Hawkish comments from Poloz and lifting of US/Canada metal tariffs sees USDCAD u-turn lower

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

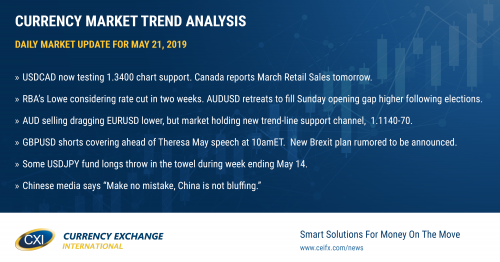

- USDCAD now testing 1.3400 chart support. Canada reports March Retail Sales tomorrow.

- RBA’s Lowe considering rate cut in two weeks. AUDUSD retreats to fill Sunday opening gap higher following elections.

- AUD selling dragging EURUSD lower, but market holding new trend-line support channel, 1.1140-70.

- GBPUSD shorts covering ahead of Theresa May speech at 10amET. New Brexit plan rumored to be announced.

- Some USDJPY fund longs throw in the towel during week ending May 14.

- Chinese media says “Make no mistake, China is not bluffing.”

ANALYSIS

USDCAD

Canadian traders are returning after the Victoria Day long weekend this morning to find USDCAD leaking lower towards chart support at the 1.3400 level. Friday’s dramatic technical u-turn off the 1.3500 handle, spurred on by hawkish comments from Stephen Poloz and the lifting of US/Canadian metal tariffs, definitely seems to be weighing on market sentiment to start the week because the broader USD is otherwise trading higher. We think the leveraged funds, which continue to hold a net long USDCAD position as of May 14, may start to sweat here as the market once again fails to deliver the sustainable rally they’ve been looking for. This week’s economic calendar features the Canadian Retail Sales numbers for March on Wednesday, and the US Durable Goods data on Friday.

Tuesday: Fed’s Evans speaks at 10:45amET, Fed’s Rosengren speaks at 12pmET

Wednesday: Canadian Retail Sales (March), weekly EIA oil inventory report, FOMC Minutes

Thursday: Canadian Wholesale Sales (March)

Friday: US Durable Goods (April)

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

Euro/dollar is trading on the defensive this morning, but it appears to be inspired by AUDUSD selling rather than the broad risk-off flows we saw on Friday. A downward sloping trend-line support channel has now formed on the hourly chart (1.1140-1.11.70), and we think this zone will now become the pivot for price action heading into mid-week. This week’s European calendar will feature the widely followed Markit PMIs for Germany and the Eurozone on Thursday, as well as the EU elections (which span from Thursday to Sunday). Mario Draghi will also be making some opening remarks at an ECB event tomorrow morning. The funds trimmed short positions during the week ending May 14, and they appear to be covering again now as Theresa May has announced that she’ll be setting out a new proposal for her Brexit deal in a speech at 10amET.

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

Sterling is finally seeing a bounce this morning, and it has come just in the last hour as headlines cross about a speech that Theresa May is now scheduled to make at 10amET today. According to ITV News and the UK’s Express, this comes after a just concluded Cabinet meeting where members told reporter Paul Brand that “the Cabinet is in agreement and the Prime Minister would be outlining her deal shortly.” GBPUSD has rallied 50pts off its lows, and this comes after a seven day, 350 point, decline in prices. The EURGBP cross has retreated off trend-line resistance in the 0.8780s, in anticipation of positive Brexit headlines to come. All eyes will now turn to the tele to see if May’s new proposal is compelling enough to convince other UK lawmakers to vote her way. The UK will be reporting its April CPI figures on Wednesday and its April Retail Sales numbers on Friday, but we think traders will likely ignore the data once again as Brexit is the focus right now.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar has had a volatile start to the week. A surprise victory for the incumbent Scott Morrison in Saturday’s national elections saw AUDUSD gap higher. A rallied then ensued, taking the market all the way back up to Thursday’s trend-line resistance level in the 0.6930s. Traders sold this level in European trade yesterday, and once more this morning after the release of the dovish RBA Minutes. Reserve Bank of Australia Governor Philip Lowe then took the mic in a speech before the Economic Society of Australia and surprised traders with the comment that “at our meeting in two weeks’ time, we will consider the case for lower interest rates. More here from the Sydney Morning Herald. This saw AUDUSD quickly retreat lower in early European trade today, and we have now mostly filled the market’s Sunday opening gap (0.6870-0.6900). The funds increased their net short position in AUDUSD during the week ending May 14, and this net position now stands at a new 22 week high (-64k contracts). We still think they remain in charge here.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

USDJPY

Dollar/yen is enjoying a rally to start the week as equity traders appear to be getting comfortable with the growing tough trade talk out of the Chinese state media. Funny enough, Xinhua reports today that “make no mistake, China is not bluffing”. Dollar/yuan has been trading steady since hitting chart resistance just shy of the 6.9500 level on Friday. The S&Ps tested support in the 2830-50s yesterday and bounced. We’ve also see a number of USDJPY speculative longs throw in the towel, if we look at fund positioning in yen futures as of May 14. We think USDJPY traders may be eyeing to fill another Sunday chart gap at some point this week (110.95-111.10 from May 5), provided a wrench is not thrown into broader risk sentiment for global equity markets.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com