Fed disappoints the doves. Bond rally continues.

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Powell doesn’t provide update/hints on “outcomes-based” forward guidance.

- Bond markets therefore continue their rally based on Fed’s worried outlook.

- Flight to quality now hurting risk sentiment and risk currencies (CAD & AUD).

- Second consecutive week of rising US Jobless Claims adds fuel to risk-off fire.

- Trump adds potential USD-negative wrinkle with thoughts of delaying elections.

- Month-end USD sales in play. Sterling buoyant on continued EURGBP sales.

ANALYSIS

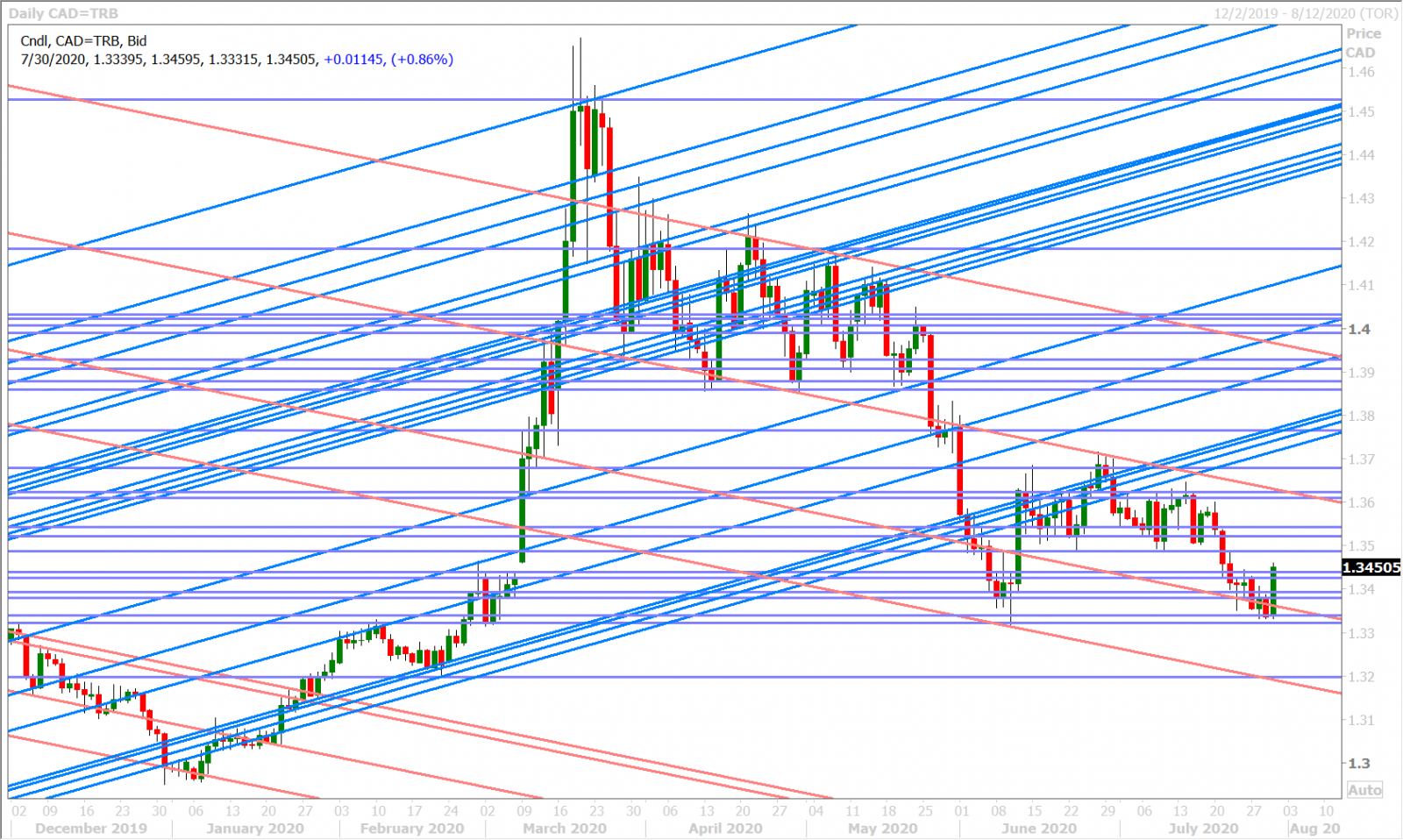

USDCAD

The Federal Reserve reiterated its commitment to using its full range of tools to support the US economy yesterday (as expected) and while Jerome Powell referenced a deterioration in recent “high-frequency” economic data and how he sees the outlook significantly dependent on the course of the virus (not surprising), he didn’t provide any updates/hints whatsoever as to the Fed’s thinking on potential “outcomes-based” forward guidance (disappointing considering the very dovish market expectations going into the FOMC meeting). We think it was this last point that ultimately put a floor underneath the USD and global bond markets going into overnight trade. The marketplace already knows that the Fed is “all-in” with regard to its QE/repo/swaps/emergency lending programs and that it’s increasingly worried about COVID-19, but it didn’t hear what it needed to hear as justification for holding on to its recent “Fed may let inflation overshoot via outcome-based forward guidance” thesis.

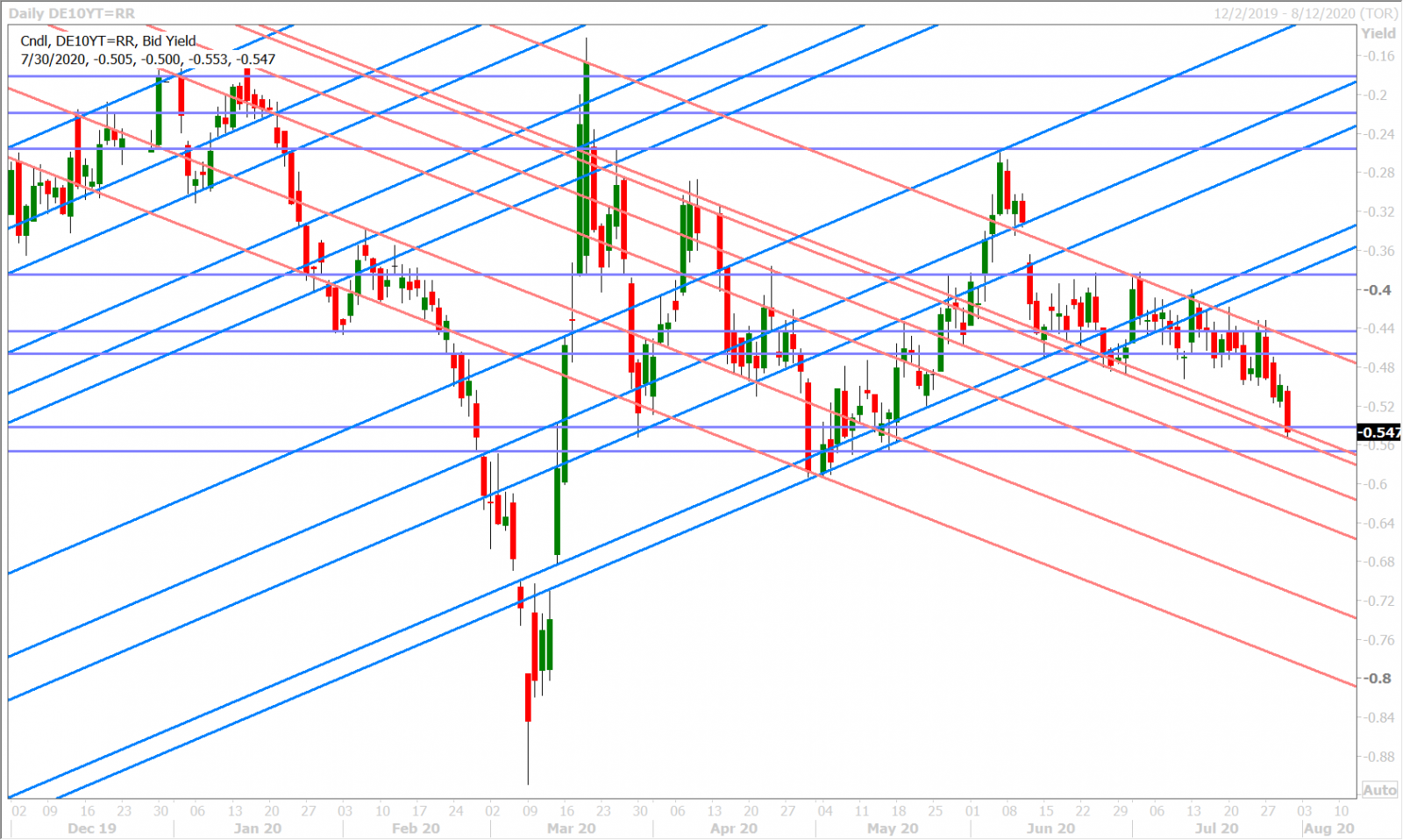

European traders played catchup to yesterday’s post-Fed price action this morning by aggressively pushing the German bund yield to new 3-month lows. This wasn’t so much a reaction to Germany’s horrible 10.1% decline for Q2 GDP (old news and largely as expected), but more so of a “Fed under-delivered and the outlook is still bad” trend continuation trade. The entire US bond curve followed suit and this morning’s US Jobless Claims figures for the week ending July 25 are now adding some fuel to that fire as the +1.434M number came in higher than last week’s +1.416M, which now marks a second week in a row of claims moving in the wrong direction.

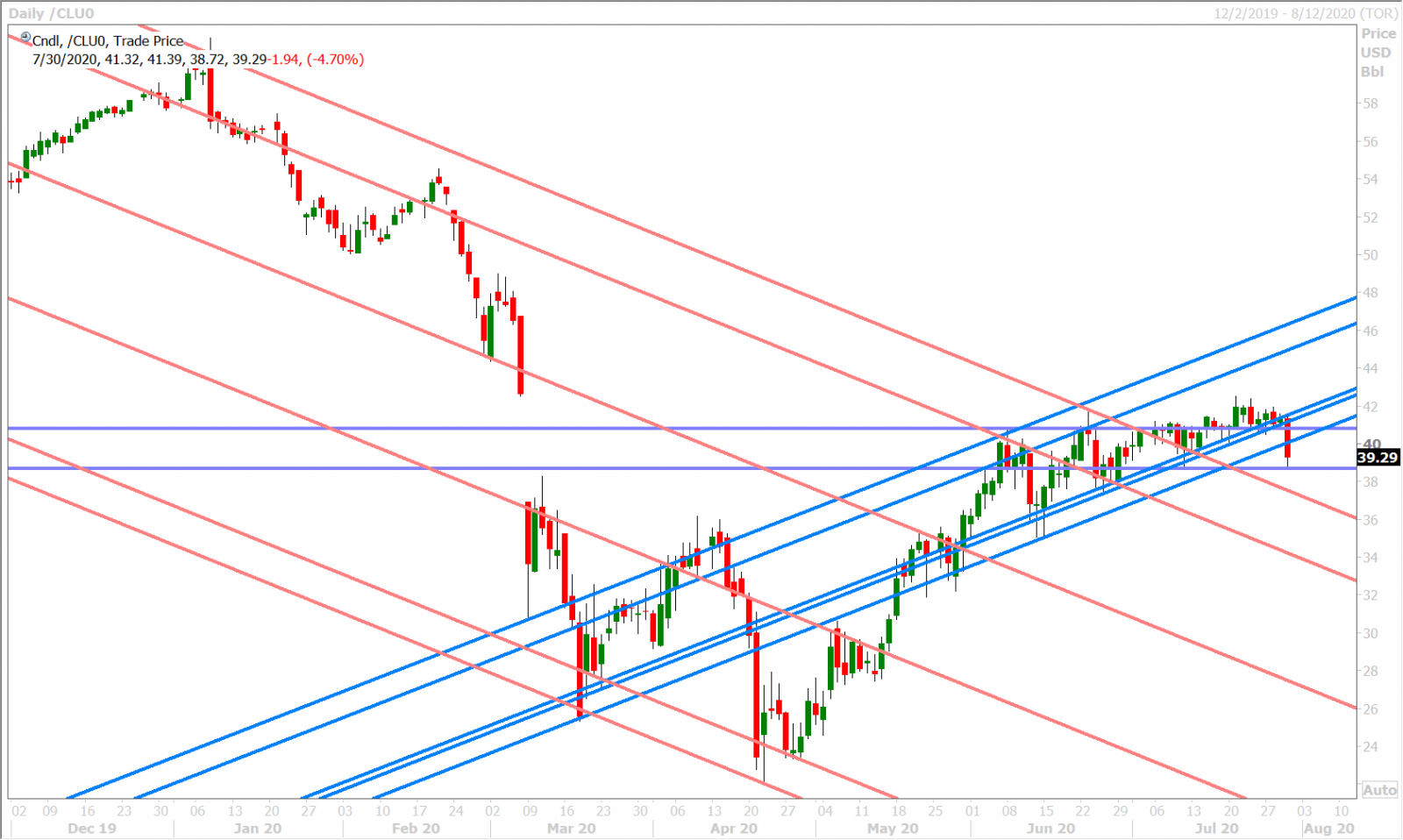

We feel this morning’s rush into bonds very much explains the softer overall risk tone and the USD’s bid against the risk currencies (CAD and AUD). Dollar/CAD is now rocketing through the 1.3430-40 resistance level as the selling in September WTI intensifies (-5%). We think hedging around tomorrow’s huge option expiries ($2bln at both the 1.3400 and 1.3500 strikes) could also provide upside influence and support to the market on dips.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

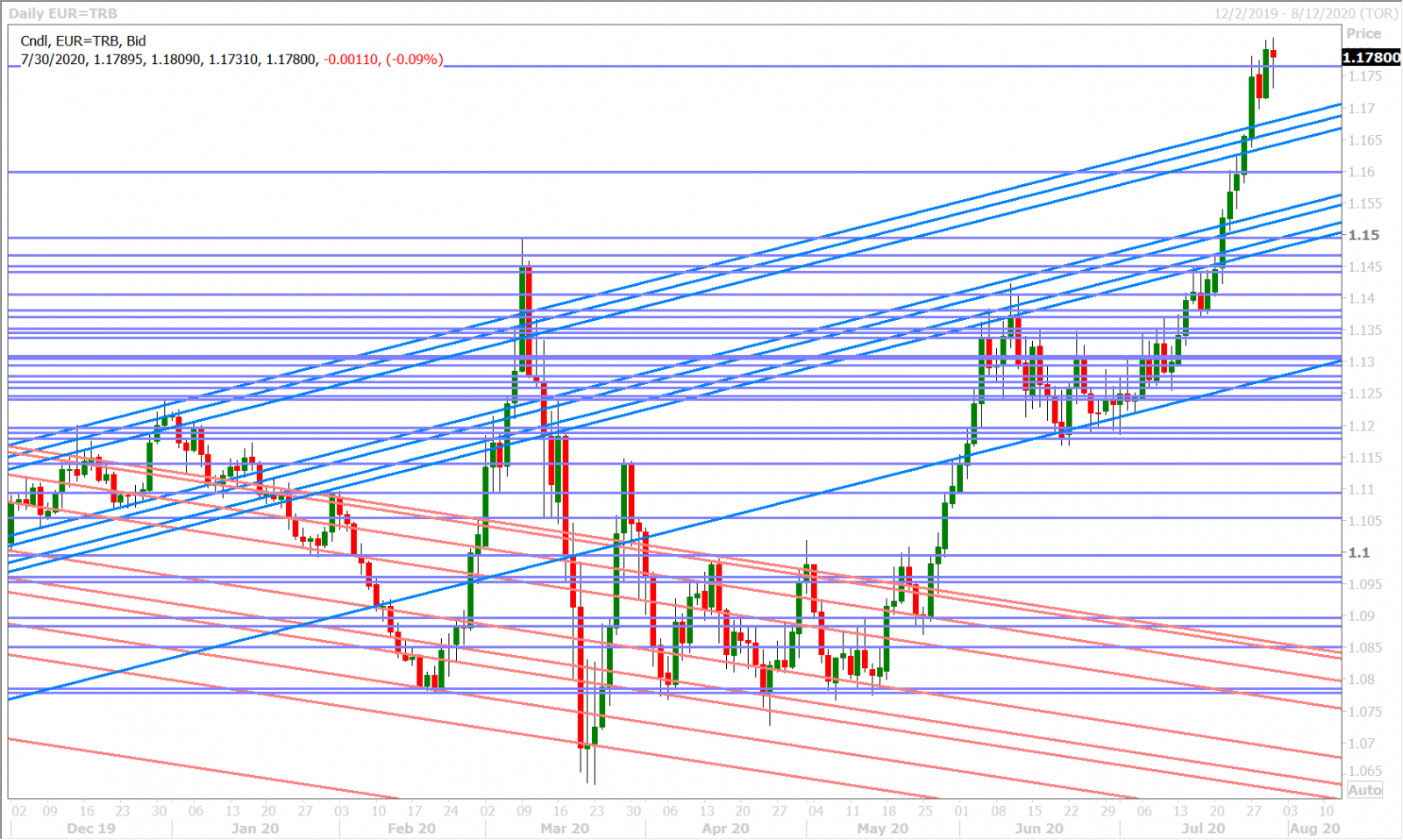

EURUSD

Euro/dollar topped out after yesterday’s less dovish than expected FOMC meeting, but we think the fact that the market couldn’t close below the pivotal 1.1760s level is contributing to today’s “buy-the-dip” mentality. This morning’s broad USD buying against the risk currencies could only register a modest decline for EURUSD below the 1.1760s and the market has now quickly regained this level following Trump’s tweet about possibly delaying the US elections in November (see below). Month-end USD sales also seem to be in play.

“With Universal Mail-In Voting (not Absentee Voting, which is good), 2020 will be the most INACCURATE & FRAUDULENT Election in history. It will be a great embarrassment to the USA. Delay the Election until people can properly, securely and safely vote???”

EURUSD DAILY

EURUSD HOURLY

SPOT SILVER DAILY

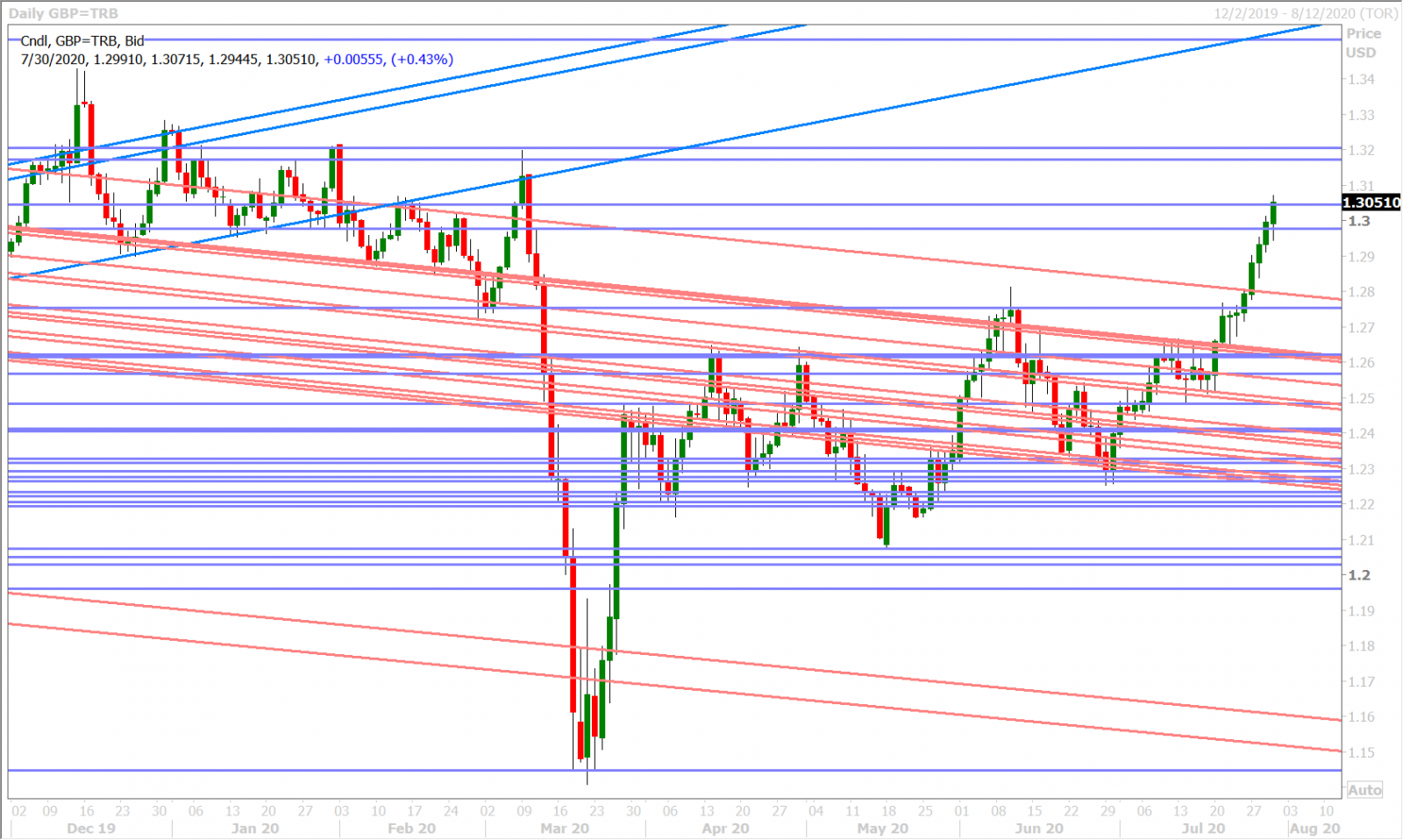

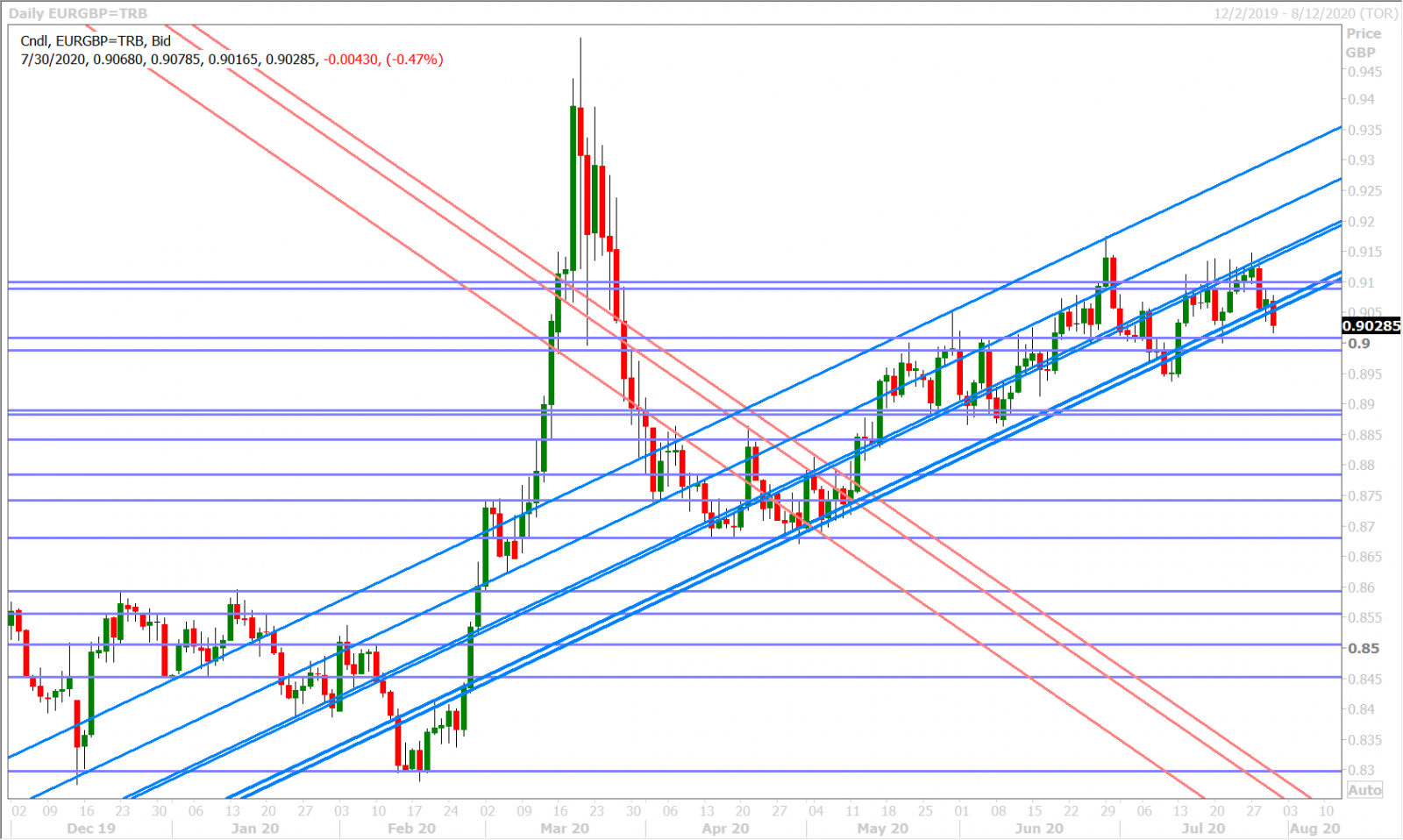

GBPUSD

Yesterday’s post-Fed price action in GBPUSD proved that sterling’s most recent rally is not something we want to stand in the way of for now. While the Fed failed to feed the “outcome based monetary policy doves” in our opinion, the meeting couldn’t produce a NY close for GBPUSD below the pivotal 1.2970s we talked about. As was the case for EURUSD this morning, we feel this technical strength added to today’s “buy-the-dip” feeling in London trade. Does somebody also know something we don't on the Brexit negotiation front?...because it’s hard not to notice EURGBP’s 50pt plunge and how it quickly propped GBPUSD right back above the 1.2970s when it commenced at 4amET this morning.

Trump’s tweet about potentially delaying the elections seems to be generating a knee-jerk reaction lower in the broader USD, but we think it’s still a bit early to tell if this is start of a “sell everything USA” trade. We could also be seeing some of month-end USD selling this morning; something that Citibank predicted earlier this week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

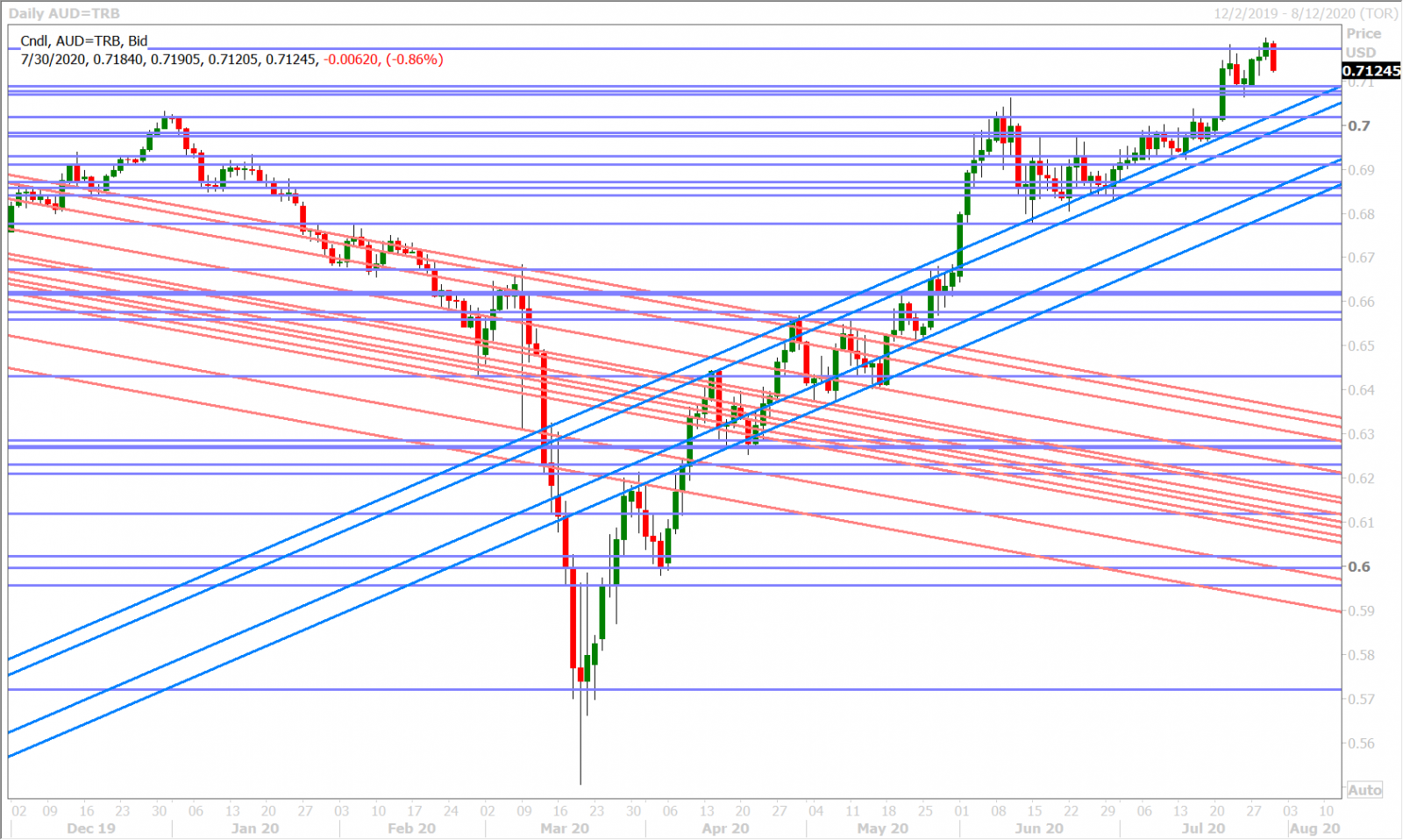

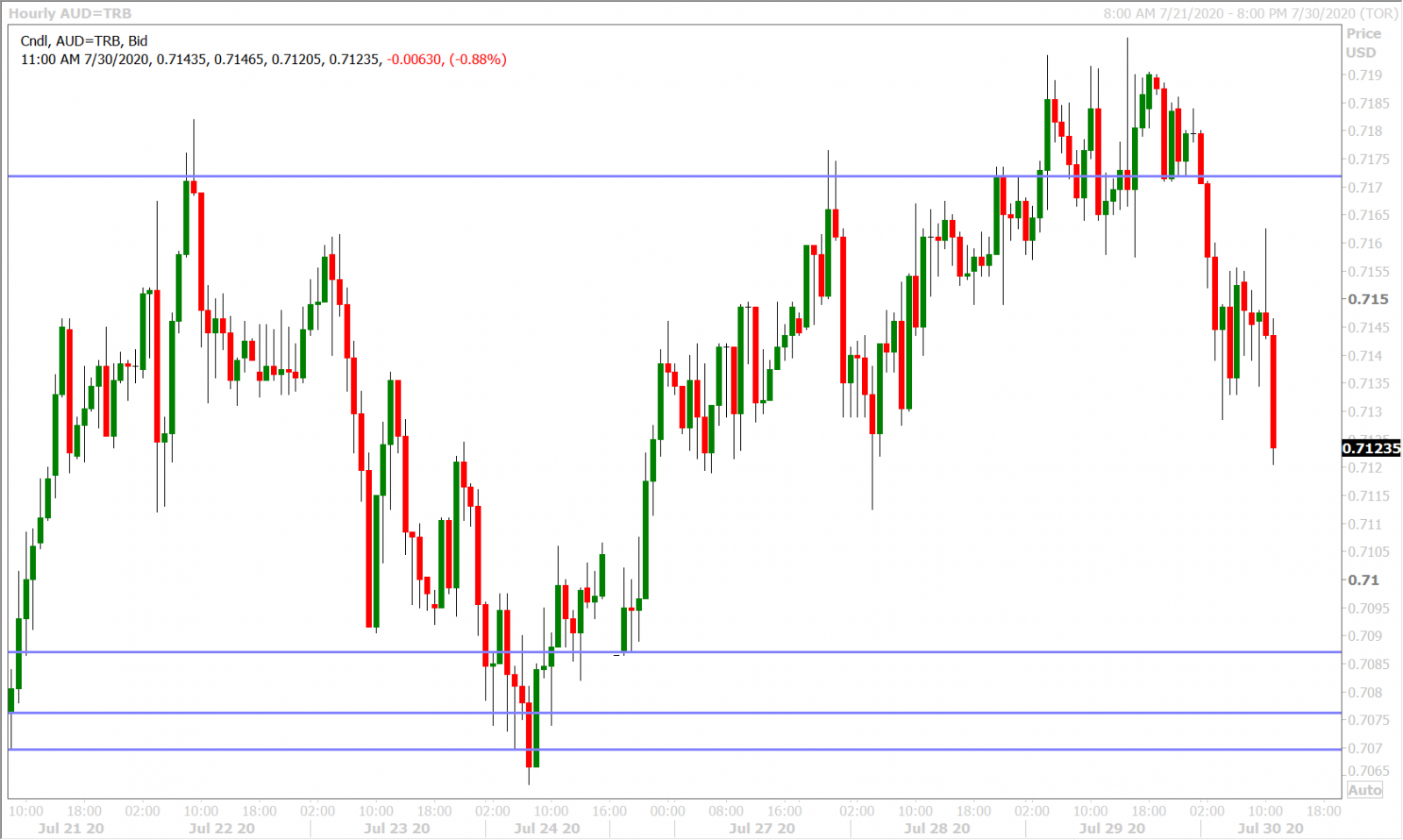

AUDUSD

The Australian and Canadian dollars (the risk currencies) are very much bearing the brunt of the marketplace’s desire to reduce risk broadly after the Fed meeting. The Aussie has given up the pivotal 0.7170s and while Trump’s tweet has some knee-jerk USD selling after the NY open, it feels temporary for the moment…the USD selling could also be month-end related too (which is also temporary), and so we’d be on guard for some negative momentum to resume at some point for AUDUSD.

Remember tomorrow’s large 1.2blnAUD option expiry at the 0.7050 strike…it’s not too far away and could become a magnetizing force should we see another wave of risk-off flows into late NY/overnight trade. The Australian state of Victoria reported some awful COVID statistics today but markets are unsurprisingly continuing to brush off negative headlines on this front.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

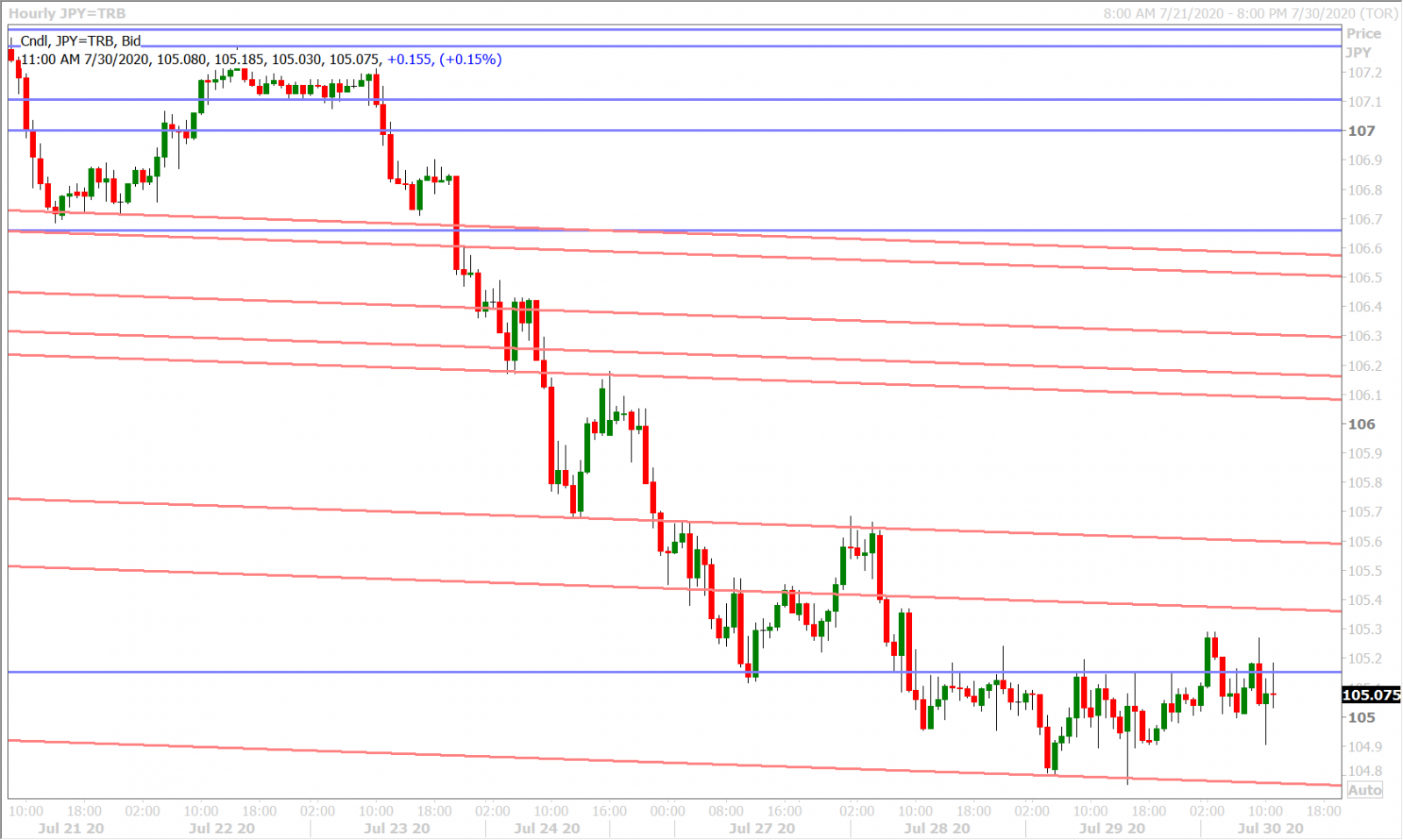

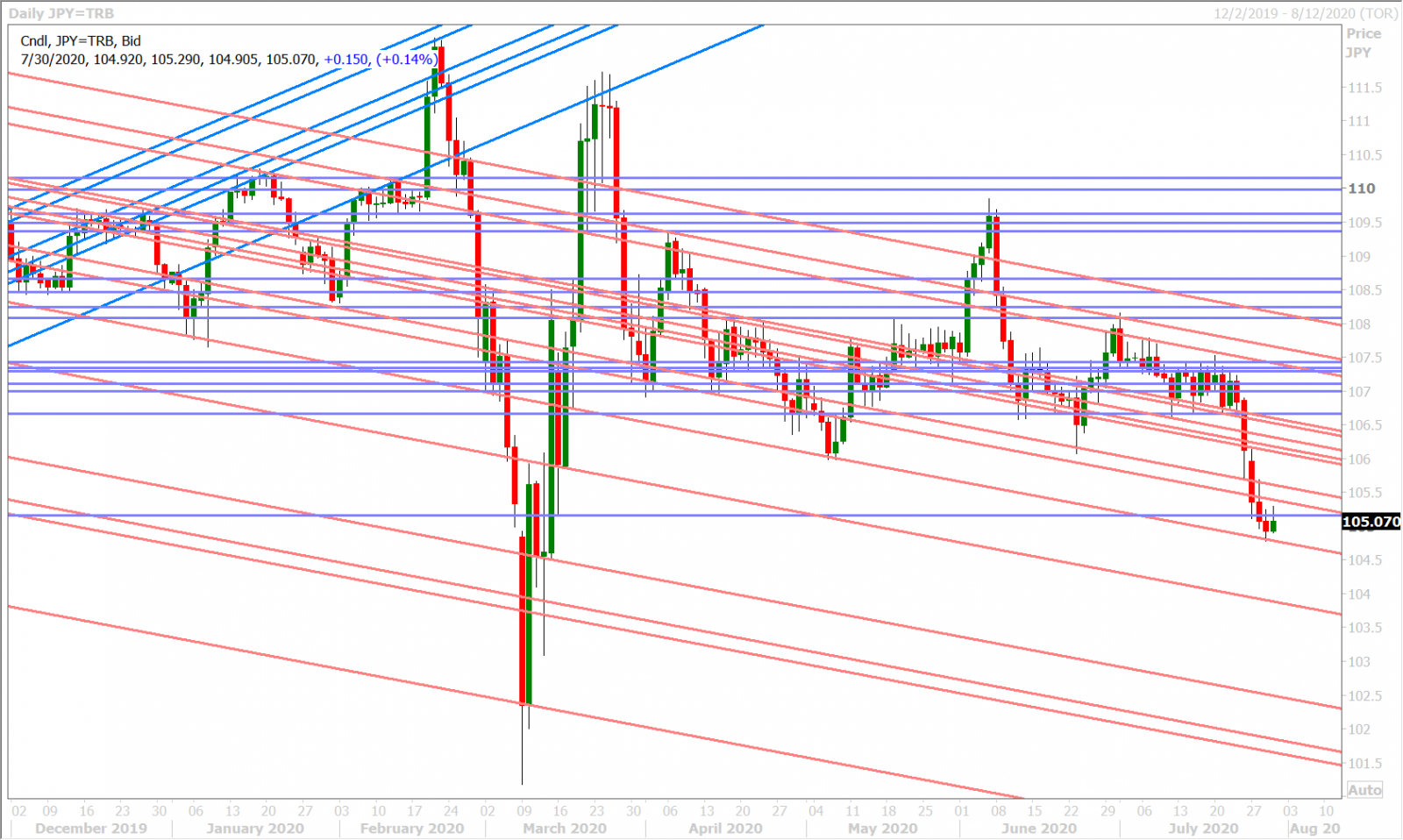

Dollar/yen traders got a familiar comment from a Japanese Ministry of Finance official last night about how the ministry is watching the FX markets with a “sense of urgency” and how foreign exchange stability was important. We heard the same thing from Japanese officials back in March when the yen surged through the 105 level and so this news is not really all that surprising. Talk is cheap when it comes to BOJ policy.

We didn’t get a meaningful bounce in USDJPY yesterday after the Fed delivered a less than dovish hold to monetary policy and we think the market’s inability to close NY trade above the 105.10s and today’s competing influences (weak yields vs risk-off USD buying) is leading to indecision for traders at the moment. Tomorrow’s $1bln option expiry at the 106.00 will likely only prove magnetic if the 105.40-60 resistance level can be surpassed.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10-YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com