Patient Fed roils the USD. US/China trade talks going well, but deal not expected this week. US payrolls report on deck for tomorrow.

Summary

-

USDCAD: The doves got what they wanted from the Fed yesterday, and more. Not only did the Fed keep interest rates on hold (as expected) and signal a willingness to adjust balance sheet normalization if needed (somewhat expected), but it dropped “further gradual increases” when referring to interest rate policy going forward (not expected), and more importantly stressed that “the Committee will be patient as it determines what future adjustments may be appropriate” (not expected, and super dovish considering the word adjustment can be interpreted to mean cuts to interest rates as well). The Fed fund futures curve plunged yesterday back to a 2.3-2.4% implied funds rate for all the way out to May 2020, suggesting rate hikes are now completely off the table in the US. The stock market loved the news, rallying strongly to a new high on the year. Bond fund manager Jeffrey Gundlach slammed Powell saying he is “caving to the stock market”. US bond yields rallied and the USD got sold heavily across the board. USDCAD gave up on its attempt to regain the 1.3210s it broke down below earlier in the session, and instead plunged all the way down to the Nov 16th lows in the 1.3120s. March crude oil prices are holding gains this morning after a smaller than expected build in yesterday’s weekly EIA inventory report spurred a second day of advances for the commodity. The Canadian GDP figures for November were just released and they marginally beat expectations (+1.7% YoY vs +1.6%). We also just got the Canadian Raw Material and Industrial Product price data for December and it looks like a mixed bag (stronger than the previous read on the former and a much weaker than expected read on the latter). It doesn’t look like we’re going to get any ground breaking headlines out of Washington today regarding ongoing US/China trade talks. Despite President Trump saying the meetings are going well, he said via tweet this morning that “No final deal will be made until my friend President Xi, and I, meet in the near future” (February now, according to the WSJ). This, plus the arguably ho-hum Canadian data points this morning might provide some fuel for a bounce today in USDCAD. Canadian dollar futures traders added 1352 contracts in new positions yesterday, suggesting USDCAD shorts are piling on now.

-

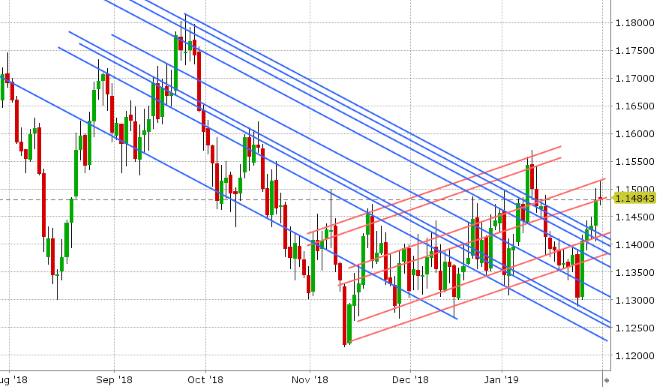

EURUSD: It’s been a choppy overnight session for the Euro, with an extension of the post Fed gains being met by trend-line chart resistance in the 1.1510s and some dismal economic data out of Europe today. German Retail Sales data for December plunged 4.3% MoM vs -0.6% expected. The German Unemployment change for December fell smaller than anticipated (-2k vs -10k). The Eurozone Q4 GDP figures were nothing to get excited about, coming in at 0.2% QoQ and +1.2% YoY (in-line with estimates). More importantly, Italian GDP contracted larger than expected in Q4 2018, falling 0.2% QoQ vs 0.1%, which means Italy has technical gone into another recession. The Italian PM is trying to dial back the concerns this morning by saying the downdraft is temporary and due to the ongoing US/China trade war. It appears EUR traders are not so sure about. The BTP/Bund spread is trading steady at 3-month lows in the +240s, but one has to wonder how Italy is ever going to achieve the 2019 growth targets it gave to the EU when wrestling with them over its budget last year. We think EURUSD could chop around for a bit here. Futures traders added just over 1k contracts in new positions yesterday.

-

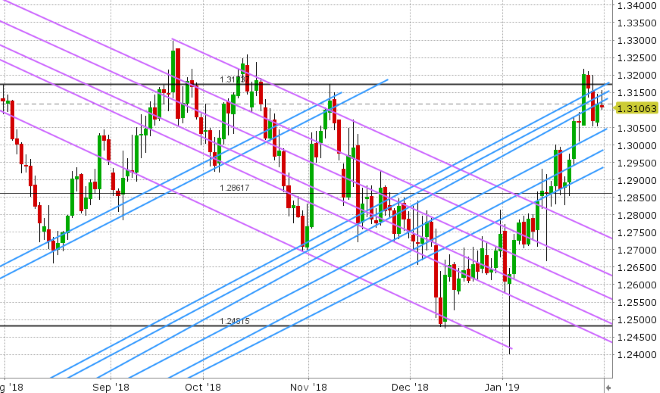

GBPUSD: Sterling is struggling to make headway today, as some thick overhead chart resistance in the 1.3120-40s capped the moderate gains that were achieved post Fed yesterday. We feel the results of Tuesday’s Brexit amendment votes in the UK parliament still loom over the market. No-deal Brexit risks have gone up we feel and we think this may continue to make the GBP lag EUR for the time being. British pound futures traders liquidated 3,943 contracts in yesterday’s trade.

-

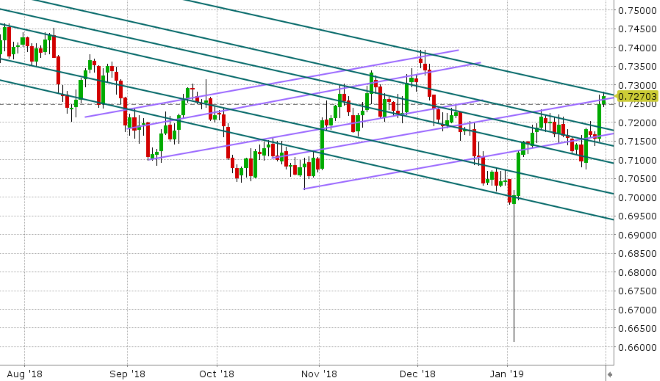

AUDUSD: The Aussie leading the G7 FX space higher this morning as March copper prices continue their breakout higher from yesterday. The copper move higher appears to be due, in part, to the surge in iron ore prices following a dam collapse in Brazil. More here. A even more dovish turn from the Fed certainly helped. China reported its January manufacturing PMI below 50 last night (below 50 means contraction), but the 49.5 print beat estimates of 49.3. We think AUDUSD could stall here at trend-line resistance in the 0.7280s ahead of the US jobs reports tomorrow. Australian dollar futures traders added almost 4k contracts in new positions yesterday.

-

USDJPY: Dollar/yen is extending declines this morning after a wave of EURJPY selling swept through in early European trade today. This has seen USDJPY now break support in the 108.80-109.00 area; a level which was tested after the Fed meeting yesterday. We think this is a combination of post-Fed, USD re-positioning because interest rate hikes are no longer coming + reaction to the negative data out of Europe today. The traditional correlation to US stocks and bond yields is taking a back seat right now. We think USDJPY will move to a new lower range (108.30-108.80s) if the market cannot regain the 108.90s at some point today. Japanese yen futures traders liquidated over 4k contracts in positions yesterday. The Japanese Industrial Production figures for December beat expectations last night, coming in at -0.1% MoM vs -0.4%.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

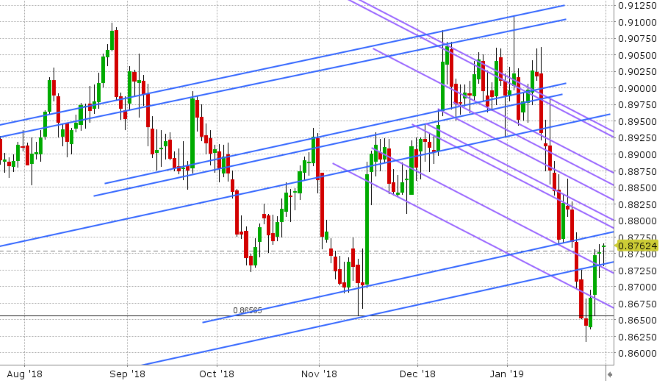

EUR/GBP Daily Chart

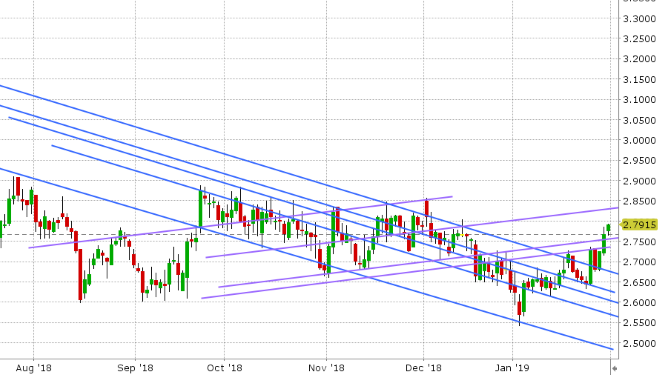

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com