Powell sees low inflation as transitory. USD goes bid post Fed meeting

Summary

-

USDCAD: Dollar/CAD is stuck at trend-line resistance in the 1.3430-40s this morning as the broader USD struggles to build upon yesterday’s post Fed gains. The Federal Reserve delivered what was arguably a more upbeat hold on interest rates. While the press release had a dovish tilt to it (citing global economic issues, muted inflation pressures and the need to remain patient), the press conference had a more positive tone (with Jerome Powell acknowledging better financial market conditions and his view that the low inflation data was “transitory”). The reaction in the FX was what one would expect; lower initially for the broader USD, but then a sharp reversal higher during the press conference. USDCAD made a run to close above chart resistance in the 1.3430-40s, which is what the fund longs needed to do in order to repair the market’s technical outlook on the daily chart. They achieved this, but just barely and unfortunately a few waves of broad USD sales in overnight trade is hindering the upward momentum as we head into NY trade today. European traders had reason to be more optimistic and buy EUR/sell USD this morning, as the Markit Manufacturing PMIs out of Spain, Italy, France and the Eurozone (for April) all beat expectations. Germany’s weaker than expected Manufacturing PMI, however, calmed the EUR bid a little bit though and allowed USDCAD to recover somewhat. We now head into a North American session that will feature the US Factory Orders data for the month of March at 10amET. The 10am hour is also when over 1.1blnUSD in USDCAD options will be expiring at the 1.3400 strike. With June crude oil prices now slipping below the 63.10 support level this morning and talk of a strong US Employment Report for tomorrow likely to make the rounds today (following yesterday’s ADP beat), we think USDCAD traders will attempt to build upon yesterday’s gains. The Bank of Canada’s Stephen Poloz largely repeated his optimistic House of Commons testimony before the Senate when he spoke late yesterday.

-

EURUSD: Euro/dollar spiked higher and then reversed lower following, what the financial media is now calling, a less dovish than expected hold on interest rates from the Federal Reserve yesterday. It’s hard to argue with this interpretation, and we have to admit that Jerome Powell sounded more positive yesterday compared to the last time around. Fed fund futures traders had to rachet back some of their rate cut expectations for later this year, the US 10-yr bond yield reversed strongly back above the 2.50% level, and EURUSD fell to trend-line support in the high 1.11s. Since then though, there’s been a persistent attempt by traders in Europe to bounce the market higher. Over 1.2blnEUR in options expire at the 1.1200 strike this morning and we think is part in parcel what’s adding to the market’s choppy tone at this hour. Chart support today comes in at the 1.1170-80s, while resistance lies at 1.1220. Dollar/yuan toyed with a break above key trend-line resistance in the 6.7450s during early European trade today (which would have been EURUSD negative), but this attempt has failed as NY trade gets underway today.

-

GBPUSD: Sterling traders are currently digesting headlines from Mark Carney’s press conference following the latest hold on interest rates from the Bank of England. The UK central bank came to a unanimous, and expected, 0-0-9 decision to keep monetary policy unchanged. They made upward revisions to their GDP growth forecasts for 2019, 2020 and 2021, but trimmed their inflation projections for each of these years. In the press conference, which has just concluded, governor Carney mentioned that global tensions have eased since February and that “if” forecasts come to pass, it will require rate hikes. He also talked positively about UK wage growth, but tempered this back with the comment that businesses do not expect Brexit uncertainty to be resolved for some time. Long story short, we think we have a Bank of England here that wants to hike rates but cannot, because Brexit remains unresolved. GBPUSD is understandably not doing much of anything here aside from, what appears to be, tripping stop orders at both ends of the 1.3020-1.3080 price range. About 1blnGBP of options expire between 1.3000 and 1.3035 this morning at 10amET, and so we think the market might test downside support once again.

-

AUDUSD: The Aussie is showing a similar price pattern to EURUSD ever since the Fed yesterday. Buyers were found at trend-line support in the 0.7010s, while sellers have come back in since EURUSD rejected the 1.1220s overnight. July copper prices are extending yesterday’s tumultuous 4% drop by another 0.5% at this hour. According to Reuters, computer-driven fund selling, stops, and thin market conditions (because China is on holiday for the rest of the week) were behind the move lower following a large options expiry. We’re still amazed at how this copper move didn’t negatively affect AUDUSD yesterday, but we think Aussie traders should continue to pay attention here given historical correlations. June gold futures are not having a fun time this morning, as prices fall another 1% lower following yesterday’s swift decline after the Fed. We think the pressure remains on AUDUSD today heading into the US jobs report tomorrow. Australia reports its March Building Permits data tonight at 9:30pmET, and traders expect -14% MoM.

-

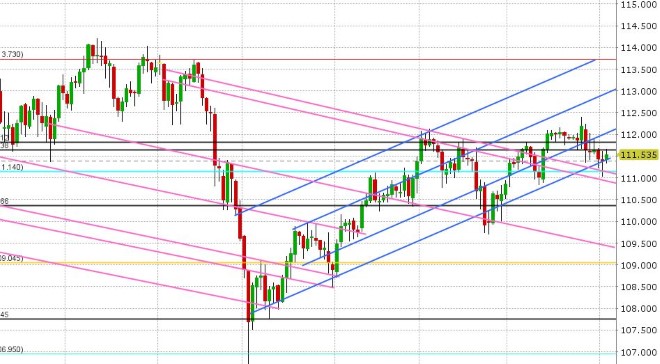

USDJPY: Dollar/yen rebounded yesterday after the Fed meeting as both US bond yields and the broader USD galloped higher. The lower bound of the familiar chart zone 111.60-80 has capped prices however and the market has been consolidating ever since. The Golden Week holidays continued in Japan today with no abnormal volatility noted in overnight trading during the Asian time zone. We think USDJPY coasts here ahead of the US employment figures out tomorrow, with about 1blnUSD in options expiring at the 111.50 strike likely to add to the malaise. Japanese markets re-open next Tuesday.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

July Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com