US/China "Phase 1" deal optimism fizzles a bit

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

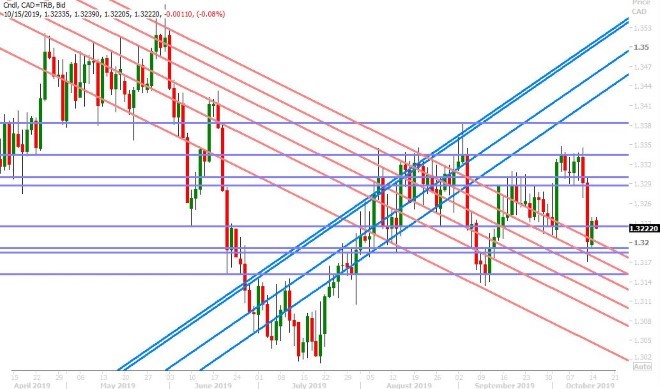

USDCAD

Dollar/CAD is trading very quietly this morning on both sides of a horizontal trend-line in the 1.3220s that capped prices in quiet holiday trade yesterday. Trump’s touted “substantial phase one with the China” (announced late Friday) has since been getting picked apart by market participants for its lack of detail and the fact that nothing was written down. We’ve also seen reports since that suggest the Chinese want to sit down again before the deal is signed and that they now want the US to remove ALL retaliatory tariffs so that they can reach the $50bln/annum in verbally agreed-upon purchases of US agricultural goods. November crude oil prices are trading down by 1% as focus returns to the weakening global demand outlook, the S&P futures are wandering more than 20pts off their Friday highs ahead of the Q3 corporate earnings season (which kicks off this morning), and the US 10yr yield has settled back below 1.70% as the Fed’s Bullard touts the party-line of “T-Bills purchases are not QE” this morning. In case you missed it last week, the Fed will start buying $60bln/month of US treasury bills starting today in an effort to ensure ample reserves in the banking system and it will continue this “technical” program until at least until the second quarter of 2020.

Friday’s stellar Canadian employment report for September put a dent in the USDCAD chart, and while Friday’s brief foray below the 1.3200 was technically negative for a few hours, there’s been enough negative US/China headlines since then to keep the sellers at bay for now. This week’s North American calendar features US Retail Sales, Canadian CPI and a ton more Fed-speak (see below). We’d be on guard for a possible correction higher into the high 1.32s should the 1.3220s hold today, otherwise expect the market to refocus on last week's lows at some point. The funds at CME kept their net short USDCAD position more or less unchanged during the week ending Oct 8th, which is a bit surprising given the swift, early October move to re-test the pre Bank of Canada meeting range highs.

Tuesday: Fed’s Bostic at 9amET, Fed’s George at 12:45pmET, Fed’s Daly at 3:30pmET

Wednesday: US Retail Sales (Sep), Canadian CPI (Sep), Fed’s Evans, Brainard and the Beige Book report

Thursday: US Housing Starts/Building Permits (Sep), US Philly Fed survey (Oct), Canadian Manufacturing Sales (Aug), US Industrial Production (Sep), Fed’s Evans, Williams.

Friday: Fed’s Kaplan, George, Kashkari and Clarida

USDCAD DAILY

USDCAD HOURLY

NOV CRUDE OIL DAILY

EURUSD

Euro/dollar is slumping back to the 1.1000 level this morning as traders found little comfort in Germany’s latest ZEW survey, where the results came in slightly better than expected for October. While Current Conditions came in at -25.3 vs -26.0 expected, the index still fell 5.4 points from September, which is now the lowest reading for German economic sentiment since 2010. More here from the Financial Times. Over 1blnEUR in options expire around the 1.1015-20 strikes at 10amET this morning too, which could also be adding weight to the market. We think EURUSD’s failure to rally and stay above the 1.1030s earlier this morning was technically negative and we’re getting a little concerned about December gold’s inability to get back above the $1500 mark. With nothing really on the calendar until the US Retail Sales report and a speech from the ECB’s Lane in Washington tomorrow, we think EURUSD could be relegated to a range trade between the 1.0990s and the 1.1030s, or some more selling down to the 1.0960s should the 1.0990s give way. The funds at CME increased their net short EURUSD position to its highest in 17 weeks during the week ending Oct 8th.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling traders are deciding what to do next this morning after some conflicting headlines from the Michel Barnier. While the chief Brexit negotiator remained hopeful that a deal can be struck in time for this week’s EU summit (Thursday/Friday), he warned that the latest UK proposal remains inadequate and said he needs agreement on the legal text by end of day today. The proposal seems focused on creating a bespoke customs deal solely for Northern Ireland, according to the Guardian (not the North-Ireland only backstop that the EU already likes), but the UK government has not yet disclosed any details about it. More here. Today’s UK employment report for August came in below expectations for both headline job creation (-56k vs +23k) and wage growth (+3.8% 3M/Yr vs +4.0%), but as usual with most economic news out the UK these days, it got lost in the weeds of Brexit headlines. The UK reports its September CPI data tomorrow and its September Retail Sales data on Thursday. The BOE’s Gertjan Vlieghe said earlier today that he sees lower rates in the UK if Brexit is delayed again. And for today’s comic relief, BOE Governor Mark Carney told MPs that UK banks have been instructed to not take big positions betting for or against the pound over the next few days and weeks (according to the Financial Times).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie traders got their “mini” US/China trade deal late Friday and while President Trump celebrated what he called “Phase 1”, it appears there wasn’t much substance behind it. In our opinion, this seemed like China agreeing to buy more soybeans in exchange for the US cancelling planned new tariffs this week, but nothing was written down and reports suggest today that China wants all tariffs to be dropped before they’ll commit. Add to this the fact that China needs beans anyways and that nothing was agreed upon regarding technology transfer (one of the more serious topics), we think markets have already begun to re-price for negative developments. The 0.6750 AUDUSD chart support level we talked about on Friday got tested in quiet holiday trade yesterday, and it’s getting tested again now as NY trade gets underway today. We think traders need to be prepared for further downside should the market close below this level. Australia reports its September employment report at 8:30pmET tomorrow night.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen remains confined to a tight 108.10s-108.40s range as US bond yields open a tad lower to start the week, but we think the bulls have the upper edge here as the funds remain stubbornly net short the market (as of Oct 8th). We think a NY close above the 108.40s will usher in a bullish upside breakout and so we have to wonder if some positive US/China, Brexit or hawkish Fed-speak is in store for us this week.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com