Brexit vote delayed, Boris Johnson forced to ask EU for Article 50 extension

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

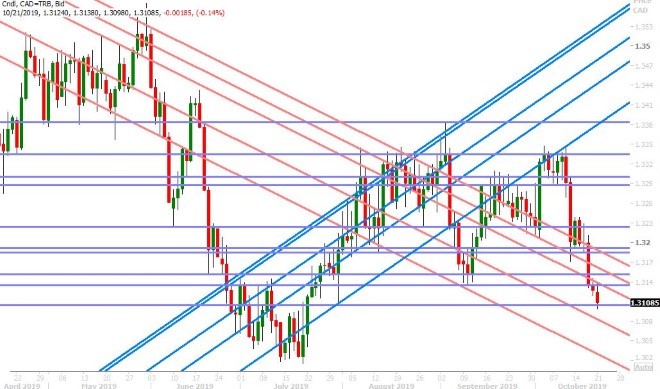

USDCAD

Dollar/CAD is slumping lower to start the week as another wave of cautious Brexit optimism sweeps over markets. It’s not coming though from the passage of Boris Johnson’s new Brexit deal (which got delayed by the UK House of Commons on Saturday), but instead from “no-deal” relief in our opinion after Boris Johnson was forced to send the EU a letter formally requesting an Article 50 extension (more on this below). We also think some positive comments from Chinese Vice Premier Liu He, about China and the US making “substantial progress” at recent trade talks, is helping the “risk-on” mood this morning. All this is seeing US equities and yields trade higher, while the USD trades broadly lower. USDCAD has resumed lower and is now testing some psychological support at the 1.3100 level.

This week’s calendar should feature some Brexit volatility to start as Boris Johnson tries to once again bring his new deal to a vote. Canadians are going to the polls today, although we don’t think the expected election results will have much effect on the markets. The economic data docket features Canadian Retail Sales for August and the widely followed Q3 Business Outlook Survey from the Bank of Canada tomorrow, Canadian Wholesale Trade for August on Wednesday, and US Durable Goods for September on Thursday. Friday’s final round of Fed-speak (before the Fed’s blackout period) didn’t do much to dispel the odds of a further rate cut from the FOMC when it meets next on Oct 30. The odds now stand at 88% that they go another 25bp. Contrast this to the Canadian OIS market, which is saying the Bank of Canada stands pat on interest rates on Oct 30.

The CFTC’s latest report on speculative positioning at the CME showed the funds aggressively adding new short USDCAD positions in the aftermath of the stellar Canadian employment report on Oct 11th; something that we think this adds validity to the market’s recent slide. The chart technicals also continue to suggest further deterioration for USDCAD, if we look at the market’s swift move back below 1.3200 last week and its attack of the 1.3100 level so far this week.

USDCAD DAILY

USDCAD HOURLY

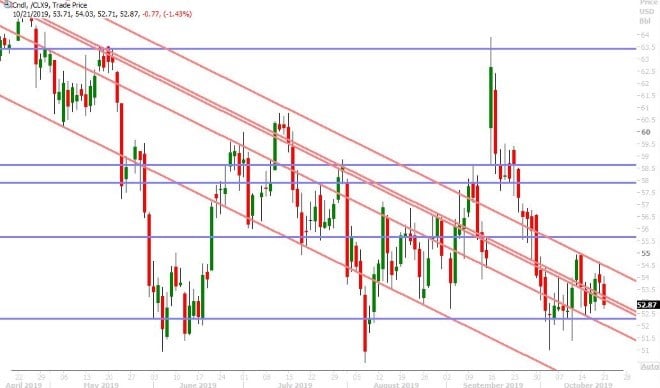

NOV CRUDE OIL DAILY

EURUSD

It feels like euro/dollar traders are trying to figure out what to do next this morning. This weekend’s Brexit vote hype was essentially put on hold and hawkish viewpoints surrounding this week’s ECB meeting appear to be getting challenged this morning by another negative outlook on the German economy from the Bundesbank. Some large option expiries are also in play this morning between 1.1150 and 1.1160, which seems to keeping the market stuck for the moment.

This week’s main events will be the October flash manufacturing PMIs out of Germany and the Eurozone early Thursday, followed by the ECB meeting later that day, where we think traders will be yearning for an update following last month’s shock QE announcement. How divided is the governing council now on the topic of asset purchases? Will the ECB increase its issuer limits? (an unresolved sticking point that sort of cancelled out the dovishness of Draghi’s QE announcement). What other ideas does the ECB have to convince the market its inflation efforts will work in the event EU governments don’t start spending? We think the ECB is a sitting duck here, and this is one of the reasons EURUSD continues to rally. After liquidating both long and short positions, it was revealed by CFTC that the funds at CME kept their net short EURUSD position unchanged during the week ending Oct 15th.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling appears to be benefiting from the perception that “no-deal” Brexit risk went down this weekend. Super Saturday turned out to be a super dud, as the UK House of Commons instead voted on the Letwin amendment, which withholds approval of the Brexit deal until parliament passes detailed legislation to ratify it. In the meantime, Boris Johnson was forced on Saturday to request a Brexit extension from the EU to January 2020 under the Benn Act and EU sources have already reportedly signaled a willingness to grant it. They want to see first however what happens in the UK this week. Boris Johnson is now trying to get House Speaker Bercow to re-schedule Saturday’s vote for today, and if that fails the talk is he’ll table the full withdrawal agreement bill (ie. all the details) so long as it’s not subject to amendments. While one could make the argument that perhaps GBPUSD has run too far, too fast while the political deadlock within the UK hasn’t changed at that much, one could also rationalize that there’s more to go simply based on the fact that the fund net-short GBP position at CME (which took a serious 500pt hit during the week ending Oct 15th) continues to hold on to losing bets.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie continues higher to start the week after last Thursday’s bullish technical breakout, lingering thoughts of the hawkish comments from the RBA’s Lowe and some cautiously optimistic news on the Brexit and US/China trade front over the weekend all combine to frustrate the fund net-short AUD position. Being short the Australian dollar is simply not paying off for this large and influential segment of FX marketplace and we think this could be the fuel the propels the market higher though the 0.6900 level at some point here. Australia reports its flash October manufacturing PMI data on Wednesday night.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen has begun the week with a cautiously bid tone as the world waits in limbo to see what happens next on Brexit. This week’s price action may also see some influence from the stock market as the US Q3 corporate earning season kicks into high gear. It looks like the funds at CME finally starting throwing in the towel on their short USDJPY bets during the week ending Oct 15. After liquidating shorts and adding longs, the funds have now flipped to a net long USDJPY position for the first time since late June.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com