US/China trade talk optimism leads the Chinese yuan and commodity currencies higher into NY trade. FOMC meeting at 2pmET.

Summary

-

USDCAD: Dollar/CAD is slumping back down again this morning after yesterday’s NY closing pattern left much to be desired from those in the long USD camp. Sellers were invited back in with the move back below the 1.3270s and they’ve been content to push the market lower ever since. Some broad demand for commodities and commodity/trade sensitive currencies is not helping the cause for USDCAD this morning either, as optimism is in full swing ahead of US/China trade talks in Washington today. The Chinese yuan has hit a new 6-month high this morning, the Aussie is up 0.6% on the session, and crude oil prices are extending gains made after the market surged back above the $53 level yesterday. One could argue positive equity market sentiment is also playing a factor this morning, after Apple beat on earnings last night. The US ADP employment numbers for December were just announced and they beat expectations (+213k vs +181k). Next up are the weekly EIA oil inventory figures at 10:30amET, where traders are looking for a build of 3M barrels following last night’s build of 2.098M barrels in the API report. Then of course we’ll get the FOMC meeting at 2pmET followed by a press conference from chairman Powell at 2:30pmET. Markets are not expecting any change to interest rates today, but traders will be paying close attention to the commentary surrounding the pace of the Fed’s balance sheet unwind following the WSJ article from last week. While we wouldn’t doubt that the Fed has leaned more cautiously lately, we think the dovish Fed market chatter is getting a little long in the tooth, and so we think there’s a risk the Fed disappoints those looking for even more cautious commentary today (would be USD positive). From a technical perspective though, we’d argue that the trend is still down and the 1.3210s will be key for near term USDCAD sentiment. Failure to hold this level could lead to swift selling into the low 1.31s.

-

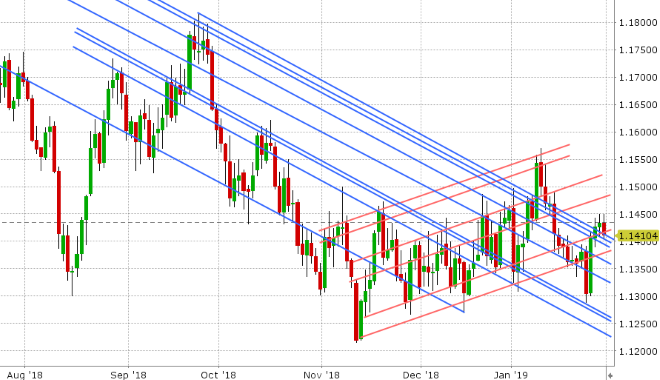

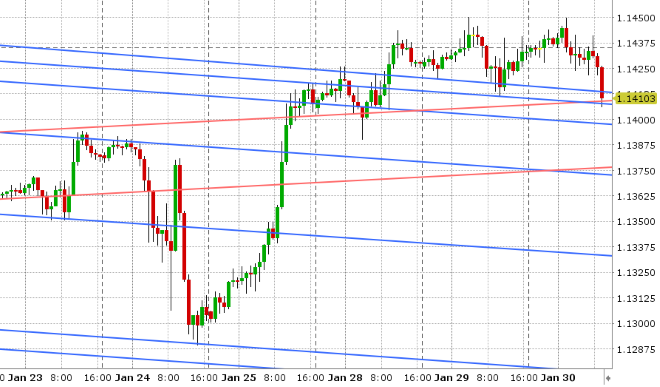

EURUSD: Euro/dollar continues to coast ahead of today’s much anticipated Fed meeting. The German January CPI figures were just released and they missed expectations (+1.4% YoY vs +1.6%), but this had very little effect on prices. Ditto for the better than expected US ADP employment figures that were just announced as well. We think a less dovish than expected Fed may lead to EURUSD selling into 1.1370s chart support, whereas an even more cautious Fed will be the impetus for traders to gun for the 1.1500 handle. We’d also continue to note the Chinese yuan’s strength here (new 6 month lows in USDCNH) as a growing and increasingly positive influence on EURUSD.

-

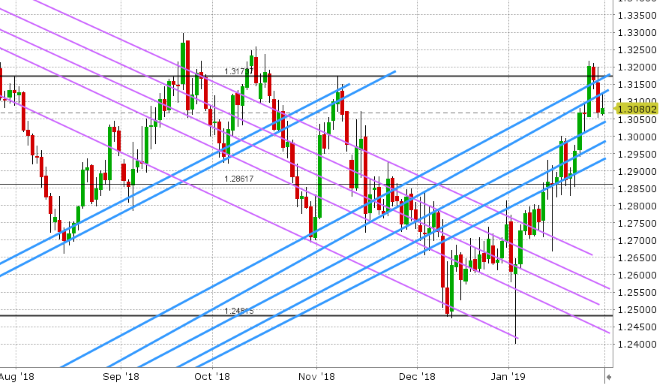

GBPUSD: Sterling is trading on the defensive this morning following the defeat of the Cooper amendment in the UK House of Commons yesterday, and the passage of the Brady amendment. This will now force Theresa May to come up with a Brexit resolution by the original March 29th deadline (the UK Parliament cannot take over and extend Article 50 itself), and it further solidifies the UK position about the need to re-negotiate the Irish backstop. Problem is the EU continues to say that it will not renegotiate, and was quick to reiterate this after the votes concluded yesterday. More here. Theresa May now has a mandate to go back to Brussels, but nobody has any idea just how she’ll get the EU to budge. GBPUSD traders are now effectively re-pricing some “no-deal” Brexit risk back into the markets, but we think the market is not taking it all that seriously yet. Chart resistance ahead of the Fed today is 1.3120, then 1.3160-80. Support lies in the 1.3020-30s, then the 1.2970s. The EURGBP cross has rocketed back above 0.8720s, which may cause GBP to lag, all else being equal.

-

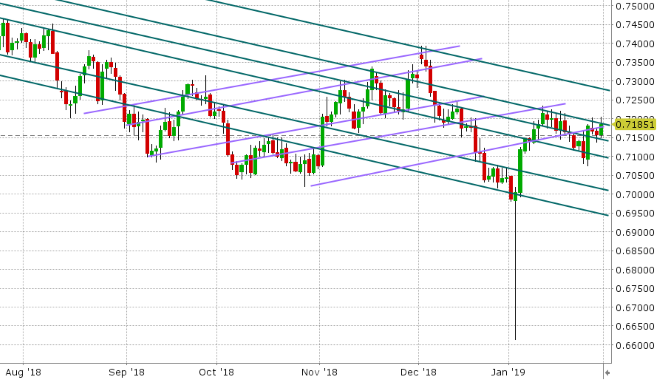

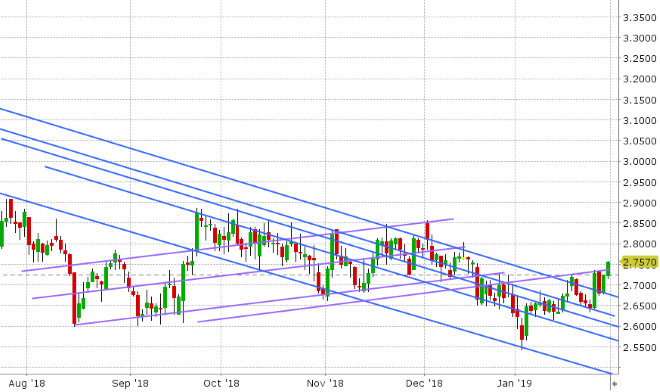

AUDUSD: The Aussie is outperforming the majors this morning after the Australian Q4 2018 CPI figures beat expectations last night. This saw AUDUSD vault over trend-line resistance in the 0.7170s (which it couldn’t surpass in NY trade), and then the market broke resistance in the 0.7180s as the USDCNH made new lows. Sellers have crept back in now following the beat on the US ADP employment report, and they’re putting the 0.7180s to the test. We think this level becomes the pivot for price action heading into the Fed announcement later. A strong move back above could usher a rally into the mid-high 0.72s, whereas we risk unwinding the entirety of the overnight move higher if we continue to trade below it. March copper prices are flirting with a break out today above the 2.75 level.

-

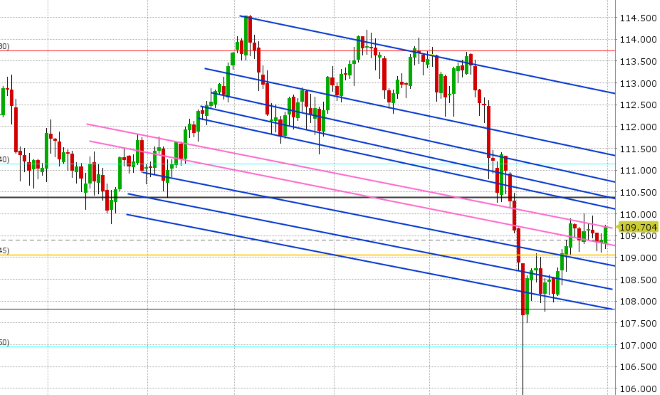

USDJPY: Dollar/yen is enjoying a bit of a rally here this morning, following the upbeat US ADP jobs report just released. Traders are now making a bee-line for trend-line resistance in the 109.70s. We think the market could make a run for the low 110s later today if we see broad USD buying after the FOMC meeting. The S&P futures are currently trading up 12pts on the session.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com