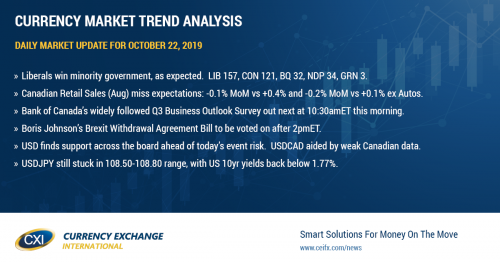

Trudeau holds on for 2nd term. Canadian Retail Sales disappoint. BOS up next.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD bounced off trend-line support in the 1.3070s overnight as some pre Withdrawal Agreement Bill vote jitters saw GBP sales lead the broader USD higher. Canada just reported its Retail Sales figures for the month of August and the numbers missed expectations: -0.1% MoM vs +0.4% and -0.2% MoM vs +0.1% ex Autos. This is now causing the market to break above yesterday’s support (now turned resistance) at the 1.3100 level. The next chart resistance levels come in at the 1.3130s, the 1.3150s, and then the 1.3180s…levels that could come into play should the Bank of Canada’s Q3 Business Outlook Survey disappoint at 10:30amET this morning. Justin Trudeau hung on to a second term in office during the Canadian elections last night, but now with a Liberal minority government that will likely need support from the NDP. All this was largely expected by market participants though during the campaign and so last night’s results were largely a non-event for USDCAD.

USDCAD DAILY

USDCAD HOURLY

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar is testing the lower bounds of a trend-line support channel in the 1.1130-50s this morning after yesterday’s failed attempt by traders to close the market above chart resistance in the 1.1160s. Traders have reason to pause here in our opinion, with Boris Johnson’s Brexit Withdrawal Agreement Bill vote, German October flash Manufacturing PMI and the ECB meeting all looming over the calendar for the next 48hrs.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is backing up a bit this morning as traders hedge the possibility of Boris Johnson pulling his Brexit Withdrawal Agreement Bill altogether today. While the UK government insists that it has the numbers (of MPs) to get this legislation through Parliament, it has threatened to scrap the legislation all together if opposition MPs start adding amendments (ie. stay in the EU customs union and/or 2nd referendum) that would force it to go back to the EU and the UK public. See here for a great summary of the last 72hrs in Brexit from Vox.com. Voting is expected to begin around 2pmET, with EU leaders looking on closely. UK lawmakers will first vote on the Withdrawal Agreement Bill and then on the government’s three-day timetable for approving the legislation.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar stalled at the 0.6880s in early NY trade yesterday when EURUSD receded back below the 1.1160s, and the market has failed on two occasions since then to break above it. We think this negative technical development was reason enough to invite sellers back in during European trade this morning, but we don’t think this will be the start of any serious selling given last week’s bullish upside breakout in AUDUSD. RBA Assistant governor Christopher Kent will be making a speech at 6:20pmET tonight.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen had a quiet overnight session as Japanese markets were closed for the Core Enthronement Ceremony holiday. US 10yr yields are falling back this morning as bond traders prepare for the event risk of the day (Brexit vote). USDJPY remains largely trapped in a 108.50-108.80 range trade that has persisted since Thursday’s failed upside breakout attempt into the 109 handle.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com