Surge in Brexit & China deal optimism leads to broad "risk-on" flows. Canada reports blowout jobs number.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- GBP continues its “pathway to a possible deal” surge following “constructive” Barnier/Barclay meeting today.

- Expectations high for some sort of mini deal or truce on the US/China trade front. Trump/Lui He meeting at 2:45pmET.

- Canada reports +53.7k jobs gained in September vs +10k expected. Wage growth higher. Unemployment rate lower.

- EURUSD riding on the coattails of GBPUSD, breaks above 1.1025-1.1040 chart resistance zone.

- AUDUSD rallied overnight as well, but now stalls as “risk-on” move takes a breather. USDCNH holding 7.0920s.

- USDJPY meeting sellers at 108.40s as US 10yr yields stall into NY trade.

- Canadian markets closed on Monday for Thanksgiving holiday.

ANALYSIS

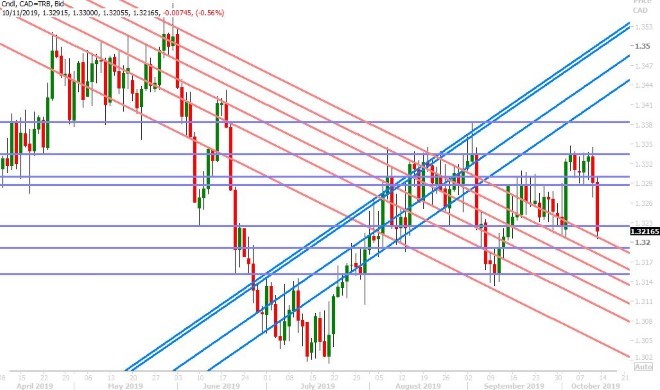

USDCAD

Dollar/CAD is collapsing lower this morning after Canada released a blowout employment report number for the month of September. The headline job gain came in at +53.7k vs +10k expected, wages rose +4.3% YoY vs +3.8% last time around, and the unemployment rate ticked down to 5.5% vs 5.7% expected. We would say that the surge Brexit and US/China “deal optimism” over the last 24hrs, starting with yesterday’s buyer failure above the 1.3330s, was a negative precursor to this. We also think yesterday’s bearish outside day pattern on the USDCAD chart was a negative omen. This morning’s crude oil bid off an alleged missile attack on an Iranian oil tanker is getting some attention, but we think the focus will now quickly return to President Trump’s upcoming meeting with Chinese Vice Premier Liu He at 2:45pmET today. We would caution however that positive expectations are very high ahead of this meeting and so we think traders need to be on guard for a “risk-off”, USD-positive, move should the headlines disappoint. We think this event risk could keep USDCAD supported for the time being at the 1.3205-1.3225 support zone.

USDCAD DAILY

USDCAD HOURLY

NOV CRUDE OIL DAILY

EURUSD

Euro/dollar continues higher again in early European trade today, led this time by the surge higher in sterling in our opinion. With the market now breaching above trend-line chart resistance at 1.1025-40, we think traders have to be prepared for a move the 1.1100 level at some point. Reuters is reporting this morning that the ECB could buy German debt for one year before reaching its self-imposed issuer limits. Mario Draghi doubled down on his call for EU governments to do more earlier today:

ECB's Draghi: More Active Euro Zone Fiscal Policy Would Make It Possible To Adjust Our Policies More Quickly

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling has skyrocketed 3% in the last 24hrs as hopes for a Brexit deal surge following a surprising headline that came out of a meeting between Boris Johnson and the Irish PM Varadkar. Their joint statement highlighting a “pathway to a possible deal” has now been followed up by talk of a “constructive” meeting today between EU Brexit negotiator Michel Barnier and his British counterpart Stephen Barclay. Pound risk reversals are exploding higher into the positive (calls now trading at a big premium to puts) as option traders now bet the GBPUSD market has turned the corner. We reckon the funds are also scrambling for the exits, as they were net short the market coming into these headlines. EU Council President Donald Tusk introduced some doubt, an some immense volatility, in GBPUSD this morning with his tweet:

The UK has still not come forward with a workable, realistic proposal. But I have received promising signals from Taoiseach @LeoVaradkar that a deal is possible. Even the slightest chance must be used. A no deal #Brexit will never be the choice of the EU”,

...but the markets seemed to ultimately focus on the second sentence. We’d be extremely careful about making decisions in “no-mans” land, which is where we currently sit on the charts for GBPUSD. We think risk can better be defined at chart support at the 1.2590s and chart resistance at the 1.2670s, then the 1.2730s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is pumped for some sort of “mini” deal or truce on the US/China trade front later today, but to say the expectations are high for today’s meeting between Trump and Vice Premier Lui He is an understatement in our opinion, and so we think traders need to be on guard for some heavy selling in the event we don’t get the positive headlines that everyone’s expecting. Some AUDUSD sellers have stepped in at trend-line resistance at the 0.6790-0.6800 level as NY trade gets underway. We think the downside levels to watch are 0.6770-80 and 0.6750. On the topside, we would watch the 0.6810s and then the 0.6830s as resistance levels. USDCNH continues to hold support in the 7.0920s. Stay tuned for 2:45pmET.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen continues its gallop higher this morning as global markets price in some sort of deal between the US and China later today. Expectations are very high though and so we’d urge caution ahead of today’s 2:45pmET meeting between President Trump and Chinese Vice Premier Liu He. The market broke above chart resistance at both 108.10 level early today, but it is meeting sellers now at resistance in the 108.40s. US 10yr yields are also taking a little breather here as NY trade gets underway.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com