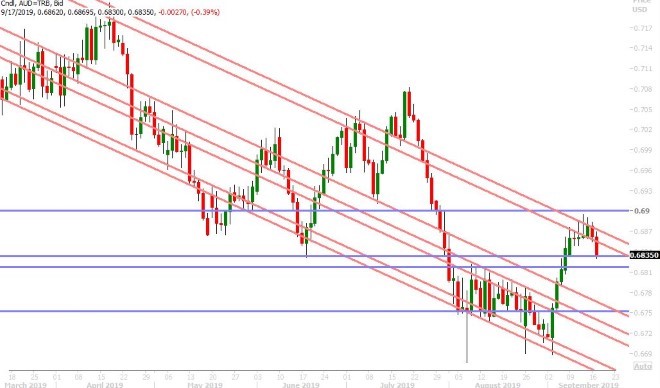

The Australian dollar has broken down from the 0.6855-0.6875 price channel we’ve been talking about for the last couple days, and it appears last night’s dovish sounding RBA Minutes did the trick. More here from Reuters. The AUDUSD market is now pressuring the next support level at the 0.6830s, and below that we see support in the 0.6810s.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is hovering around atop chart resistance at the 108.10 level this morning after the market successfully filled its Sunday opening gap (and then some) to close NY trade yesterday. US 10yr yields are dribbling below chart support in the 1.8260% level this morning, but we’re not seeing any sort of panicky price action in light of what’s going on in repo. BOJ officials think lowering negative interest rates further, if they chose to do so in the coming months, wouldn’t backfire in financial markets because investors are aware of the possibility. More here from Bloomberg. With JGB yields now “behaving” (back within the BOJ’s target 0% +/- 20bp range), we think the BOJ does absolutely nothing but breathe a sign of relief at its next policy meeting on Wednesday night.

USDJPY DAILY

USDJPY HOURLY

JAPAN 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com