Huge beat on Chinese manufacturing PMI boosts risk sentiment to start week

Summary

-

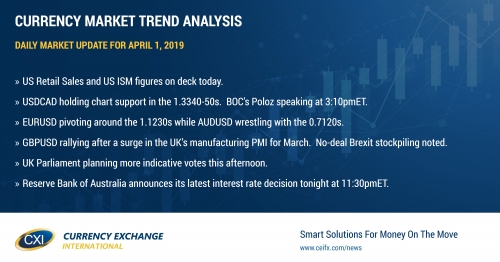

USDCAD: Dollar/CAD is trading with an offered tone to start the week after China reported a much better than expected manufacturing PMI figure for the month of March over the weekend. The reading of 50.5 beat the consensus estimate of 49.6, and jumped into expansionary territory (above 50) for the first time in four months. Global markets are celebrating the news this morning by bidding up equities, bond yields, and commodity prices. The broader USD and USDCAD is trading lower amid this optimism, but we’ve seen a bit dialing back now as traders prepare for a busy North American calendar today. The US Retail Sales figures for February are up first at 8:30amET, with market participants looking for +0.3% MoM and +0.4% ex Autos. Then we’ll get the US ISM manufacturing PMI at 10amET, where the consensus is looking for a read of 54.2. The Bank of Canada’s Stephen Poloz will be speaking at 3:10pmET today before the Baffin Regional Chamber of Commerce, and his prepared remarks will be released on the BOC’s website at 2:55pmET. We think USDCAD holds trend-line support in the 1.3340-50s and bounces today should we get better than expected US data. Conversely, we expect pressure into 1.3320-30 on weak data. The leveraged funds at CME trimmed long positions and added to short positions during the week ending March 26th.

-

EURUSD: Euro/dollar is bouncing above trend-line resistance in the 1.1230s this morning, but the buying momentum is fizzling out as NY trade gets underway. The EUR naturally benefitted from the stronger than expected Chinese manufacturing PMI, but the same PMIs out of Europe this morning were less exciting. While Spain’s manufacturing PMI for March beat estimates, the numbers for France and Italy were reported in-line, the German and broader Eurozone figures missed estimates, and the surge in the PMI for the UK is being brushed off due to abnormal, Brexit driven surge in stockpiling from businesses. This is leaving traders sort of directionless ahead of the US data this morning. The funds remain net short EURUSD and they added marginally to this position as of March 26th by liquidating long positions.

-

GBPUSD: Sterling is bouncing this morning as traders buy the huge beat in the UK manufacturing PMI for March. More here. One could argue that the stockpiling masks the underlying weakness in the UK manufacturing sector, but this is a positive headline for a change out of the UK and traders don’t appear to be fighting it. They’ll be another round of indicative votes in UK parliament this afternoon, and so we’d be on guard for some more GBP volatility. With GBPUSD regaining the 1.3000 level and now trading all the way back into Friday’s opening range, we think there’s a possibility the market could break above chart resistance in the 1.3140s. The leveraged funds at CME continued to cover short positions and add to long positions during the week ending March 26th, bringing the market’s net short position to the lowest it has been since June 2018.

-

AUDUSD: The Aussie is trading higher this morning as global equities, copper prices and the Chinese yuan uptick in response to the huge beat on the Chinese manufacturing PMI. Some trend-line chart resistance in the 0.7120s is capping prices now as traders await some US data. The Reserve Bank of Australia releases its latest decision on interest rates tonight at 11:30pmET. Australian Building Permit data for February will be released at 8:30pmET.

-

USDJPY: Dollar/yen drifted higher to chart resistance in the 111.10s to start the week as the Nikkei and the S&P futures rallied off the Chinese PMI, but we’re seeing a bit of a pullback now as traders await the US Retail Sales and ISM figures. The funds continued to add to USDJPY longs during the week ending March 26th, which proved out to be a good move given the market’s bounce off the 110.00 level.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com