Fed outlook gives markets another dovish surprise, but traders now fretting over the underlying reasons for it

Summary

-

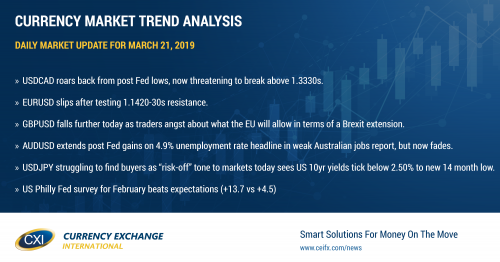

USDCAD: Dollar/CAD is roaring back to yesterday’s pre-Fed levels this morning as traders appear to be fretting over why the Fed had to surprise global markets yet again with a more dovish than expected outlook. The FOMC lowered its GDP and inflation forecasts for 2019/2020, eliminated its two remaining dot plots for 2019 rate hikes, reduced its 2020 dot plot to show just one rate hike, and signaled the end of its balance sheet runoff program (quantitative tightening) by September of this year. This news caused a boost to US stocks and broad selling in the USD initially, but these knee jerk moves started to reverse themselves heading into the NY close. Asian and European investors appeared to have questions too, and decided to sell equities today in response. Now, all of a sudden, we have the S&P futures down 10pts on the session (or 30pts off yesterday’s post Fed highs) and the USD trading broadly higher. The US Philly Fed survey for March was just released and it beat expectations (+13.7 vs +4.5). May crude oil is pulling back a tad this morning after breaking out yesterday on bullish EIA oil inventory news. With USDCAD now attacking trend-line chart resistance in the 1.3330s, we think there’s a risk the market breaks higher here. We’ll be paying close attention to the S&Ps today and the broader tone to risk sentiment.

-

EURUSD: Euro/dollar shot up to the next major trend-line resistance area, in the 1.1420-30s, after the Fed released its more dovish than expected outlook yesterday. Traders have since been selling as they reassess and ask “what does the Fed know that we don’t know?”. USDCNH has recouped the 6.68 trend-line support level after losing the level in Asian trade overnight. The BTP/Bund spread is trading steady in the low +240s. We think EURUSD might prove to be a little choppy during NY trade today. While we’d argue there’s room for the market to slip further to trend-line support in the 1.1360s (yesterday’s resistance now turned support), we think the headlines this morning about the US 10yr yield slipping to new 14 month lows below 2.50% might attract some buyers.

-

GBPUSD: Sterling didn’t benefit much from the broad, knee jerk, move lower in the USD post Fed yesterday. The sellers came right back in after the market couldn’t get above horizontal chart resistance in the 1.3240s. The Asian session found some dip buyers at the 1.3200 level, but traders were back to pounding the pound when Europe opened up today because they had yet more negative Brexit news to digest. It appears EU leaders (who are meeting in Brussels today) look set to reject Theresa May’s request for a Brexit extension to June 30. This is now raising the angst as to what the EU will accept, and it technically also increases the risk of a “no-deal” Brexit come March 29th. GBPUSD now trades just above trend-line support in the 1.3110s, but well below trend-line resistance in the 1.3170-80s. The EURGBP cross broke out comfortably to the upside yesterday. Holding the 0.8640-50s this week would do much to confirm a positive change in trend here in our opinion (which would be broadly GBP negative). The UK reported better than expected Retail Sales numbers for February this morning, but traders didn’t seem to care. The Bank of England just announced a 0-0-9 decision to keep monetary policy unchanged at its latest meeting, and there’s not much market interest in these headlines either. The UK central bank struck a balanced tone with its economic outlook, but cited continued uncertainty about Brexit (which is quite obvious). All the market continues to care about right now is Brexit, and so we’d be paying close attention to what the various EU leaders say out of the summit in Brussels today.

-

AUDUSD: The Aussie is pulling back today as well, but from a much higher level, as the trading algorithms oddly celebrated last night’s headline about Australia’s unemployment rate dropping to its lowest level in 8 years. This was one of the headlines that crossed with Australia’s weaker than expected February employment report. Only 4.6k jobs were gained last month versus the consensus estimate of +15k, but the 4.9% unemployment rate made for some great PR. We think what we’re seeing this morning is the market coming to its senses because a lower workforce participation rate can manipulate the unemployment rate lower. We think we’re also seeing the AUDUSD fall with EURUSD and the S&P futures, as the world reassesses what the Fed told us yesterday. Chart support in the 0.7120s is being threatened at this hour. It’s quite possible we could see a bearish, inverted hammer, candlestick pattern today on the charts should the market close below this level.

-

USDJPY: Dollar/yen is struggling to find buyers this morning as the late-day reversal higher in the broader USD yesterday failed to see the market get back above trend-line support in the 110.70s. This was an invitation for the sellers to come back in our opinion, and when we combine this technical development with a broad “risk-off” tone to markets this morning (S&Ps down 10 and US 10yr yields ticking below 2.50%), it’s making it tough for USDJPY buyers to step up. There appears to be some interest at the 110.30s now but we think some good news and a lift in broader risk sentiment is needed to help the market here. Japan announces its February inflation figures tonight at 7:30pmET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com