US/China negotiators “laying the groundwork” for delay of Dec 15th tariffs (WSJ).

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

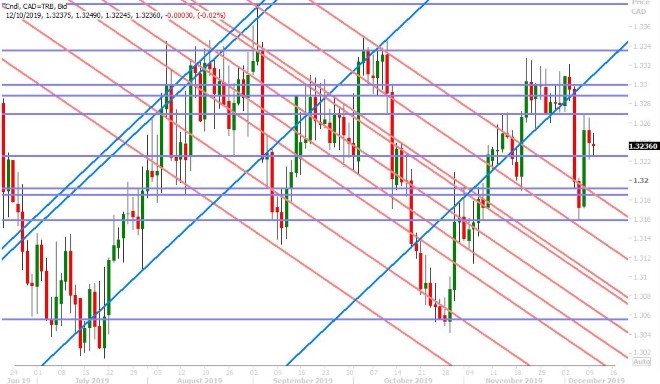

USDCAD

Dollar/CAD continues to trade towards the middle of Friday’s newly defined 1.3160-1.3260 price range. Some upbeat USMCA headlines knocked the market lower yesterday (towards the mid-way mark of this range in the 1.3220s), but we think part of this morning’s bid off this level is due to trader nervousness that the potential December 18th USMCA vote in Congress won’t happen. Canada reported weaker than expected November Housing Starts and October Building Permits data yesterday, but the markets didn’t seem to care as the clear focus for traders into mid-week is tomorrow’s FOMC meeting. We think Jerome Powell will use last Friday’s better than expected non-farm payrolls report to talk up the state of the US labour as much as he can, and we think he’ll continue to downplay the relevance of all the repo and T-Bill operations that the NYFed is conducting. It will truly be another “sigh of relief” meeting for the FOMC in our opinion because recession fears have miraculously subsided and the money markets are not forcing the Fed to do anything at this point. We’ll get a look at US November CPI before the meeting at 8:30amET tomorrow.

The Canadian economic calendar for the rest of the week doesn’t feature any notable releases, but we will have a speech from Bank of Canada governor Stephen Poloz on Thursday at the Empire Club in Toronto. The leveraged funds at CME did well to add to their net short USDCAD position during the week ending December 3rd as the surprisingly less dovish the expected Bank of Canada meeting killed the market’s brief new uptrend.

USDCAD DAILY

USDCAD HOURLY

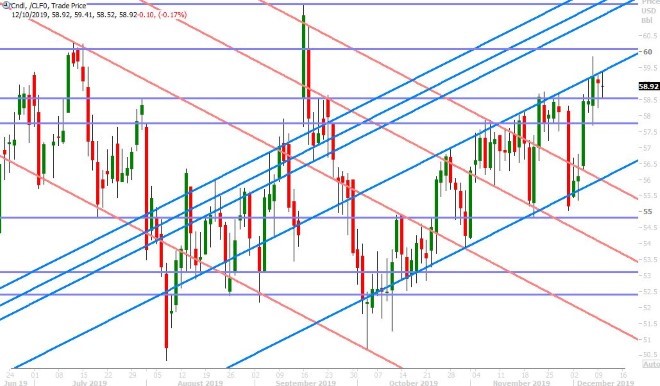

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar has managed to claw back half of its post NFP losses from Friday, and while one could make the argument that we’ve seen a couple of better than expected German data points so far this week (October Exports and December ZEW Economic Sentiment), we’d argue the market’s bid feels more option-flow-related than anything else as over 2.3blnEUR in expires occur at the 1.1065-70 strikes this morning.

All eyes this week will be on the FOMC meeting tomorrow of course, and then Christine Lagarde’s first ECB meeting on Thursday. Markets aren’t expecting any changes to interest rates or the ECB’s new asset purchase program, but it will be interesting to see how the former IMF chief communicates in general and how she’ll address some of the criticism that the ECB’s governing council has taken of late (both externally and from within the ECB). The funds extended their net short EURUSD position during the week ending December 3rd, largely by trimming long positions.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Election day 2019 is almost here in the UK, and sterling traders have now effectively priced in a slam-dunk Tory majority government on Thursday. YouGov’s final MRP poll is expected at 5pmET today to confirm this but, similar to last time around, expect somebody to leak the results at some point today. GBPUSD is now testing weekly chart resistance in the 1.3180s and the EURGBP cross continues to hover near 2-year lows. The UK reported a slew of October economic data points this morning, but it was arguably mixed and far less important than Thursday’s election result in our opinion.

UK GDP: 0.0% MoM vs +0.1% exp

Industrial Output: +0.1% MoM vs +0.2% exp

Manufacturing Output: +0.2% MoM vs 0.0% exp

Trade Balance: -14.48B vs -11.65bln exp

The funds at CME were busy adding to both long and short positions during the week ending December 3rd, and on balance they decreased their net short GBPUSD position a little bit heading into this week’s UK election. We’d guess they’re a lot less short by now considering the almost 200pt rally we’ve seen with the break above 1.3000 since then.

GBPUSD WEEKLY

GBPUSD HOURLY

EURGBP DAILY

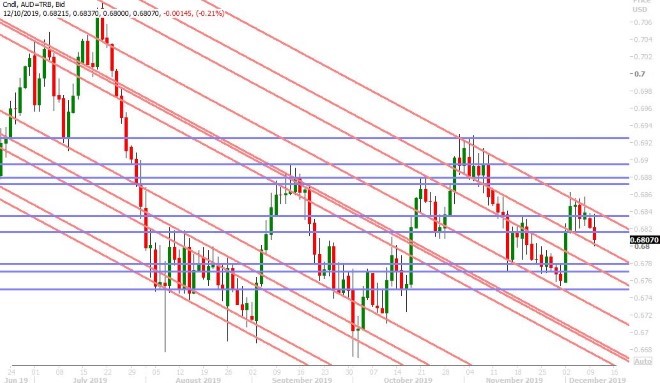

AUDUSD

The Aussie, unlike euro and sterling, continues to struggle so far this week to regain its losses from the US NFP report on Friday. The swift move back below the 0.6840s on Friday was a negative technical development for the market on the charts, and traders are now worried that the Trump administration will end-up slapping China with new tariffs if the Phase 1 trade deal is not agreed upon by the December 15th deal deadline. The WSJ is out with some breaking news just now however, saying…

“U.S. and Chinese trade negotiators are laying the groundwork for a delay of a fresh round of tariffs set to kick in on Dec. 15, according to officials on both sides, as they continue to haggle over how to get Beijing to commit to massive purchases of U.S. farm products”

…and so AUDUSD has caught a bid. These are exactly the kind of headlines that the AUD bulls need right now, but we’d argue they need more. We don’t see a sustainable path higher for the market until it can break back above the 0.6840s on a closing basis. The funds cut back their AUDUSD net short position by almost 10k contracts during the 100pt pop early last week.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

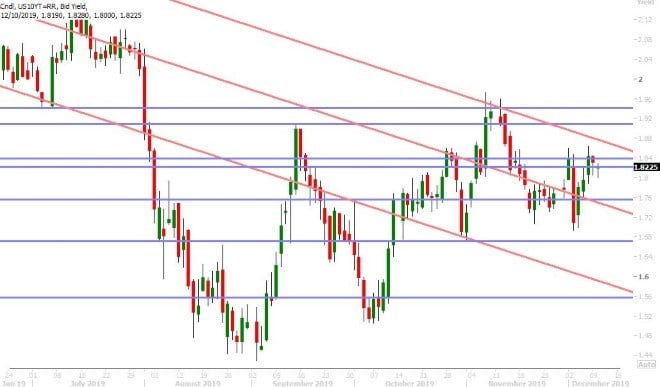

Dollar/yen continues to tread water so far this week, as over 1.5blnUSD in options expire at the 108.60-65 strikes this morning. The positive US/China headline to come, which we postulated about on Friday, seems to just have occurred. More here from the WSJ. Off-shore dollar/yuan traders are once again focused on the sub-7.03 level and USDJPY traders are trying to spike the market higher here. US 10yr yields are going along for the ride too, but we’d argue 1.83-1.84% could be tough chart resistance zone for now, at least until tomorrow’s FOMC meeting. The funds at CME extended their new net long USDJPY position for the 7th week in a row during the week ending December 3rd, and while we’d argue this position accumulation added credence to market’s October/November rally, it no longer does since the USDJPY chart technicals turned sour on the December 2nd bearish daily reversal. Recent USDJPY longs are now under-water and may want to bail.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com