Risk sentiment up mildly after yesterday's pandemic fear driven moves

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders also talking about April gold’s negative reversal lower late yesterday.

- EURUSD recedes off 1.0860s resistance with gold decline, now likely to deal with option expiries.

- Pause in risk-off sentiment helps oil market bounce, stalls USDCAD attempt at 1.33 handle yet again.

- AUDUSD not looking too hot with prices still below 0.6605-0.6630. Ignoring today’s pause to risk-off.

- USDJPY finds buyers at 110.20-50 support zone. Japanese coronavirus case count grows to 160.

- GBP outperforming as EU ministers reveal negotiating mandate for UK trade talks.

- Bank of Canada’s Timothy Lane to speak at 12:30pmET. Text of speech to be released at 12:15pmET.

ANALYSIS

USDCAD

Dollar/CAD continues to struggle with the 1.3300 mark this morning as global markets try to shake off another overnight session of concerning coronavirus headlines. The virus is still spreading in Italy, South Korea and Iran where the numbers have increased to 283, 977, and 95 respectively but the pace of the increase feels a tad slower when compared to developments over the weekend. We also got more positive news out of China -- just 9 new cases outside Hubei province for February 24 and a whole bunch of new economic stimulus measures aimed at helping Chinese small businesses.

Everyone was talking about gold prices late yesterday and how they reversed lower into the close. We heard rumors that the Bank of International Settlements was on the offer, and while we didn’t think this gold selling would initially bolster risk sentiment going into Asia, it seems like it ultimately did. April gold futures kept falling in Asia and in early European trade today and we think this part in parcel explains the 18pt bounce we’re seeing this morning in the S&P futures.

Today’s North American session will be another quiet one in terms of economic data but we will hear from the Bank of Canada’s deputy governor Timothy Lane at 12:30pmET (text of his speech titled “Money and Payments in the Digital Age” to be released at 12:15pmET).

April crude oil futures are trading moderately higher this morning as well as the market survives two downward re-tests of the 51.10-30 level that it broke above late yesterday. We've heard chatter that some Chinese airlines have revealed plans to start reopening routes that were shut down due to the coronavirus outbreak.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar pulled back from chart resistance in the 1.0860s yesterday and this retreat coincided nicely with April gold’s late session reversal lower. We can debate the merits of the gold selloff and the seriousness of the overnight coronavirus headlines, but the fact is that risk sentiment is mildly better than this morning and this not good for EURUSD given its new status as a funding currency. Over 1.1blnEUR in options are expiring between the 1.0825 and 1.0835 strikes this morning and we think this is also adding some weight to the market here.

Large option expiries will likely be a feature for EURUSD for the rest of the week as well, with nearly 4blnEUR rolling off tomorrow between 1.0850 and 1.0900, 1.2bln at 1.0820 on Thursday, and 1.1bln near 1.0900 on Friday. This would suggest an eventful trading range for the rest of the week, baring any massive surprises on the coronavirus front. Germany reported its seasonally adjusted Q4 2019 GDP figures this morning and the numbers met expectations of flat (no growth) QoQ and +0.3% YoY.

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling is rallying this morning after EU ministers approved their negotiating mandate for 2020 trade talks with the UK. Full press release here. This sounds good on the surface, which we think partly explains the pound’s relative strength vis a vis euro today, but we still need to hear from the UK and what their mandate will be (expected on Thursday). Traders are also talking about a large option expiry at the 1.3000 strike for tomorrow (555mlnGBP). The Bank of England’s Andy Haldane sounded mildly optimistic about the UK economy when he spoke yesterday afternoon. More here from Reuters.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

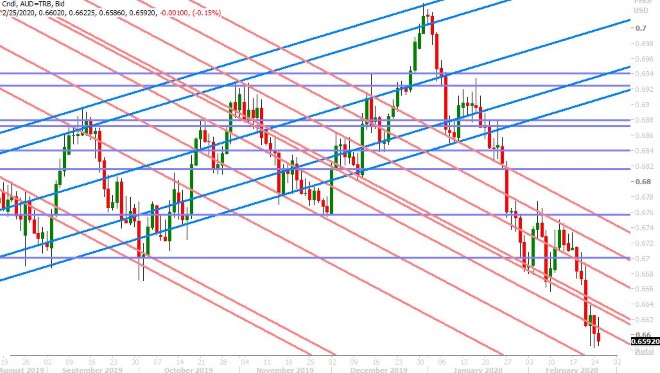

The Aussie is getting sold this morning despite evidence of risk sentiment improving overnight. This has us on guard for negative headlines that could spur a continuation of the risk-off move that slammed global stock markets yesterday. We think the funds will feel comfortable adding to their net short positions so long as the market remains below the 0.6605-0.6630 level. The OIS market is still pricing in no chance of a 25bp interest rate cut when the Reserve Bank of Australia meets next Tuesday.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen indeed found buyers over the last 24hrs at the 110.20-50 chart support zone we outlined yesterday. While the market followed US stocks lower during the North American session yesterday, we’d argue some of this was sell-stop order driven and we think it’s still too early to conclude that the yen’s safe haven status has been restored. Confirmed coronavirus cases in Japan now stand at 160, and while the growth rate of new daily infections seems lower today compared to what we’re seeing in Italy and South Korea, we don’t have confidence that Japan has its outbreak under control yet.

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Side bar content: or Cancel