USD trading mixed into NY trade

Summary

-

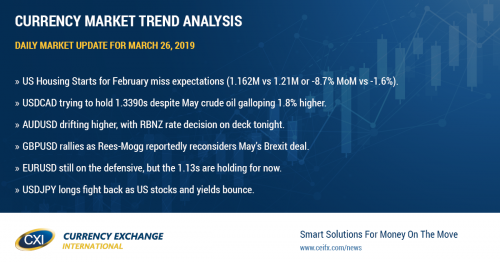

USDCAD: Dollar/CAD is trading with a neutral to bid tone this morning as the broader USD bounces off its overnight lows. There’s still not much to write home about so far this week as the headlines have been few and far between. The US Housing Starts figures for February just missed expectations, coming in 8.7% lower MoM versus -1.6%. We think the market can drift higher here so long as chart support holds in the 1.3390s, however a gallop higher in May crude oil prices above the 59.20s this morning might make it difficult.

-

EURUSD: There’s a whole lot of nothing going on in EURUSD as well this morning, with a lack of data catalysts seemingly leaving traders content to hold the 1.1300 support level for now. USDCNH is trading steady this morning, but is creeping up on trend-line resistance at 6.72. We think a break above this level would be EURUSD negative.

-

GBPUSD: Sterling is trading bid this morning, but within yesterday’s price range. The major Brexit headline so far today has been an apparent softening in stance from influential UK lawmaker Rees-Mogg. More here. This is faint glimmer of light for Theresa May, who formally lost control to negotiate Brexit alternatives yesterday in UK parliament. Theresa May is now expected to address Tory lawmakers at 1pmET tomorrow, where some are speculating that she will announce her resignation date. GBPUSD is trading just shy of chart resistance at the 1.3240s this morning. A move above will invite further buying to the 1.3290-1.3300 area in our opinion.

-

AUDUSD: The Aussie drifted higher in overnight trade and has now tested the upper bound of the near term range we talked about yesterday (0.7130). We think the market stalls here as EURUSD is lacking momentum at this hour, but we’d be on the lookout for potentially volatility tonight at 9pmET when the Reserve Bank of New Zealand announces it latest decision on interest rates. The AUD can at times correlate with significant movements in the NZD (its antipodean cousin).

-

USDJPY: The dollar/yen longs are fighting back this morning as the S&P futures and US bond yields drift higher. Chart support in the 110.10s has been regained, and near term chart resistance in the 110.20-30s has been breached. We think this opens up the possibility for further bounce up to 111.00 level.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com