US/Iran tensions escalate over the weekend, but markets starting to calm down again

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

An escalation of US/Iran tensions over the weekend invited another wave of “risk-off” flows into the markets when trading re-opened last night. Iranian officials continued their threats of retaliation against the US, which included a statement about ending Iran’s 2015 nuclear deal commitments. The Iraqi parliament passed a non-binding motion to begin the process of expelling US troops. In response, President Trump threatened severe retaliation against Iran in the event American citizens or assets are struck. He also threatened harsh sanctions on Iraq should the US be forced to leave the country. All this was enough to send gold and oil futures 2% and 1% higher respectively when trading began. Equity futures and bond yields opened lower as one might expect, but the effect on the broader USD was rather muted...which was interesting and rather foretelling of the price action we see now. We’ve definitely seen some calming down to global markets since the start of European trade as we think traders are coming to their senses that while tough words have been exchanged this weekend, World War III has not started.

The highlights of this week’s North American calendar will be the December employment reports out of both the US and Canada on Friday. We’ll get the latest US factory order data and the most recent US Non-Manufacturing ISM report on Wednesday. Thursday’s session will also feature a slew of Fed speak.

Dollar/CAD is trading rather quietly this morning within Friday’s 1.2960s-1.3000 price range. We think the market may attempt to bounce this week, but we feel the bears remain in charge so long as the market remains below 1.3030.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar is getting a boost from some rather upbeat Services PMI data out of Germany and the Eurozone this morning. The December figures for Germany were reported 52.9 vs 52.0 expected and the Eurozone numbers were reported 52.8 vs 54.4, both of which allowed the overall “Composite” readings for December (which includes Manufacturing) to beat expectations as well. Has Europe turned the corner economically? Far from it in opinion, but we think today’s data was enough to finally trip out some short sellers that may have gotten a little too excited during Friday’s early, “risk-off”, USD rally.

This week’s European calendar features the German Industrial Orders and Industrial Output data for the month of November. There are also a slew of large option expiries on deck for Wednesday and Thursday near the 1.1200 strike, which could act as a magnet for spot EURUSD prices. The rally up to the 1.12 handle during the holidays and the subsequent dip buying (post-Soleimani) has definitely opened up the prospect of a higher trading range for the market in our opinion. We think a NY close above the 1.1190s will help with that thesis.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling is also enjoying a boost from its December Services PMI data this morning. The number came in 50.0, beating expectations of 49.1. This news, along with EURUSD strength, appears to be catalyst for GBPUSD strength this morning but we’d note the emergence of sellers now at former support (turned resistance) in the 1.3170s.

This week’s UK calendar doesn’t feature any other notable economic data releases and so we think sterling will trade off the broader USD tone. Tory MPs will return to parliament on Tuesday after the Christmas recess and one of their first tasks will be to push the recently passed Brexit Withdrawal Agreement bill through the committee stage. See here for more from the BBC.

GBPUSD DAILY

GBPUSD 10-MINUTE

EURGBP DAILY

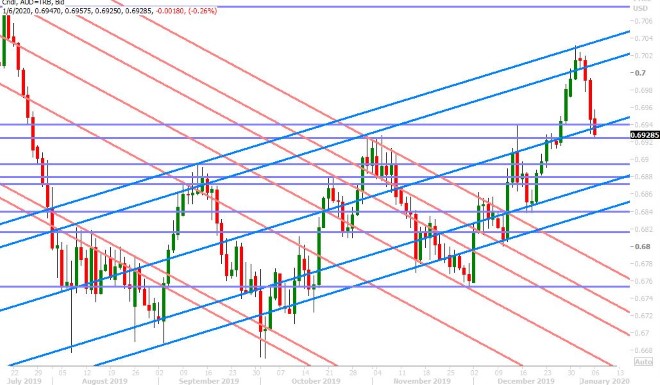

AUDUSD

The Australian dollar is having a tough time this morning. Unlike the euro and the pound, it cannot cling to some positive data points for today and so we think the market is following the broader risk tone, which started off the week quiet negatively. We’re also hearing chatter that the Reserve Bank of Australia may use the worsening Australian wildfire situation as a reason to cut interest rates again on February 4th. The OIS market is currently pricing in an 87% chance that this happens.

This week’s Australian economic calendar features the November Building Permits data on Tuesday night and the November Retail Sales report on Thursday night. We’ll get an updated read on the fund net short AUDUSD position today, from the CFTC, at 3:30pmET. It will be interesting to see if they bailed on the holiday break-out rally to 70 cents. That being said, we think a NY close below the 0.6920-40 support level puts the fund shorts firmly back in charge.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

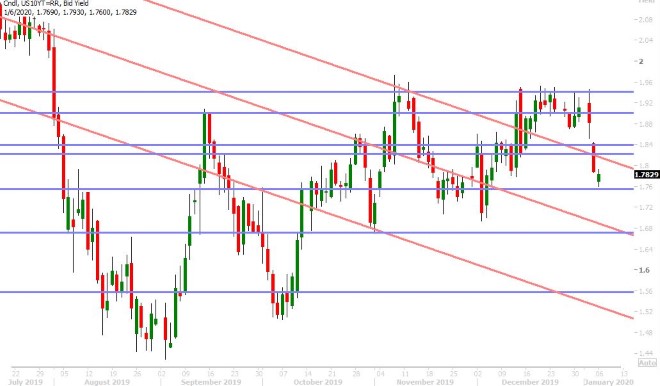

Dollar/yen is clinging on to the 108 handle this morning as Japanese names were said to have bought heavily in Asian trade overnight, according to Reuters. This sort of flies in the face of the “risk-off” flows we’ve seen in the S&P futures and the bond market since the start of trade last night, and so we think today’s “seller failure below 108” is the story “de-jour” so far. Japanese markets reopened today after a 4-day banking holiday and so perhaps we’ve seen some position squaring from those who benefitted from being short USDJPY during that time period.

The US 10yr yield continues to trade lower today however after this weekend’s US/Iran headlines, and it comes off an awful NY close from Friday; a close that was so negative in our opinion that it could very well start a new downtrend for US interest rates. We also noted a bearish weekly reversal in the German 10-yr bund yield on Friday; a negative technical development that we think could trickle through to US yields and in turn USDJPY at some point over the next two weeks.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com