UK July GDP surprises to the upside.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

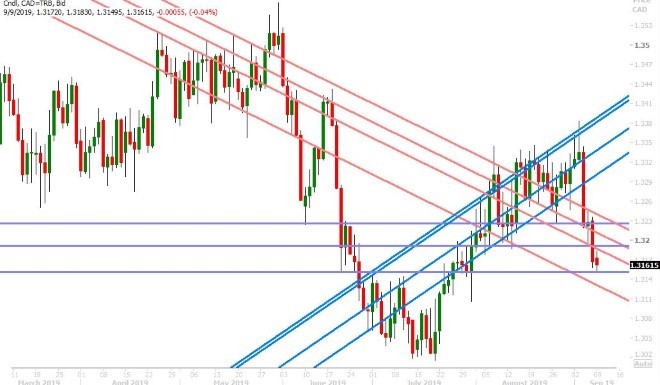

USDCAD

Dollar/CAD is starting the week with an offered tone as Asian markets play catch-up to how traders reacted to the August employment reports out of the US and Canada on Friday. The US report missed expectations on headline job growth (+130k vs +158k) while and the Canadian one beat consensus by a long shot (+81.1k vs +15.0k), causing the market to fall below chart support in the 1.3190s. We’re also seeing some broad USD selling in Europe today, led by GBPUSD buying in wake of some relieving GDP data out of the UK for July. October crude oil prices are trading back above the key 56.60 level this morning after Saudi Arabia announced the appointment of a new energy minister over the weekend, and we think this is contributing to the offered tone in USDCAD as well. More here from the Financial Times. The leveraged funds at CME trimmed their net short USDCAD position to the lowest level since early July ahead of the Bank of Canada rate decision last week, but we think the damage done to the charts since then has encouraged a number of them to come back in. This week’s economic calendar will be relatively less exciting, and so we think there’s a good probability USDCAD tries to consolidate at some point the week, but we think the market might want to first stretch this downside move a little further into the low 1.31s.

Tuesday: Canadian Housing Starts (August)

Wednesday: US PPI (August)

Thursday: US CPI (August)

Friday: US Retail Sales (August)

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Will Mario Draghi disappoint the markets again this week? We think this is the big question heading into Thursday’s ECB meeting, where expectations are high for Mario Draghi to go out with a bang before passing the torch to Christine Lagarde. This will be Draghi’s last meeting as ECB President and while markets are expecting him to cut the deposit rate by at least 10-20bp, there’s much talk making the rounds that he’ll also re-launch quantitative easing (QE). We think Draghi may lay the groundwork for this on Thursday, but we think he'll find some excuse not to do it just yet. A number of hawkish comments have come out from other ECB members over the last week, European bond yields look to be putting in a short-term bottom, the Fed and the Bank of Canada disappointed markets of late, and like we said last week…we just don’t think he’s going to give Christine Lagarde a whole new monetary easing paradigm to inherit. It would be better for him, in our opinion, to ride off quietly into the sunset and let the former IMF chief deal with it when she takes over in November. The leveraged funds at CME added to their net short position during the week ending Sep 3, which is not hugely surprising given EURUSD’s swift collapse during that time, but we think the bullish hammer close on that very same day (along with swift bullish reversals in GBPUSD and AUDUSD) have given these new shorts something to think about. This week’s European economic calendar will be light as well, and so we think the market could resort to range-trade ahead of Thursday’s ECB meeting. Chart support comes in at the 1.1010s this morning, while resistance lies in the 1.1070s. The 1.1040s appears to be the pivot for price action in NY trade so far today.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

The rally continues in sterling today. After a brief pause following Friday’s struggle to benefit from weak US payrolls data, the market is focusing on positive UK economic data this morning. July Industrial and Manufacturing Output both beat expectations by +0.2% and +0.4% MoM, but the real kicker was the July GDP figure, which came in at +0.3% vs flat in July. This caused the rolling 3-month GDP average to also come in flat, which is boosting hopes a pre-Brexit technical recession can be avoided. Markets also appear to taking some comfort from Boris Johnson’s admission that he’ll have no choice but to follow the law and ask the EU for an extension if worse comes to worse (rumors made the round over the weekend that he might not follow-though with parliament’s wishes). UK lawmakers now have just a few hours left to debate before parliament will be prorogued until October 14th. The leveraged funds at CME continued to trim their net short position during the week ending Sep 3.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

Everything is going right for the Australian dollar right now. September third’s bullish outside reversal on the heels of an RBA hold to interest rates and a massive re-pricing of “no-deal” Brexit risks got us started, and last Friday’s weaker than expected US payrolls data and the Chinese RRR cut added fuel to the fire. This week’s price action begins atop chart resistance in the 0.6830s, which means the 0.6870-80s are now easily within reach in our opinion. There is no major Australian economic data on top for this week.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders continue their battle at the 107.00 level as a more upbeat mood to global markets this morning competes with some technical damage done to the charts following the weaker than expected US payroll data on Friday. Global bond yields are rising after Jerome Powell didn’t really offer anything for the rate cutting doves to latch onto mid-day Friday. In our opinion, the “we are not forecasting a recession” language was the real headline from Powell’s speech in Zurich, and so we think the “Fed rate cut trade” is starting to get nervous once again here. The Fed has now entered its blackout period ahead of its September 18th decision on interest rates. The leveraged funds marginally trimmed their net short USDJPY position during the week ending Sep 3.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com