USD trading mixed into NY trade. US Industrial Production up next.

Summary

-

USDCAD: Dollar/CAD is trading with an offered tone this morning, but from much higher levels compared to yesterday. The Bank of Canada’s quarterly Business Outlook Survey noted that “firms’ sales expectations remain positive but have moderated in part due to energy sector uncertainty, weakness in housing demand and impacts from global trade tensions.” More here. This weaker than expected news caused an intra-day USDCAD short squeeze in our opinion yesterday, as the market’s break below 1.3315 prior to the headlines set the momentum to the downside. The spike higher stalled at trend-line resistance in the 1.3390s however, and this very same level has capped the market in overnight trade so far today. We’re seeing some broad USD selling in Europe today as the S&P futures march higher yet again. AUDUSD, in particular, has catapulted back above the 0.7150s at this hour, and this seems to be accelerating the USDCAD selling right now. Crude oil is bid to the tune of 0.4% this morning ahead of today’s May options expiry. The Canadian Manufacturing Shipments data for February was just released and it missed expectations (-0.2% MoM vs -0.1%). We think USDCAD buyers and sellers will wrestle for control around the 1.3370s today. Staying above this level may give the buyers the confidence to re-challenge key resistance in the 1.3390s, whereas moving below could spark a bearish reversal on the charts that would then put the 1.3330s back in focus.

-

EURUSD: Euro/dollar has recovered back into the green this morning after a dovish-sounding Reuters article knocked the market lower earlier. Several ECB policymakers are now said to doubt their own projections for a European growth rebound in the second half of 2019. More here. This saw EURUSD quickly test chart support in the 1.1280-90s. Buyers stepped in however at this level and we have since rebounded as further headlines have now crossed about the ECB having “not discussed further deposit rate cuts” at the current time. It looks like the pop higher in AUDUSD over the last hour has helped EURUSD a little bit here as well, but we’re now fading a bit as NY trading gets underway. The German ZEW survey for April came out earlier this morning and it was very much a non-event for markets (weaker than expected on the headline Current Situation, but stronger than expected on the Economic Sentiment component). Next up for the markets is the US Industrial Production figures for the month of March, where traders are expected a read of +0.2% MoM. We think EURUSD might struggle with upside momentum again today, but we think longs should be encouraged by the fact that we continue to hold the 1.1280s.

-

GBPUSD: Sterling is trading with a choppy, downward tone this morning as EURGBP bulls try to reassert themselves above a trend-line resistance level in the 0.8630s. Today’s UK employment report for February came in largely in-line with expectations (slightly higher than expected claimant count of 28.3k vs 20k, unchanged on the unemployment rate of 3.9%, and +3.4% 3M/Yr growth in wages). The EU’s Tusk was on the wires earlier and reiterated that there will be no re-opening of the Brexit withdrawal agreement. We think GBPUSD will continue to trade choppy today as the market’s downward momentum competes with dealers hedging over 1.6blnGBP of options expiring at the 1.3100 strike this morning.

-

AUDUSD: It’s been a volatile overnight session for the Australian dollar. The RBA Minutes, released last night, were quite dovish in tone as it showed that the Australian central bank clearly talked about the benefits of a rate cut, and that it would be “appropriate” to cut if inflation stayed low and the unemployment rate trended up. This saw AUDUSD fall swiftly back to chart support in the 0.7140-50s. Terry Mccrann from the Herald Sun then published an article just prior to 7amET titled “Despite the headlines, there’s no rate cut imminent”, which challenged the market’s interpretation of last night’s Minutes and AUDUSD has since rallied funny enough. We think the market may dial things back a bit now as EURUSD and GBPUSD continue to struggle with upward momentum. China will be reporting a fair bit of economic data tonight: March Retail Sales, March Industrial Production, and Q1 2019 GDP (all at 8pmET).

-

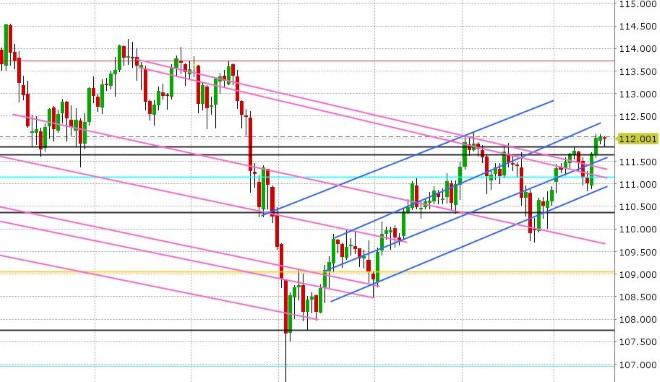

USDJPY: Dollar/yen continues to hold to the upper bound of the 111.50-80 chart support zone we talked about yesterday, however the overnight range has been extremely tight, despite price gains in both the S&P futures and US 10yr yields beyond yesterday’s highs. June gold prices saw some swift selling over the last hour, but USDJPY is failing to benefit like it did last week. With gold now finding some support at the 1281 level, we think USDJPY might struggle here again today.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com