Markets on edge once again as the Chinese reportedly lose interest in negotiating

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

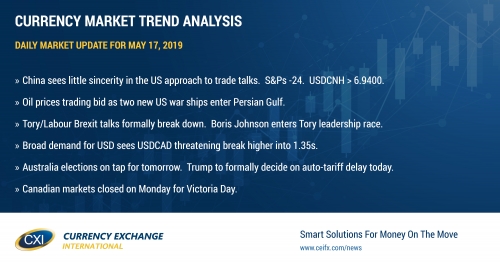

- China sees little sincerity in the US approach to trade talks. S&Ps -24. USDCNH > 6.9400.

- Oil prices trading bid as two new US war ships enter Persian Gulf.

- Tory/Labour Brexit talks formally break down. Boris Johnson enters Tory leadership race.

- Broad demand for USD sees USDCAD threatening break higher into 1.35s.

- Australia elections on tap for tomorrow. Trump to formally decide on auto-tariff delay today.

- Canadian markets closed on Monday for Victoria Day.

ANALYSIS

USDCAD

Dollar/CAD is trading bid once again this morning as another bout of “risk-off” flows sweep across global markets. Today this is coming from more discouraging trade talk from China, rising tensions in the middle east, and a formal collapse in Tory/Labour Brexit talks. According to Bloomberg, China’s state media signaled a lack of interest in resuming trade talks right now as it sees little sincerity in the US’ approach and that the US has been “playing little tricks to disrupt the atmosphere” (think Huawei). Two more US war ships entered the Persian Gulf late Thursday in the latest round of US provocation against Iran. Finally, Labour leader Jeremy Corbyn has admitted that Brexit talks with the government have “gone as far as they can” and that there’s not much point to negotiate further with a Tory leader that is set to depart the position in June. All this is seeing the S&P futures lower, oil prices higher, sterling weaker, and the USD broadly bid. USDCAD, in particular, has completely reversed yesterday’s negative chart development and now finally looks poised to break higher into the 1.35s. While today’s North American economic calendar is light (US Michigan Sentiment Index for May at 10amET), expect further clarity at some point on Trump’s plan to delay auto tariffs beyond tomorrow’s May 18 deadline. We have a feeling traders might not want to go home “long risk” heading into what could be an eventful weekend of headlines. Canadian markets will be closed on Monday for the Victoria Day holiday.

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

Euro/dollar is being pressured further this morning as traders flock into the traditional safe havens (USD, JPY, US and German bonds). Dollar/yuan continues to rally after yesterday’s upside breakout above the 6.9240s. Trend-line support at the 1.1170 level has just given way in EURUSD, but we’re not seeing much follow-through to the downside, probably because over 1.6blnEUR in options expire at the 1.1175 strike at 10amET. We think yesterday’s firm reject of the 1.1220s will give the entrenched EUR fund short position comfort heading into the weekend.

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

Things are going from bad to worse for the British pound. Key horizontal chart support in the 1.2770s (or the February 2019 lows) has given way in early European trading today and a flood of selling has ensued. Today’s news about Tory/Labour Brexit talks formally breaking down is the last thing the market needs right now and we think Boris Johnson’s confirmation to bid for Tory party leadership in June is adding to trader anxiety, considering he’s a hardline Brexiteer. The EURGBP cross continues its amazing 10-day rally, as it’s the purest way for the fund community to play deteriorating Brexit fundamentals (without broad USD influences). We see the next meaningful resistance level for the cross around the 0.8800 level, which means traders will likely continue to sell GBP on bounces.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

Australian dollar traders made no attempt to get the market back above the 0.6930s in NY trade yesterday, and so they resumed selling after some positive US data knocked EURUSD lower. So where does chart support lie today? We think quite possibly at 0.6850, where a downward sloping trend-line anchored off the March low comes in. Australia will be electing a new government tomorrow. More here from CNN on the dilemma facing voters down under.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

USDJPY

Dollar/yen is pulling back this morning amidst selling in the S&P futures and demand for the traditional safe-havens. Last Sunday’s opening chart gap in the 109.85-95 area filled in NY trading yesterday, and there was an attempt to get above the psychological 110.00 in Asia today, but this failed. The market has been facing sellers ever since, but we think today’s 1.2blnUSD option expiry at the 110.00 strike might exert some upside influence. We’ll be paying close attention to the Trump administration again today, and what the formal communication will be regarding the planned auto tariff delay. We think chart support in the S&Ps around 2837-2850 is at risk of getting tested, which would be USDJPY negative.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com