Coronavirus outbreak takes turn for the worse over the weekend

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-8333-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Almost 3000 now infected in China, 81 dead, but "unofficial" talk on the ground is numbers are way higher.

- China extends Lunar New Year holiday by one week to help stem spread of the disease.

- Global markets go into “risk-off” mode to start week, with plunge in Chinese yuan leading.

- AUDUSD collapses. USDCAD threatens upside break above 1.3170-90. Oil down another 2%.

- All eyes on USDCNH and 6.99 resistance level as pivot for broader risk sentiment.

- Sunday opening gap for USDJPY leaves 109.10-25 near term upside target.

- This week’s calendar features the FOMC meeting on Wednesday. No change to US rates expected.

ANALYSIS

USDCAD

Dollar/CAD is rallying with the broader USD to start the week as coronavirus fears took a turn for the worse over the weekend. Almost 3,000 people in China are now reportedly infected with the virus and 81 are now confirmed dead, according to state broadcaster CCTV, but other “unofficial” sources on the ground over the weekend describe a pandemic-like situation that is far worse that what Chinese officials are saying. Canada just reported its second “presumptive” case of the Wuhan Coronavirus this morning, saying the wife of the man who become the first case of the illness in Canada on Saturday has also tested positive. More here from the Canadian Press.

All this fear is contributing to a broad “risk-off” move in global markets this morning; with global equities, the Chinese yuan, oil futures and commodity currencies trading lower while traders flock to bonds, gold and the yen. USDCAD, in particular, is now threatening a break above the 1.3170-90 resistance region we spoke about on Thursday.

Today’s North American calendar is devoid of any major economic data releases and so we think traders will focus on the coronavirus news flow and perhaps try to retrace some of these overnight moves by the London close if we don’t get any further negative headlines. Various chart technicals are also pointing to a potential halt to this “risk-off” move, with USDCNH already achieving the 6.99 target resistance level we talked about on Thursday and with USDJPY leaving a Sunday opening gap in the low 109s that is attracting attention. All this would mean USDCAD is at risk of retracing lower at some point today as well.

The leveraged funds at CME added to their net short USDCAD position during the week ending January 21, which adds even more weight to our theory last week that the fund community was positioned poorly heading into the Bank of Canada meeting. We have to think that a good chunk of these bets have since been liquidated and that this helped USDCAD explode higher through the 1.3070s.

This week’s calendar features the FOMC meeting on Wednesday, where the Fed is expected to keep US interest rates on hold. We’ll also get some GDP data out of the US and Canada, along with a speech from Bank of Canada deputy governor Paul Beaudry.

Tuesday: US Durable Goods (Dec), US Consumer Confidence (Jan)

Wednesday: FOMC rate decision

Thursday: US Advance GDP (Q4 2019), speech from BOC’s Beaudry

Friday: Canadian GDP (Nov)

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

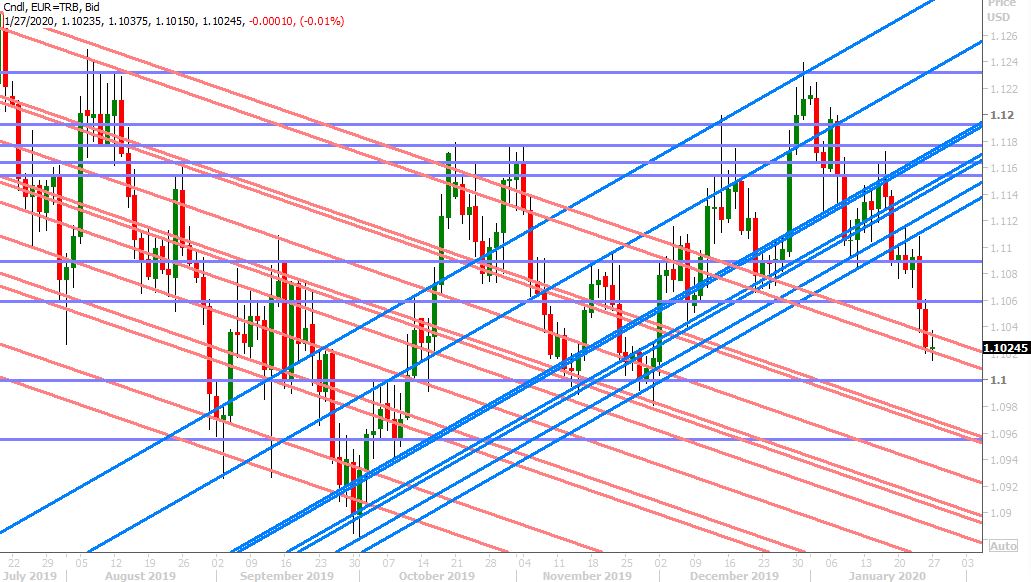

EURUSD

Euro/dollar is clinging to familiar trend-line support in the low 1.10s this morning as a weaker than expected German IFO survey and downside option expiries for later this week outweigh the positive influence from higher gold prices. Germany’s Ifo Institute, a Munich-based think tank, said its latest sentiment survey for January missed expectations on all three categories (Business Climate, Current Conditions, Expectations). More here from the Financial Times.

This sort of flies in the face of last week’s better than expected German ZEW survey, and so we think traders are justifiably taking pause here on the whole German “green shoots” economic narrative that we kept hearing last week. We also have over 3blnEUR in option expiries occurring between the 1.0985 and 1.1005 strikes later this week, which we think is adding weight to spot EURUSD prices here.

EURUSD HOURLY

FEB GOLD DAILY

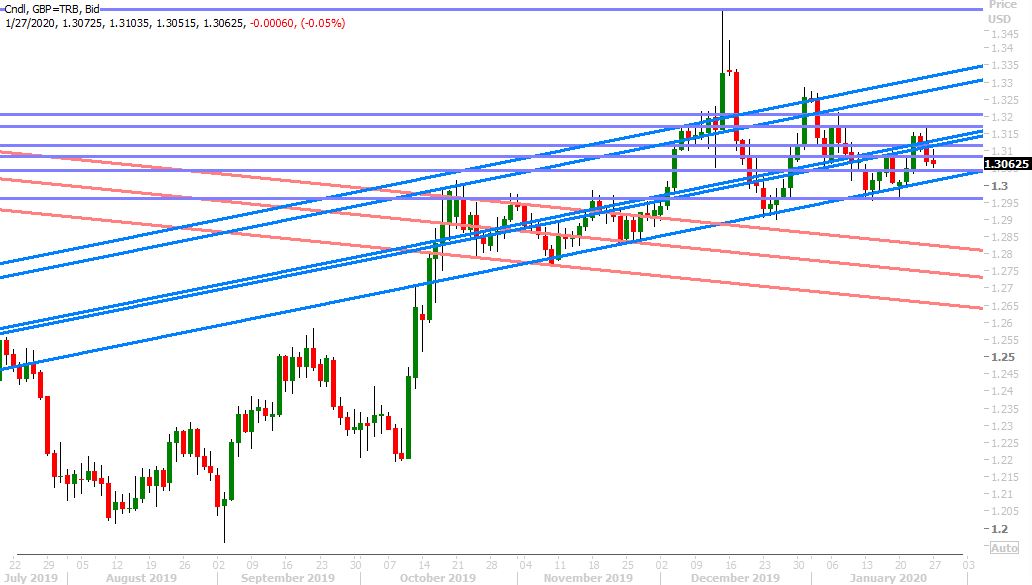

GBPUSD

Sterling is chopping around both sides of Friday’s 1.3080 chart support level as the rate cut picture for Thursday’s Bank of England meeting doesn’t get any clearer. The major banks seem to be evenly divided with their rate cut calls. The OIS market continues to reflect this as well by showing coin-flip odds (58%). Needless to say, we think tomorrow’s release of the CBI Retail Sales survey for January at 6amET will get undue attention from the marketplace, but as always, we think traders should let chart technicals do the talking as opposed to speculating on the contents of the press release/press conference.

Right now, the charts are saying to beware of the downside once again, largely because of Friday’s bearish reversal back below the 1.3100 level in our opinion. The bears do not yet have full control (given that the market still trades above last Monday’s low in the 1.2960s), but we think the momentum for GBPUSD has shifted moderately lower for the time being. The leveraged funds at CME finally started trimming their net long GBPUSD position during the week ending January 21st.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

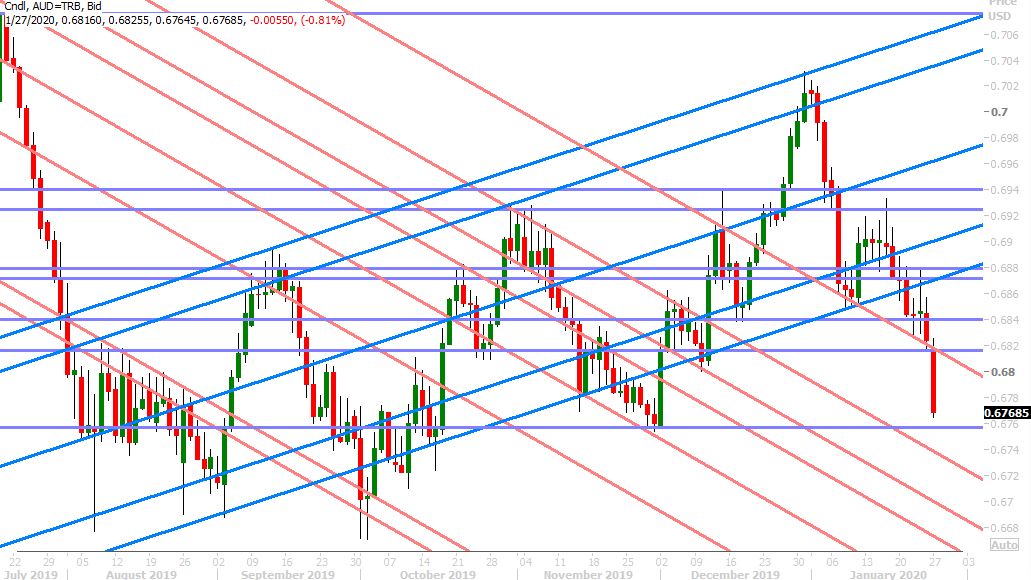

AUDUSD

The China-sensitive Australian dollar is getting hit hard this morning as Chinese capital market proxies get hammered today. Futures on the China A50 Index plunged 6% today in Singapore. The Chinese yuan has collapsed in off-shore markets, leading to a panicky rise in USDCNH to the 6.99 level (a scenario we warned about on Thursday). March crude oil futures are also falling another 2% lower today, as fears grow that the Chinese economy will be significantly hurt by the ongoing spread of the coronavirus. The Chinese government has now formally extended the Lunar New Year holiday by a week to help stem the outbreak, but we think the "Chinese-demand fear” trade is already out of the bag.

The bearish “head & shoulders” pattern that we first pointed out on January 16th has sure proven devastating for AUDUSD. With chart support at the 0.6810s now having given way, we think the next stop for the market lies in the mid 67s (not too far from here).

Australia reports its NAB survey for December at 7:30pmET tonight. Its CPI figures for Q4 will be released tomorrow night. The leveraged funds at CME continued to cover short AUDUSD during the week ending January 21st.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

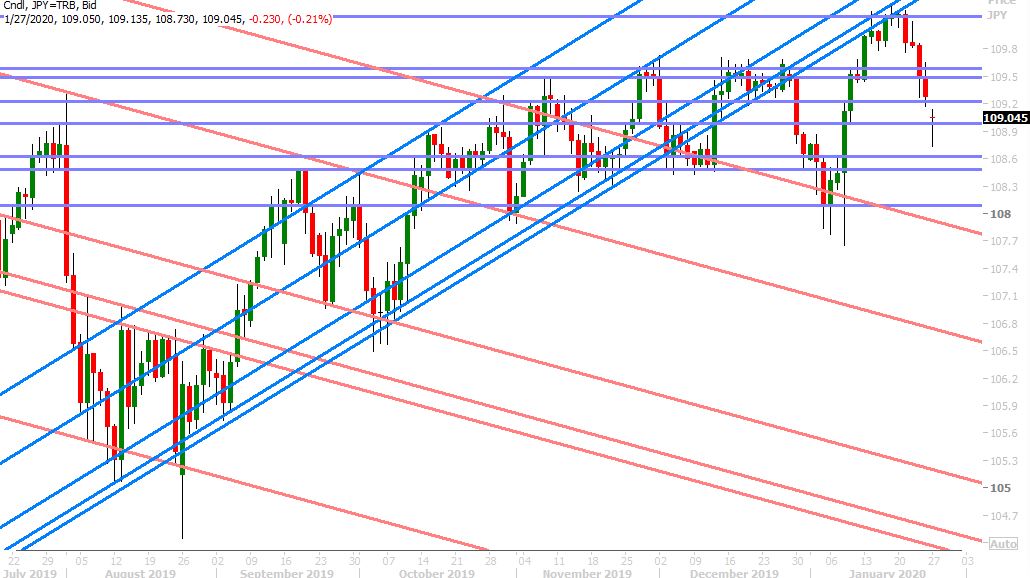

USDJPY

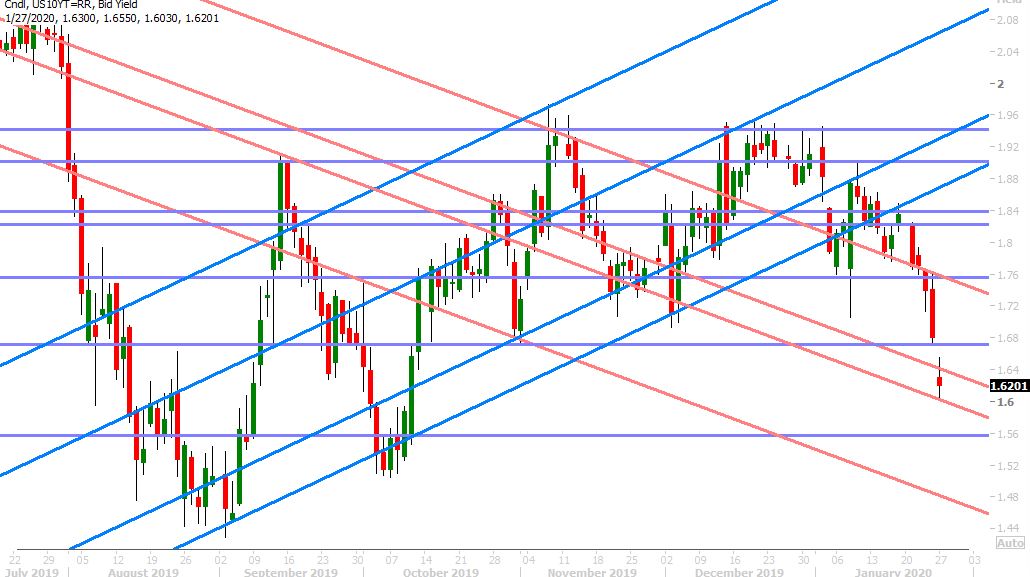

Dollar/yen gapped lower at the Sunday open yesterday, which was not too surprising frankly given the very poor structure for US 10yr yields heading into Friday’s NY close. The coronavirus crisis indeed escalated in China over the weekend and the traditional safe havens were sought right away when trading resumed. All this being said though, USDJPY has not collapsed below the 109 level (mild seller failure) and with USDCNH now struggling a bit at the 6.99 level, we think there’s a possibility global markets calm down a bit today and the Sunday opening gap gets filled (109.10-25).

The leveraged funds at CME piled into long USDJPY positions during the week ending January 21st, and so have been caught completely off guard by last week’s outbreak of the coronavirus. We continue to point to weakening chart technicals on January 17th as the negative precursor for USDJPY's recent move lower.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com