USD trading bid ahead of the US non-farm payrolls report

Summary

-

USDCAD: Dollar/CAD is trading quietly bid this morning as traders await the non-farm payrolls (NFP) data out of the US for April at 8:30amET. The consensus estimate is for a gain of 190k jobs on the headline, +3.3% YoY and +0.3% MoM growth in wages, and 3.8% on the unemployment rate. We think a blowout number, like the ADP jobs report earlier this week, could extend the post-Fed USD rally even further and see USDCAD trade with a 1.35 handle. After the NFPs, we’ll get the US ISM Non-Manufacturing numbers at 10amET and the expectation here is for a read of 57.0 for April. There will also be an avalanche of Fed speak on the docket today (largely from the Hoover Institute Policy Conference), with Williams, Evans, Clarida, and Bowman all scheduled for speeches between 10:15am and 3pmET. The Fed’s Bullard, Daly, Kaplan and Mester will be speaking after the close today at 7:45pmET.

-

EURUSD: Euro/dollar is slipping lower this morning as yesterday’s NY close below trend-line support at 1.1175 emboldens the fund short position heading into the NFP report. The weaker than expected March Eurozone PPI data released earlier today (-0.1% MoM vs 0%) is not helping the mood here either we would argue. Chart support today comes in at the 1.1120-30s, then the 1.1080s. Expect further pressure in EURUSD should we get stellar employment numbers out of US. Conversely, expect a bounce up to the 1.1200-1.1220 level, where over 2.5blnEUR in options expire at 10amET, should we get weak numbers.

-

GBPUSD: Sterling has given up chart support in 1.3010-20s this morning after the April Markit Services PMI data for the UK missed expectations (50.4 vs 50.5). Some buyers have now stepped in at a down-ward sloping trend-line support level in the 1.2980s ahead of the NFP numbers. The EURGBP cross continues to hug a trend-line that held up prices yesterday (0.8560-70s). Theresa May said she “profoundly disagrees” with calls for a 2nd Brexit referendum, when she spoke to the nation in a televised address in the last hour.

-

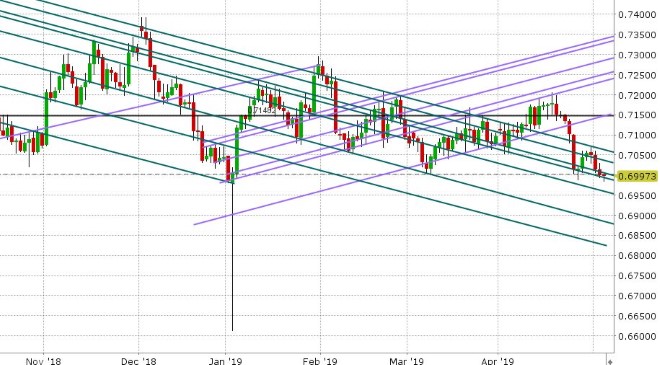

AUDUSD: The Australian dollar isn’t doing much here as traders await the always anticipated NFP numbers out of the US, but unlike EURUSD and GBPUSD, it is holding yesterday’s chart support levels. July copper prices are trading pretty much flat on the session so far, but still remain close to yesterday’s lows. Dollar/yuan has inched above the 6.7450s in European trade so far today, which is technically bullish for the broader USD here we feel. Perhaps we do get strong US job numbers for April?

-

USDJPY: Dollar/yen has gone to sleep here as market participants await the NFPs. The S&P futures have recovered to the levels they were at yesterday prior to the headlines crossing about US/China trade talks being at an impasse. US bond yields are trading higher this morning too as there seems to be optimism that we’re going to get good US numbers.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

July Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com