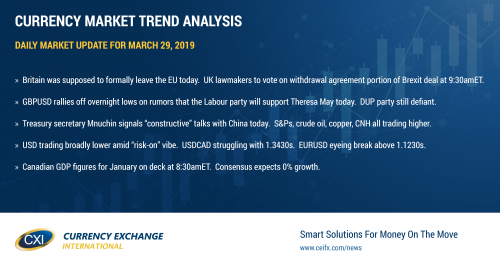

Happy Brexit day

Summary

-

USDCAD: Dollar/CAD continues to struggle with trend-line chart resistance in the 1.3430s this morning, and the positive headwinds that ought to have seen the market break through it yesterday are now reversing. The S&P futures are trading 12 points higher after Treasury secretary Mnuchin said the latest round of US/China trade talks were “constructive” in Beijing today. The British pound is spiking higher at this hour on rumors that a number of Labour lawmakers have finally come around and will vote for the withdrawal agreement portion of Theresa May’s Brexit plan at 9:30amET today. Finally, May crude oil prices are trading back over $60 this morning amid a broad “risk-on/sell USD”, vibe to global markets this morning. All this is now putting pressure on USDCAD as traders await the Canadian GDP report for January at 8:30amET. The consensus estimate is for no growth (0% read), which is a bit pessimistic in our opinion. Expect selling down into the high 1.33s should the numbers beat expectations.

-

EURUSD: Euro/dollar seems to be following GBPUSD this morning. The market dipped briefly below yesterday’s chart support in the 1.1210s when sterling sold off around 4amET, but it has since recovered on hopes the withdrawal agreement passes in the House of Commons later this morning. Trend-line resistance in the 1.1230s is capping at this hour. USDCNH has reversed lower today on the Mnuchin comments, which is EURUSD supportive. We think the market could see some short covering into week’s end should the 1.1230s give way to the upside. Today’s North American calendar also features the US PCE price index for January at 8:30amET, followed by the Chicago PMI for March at 9:45amET. We’ll also have Fed speak from Williams (9:25amET), Kaplan (10:30amET) and Quarles (12:05pmET).

-

GBPUSD: It’s Brexit day in the UK, or the day that Britain was supposed to formally leave the EU. Instead, politicians will be voting on the withdrawal agreement portion of Theresa May’s Brexit deal today at 9:30amET (nothing seems to be working for the UK government, and so they have proposed voting on the withdrawal agreement and political declaration separately). More here from Sky News. GBPUSD has rebounded off chart support in the 1.3010s this morning to test resistance in the 1.3130-40s. The DUP party from Northern Ireland has reiterated that they will not vote in favor the withdrawal agreement as it currently stands. Today’s session could be quite volatile.

-

AUDUSD: The Aussie indeed dripped lower after yesterday’s option expiry, but buyers were found once again at downward sloping trend-line support in the 0.7060s. It’s been a slow drift higher ever since, with today’s broad “risk-on” tone lending a helping hand (S&Ps and CNH higher, while USD broadly lower). We think there’s scope for AUDUSD to rally a bit higher today if EURUSD can extend gains above the 1.1230s.

-

USDJPY: Dollar yen is trading with a very choppy tone as the broad “risk-on” tone to global markets this morning competes with broad USD weakness. Japan reported a slew of economic data last night, but it was largely ignored by traders. Tokyo CPI for March beat on the headline, but came in on target at +1.1% YoY for the core reading. The Japanese unemployment rate fell to 2.3% in February vs 2.5% expected. Industrial Production for February beat on the MoM figure (+1.4% vs +1.0%), but missed on the YoY (-1.0% vs -0.1%). Finally, the Retail Trade numbers for February missed expectations (+0.4% vs +1.3%). We think USDJPY coasts here into the weekend.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com