April flash PMIs miss across the globe. US Jobless Claims + EU Summit up next.

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Early looks at April economic activity show weaker than expected contractions worldwide.

- EU Summit has begun, but EURUSD traders not optimistic. Topside option expiries could support today.

- US Jobless Claims (week ending April 18) up next at 8:30amET. Median consensus is +4.2 to +4.5M.

- US April flash PMIs out at 9:45amET. June WTI +12%. S&Ps/yields flat. BTP/Bunds tighter to +242bp.

- Broader USD trading mixed, with EUR lagging and AUD outperforming. USDCAD offered.

- USDJPY showing mild "risk-on", but perhaps more hedging flows from big downside option expiries.

- Sterling holding 1.2320s despite dismal UK flash PMI. EURGBP gives back week’s gains ahead of EU Summit.

ANALYSIS

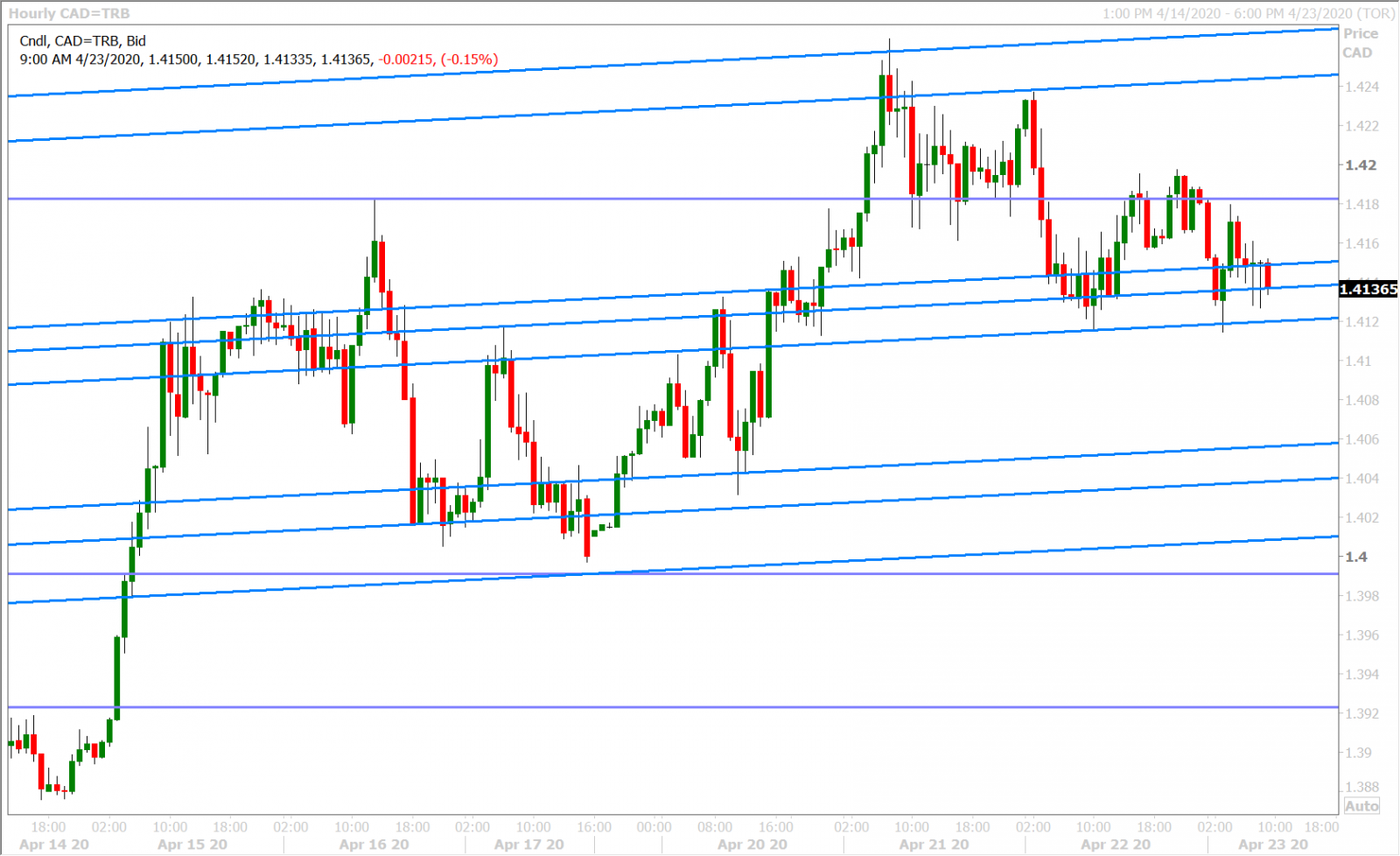

USDCAD

Global markets are trading with a cautious tone this morning ahead of the EU Summit and the weekly US Jobless Claims release. European leaders are expected to formally begin discussions on a 1.5-2.0 trillion EUR coronavirus recovery fund around 8amET. The median consensus estimate for the number of Americans claiming new unemployment insurance claims, during the week ending April 18, is + 4.2 to +4.5M, and we’ll get these results at 8:30amET.

Some weaker than expected April flash PMI data out of Europe put pressure on EURUSD earlier and we think it’s also making EU officials a little hot under the collar going into today’s discussions. Commodity currencies are outperforming again today though, likely because of June WTI’s continued rise (up 12% at this hour). We still believe that USDCAD is a 1.3900-1.4250 range trade for the time being, and we think any fall below the 1.4120s today could unleash some further selling towards the center of this range (1.4060s).

The US will report its April flash PMI data at 9:45amET. Expectations below:

US Apr Markit Comp Flash PMI, 40.9 prev

US Apr Markit Mfg PMI Flash, 38.0 f'cast, 48.5 prev

US Apr Markit Svcs PMI Flash, 31.5 f'cast, 39.8 prev

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

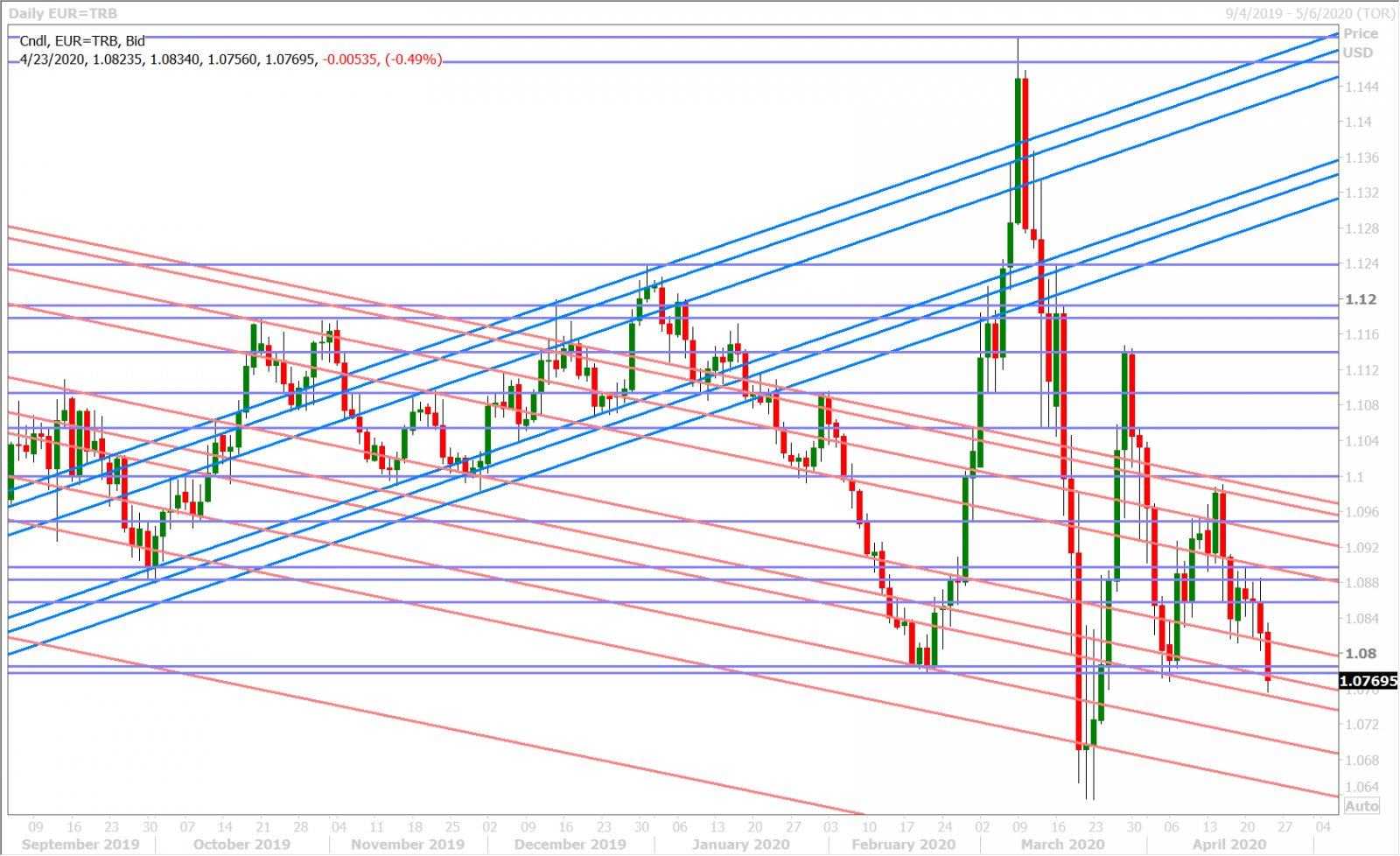

EURUSD

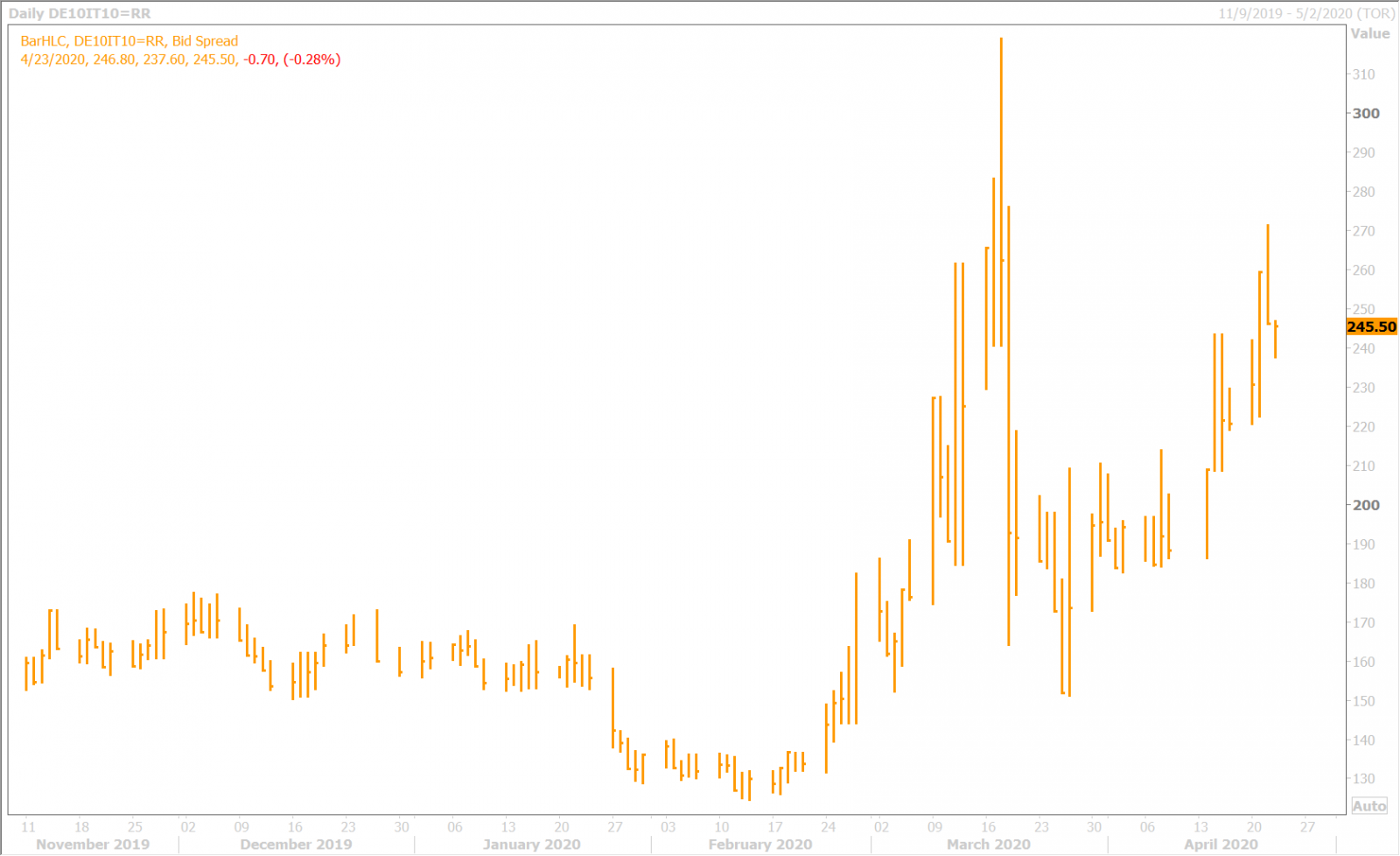

There’s not a lot of optimism heading into this morning’s EU Summit after this morning’s poor April flash PMIs came out of Europe (details below). We also think traders are being reminded of just how dysfunctional the EU bureaucracy is, when an EU official admitted that a Jan 1st, 2020 launch of the proposed recovery fund would be “the best case scenario”. Traders have managed to scramble EURUSD back above chart support in the 1.0770s though ahead of NY trade, and we believe this morning’s massive option expiries up around the 1.0800 level could oddly enough support the market a little bit. Over 4.6blnEUR in options are coming off the board, between the 1.0790 and 1.0825 strikes, at 10amET. The BTP/Bund yield spread is trading at +242bp, which is well of the +271bp highs it recorded yesterday (a mild EURUSD positive).

Eurozone Apr Markit Mfg Flash PMI, 33.6, 39.2 f'cast, 44.5 prev

Eurozone Apr Markit Serv Flash PMI, 11.7, 23.8 f'cast, 26.4 prev

Eurozone Apr Markit Comp Flash PMI, 13.5, 25.7 f'cast, 29.7 prev

German Apr Markit Mfg Flash PMI, 34.4, 39.0 f'cast, 45.4 prev

German Apr Markit Service Flash PMI, 15.9, 28.5 f'cast, 31.7 prev

German Apr Markit Comp Flash PMI, 17.1, 31.0 f'cast, 35.0 prev

Germany: “April’s PMI surveys reveal the full effects of the COVID-19 pandemic and subsequent lockdown on Germany’s economy, showing business activity across manufacturing and services falling at a rate unlike anything that has come before. Compared to a low of 36.3 during the financial crisis, the headline PMI’s reading of 17.1 paints a shocking picture of the pandemic’s impact on businesses. “Service providers bore the initial brunt of the virus containment measures, but the collapse in demand and supply constraints have caught up with manufacturers, who are now also recording an unpreceded drop in output. “The short-term work scheme is having the desired effect of curbing job losses, with employment falling much less than output during April. Still, redundancies and contract cancellations have led to a record drop in workforce numbers as firms look to cut costs and position themselves for a hard slog in the months ahead.”

Eurozone: “April saw unprecedented damage to the eurozone economy amid virus lockdown measures coupled with slumping global demand and shortages of both staff and inputs. “The extent to which the PMI survey has shown business to have collapsed across the eurozone greatly exceeds anything ever seen before in over 20 years of data collection. The ferocity of the slump has also surpassed that thought imaginable by most economists, the headline index falling far below consensus estimates. “Our model which compares the PMI with GDP suggests that the April survey is indicative of the eurozone economy contracting at a quarterly rate of approximately 7.5%. “With large swathes of the economy likely to remain locked down to contain the spread of COVID-19 in coming weeks, the second quarter looks set to record the fiercest downturn the region has seen in recent history. “Hopes are pinned on containment measures being slowly lifted to help ease the paralysis that businesses have reported in April. However, progress looks set to be painfully slow to prevent a second wave of infections. In the face of such a prolonged slump in demand, job losses could intensify from the current record pace and new fears will be raised as to the economic cost of containing the virus.”

EURUSD DAILY

EURUSD HOURLY

BTP/BUND SPREAD DAILY

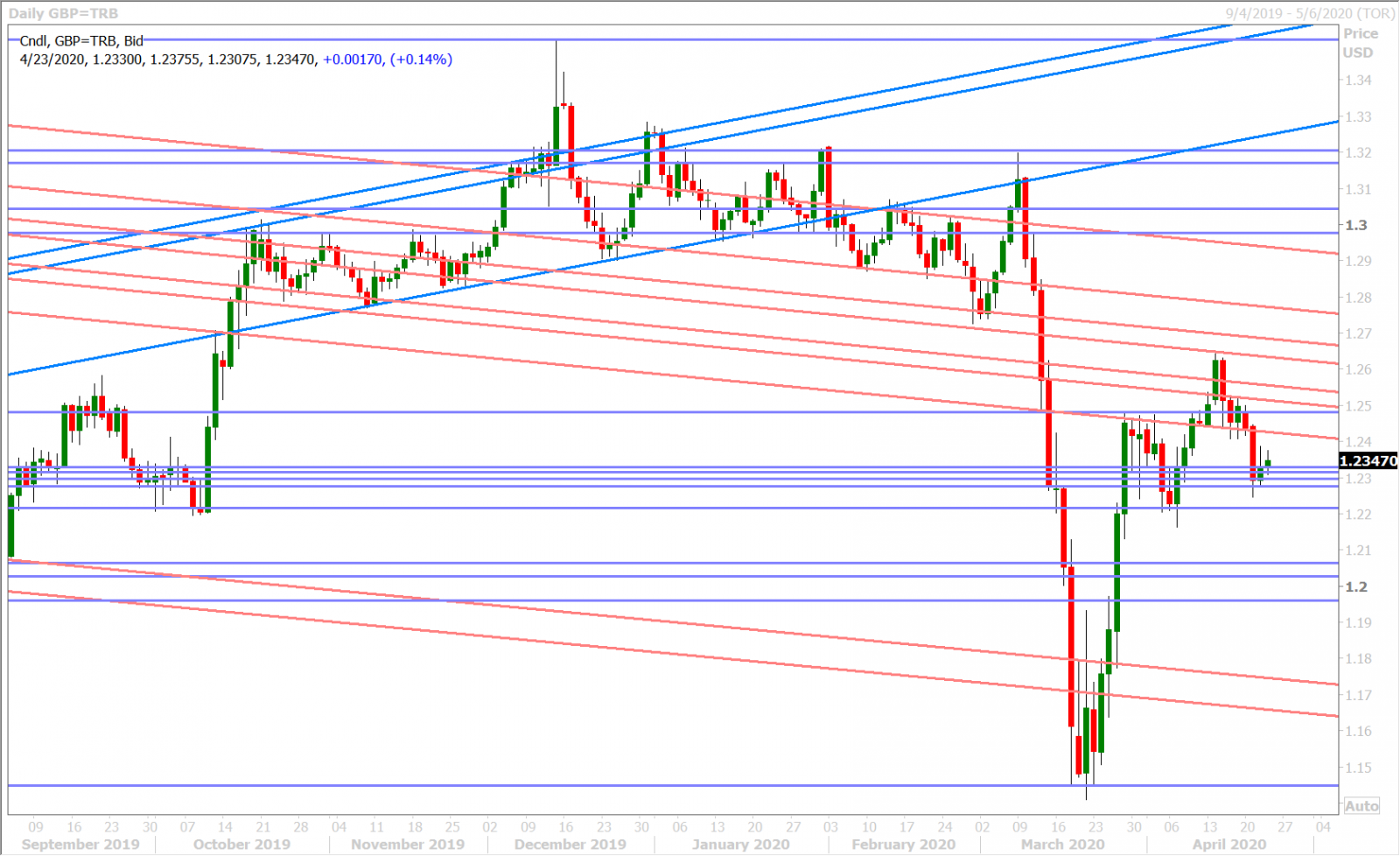

GBPUSD

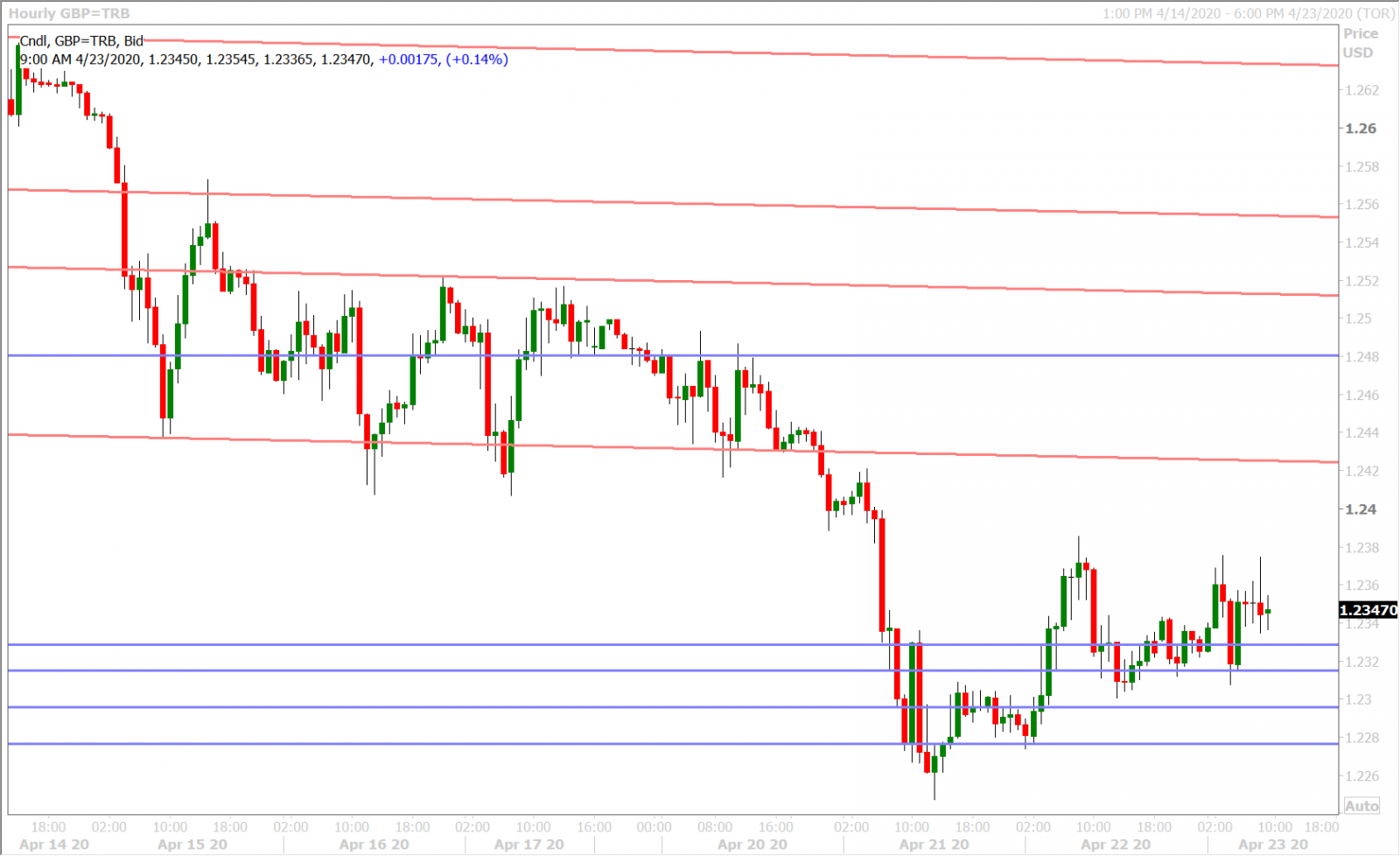

The UK reported weaker than expected April flash PMI data as well (details below), but it doesn’t seem to be impacting GBPUSD all that much. Perhaps it’s because sterling traders don’t have an EU Summit to worry about? The market is trading with a very choppy tone, but still remains above the 1.2320s that were regained early yesterday.

UK Apr Flash Composite PMI, 12.9, 31.4 f'cast, 36.0 prev

UK Apr Flash Manufacturing PMI, 32.9, 42.0 f'cast, 47.8 prev

UK Apr Flash Services PMI, 12.3, 29.0 f'cast, 34.5 prev

“The UK economy has been hit by the COVID-19 outbreak in April to a degree far surpassing anything seen in the PMI survey’s 22-year history. Business closures and social distancing measures have caused business activity to collapse at a rate vastly exceeding that seen even during the global financial crisis, confirming fears that GDP will slump to a degree previously thought unimaginable in the second quarter due to measures taken to contain the spread of the virus. "Simple historical comparisons of the PMI with GDP indicate that the April survey reading is consistent with GDP falling at a quarterly rate of approximately 7%. The actual decline in GDP could be even greater, in part because the PMI excludes the vast majority of the selfemployed and the retail sector, which have been especially hard-hit by the COVID-19 containment measures. "Record falls in output across both manufacturing and services are being accompanied by job losses on an unprecedented scale, even if furloughed workers are excluded. Pricing power has also collapsed alongside the slump in demand, leading to the largest drop in average prices charged for goods and services ever recorded by the survey. "The dire survey readings will inevitably raise questions about the cost of the lockdown, and how long current containment measures will last. One ray of light came from an improvement in business optimism about the year ahead compared to the all-time low seen in March, as an increased number of companies saw light at the end of the tunnel. Sentiment about the coming year nevertheless remained the second-lowest ever recorded to underscore how few businesses are anticipating a swift recovery."

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

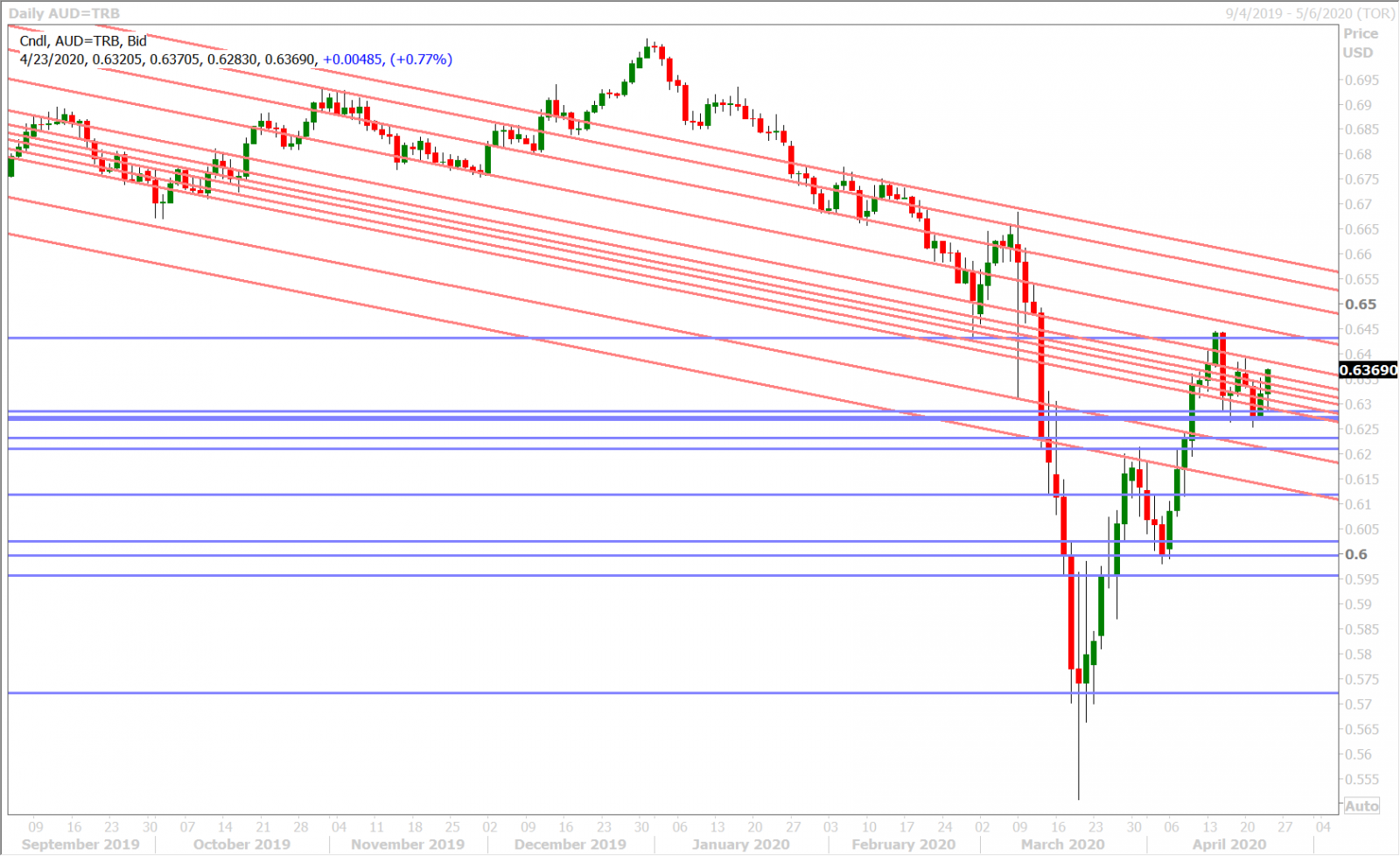

The Aussie is all perked up this morning, despite a plunge in the Australian flash April PMI to 22.4 (versus 40.7 in March). Commenting on the results, CBA Head of Australian Economics, Gareth Aird said:

“This is an astonishing result. The collapse in the headline index reflects the severe contraction in economic activity currently taking place”. “The services sector has been hit a lot harder than the manufacturing sector. And the pace of job shedding is concerning though not surprising given the large number of Australian businesses that remain shut. The extent to which the PMIs rebound will be dictated in large part by the duration of the enforced shutdown”.

The AUDUSD market appears to be looking forward and focusing on rising oil prices instead this morning, as this is real-time data and could be signaling that the worst of April’s demand destruction is behind us? Notice how we’re not confident with this explanation, but it’s the only thing that makes sense to us to explain the AUD outperformance this morning. The Aussie, like the pound, also doesn’t have an EU Summit to fret about.

Australia Apr Manufacturing PMI, 45.6, 50.1 prev

Australia Apr Composite PMI, 22.4, 40.7 prev

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

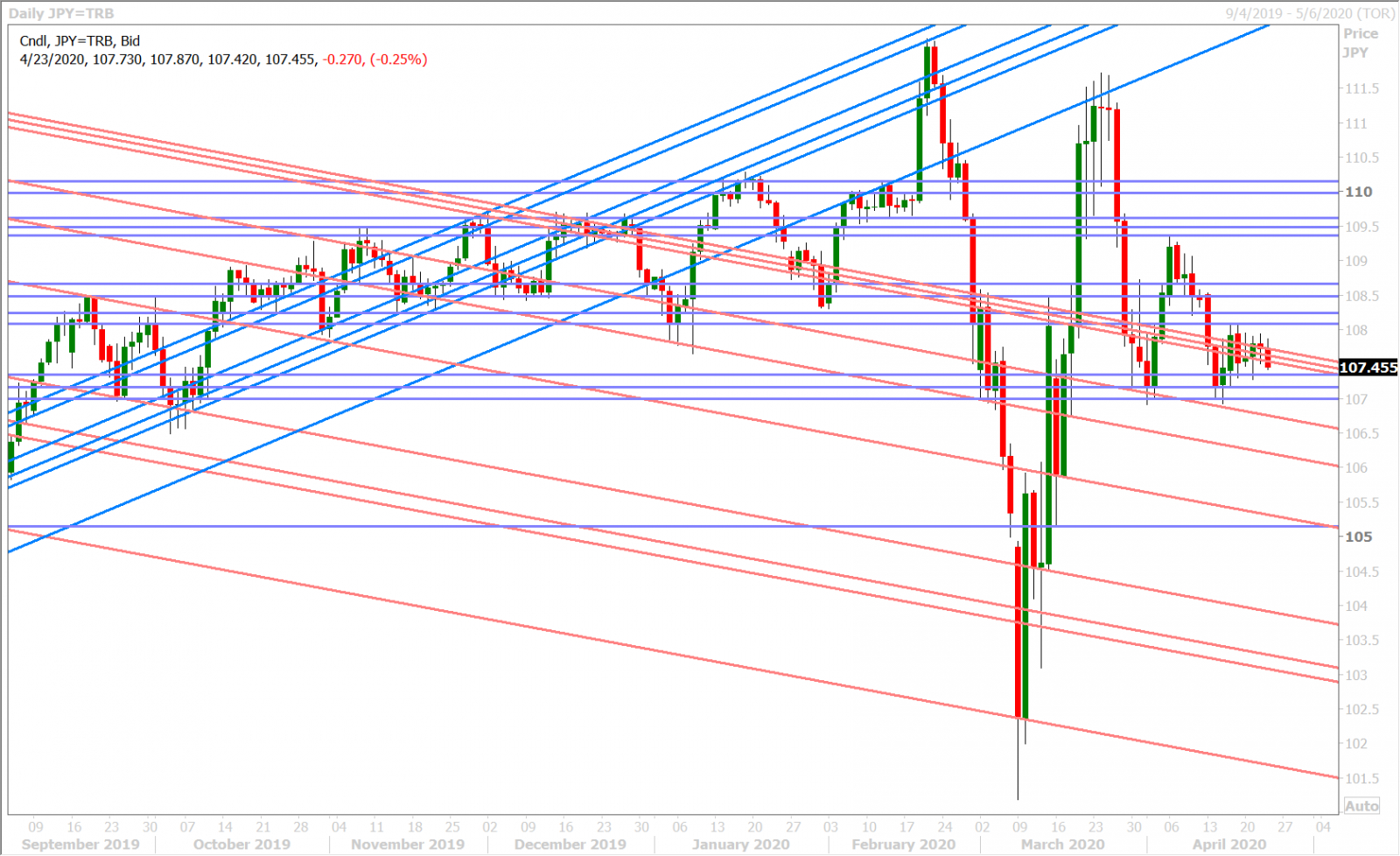

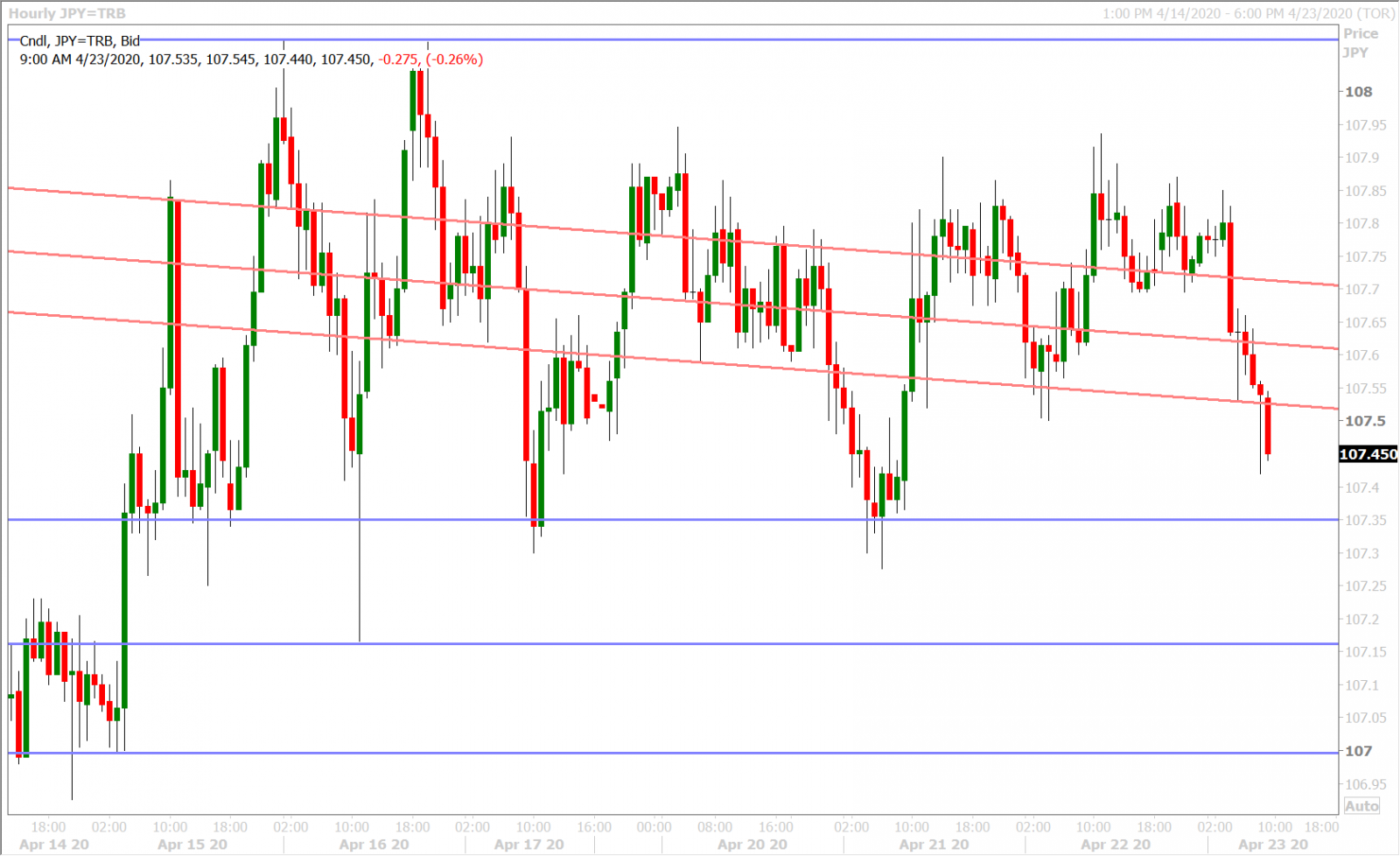

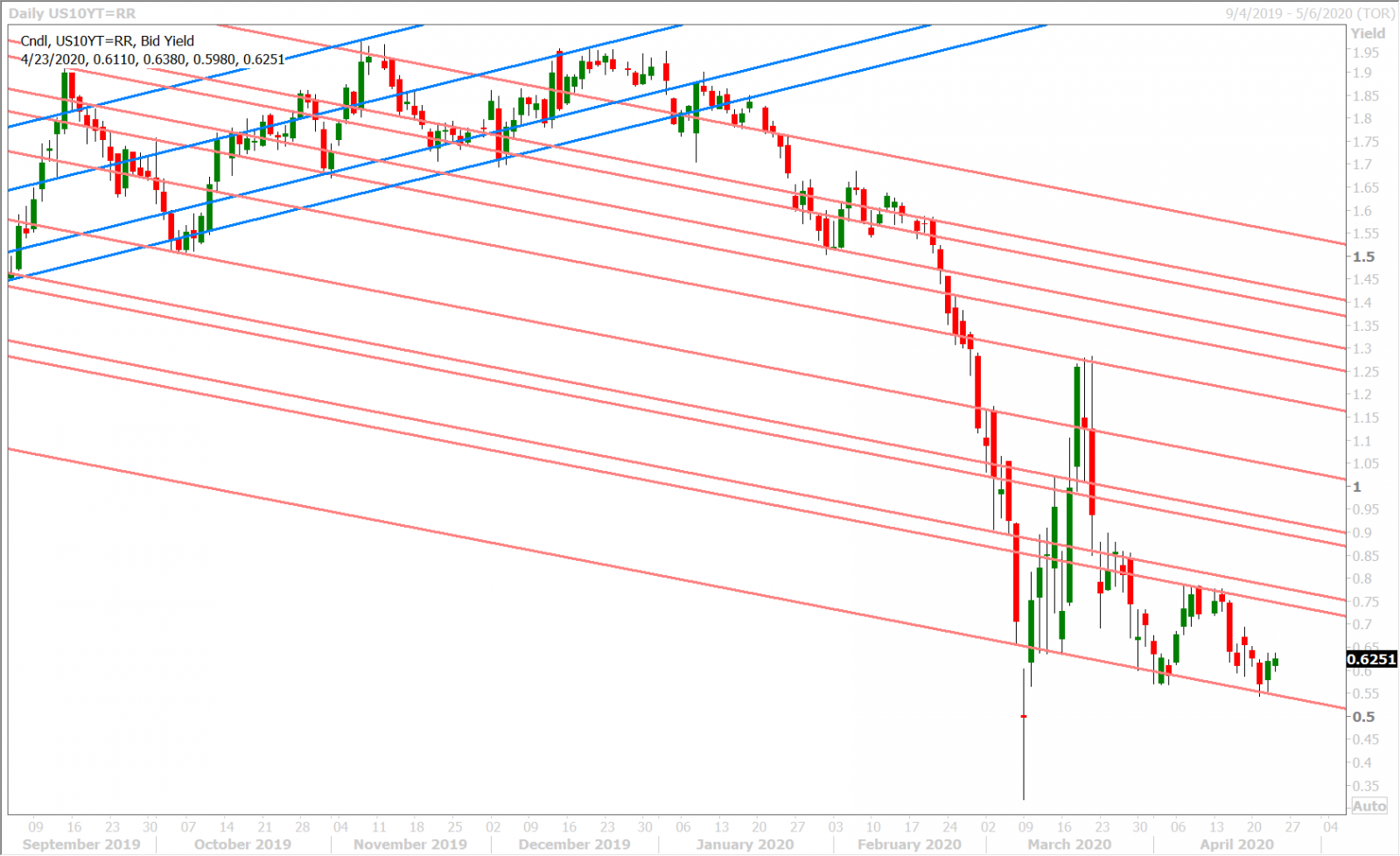

A quick look at the dollar/yen chart this morning would suggest broad risk-on flows were evident in Europe today, given the market’s now inverse correlation with risk sentiment. While we think this is true to some extent, if we look at June WTI trading 12% higher and peripheral European bond spreads trading tighter versus yesterday’s wides, we think there are other factors at play today because the S&P futures and the US 10yr bond yield are trading largely flat vs their NY closes.

We think option hedging flows could very well be that factor, as over 4blnUSD in expiries are in play between 107.20 and 107.50 heading into the 10am NY cut. Japan’s April flash PMIs slumped to their lowest level in survey history last night, 27.8 vs 36.2 in March.

USDJPY DAILY

USDJPY HOURLY

US 10 YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.