Markets await historic Brexit "Super Saturday"

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD sits just below chart support in the 1.3140-50s this morning as global markets go into a nervous lull ahead of this Saturday’s historic Brexit vote in the UK House of Commons. Today’s North American calendar won’t feature any notable economic headlines, but we will have a bunch of Fed members taking to the mic again:

9am – Kaplan

10am – George

10:30am – Kashkari

11:30am – Clarida

Canadians go the polls on Monday, but we don’t think global markets continue to care about Canadian politics right now. We think relative monetary policy continues to be the overarching negative fundamental driver for USDCAD since the end of the summer. We have a Federal Reserve that is losing credibility by the day in our opinion and will be forced to cut interest rates yet again later this month (all because bonds market don’t believe they have a grip on the deteriorating US economic and banking liquidity situation), yet we have a Bank of Canada that is not in a rush to do anything because of decent Canadian economic data. The proposed 1.3100-1.3300 range for the market we talked about on Sep 5th has largely proven accurate over the last couple months, but we’re now coming to a point where the chart technicals are starting to hint at a major downside move for USDCAD below 1.3100. So what could be some fundamentals narratives to watch out for to support such a move? Continued divergence in US vs Canada monetary policy. Passage of the USMCA through Congress. Positive news on the US/China trade front. A resolution of the Brexit nightmare.

USDCAD DAILY

USDCAD HOURLY

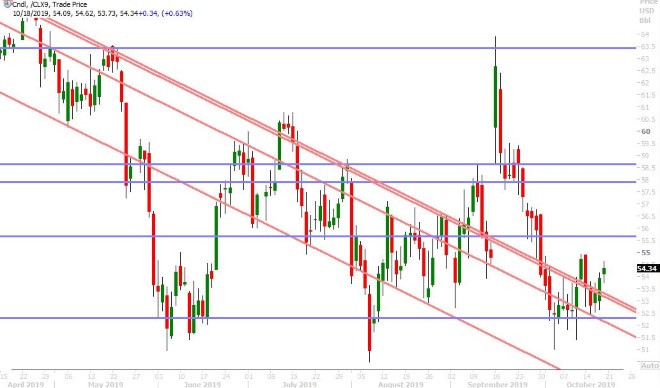

NOV CRUDE OIL DAILY

EURUSD

Euro/dollar is inching higher past yesterday’s post Brexit-deal highs this morning, in what appears to be a cruel test of resolve for the fund net-short EURUSD position ahead of tomorrow’s big Brexit vote. We think a positive outcome is entirely possible (how much further can UK politicians realistically tolerate delaying Brexit?). We also think next week’s ECB meeting is starting to play into the minds of traders as well (does the European central bank stand pat while it continues to deal with the growing distaste for QE within its ranks?). The market technicals on the weekly chart for EURUSD are looking increasingly positive, especially should the we get a NY close above the 1.1160s. One to 6 month risk reversals in the options market have all leaned higher with the spot market over the last week (suggesting a slight preference for calls over puts). We think how the market responds to topside resistance next week will be quite pivotal for EURUSD’s prospects heading into the Fed meeting the week after

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling’s fate hangs in the balance this morning, as traders confine the market to a tight range ahead of what the media is now calling “Super Saturday” in Britain. More here from the UK’s Telegraph. Expect GBPUSD to gap higher at the Sunday market open should Boris Johnson’s new, EU-approved, Brexit deal get approved by UK parliament and conversely expect perhaps an even more serious gap down should it fail. The widely followed overnight options straddle (buying both a call and a put) is trading north of 200pts this morning versus 50pts at most on an ordinary day. The 1-month 25delta risk reversal is still showing a huge recovery in the premium to own GBP puts over calls since Wednesday. We think it will be the Labour party that tips the balance (if at all) as it doesn’t look like the 10 Northern Irish DUP MPs are going to budge. Boris Johnson has one heck of a sales pitch ahead of him for the next day and Labour party members have some soul searching to do. The Benn Act requires Boris Johnson to request a Brexit extension from the EU by end of day tomorrow should the vote fail.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is toying with the fund net-short AUDUSD position as well this morning ahead of tomorrow’s key Brexit vote. The RBA’s Lowe spoke at the IMF’s annual meeting in Washington late yesterday and we think his relatively hawkish comments are providing a lift to the market as well. More here from the Sydney Morning Herald. Yesterday’s NY close was bullish in our opinion, as it confirmed a break above a strong, downward sloping trend-line that has resisted prices for most of 2019. Do the AUD shorts now through in the towel and allow the market to run to the 69 handle? The charts are suggesting this is increasingly likely.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen continues to stall as US 10yr yields struggle with the 1.77% level once again this morning. We feel the global stock and bond markets are anxiously awaiting tomorrow’s Brexit vote as well, and we think USDJPY’s Sunday opening will correlate as usual with the broader risk tone. Expect a gap higher in USDJPY should the vote pass the House of Commons and a gap down should it not. The funds remain net short the market and so the we’d argue the pain trade (the more swifter move) would definitely be higher for USDJPY here. A firm NY close above the 108.80s would add further credence to the bullish breakout we’ve witnessed in the market since last Friday’s move above the 108.00 level.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com