Month-end USD sales appear to have run their course

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- USD collapses lower yesterday afternoon after feeble post-Fed bounce.

- Did portfolio managers jump the gun with expected month-end USD sales?

- Ramp in FANG stocks ahead of earnings, helped risk sentiment into the NY close.

- USD now recovering into NY trade today. Have the month-end flows passed?

- Canada reports better than expected GDP for May, +4.5% MoM vs +3.5%.

- Huge USDCAD option expiries in play today + London fix flows at 11amET.

ANALYSIS

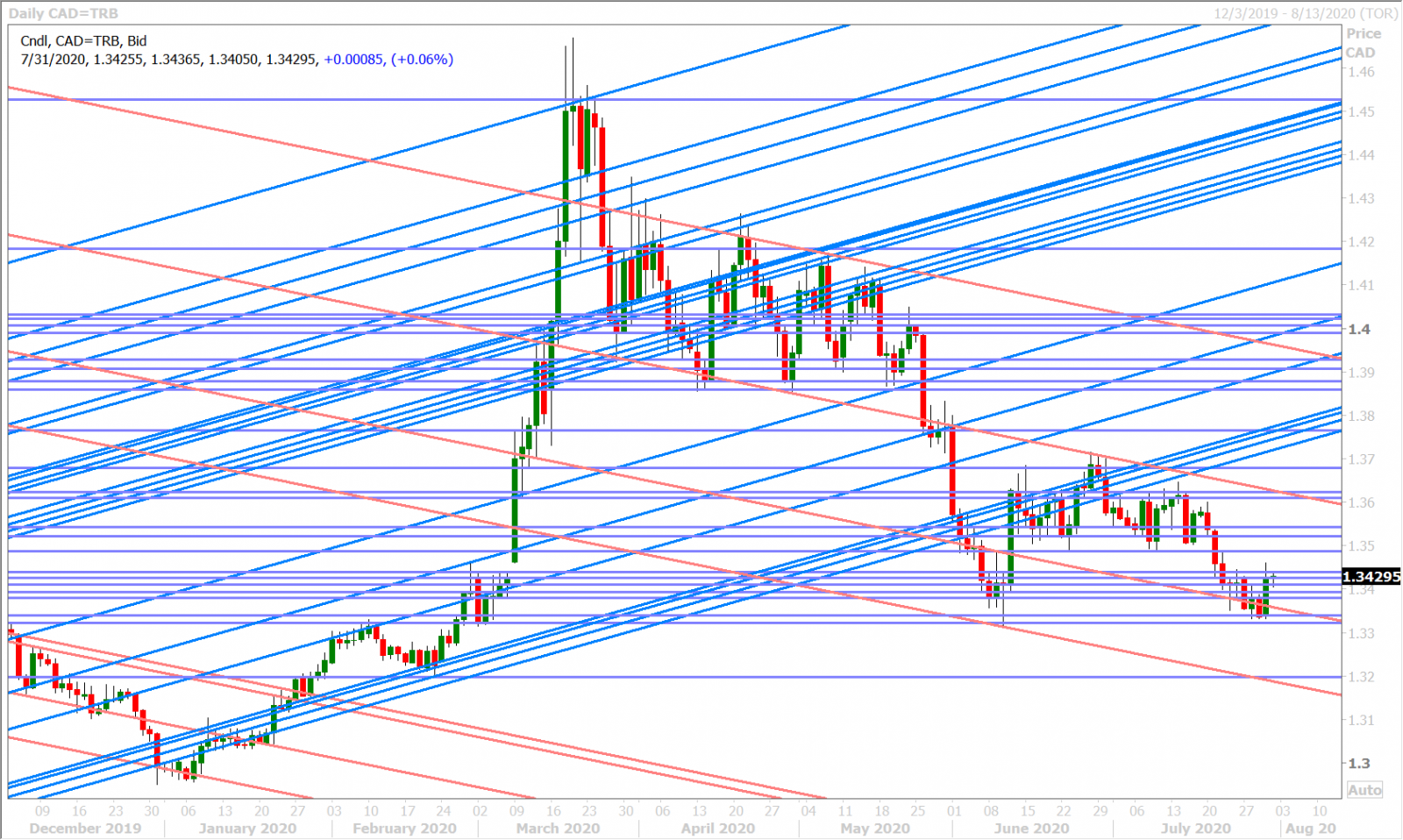

USDCAD

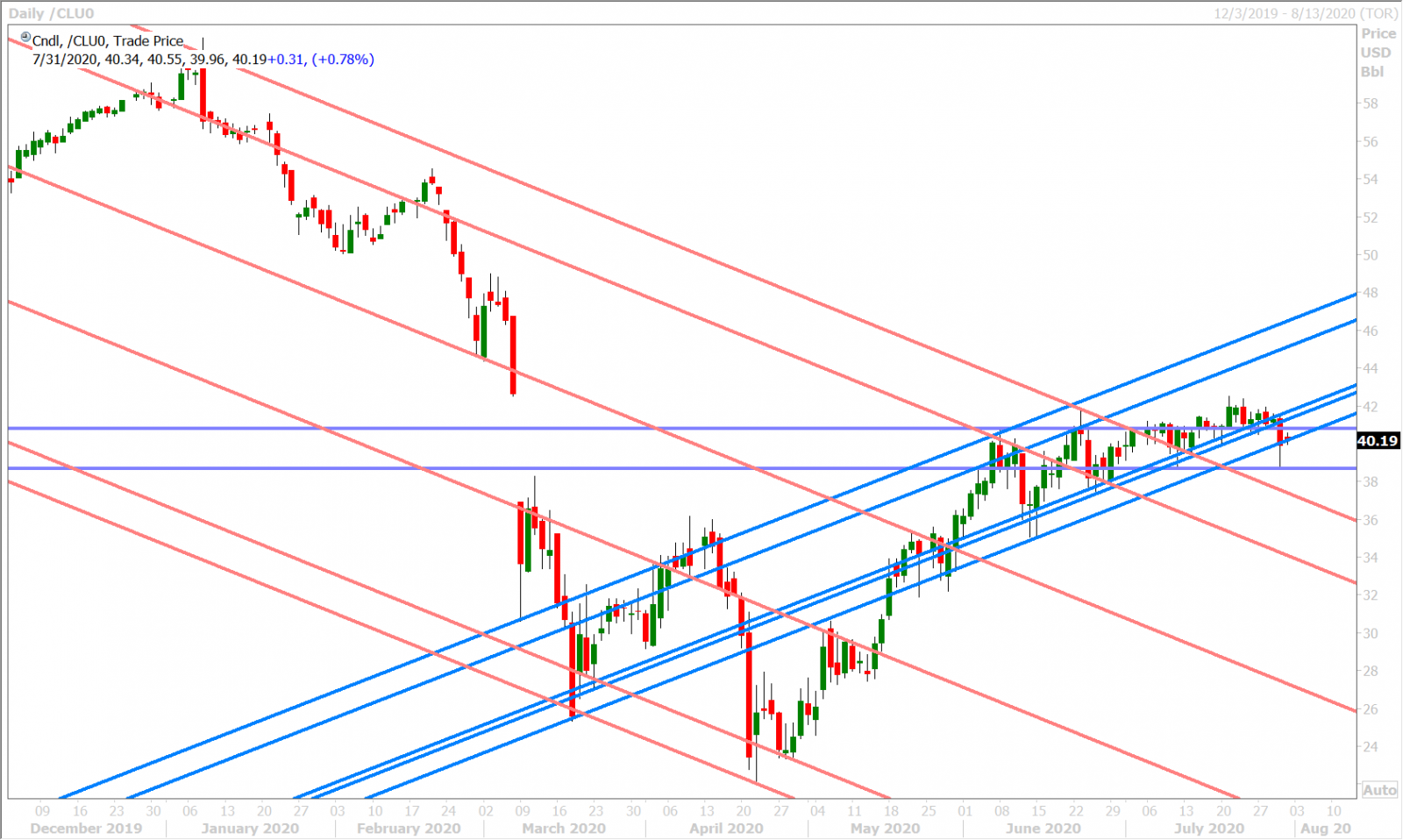

Dollar/CAD traders are trying to buy the dips this morning as month-end dollar selling seems to have run its course. The timing of these re-balancing flows is notoriously difficult to predict but we’d wager that a lot of portfolio managers jumped the gun yesterday given the broader USD’s inability to meaningfully bounce after the Fed meeting. There’s been a lot of chatter about CAD’s under-performance yesterday amidst these flows and we think this was largely because of September WTI’s 5% implosion; a sell-off that has now ruined the oil market’s upside breakout pattern from July 21. We think some pre-hedging ahead of today’s massive 1.3400 option expiry (now valued at $2.2blnUSD) also attracted CAD sales.

Canada just reported a slightly better than expected May GDP figure (+4.5% vs +3.5%), but the market’s lack of reaction tells you everything you need to know...old news…move on. Today’s 10amET NY option cut also features a $2.3blnUSD expiry at 1.3500, although the magnetizing effect of this strike shouldn’t come into play unless USDCAD breaks above 1.3450 in the next hour. Watch for some potential volatility going into the 11amET London fix, in case these month-end flows aren’t over just yet.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

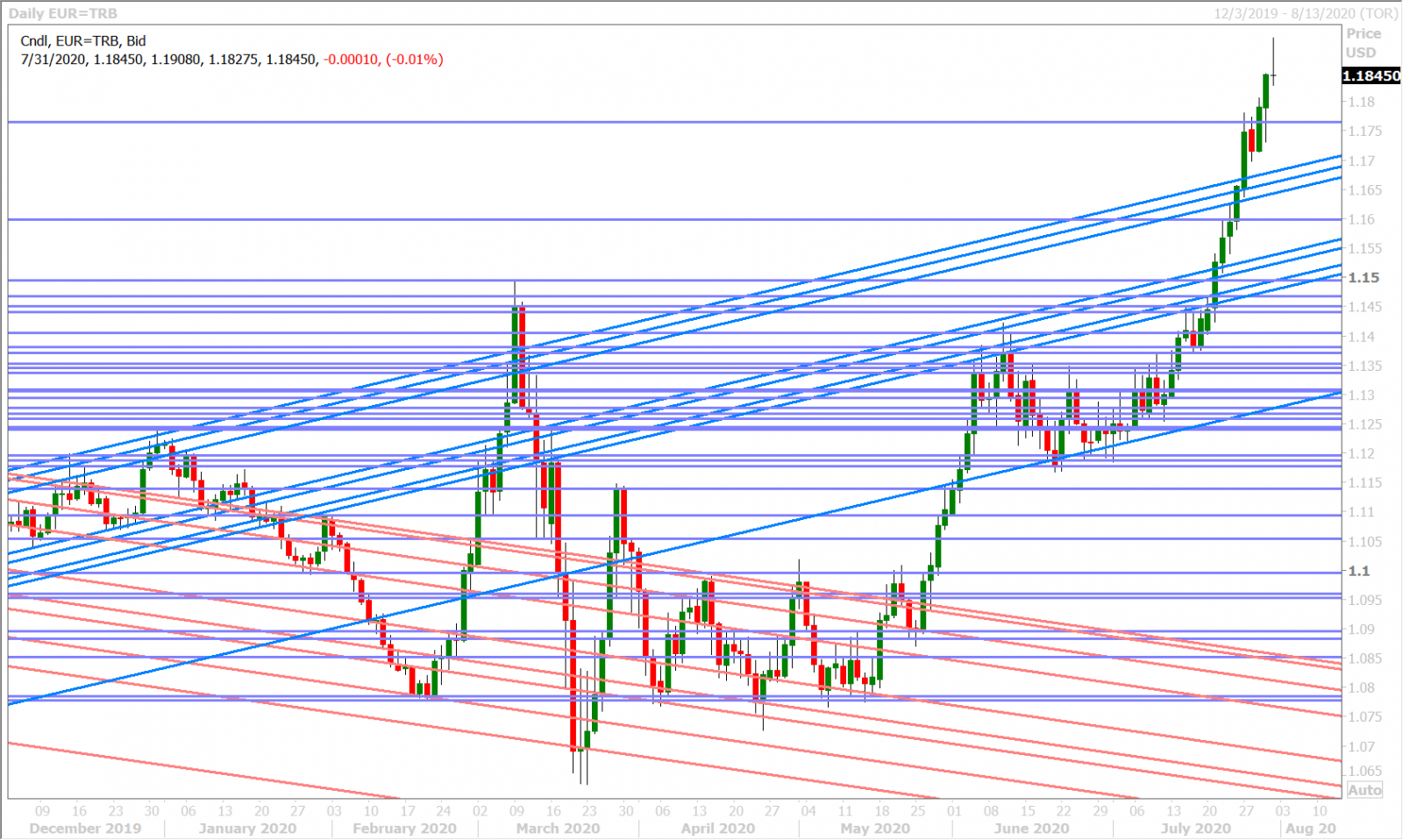

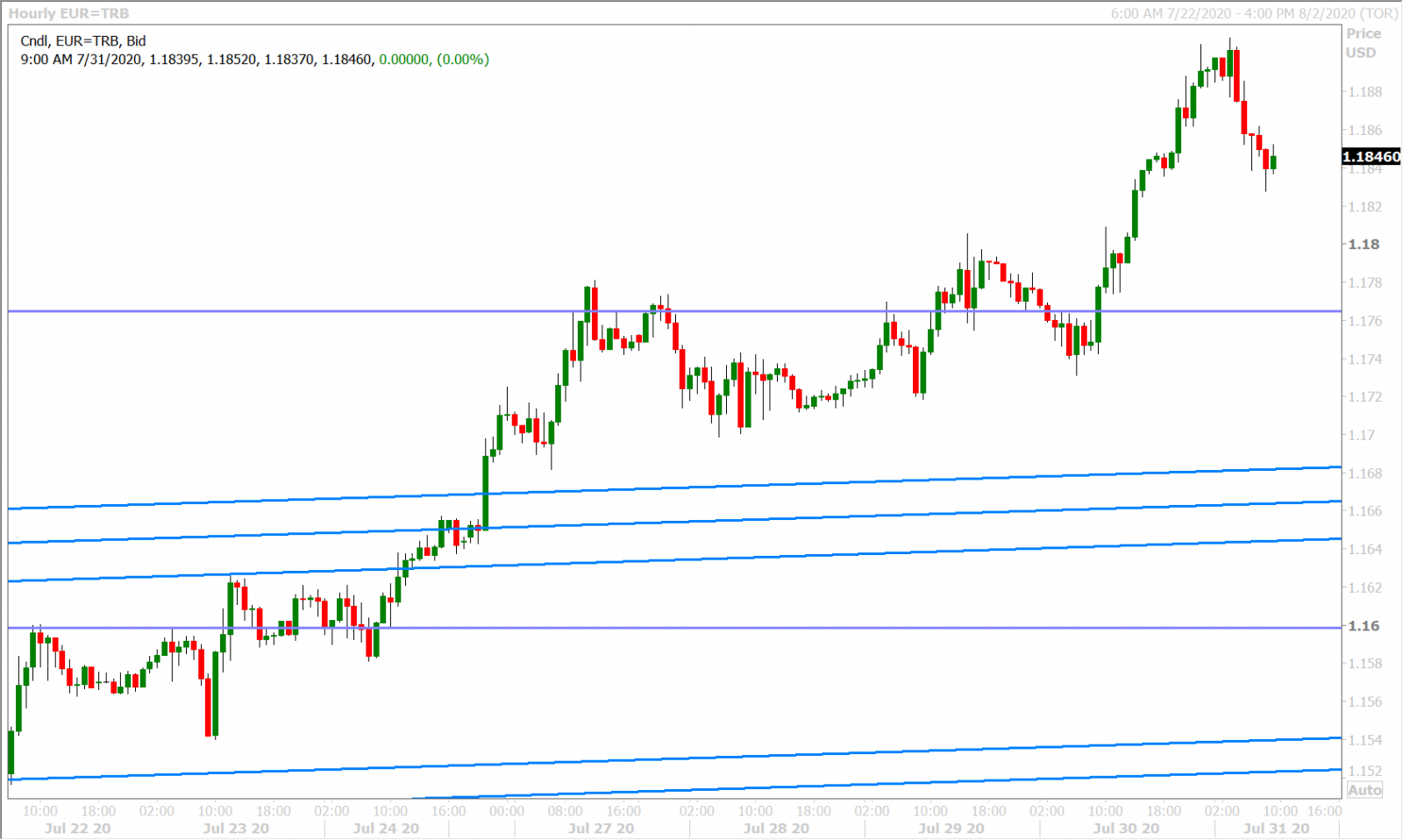

EURUSD

Euro/dollar ripped higher yesterday and, while Trump’s election-delay thoughts helped spark the move, we felt the rally was largely driven by month-end USD sales and perhaps a sprinkle of “risk-on” from well-timed buying of large-cap US tech names going into last night’s better than expected Nasdaq earnings parade. The market’s subsequent reversal lower from its overnight highs above 1.19 proves the point. These flows are fickle and they eventually pass.

We don’t seriously believe traders are worried about the US elections getting postponed and we think the growing talk of the USD’s reserve currency status being at risk is all hogwash. The global eurodollar system, no matter how broken it is, ain’t going anywhere anytime soon.

EURUSD DAILY

EURUSD HOURLY

SPOT SILVER DAILY

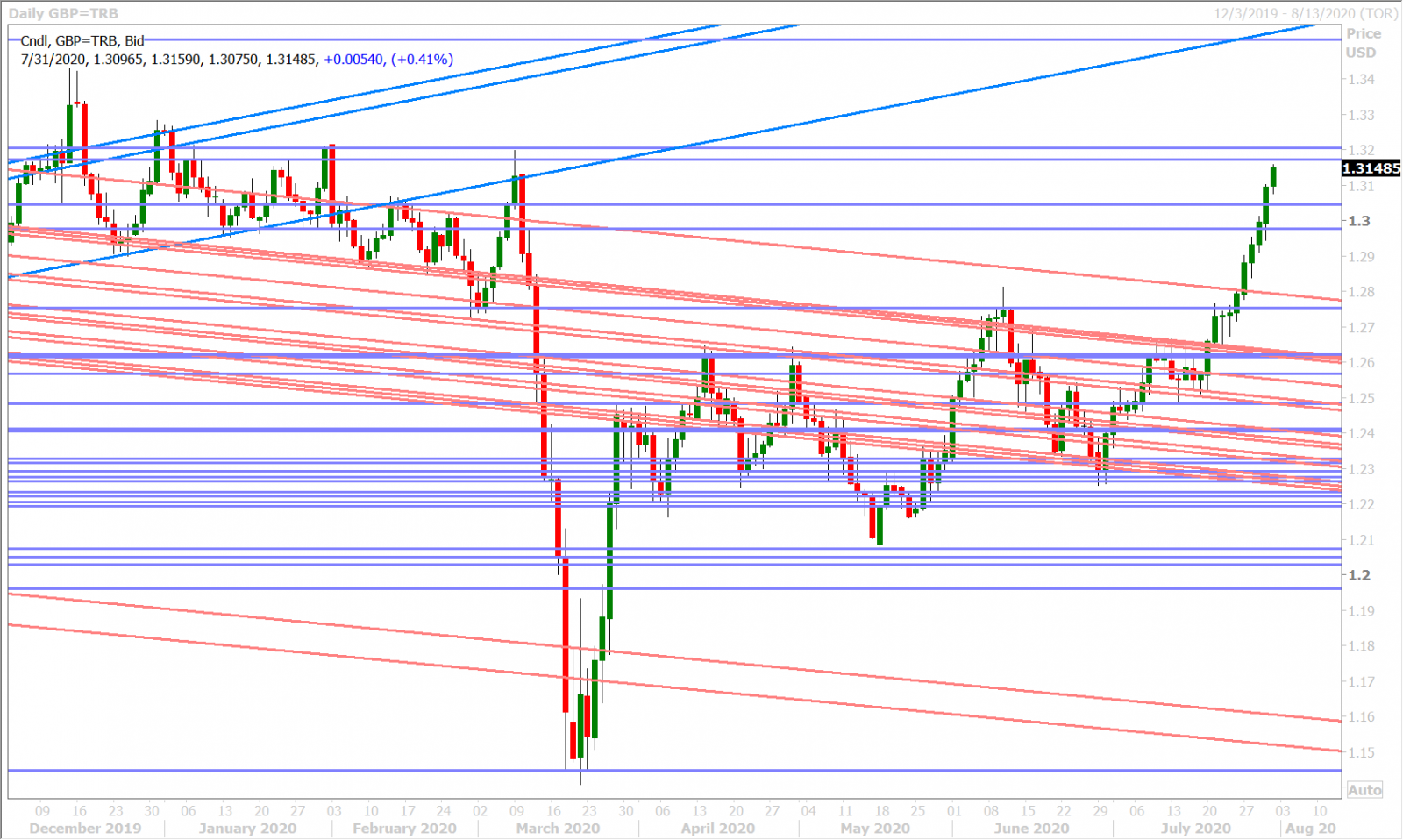

GBPUSD

Sterling continues to rip the face of whatever Brexit-inspired GBPUSD shorts still remain in this market. It closed NY trade very strongly yesterday on broad USD weakness; shattering chart resistance at the 1.2970s and 1.3040s in the process…and the market now looks poised to shoot for the 1.3200-1.3210 level. Do not stand in front of this freight train for now as the market is not trading off UK fundamentals.

GBPUSD DAILY

GBPUSD HOURLY

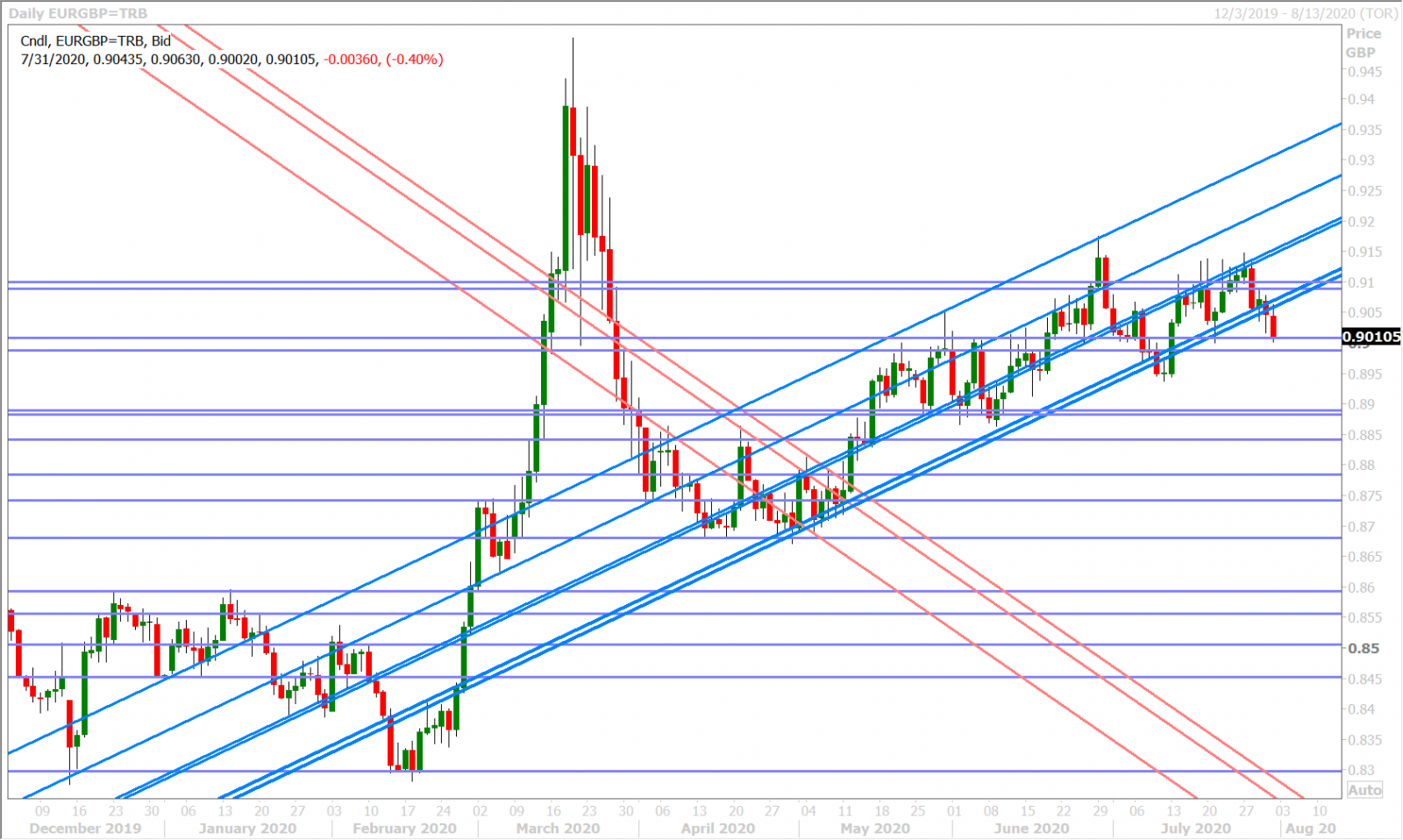

EURGBP DAILY

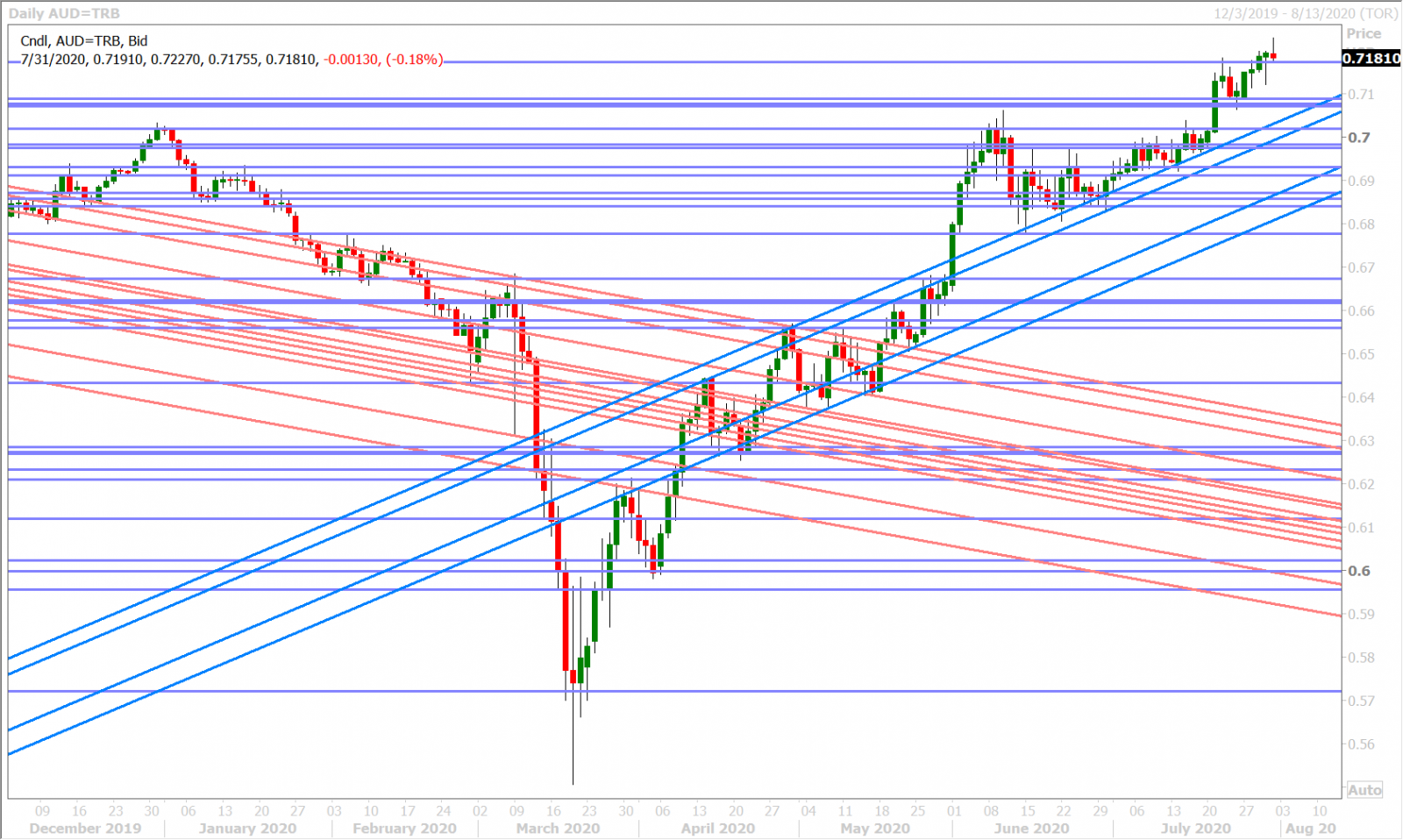

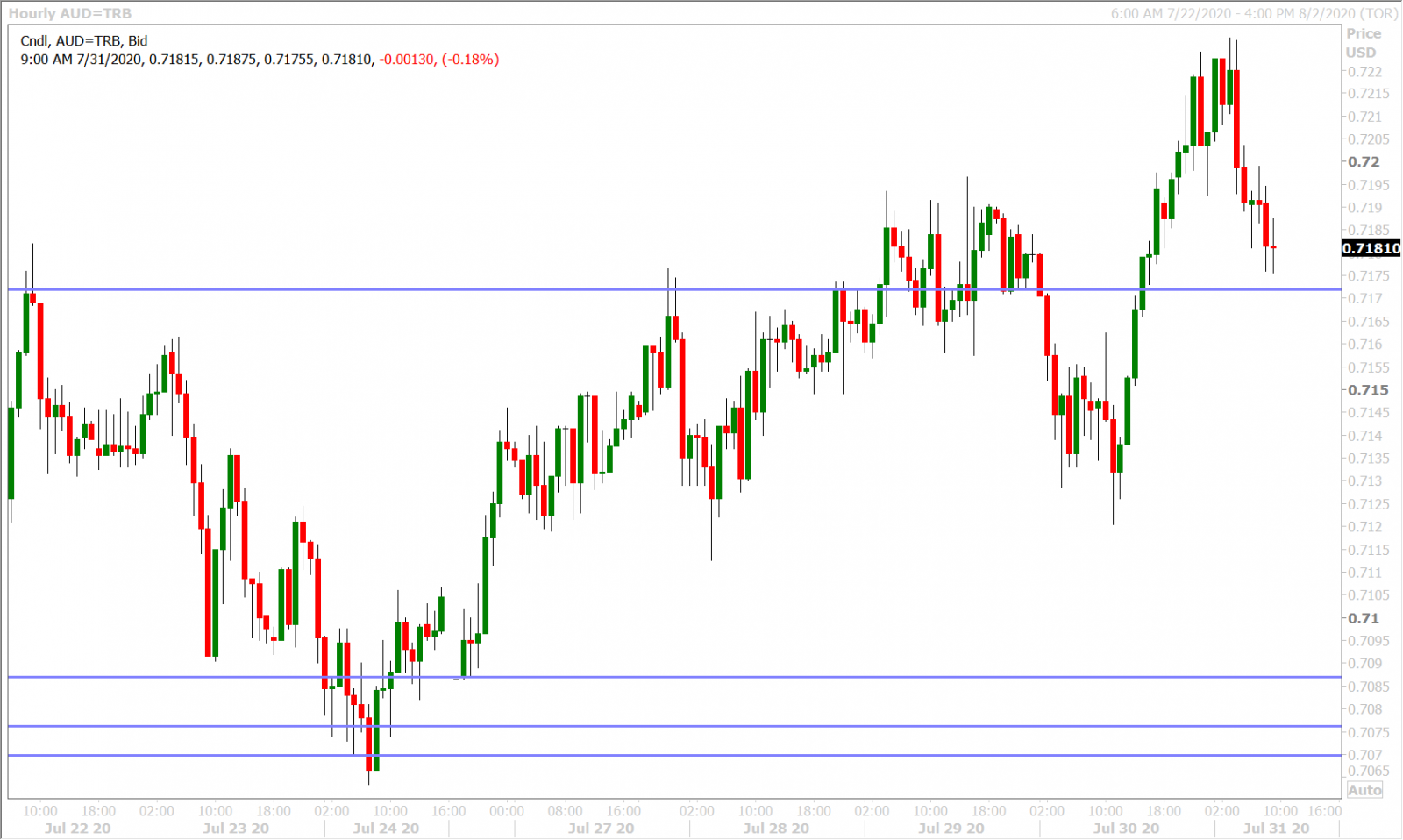

AUDUSD

The Aussie recovered to close NY trade above the 0.7170s yesterday and we think month-end USD sales and some US tech stock buying were also the drivers. These flows seemed to have passed however, which could now force another test of the pivotal 0.7170 level going into the London fix at 11amET.

AUDUSD DAILY

AUDUSD HOURLY

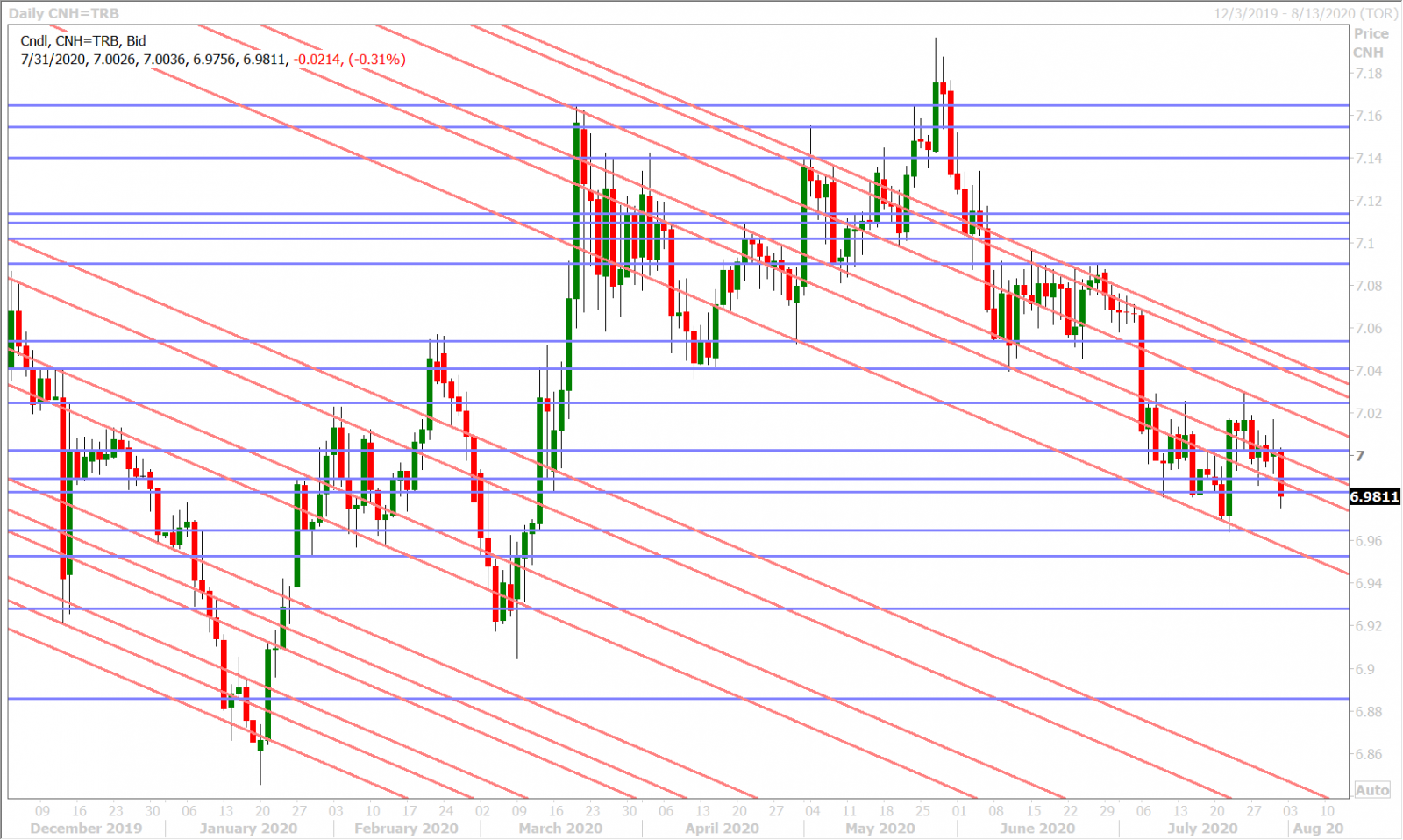

USDCNH DAILY

USDJPY

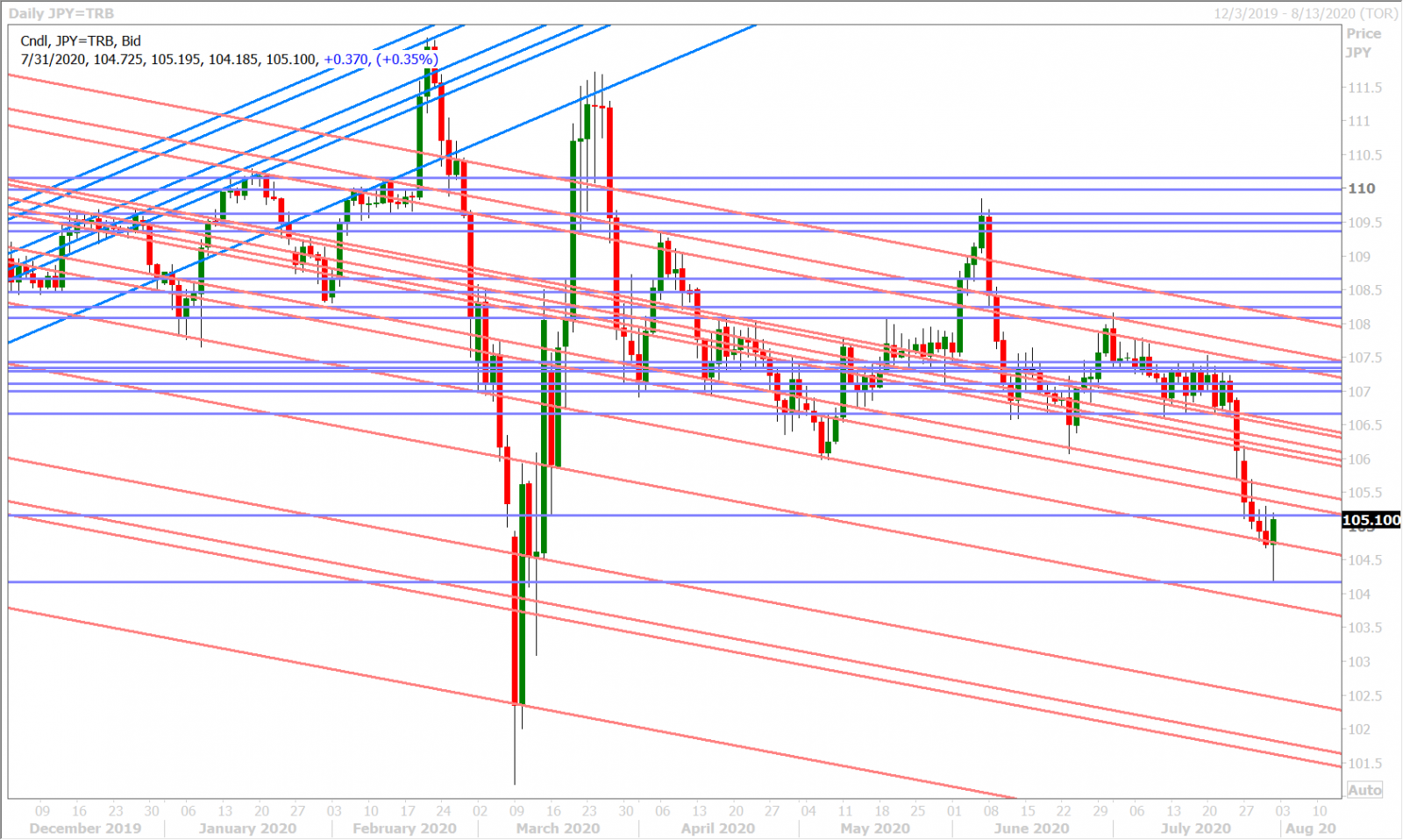

Dollar/yen traders made up their mind yesterday afternoon and continued to follow the broader USD lower when EURUSD cracked above the 1.1800 mark. We think the ongoing downtrend for US yields continues to add weight to this market, but USDJPY’s correlation with broader USD flows has been even tighter of late…and so we’re watching this dynamic even more closely.

Japanese Finance Minister Taro Aso said the same thing that one of his officials said the day before, with regards to recent yen strength. “Stability is important, so I’m closely monitoring it with a sense of urgency.” This was not the reason behind USDJPY’s bounce off the 104.20s and back above the 104.70s support level overnight, but it sure feels like Japanese officials don’t like the market trading below the 105 handle.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com