Super Wednesday kicks off with bullish OPEC supply news, mixed US CPI and a dovish Mario Draghi

Summary

-

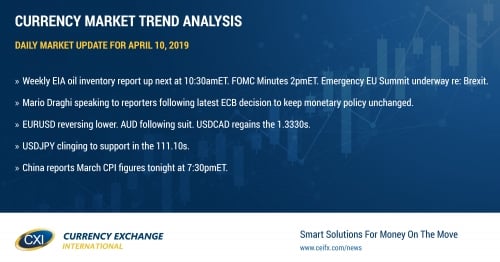

USDCAD: It’s been a busy morning so far in terms of news flow for the broader markets. OPEC released its monthly report and it basically confirmed the oil market’s bullish bias of late by noting a drop in member output by 534k barrels per day in March, over-compliance of 155% with agreed output cuts, and reduced demand growth (30.30M bpd for 2019 vs 30.46M bpd forecasted last month). The US CPI figures for March were just released and they beat expectations on the headline (+1.9% YoY vs +1.8%) but missed on the core (ex food/energy) measure (+2.0% YoY vs +2.1%). Next up is the weekly EIA oil inventory report at 10:30amET, where traders are expecting a 2.29M barrel build. Last night’s weekly API report showed a larger than expected build (+4.09M barrels vs +2.96M). Then we’ll have the FOMC Minutes at 2pmET, where hopefully traders get more detail on why the Fed adopted an even more dovish tone to monetary policy last month. With USDCAD now breaking back above the 1.3330s, we think there’s scope for the market to extend to chart resistance in the 1.3360-70s.

-

EURUSD: All eyes are on Mario Draghi at this hour, as the ECB President explains the central bank’s latest decision to keep its monetary policy statement largely unchanged from last month. Live link here. EURUSD has spiked higher and now reversed lower as Draghi starts speaking with a dovish tone. We think the market could be vulnerable to further selling here should trend-line support in the 1.1260s fail to hold. The next support level lies in the 1.1230-40s.

-

GBPUSD: Sterling is attempting to break above trend-line resistance in the 1.3080s as NY trading gets underway today, but that attempt is now fizzling out fast with downside momentum. The UK reported better than expected February GDP and Industrial/Manufacturing productions numbers this morning, but we think traders will forget about this quickly. The focus today will be squarely on the emergency European Commission Council summit now underway and how long Europe is willing to grant Britain for a Brexit extension. Germany’s Angela Merkel said this morning “I think the extension should be as short as possible but it should be long enough to create calm, so we don’t have to meet every two weeks to talk about the same subject”. We think GBPUSD may trade off EURUSD this morning, at least until we get more details out of Brussels.

-

AUDUSD: The Aussie is reversing back below chart resistance at the 0.7150 level this hour as EURUSD trades lower. May copper prices are back under pressure, after traders rejected the 2.95 handle in yesterday’s trade. Sky News is reporting that Australia will be announcing a federal election date tomorrow. We think AUDUSD ebbs and flows with EURUSD today, but with a slightly more bullish tone given improving chart technicals. China reports its March CPI figures tonight at 7:30pmET.

-

USDJPY: Dollar/yen is clinging on to chart support in the 111.10s this morning after yesterday’s early morning S&P dip saw the market break support in the 111.20s. The US CPI report caused a little bit of price gyration, but we’re still trading in a very tight range (111.10-111.25) ahead of the US stock market open. We think USDJPY buyers will attempt a bounce here should the S&P futures maintain their bid above the 2886 level.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com