Sterling falls after UK flash PMIs for November miss expectations

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

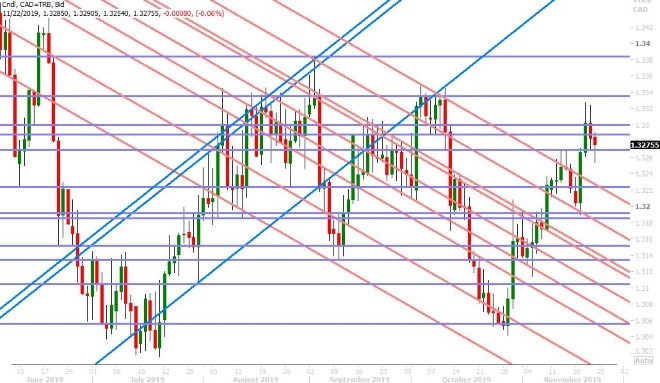

USDCAD

Dollar/CAD is slipping below the 1.3270 support level this morning, after a very quiet overnight session of see-saw price action between 1.3270 and 1.3290. The slightly better than expected Canadian Retail Sales report for September is the catalyst, but there hasn’t been much downward momentum to the move whatsoever, which has us thinking the market could reverse higher. In fact, we think the market needs to reverse higher here in order to keep the new USDCAD uptrend alive. Yesterday’s “Poloz and Pelosi effect” did some significant technical damage to the daily chart and so we think it’s imperative that the buyers show up today. Bank of Canada governor Stephen Poloz said he thinks “we have monetary conditions about right given the situation” (which didn’t sound as dovish as what deputy governor Wilkins said on Tuesday). US Speaker of the House Nancy Pelosi also gave the market some positive soundbites regarding progress towards the passage of the USMCA.

USDCAD DAILY

USDCAD HOURLY

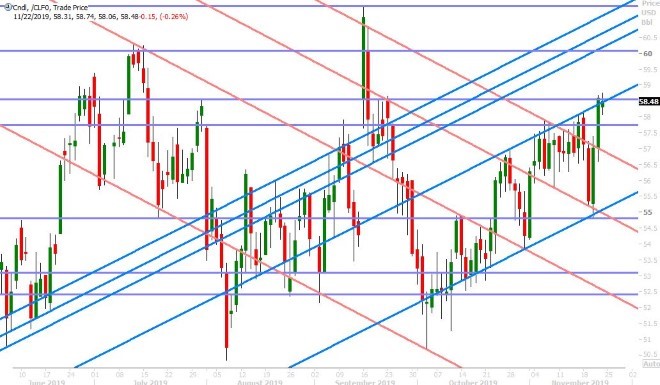

JAN CRUDE OIL DAILY

EURUSD

It was a disappointing day yesterday for those who bought EURUSD on the back of the hawkish ECB Minutes. The trend-line resistance level we talked about in the 1.1090s proved formidable and the buyer failure that occurred there gave sellers the confidence to re-enter in our opinion. Two negative sounding US/China articles from the South China Morning Post (SCMP) then put a “risk-off”, buy USD, trade back in play; but it was mild because the stock market really didn’t sell off all that much, US yields actually inched higher after a brief stutter and the recovery in gold prices faded pretty fast. The NY closing pattern produced a bearish hammer close, but the fact that 1.1050s chart support held invited some buyers back during Asian trade in our opinion. This morning’s release of mixed November flash PMI data for Germany and the Eurozone produced some volatility around the 3-4amET hour, but the recent 1.1040-50 to 1.1080-90 range continues to be respected.

German Manufacturing PMI: 43.8 vs 42.9 (beat)

German Services PMI: 51.3 vs 52.0 (miss)

Eurozone Manufacturing PMI: 46.6 vs 46.4 (beat)

Eurozone Services PMI: 51.5 vs 52.5 (miss)

Christine Lagarde’s first major policy speech as ECB President turned out to be a dud. She called on EU governments to boost spending, which is not “new” news for traders, who heard this first from Mario Draghi back in September. More here from the Financial Times. We think EURUSD will feel heavy into this morning’s option expiries around 1.1040-60 (size approx. 1bln EUR). Expect further selling should the 1.1040s give way.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is getting walloped this morning after the November flash PMIs out the UK (a new report from Markit) missed expectations on both manufacturing and services. The market collapsed back down through the 1.2910-20 support level it successfully regained by the start of European trade, hesitated a bit at the next support level in the 1.2870s, and has now resumed even lower heading into NY trade. Today’s weak PMIs has also brought out the Bank of England rate cutting doves again, but it’s largely been just market banter so far as the OIS market is pricing in just 10% of a 25bp rate cut when the BOE meets next on December 19. The EURGBP cross is re-challenging 0.8600 as a result this morning as well, a level it hasn’t seen for over a week. We think a strong NY close above this level could unleash a wave of broad GBP selling, all else being equal.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar retreated back to Wednesday’s lows yesterday amid the SCMP article-driven move to buy USD more broadly, but since the close of NY trade however, it hasn’t been doing much. Perhaps this is because of this morning’s large (1.1blnAUD) option expiry at the 0.6795 strike? Perhaps it’s simply because the barrage of conflicting US/China trade headlines appears to be taking a breather for now? The last headline that everyone is talking about is the tweet from the Chinese Global Times (which sounds a little negative towards the end).

#Opinion: China wants to work for a "phase-one" trade deal with the US on the basis of mutual respect and equality, and some tariffs rollback is an important condition for a deal. If US chooses to raise more #tariffs and escalates trade war, China will fight back and retaliate.

With USDCNH bouncing confidently off the 7.0290 support level today and EURUSD traders still eyeing the 1.1040 support level, we think there’s a risk AUDUSD eventually continues lower to the mid-0.67s.

AUDUSD DAILY

AUDUSD HOURLY

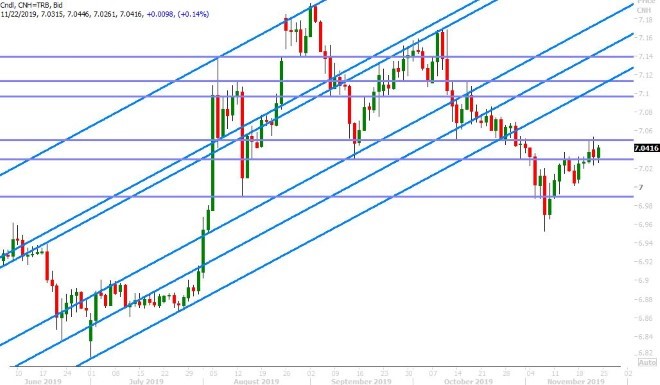

USDCNH DAILY

USDJPY

Dollar/yen continues to trade with a directionless tone today, despite a 4bp drop to the US 10yr yield around the 3-5amET hour. There was a lot going on during this time (mixed to weak flash PMIs, Christine Lagarde speech, positive sounding US/China report re: China willing to work with the US) and we noticed a very strong buying wave in the German bund. It’s hard to pin down the reasons for the rush into German paper today, but it definitely appears to be driving US yields lower this morning. USDJPY traded ever so slightly lower during this bond yield decline, but the market continues to find buyers at 108.40s chart support for the moment. We think this week’s large downside option expiries played a big part in curtailing the USDJPY selling momentum from the week prior.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com