Trump believes discussions with China will be very successful. Expects outcome in 3-4 weeks

SUMMARY

- S&Ps +20, USDJPY bounces, USDCNH off yesterday’s highs.

- Italy’s Salvini giving EUR traders an excuse to sell. EURUSD decouples from gold prices for now.

- Sterling toying with both sides of 1.2930s pivot, but sellers now taking over.

- AUDUSD staring into the abyss below 0.6940. Australian Consumer Confidence / Wage Price Index out tonight.

- USDCAD traders shaking off risk recovery and oil bid, continues to hold chart support in 1.3450-60s.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

ANALYSIS

USDCAD

Dollar/CAD is trading bid this morning as the broader USD waffles around in overnight trade. Risk sentiment has recovered somewhat after President Trump said he believed discussions with China “will be very successful” and that he expects an outcome in three or four weeks. The S&Ps are bouncing 20pts higher, USDCNH has faded off its highs in the 6.9140s, and USDJPY has recouped all of yesterday’s losses. None of this is hurting the broader USD all that much however, and so we continue to be on guard for the next negative bombshell. It appears Saudi Arabian installations were the target of seven drone attacks from Yemeni Hothi rebels in overnight trade, and this is seeing June crude oil prices trade 1.4% higher (but this is not hurting USDCAD all that much either). Today’s North American calendar doesn’t feature any notable data releases, and so we think USDCAD traders try to build upon yesterday’s progress above the 1.3450-60 level.

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

Euro/dollar hasn’t done much in overnight trade but it’s now starting to see some selling as NY trading gets underway today. Yesterday’s gold inspired rally unraveled suddenly when risk assets took another leg lower heading into the London close, and we’re now seeing EURUSD trade more in lockstep with the broader USD today as opposed to the precious metal. Germany reported its final April CPI figure this morning at +2.1% YoY, which was in-line with expectations. It also reported its ZEW survey for the month of May, but these numbers were arguably mixed (weaker than expected on the Economic Sentiment read but better than expected on the Current Situation read). Dollar/yuan, while trading off yesterday’s highs, still looks bid in our opinion (which should be EURUSD negative). We think EUR traders need to decide what they’re going to trade off here and stick to it, but it’s quite possible today’s 1.1blnEUR option expiry at 1.1240 could delay the decision making for one more day. Trend-line chart support at the 1.1220s has just given way, and this is now leading to some more EURUSD selling. The talk is deputy Italian PM Matteo Salvini has just said that his country is ready to break EU fiscal rules in order to improve labour market conditions.

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

Sterling has been a snooze fest in London trade so far today as traders toy with both sides of trend-line chart support in the 1.2930s. The EURGBP cross tried to break above chart resistance in the 0.8680s earlier, but this has now failed. This morning’s slightly weaker than expected UK employment report for March didn’t ruffle too many feathers, because the BOE hands are tied with Brexit we feel. Wages grew only +3.2% 3M/yr vs +3.4% and the headline job gain was +99k vs +140k expected. We think the 1.2930s will remain the pivot for price action heading into mid-week. Staying below this level could see the market test the 1.2890s, whereas moving back above it may give some longs the confidence to re-enter.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is flirting with a break of trend-line support this morning at 0.6940 as the broader USD sees demand heading into NY trade. The Salvini comments appear to be the driver right now. Last night’s slightly weaker than expected April NAB survey was a non-event for traders. Tonight brings Australia’s Westpac Consumer Confidence numbers for May (8:30pmET), along with the Q1 Wage Price index (9:30pmET). We think the entrenched fund short position remains in charge, and we think the lack of chart support in the market here until the 0.6850s could make the market vulnerable to significant downside.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

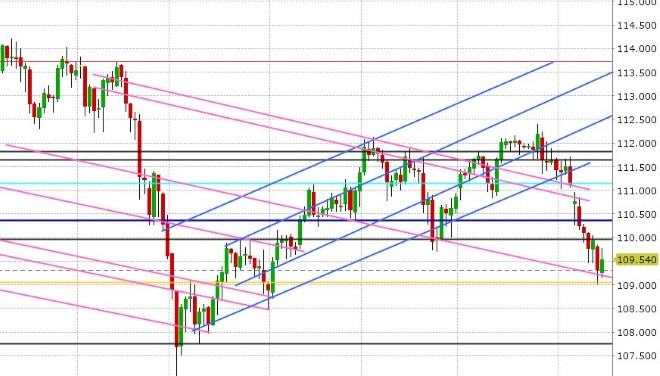

USDJPY

Dollar/yen has recovered handsomely from the 109.05-15 support level that got tested during yesterday’s global risk-off wave. The S&P futures popped higher last night following Trump’s more upbeat comments on US/China trade negotiations, and this has helped USDJPY as well. We think the fund longs dodged a bullet yesterday by avoiding the abyss below the 109 handle, and we think we may now see traders gun for Sunday’s opening gap in the high 109.80s, provided US equites hold up.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com