Reflation trades back in vogue after last week's US CPI

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- USD on the back-foot since higher than expected US CPI last Wednesday.

- Risk sentiment buoyant as traders re-focus on dovish Fed expectations.

- Last week’s record quarterly treasury refunding event has now passed.

- Weekend’s review of US/China Phase 1 deal progress postponed indefinitely.

- FOMC Minutes and global flash PMIs for August in focus later this week.

- Leveraged fund net long EURUSD position grows to new record size.

ANALYSIS

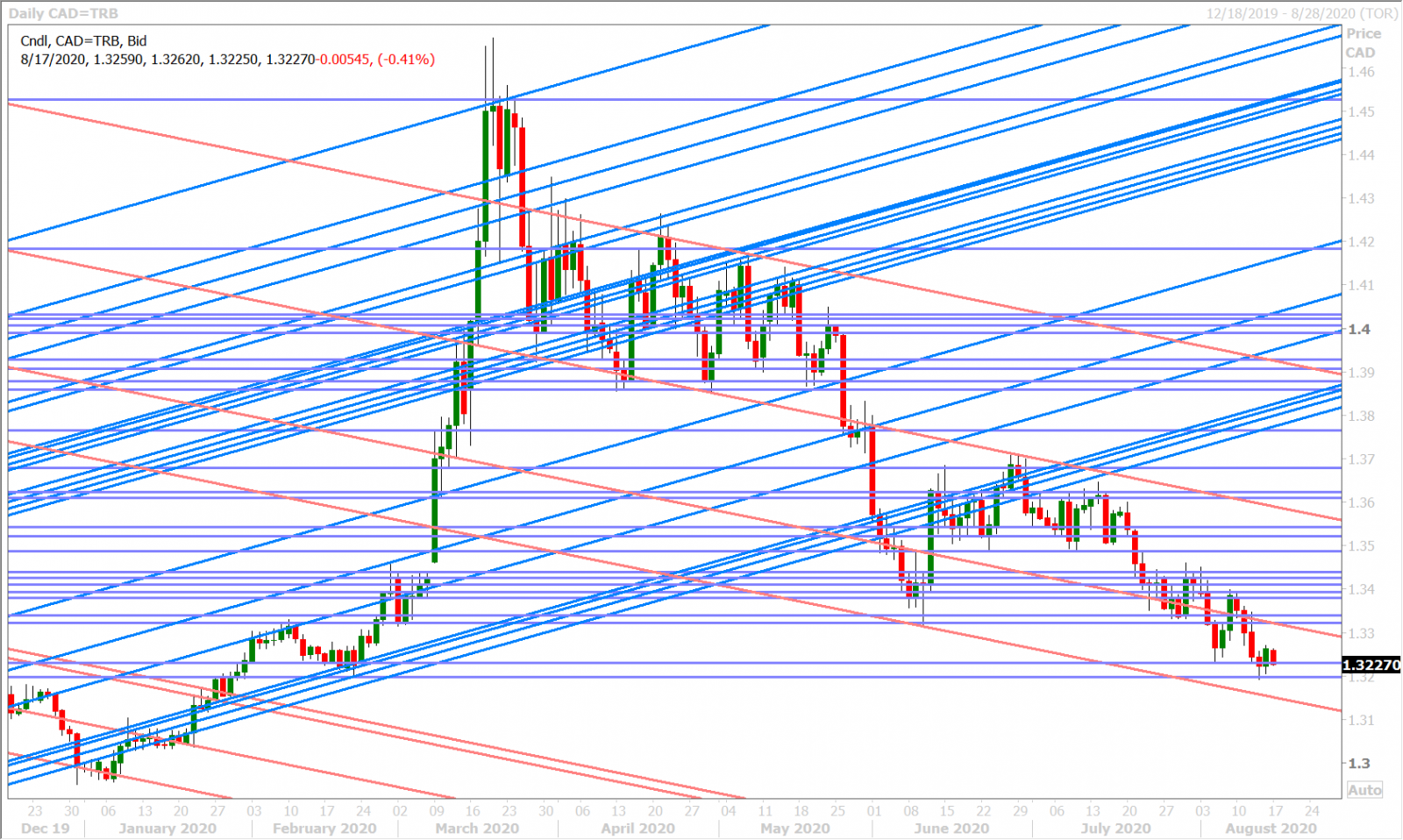

USDCAD

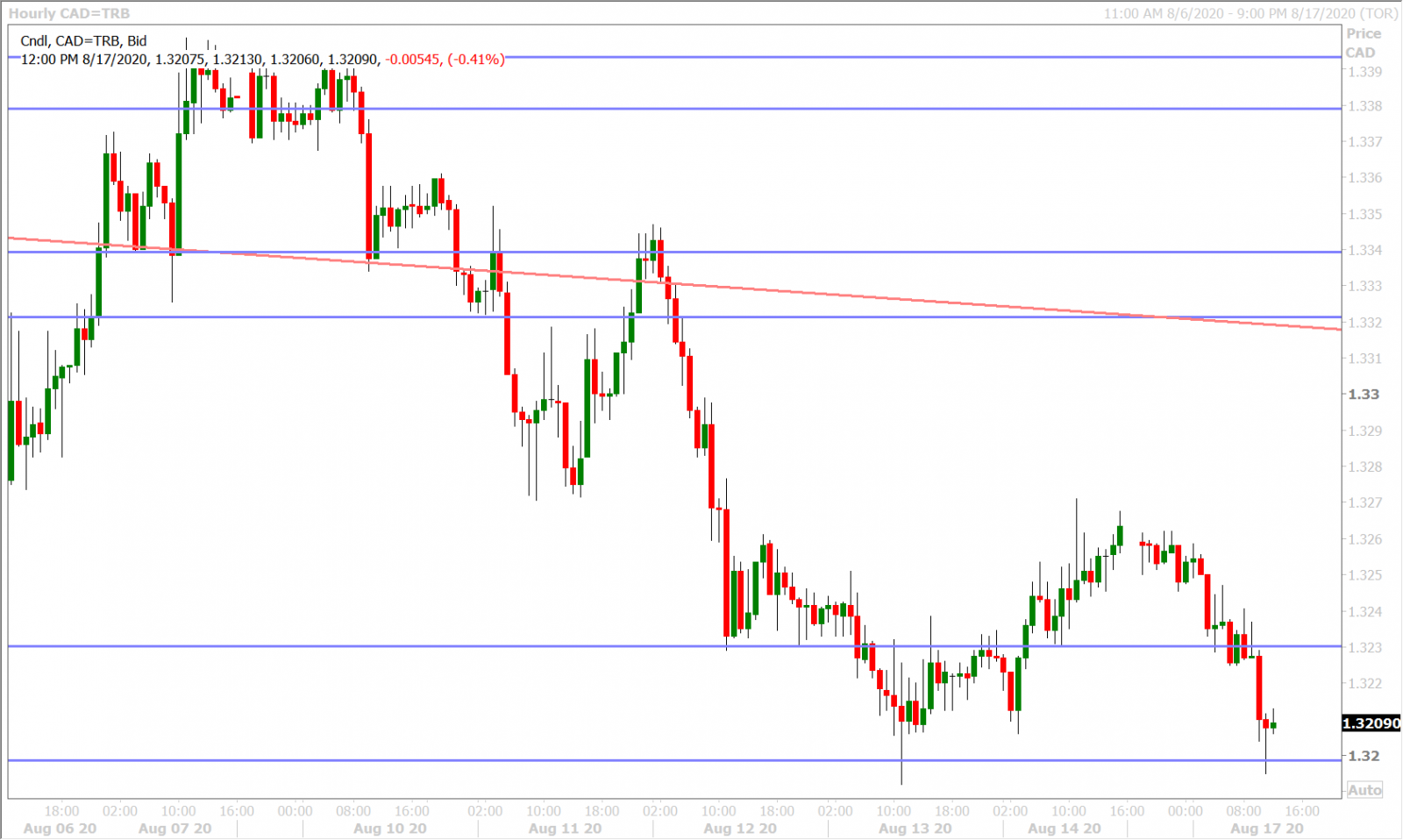

Dollar/CAD resumed its downtrend in early August and it all started with another surge in precious metal prices which saw the bottom end of the market’s post-Fed meeting 1.3370-1.3440 range give way. New US/China tension (sanctions on Chinese/Hong Kong officials + Tiktok/WeChat ban) and US congressional failure to reach a deal on new coronavirus relief brought about some risk-off USD buying which saw USDCAD try to regain the 1.3370s on August 7th, but President Trump’s signing of four executive orders towards this cause helped broad risk sentiment and pressured the market once again to start last week’s trade.

Last Tuesday’s surge in US yields/crash in precious metals (on the back of last week’s record $112bln in quarterly refunding of maturing US treasuries) helped the broader USD extend its bounce into mid-week, but USDCAD’s inability to benefit and its miserable NY close below 1.3320-40 support zone cast a negative omen going into Wednesday’s trade. Some much hotter than expected US CPI data for July (+0.6% MoM vs +0.3%) then added validity to the marketplace’s recent love affair with reflation trades and we feel that this, along with the passage of last week’s US treasury supply event, helped capped US yields into week’s end and allowed FX traders to refocus on the Fed "yield curve control/inflation overshoot policy" narrative that suppressed real US yields and the USD ahead of the last FOMC meeting.

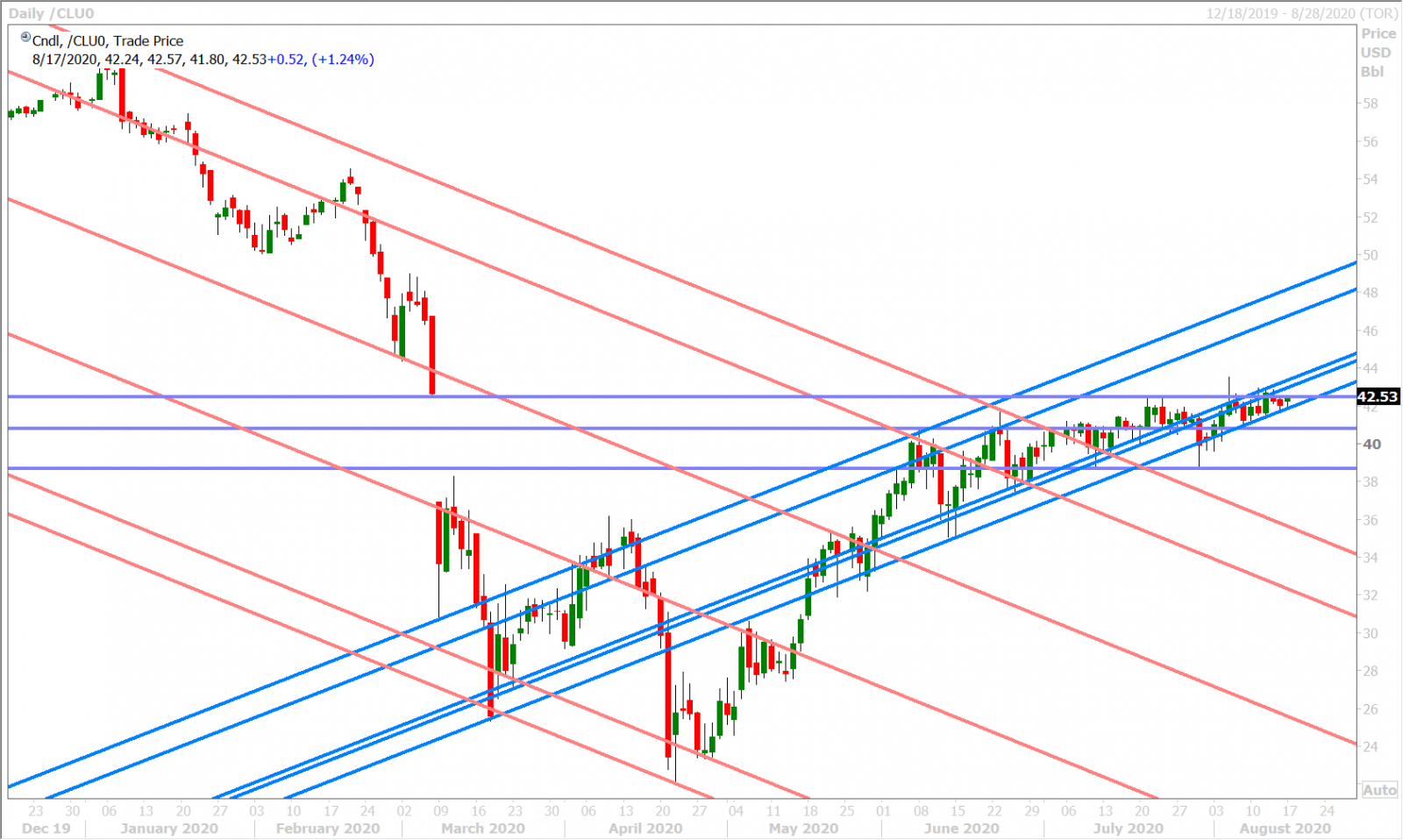

Saturday’s unexpected postponement of US/China talks to review the Phase 1 trade deal has boosted broad risk sentiment to start the week and we’d argue this is largely because traders are being spared the negative soundbites that surely would have resulted. We think overnight risk appetite was also aided by chatter that China tentatively booked tankers to transport at least 20mln barrels of US crude oil for August and September, and news that the PBOC injected 700blnCNY in liquidity to the Chinese marketplace via its medium-term-lending facility. Traders don’t seem too concerned so far about this morning’s much weaker than expected NY Fed Empire Survey for August (+3.70 vs +15.0).

This week’s North American calendar features some second tier US data for July on Tuesday (Housing Starts and Building Permits), Canadian CPI for July and the FOMC Minutes on Wednesday, the weekly US jobless claims figures and the August Philly Fed survey on Thursday, and finally Canadian Retail Sales for June and the August flash PMIs for the US on Friday. Two large USDCAD option expiries at the 1.3250 strike will feature for Thursday and Friday’s sessions, which could help the market hold a bid later this week. The leveraged funds, however, added to their net long USDCAD position for the second week in a row during the week ending August 11…which doesn’t bode well for the market right now as these bets continue to lose money.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

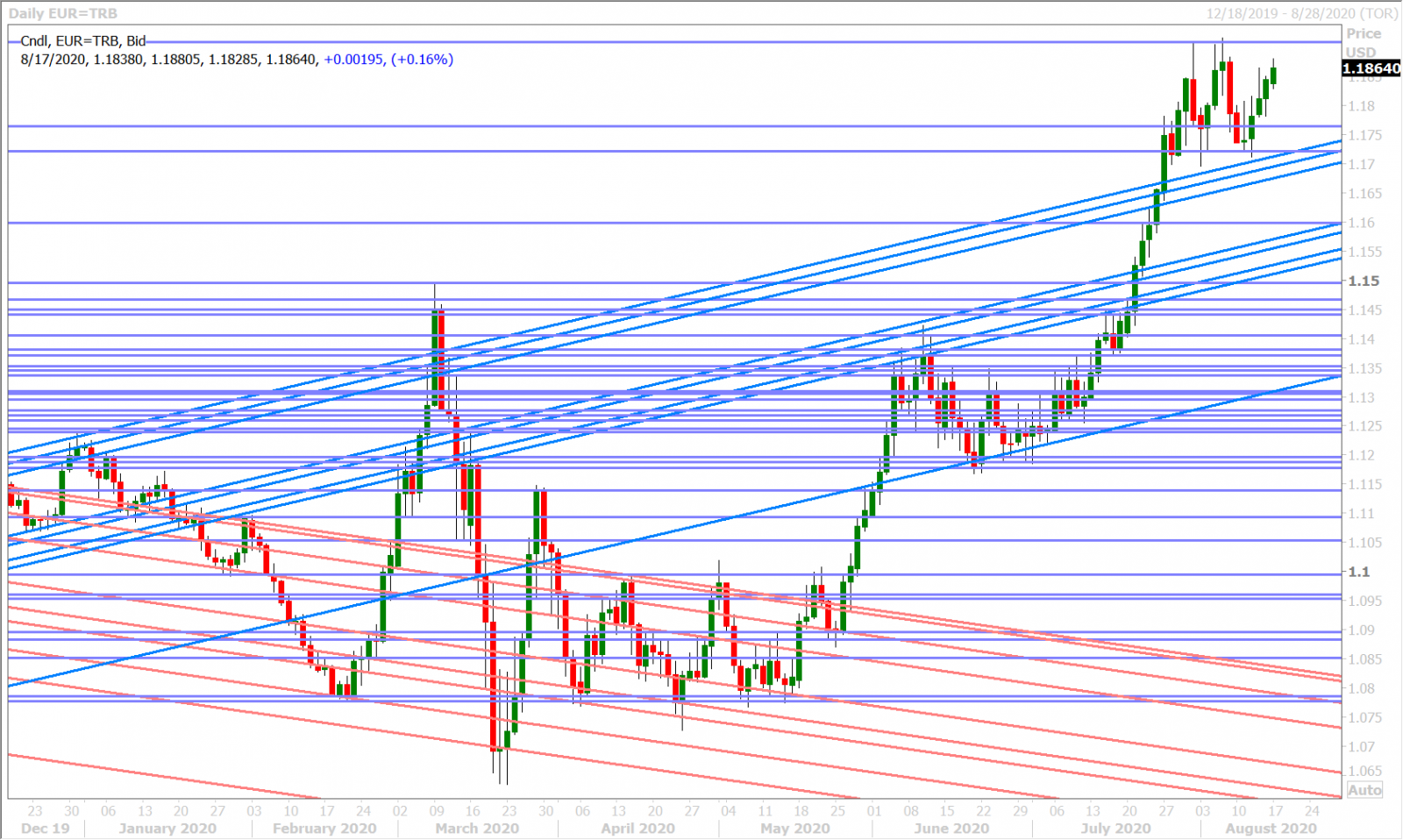

EURUSD

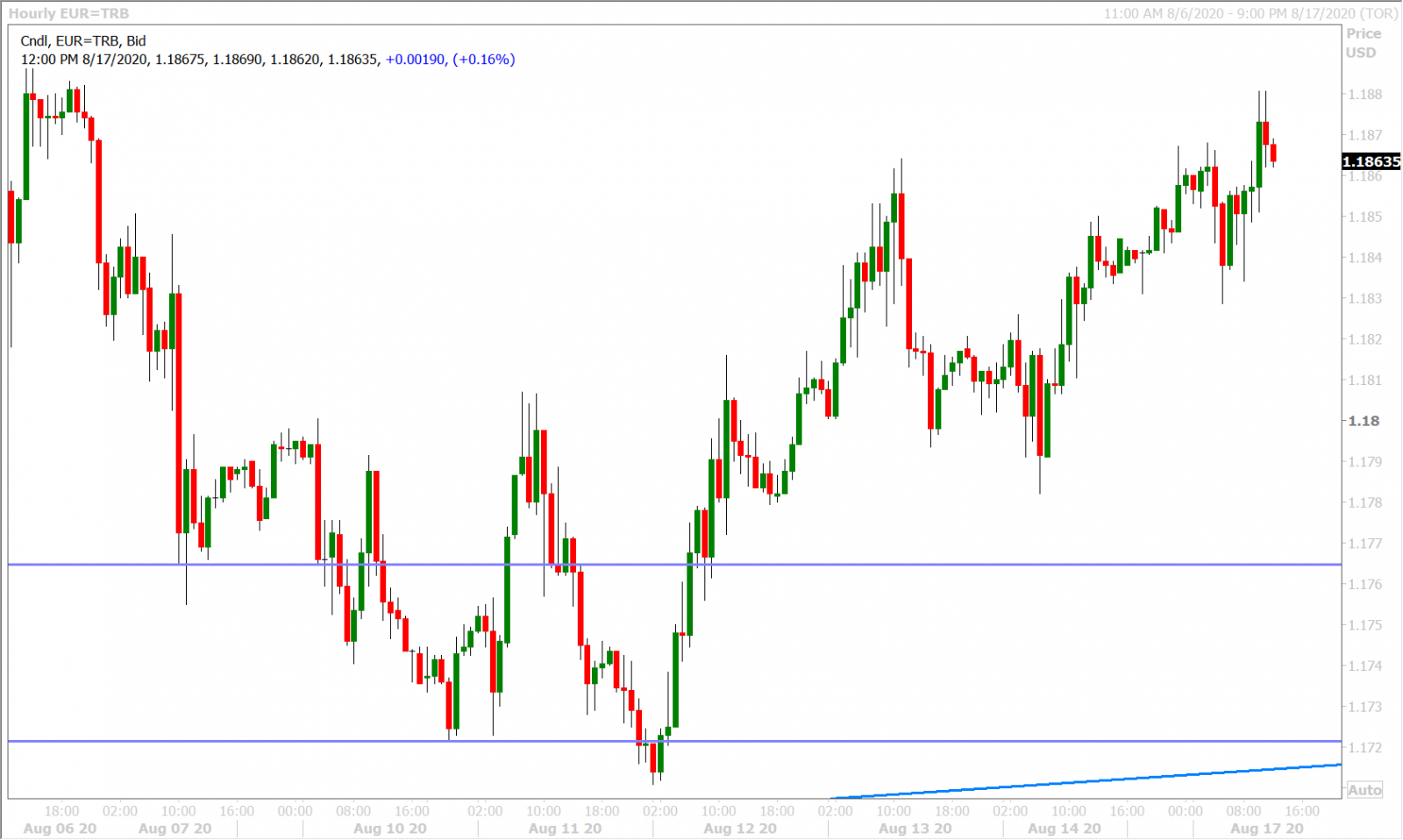

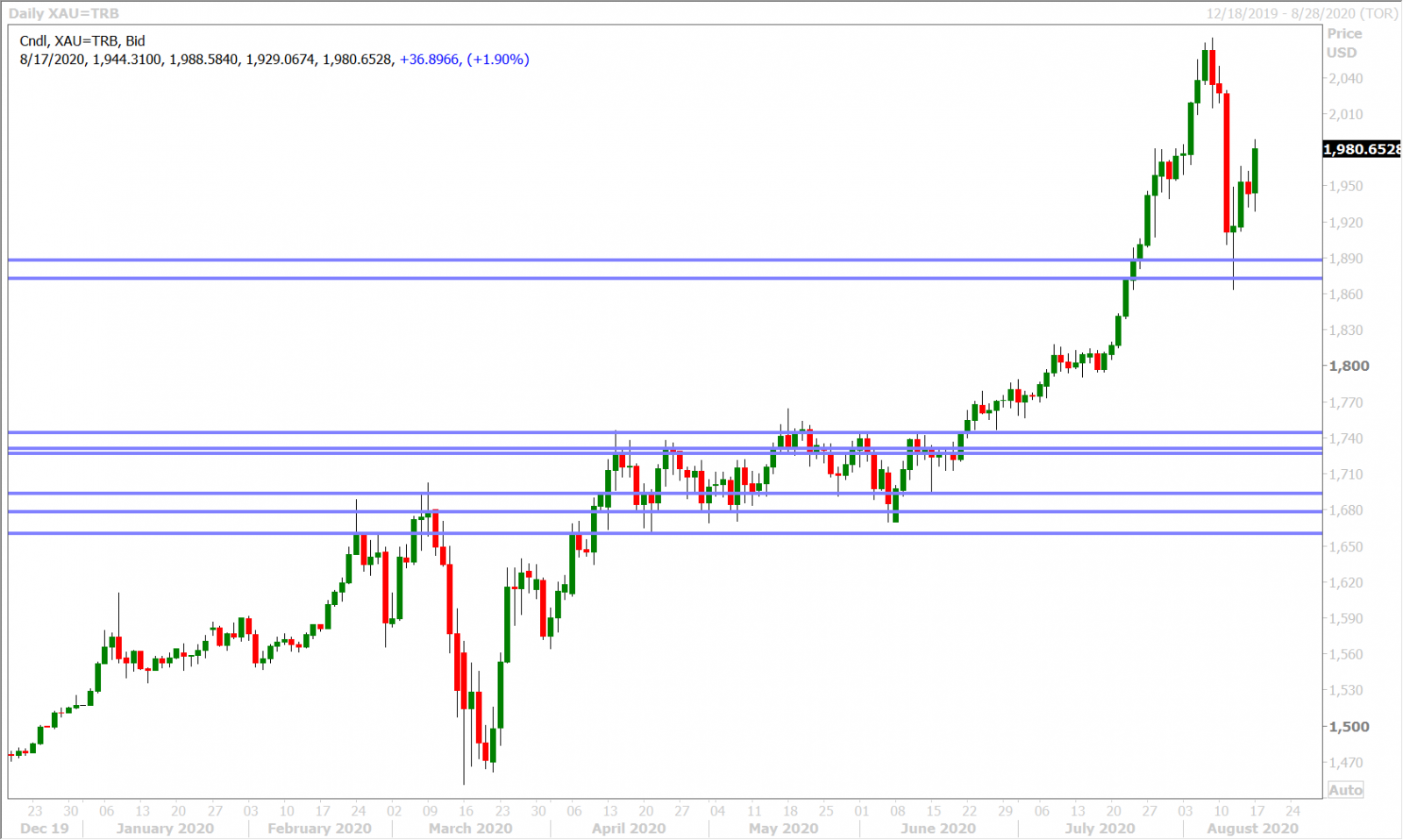

Euro/dollar has formed a new trading range so far for the month of August. Dips to the 1.1720s were bought following early August’s precious metals surge and last week’s higher than expected US CPI data; but the market’s July 31 highs just above the 1.19 handle were confirmed as near term resistance after the broad risk-off flows from August 6-7.

The leveraged funds continued adding to their net long EURUSD position during the week ending August 11 and, while the value of this position now stands at a record 24.8bln EUR, it continues to be non-factor for near term direction and we’d argue this is because these bets are paying off. This week’s European calendar features a 1.4blnEUR option expiry at the 1.1850 strike on Thursday and the August flash PMIs on Friday.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

GBPUSD

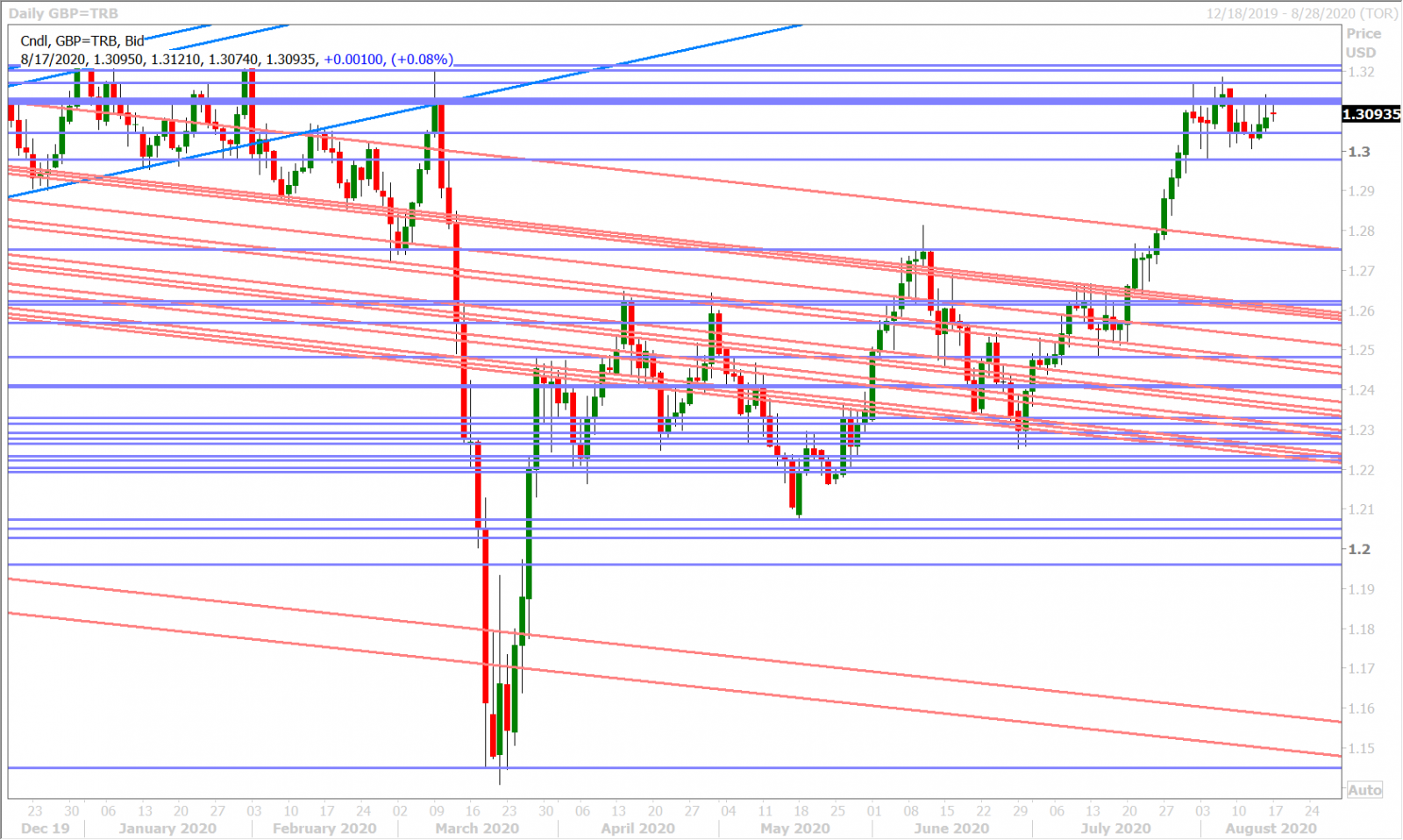

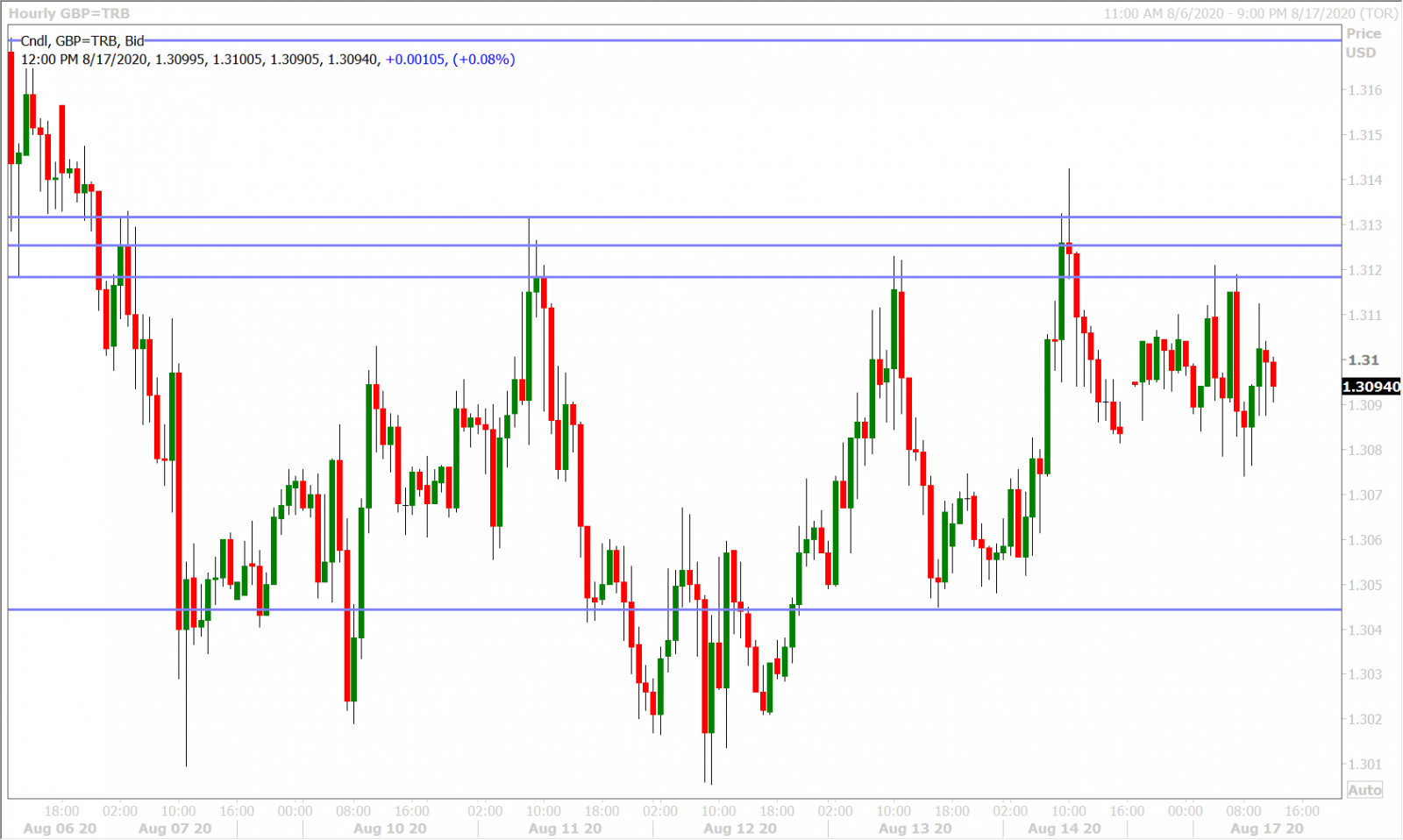

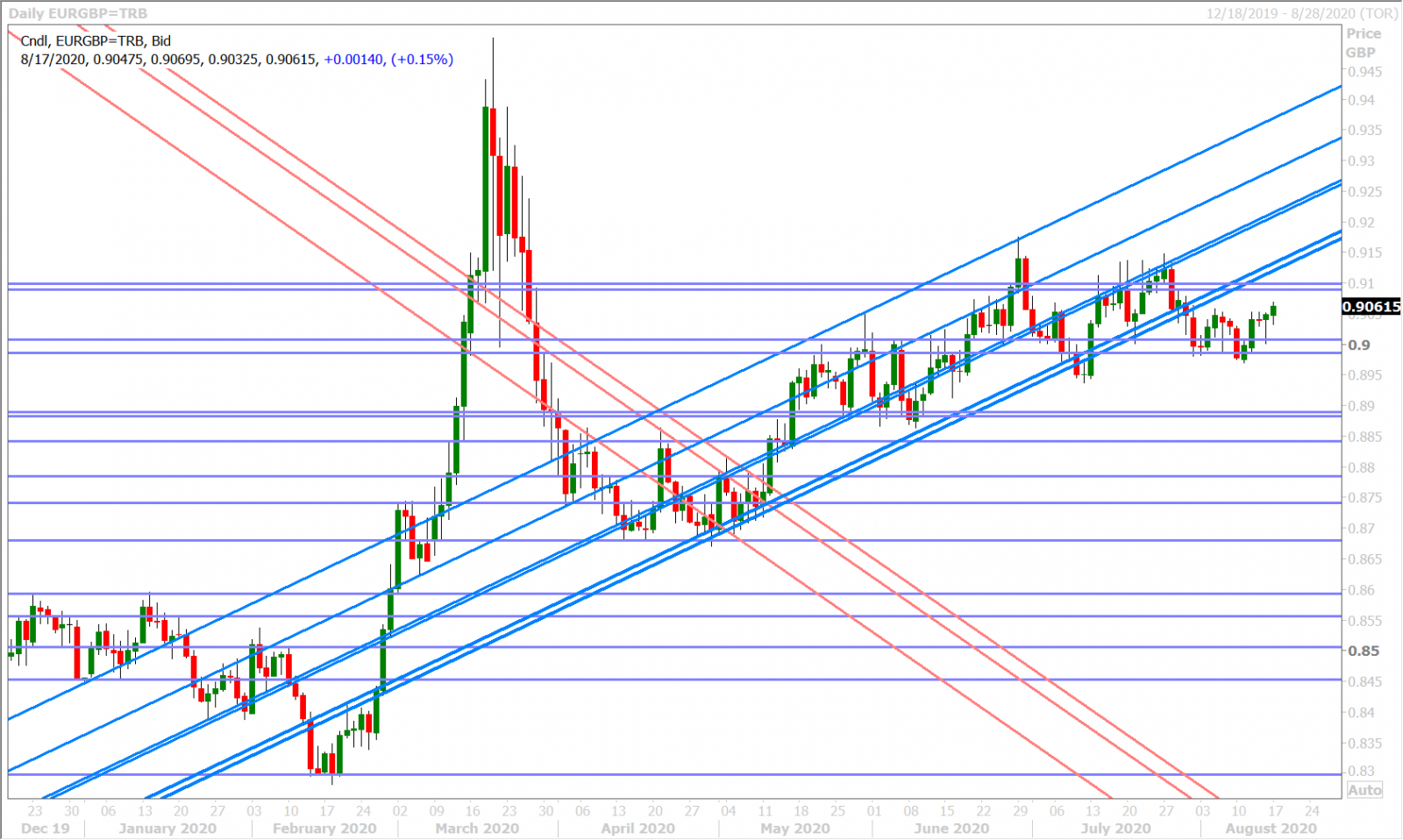

Sterling has exhibited much the same price pattern as EURUSD so far in August, leaving the EURGBP cross to languish in a tight 50pt range for the last two weeks. The moderately more upbeat tone from the Bank of England during its MPC meeting on August 6th and the slightly less worse than expected UK Q2 GDP print last week were largely non-events for this market as broad USD flows continue to dominate.

This week’s UK calendar features July CPI on Wednesday and July Retail Sales/August flash PMIs on Friday. Brexit negotiations are also set to resume tomorrow, however expectations are very low as usual. The leveraged funds have trimmed their net short GBPUSD position to almost flat during the two weeks ending August 11, which a tad surprising if you ask us. We thought the funds would be net long by now, given GBPUSD's 500pt+ surge in July, and so we think the entrenched sterling shorts could still add some fuel to the fire should broad USD sales, or a positive Brexit surprise, bring about a move above 1.3200.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

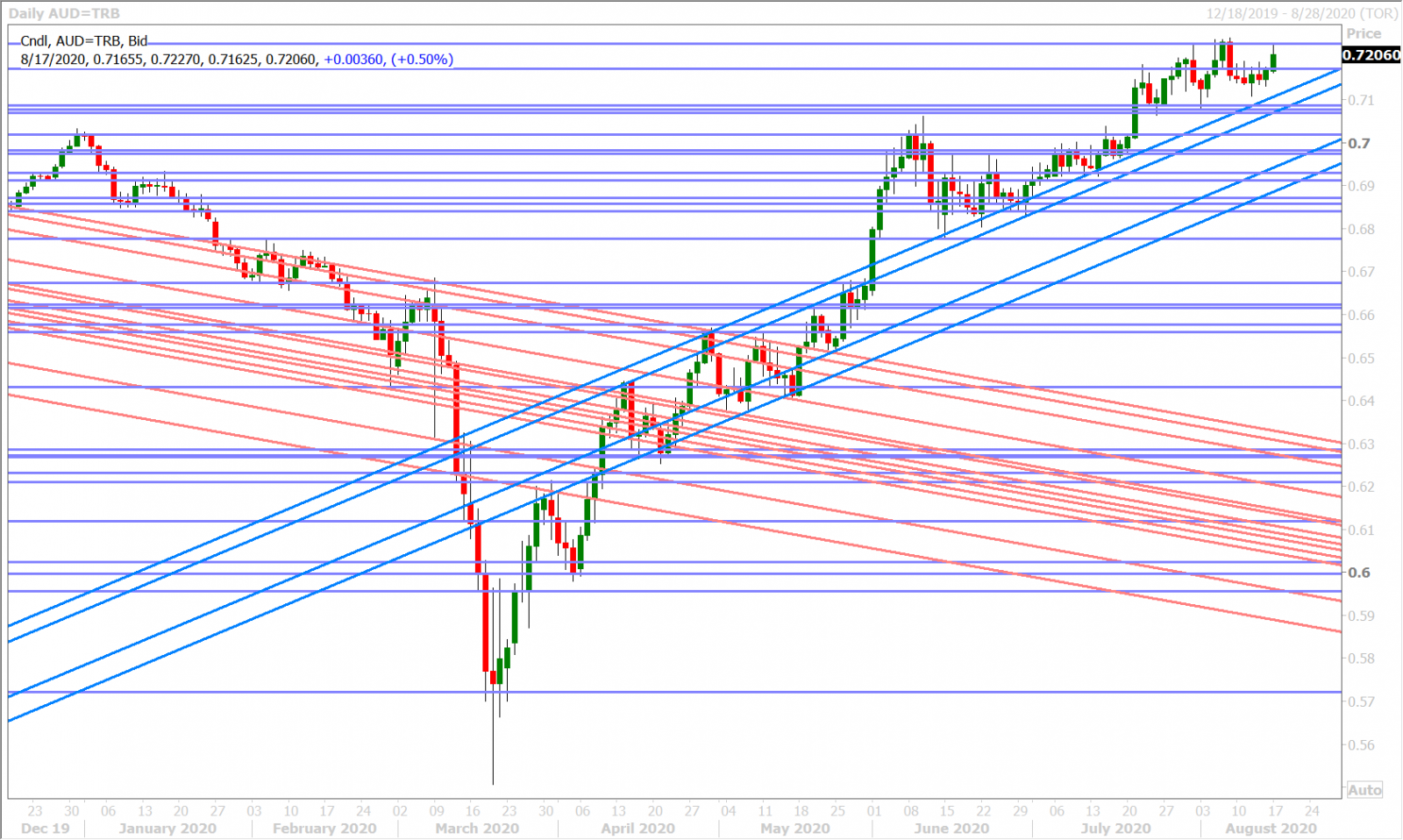

The Australian dollar has also consolidated into range trading since forming a short-term top on July 31. Dip buyers in the 0.7060-80 support zone helped the market recover on August 3 and another surge in precious metals helped AUDUSD rally back to its recent highs in the 0.7220s. Broad risk-off flows on August 7 and last week’s rally in US yields dragged the market lower, but there’s been a steady bid ever since the stronger than expected US CPI report last Wednesday. The Reserve Bank of Australia’s on-hold decision to monetary policy on August 4 was a non-event, as was last week’s better than expected Australian employment report for July (+114.7k jobs vs +40k) and the worsening COVID-19 situation in the Australian’s state of Victoria. This market continues to be driven by the pendulum of broad risk sentiment and increasingly dovish Fed expectations.

This week’s Australian calendar features the August flash PMIs on Thursday night ET. There will also be over 2blnAUD worth of options expiring between 0.7100 and 0.7150 on Thursday morning, although we don’t think this will ignite downside pressure on spot AUDUSD prices unless traders completely give up their achievement of getting the market above the 0.7170s today.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

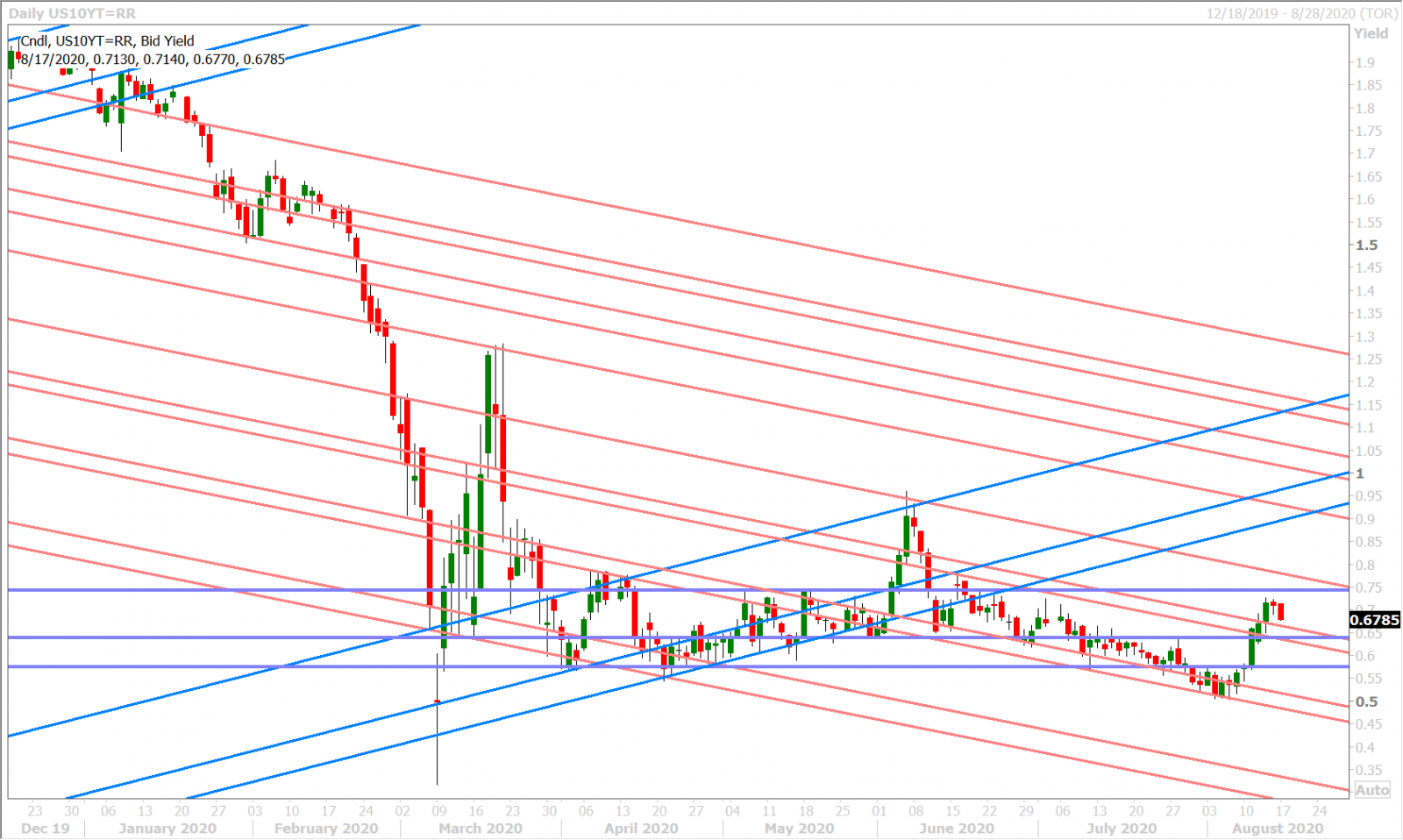

Dollar/yen was one of the biggest beneficiaries to last week’s rally in US yields and, while we felt that the bullish outside reversal pattern from the July 31 chart was the signal that allowed for some upside market momentum to return, there is a resounding feeling this morning that the unprecedented size of last week’s US bond auctions was a one-time event. This event has now passed and the market now appears refocused on reflation trades once again...trades that the Federal Reserve might encourage even more at their next FOMC meeting in September…and this is all risk-on, USD-negative type of stuff.

The leveraged funds marginally trimmed USDJPY shorts during the week ending August, but still remain profitably net short the market since March. We’ve noticed the dollar/yen correlate more closely with rates when bond market volatility picks up and more closely with the broader USD when bond market volatility cools off.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com