German ZEW misses. US CPI beats. USDCNH steady.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD crawled higher in the overnight session today, after some rather lackluster trade between the 1.3210s and the 1.3240s yesterday. There hasn’t been much of a catalyst for the move higher, but the market’s venture above 1.3240s in Asia was technically positive, CAD was being sold mildly across the board in early European trade today and more recently we’re seeing September crude oil retreat from the $55 handle once again (which is a mild CAD negative). The US just reported its CPI data for the month of July and the headline numbers beat expectations (+1.8% YoY vs. +1.7% exp and +1.6% prev). The core figures also beat expectations (+0.3% MoM vs +0.2% exp and +2.2% YoY vs +2.1% exp). This is understandably causing some broad USD buying now as the “Fed rate cut trade” unwinds positions here a little bit (bonds, Eurodollars, gold lower). USDCAD, in particular, has now broken above chart resistance in the 1.3260s and is now dealing with the next level in the 1.3280s. As we read the CPI report further however, real average weekly earnings growth was rather disappointing (+0.8% YoY vs +1.2% prev) and so we wouldn’t been surprised if this knee jerk, buy USD, reaction reverses at some point today. The weekly API inventory report comes out at 4:30pmET today as usual, and this should be the next catalyst for oil prices. OPEC’s monthly report, originally scheduled for release today, will come out on Friday instead because of the Eid Al-Adha holiday.

USDCAD DAILY

USDCAD HOURLY

SEP CRUDE OIL DAILY

EURUSD

It’s been a rocky overnight session for euro/dollar. It all started with a rather discouraging NY close yesterday, which saw the market fail to finish above the 1.1210s. This invited the sellers back in, and we saw a quick re-test of the 1.1180s level that the market pivoted around yesterday. Then we got the absolutely horrible ZEW numbers out of Germany for the month of August around 5amET. The Current Situation index fell to -14.5 vs -7.0 expected and the Expectations Index fell to -44.1 vs -28.5 expected, which is the lowest reading since the Eurozone debt crisis of 2011. Surprisingly though, EURUSD has rallied higher and we think the market’s inability to fall on bad news here is very telling. Perhaps blame it on December gold prices, which continue to march higher this morning, but this market looks like it wants to go higher. The better than expected US CPI report caused brief dip in EURUSD, but the market has quickly recovered and is now threatening another attempt above the 1.1210s. We continue to believe a close above the 1.1210s will invite further buying and frustrate the shorts.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Overnight trade in sterling has largely been confined to yesterday’s NY price range. This morning’s June employment report out of the UK came in better than expected on wage growth (+3.9% vs +3.8% 3M/yr expected) and headline job growth (+115k vs +60k expected) but slightly weaker than expected on the unemployment rate (3.9% vs 3.8%). The data didn’t move the needle much for the market as it's still widely perceived that BOE policy is handcuffed right now due to Brexit, and we would chalk up the GBPUSD price gains heading into NY trade as being more EURUSD led than anything else. Sterling, like EURUSD, has now also shrugged off the better than expected US CPI figures for July. We think how the market once again responds to the 1.2100 level (yesterday’s resistance level) will be pivotal for price action heading into mid-week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

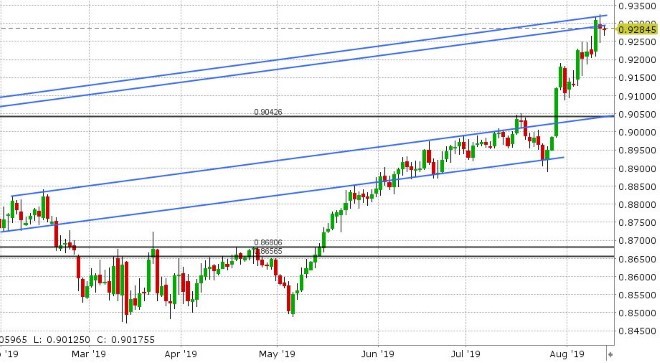

The Australian dollar bounced a bit with EURUSD in early European trade this morning, but it’s giving up most of those gains here as NY trading gets underway today. September copper prices are rejecting the 2.60 level for the third time in as many days and that could be playing a factor we feel. Dollar/yuan is trading steady as the PBOC delivered yet another lower than expected USDCNY fix last night. Australia reported its July NAB survey today and while the Business Conditions and Confidence indexes edged ever so slightly higher versus their June readings, the details of the report were still rather depressing. More here. Tonight’s overnight session could be a bit more eventful as we’ll get the Westpac Consumer Confidence data for August at 8:30pmET and the Q2 Wage Price Index at 9:30pmET. China will also be out with some numbers at the 10pmET hour (July Retail Sales and Industrial Production). The US has just released a hotter than expected CPI report for the month of July and this has unleashed a wave of broad USD buying which is threatening the overnight lows in the 0.6740s.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen continues to struggle here, largely because of the continued pressure on global bond yields and the market’s inability to get back above last week’s trend-line support zone in the 105.40-60 area. Broad selling of USD and buying of gold in Europe earlier today isn’t helping in our opinion, nor is the broader market’s decision to fade the initial reaction to the hotter than expected US CPI report just out. Over 1.7blnUSD in options expire at the 105.00 strike this morning, which could also be adding weight to the market here.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com