US/China "phase one" trade deal to be signed at 11:30amET this morning

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US Treasury Secretary Mnuchin touts “very significant”, yet “very complicated” agreement with China.

- Ceremony to take place at White House at 11:30amET. Details of the deal to be announced beforehand.

- Global markets displaying some pre-ceremony jitters, with lower US yields leading the USD broadly lower.

- US core PPI for December disappoints, +0.1% MoM vs +0.2% expected.

- OPEC releases un-inspiring Monthly Oil Report. API reports surprise build in weekly oil inventories.

- Weekly EIA oil inventory report out at 10:30amET, with traders expecting 474k barrel draw.

- Fed’s Harker to speak at 11amET and Kaplan to speak at 12pmET. Fed’s Beige Book to be released at 2pmET.

ANALYSIS

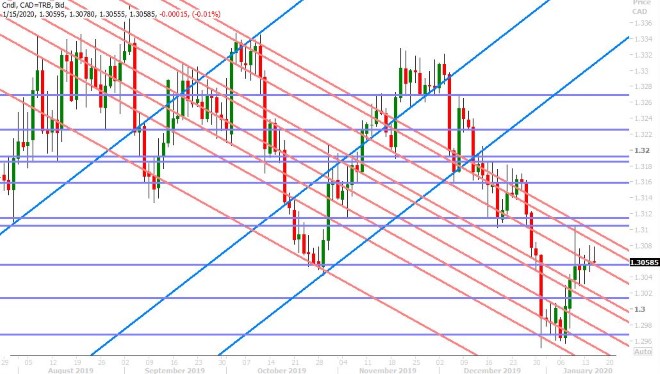

USDCAD

Dollar/CAD continues to mark time as traders await the details (if any) from today’s ceremonial “phase one” trade deal signing between the US and China. US Treasury Secretary Mnuchin told CNBC this morning the phase one deal is “very significant and has a very thorough enforcement mechanism”. He also said it’s a “very complicated agreement” and that the cybersecurity issues and tariff rollbacks expected under phase two “could come in multiple steps”. Oh great. Edward Lawrence of Fox New is reporting the following this morning, based on his sources:

China Buys over 2 yrs:

$40B in Services (Chinese Sources)

$50B Ag (POTUS & Treasury Sec Steven Mnuchin – Chinese Sources confirm $40B in Ag Buys)

$50B in Energy (Chinese Sournces)

$75 - $80B in Manufacturing (Chinese Sources)

So, depending on who you believe, we’re talking about 215-220bln in Chinese purchases over two years. There’s no reaction to any of this in the markets so far however (positive or negative), as we think traders want to read the actual text of the deal, which US Treasury Secretary Mnuchin promised will be released this morning before the 11:30amET ceremony at the White House.

In other news, OPEC released its Monthly Oil Report for January 2020 this morning. The cartel lowered its 2020 demand forecast for its own crude by 0.1mln bpd to 29.5mln bpd, around 1.2mln bpd lower than its 2019 forecast, while at the same time raising its “global” demand forecast by 0.14mln bpd to 1.22mln bpd, based on an improved economic outlook. In terms of the supply equation, OPEC raised its non-OPEC supply growth forecast for 2020 by 0.18mln bpd to 2.35mln bpd (vs 1.86mln for 2019) as it sees a growing supply threat from rivals beyond US shale. On the whole, we’d argue that this ho-hum report is not inspiring speculators to pick a short term bottom here in February crude oil. USDCAD shorts -- take note. The EIA will release its weekly oil inventory report at 10:30amET this morning, where traders are expecting a draw of 474k barrels. This follows a bearish, surprise build in oil inventories in the weekly API report, released last night (+1.1mln vs -500k expected).

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

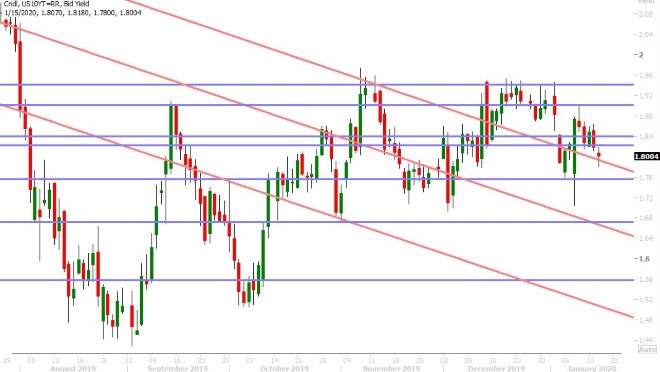

EURUSD

Euro/dollar has crawled back up to Monday’s chart resistance in the mid-1.11s this morning as US 10yr yields continue their slip lower, which commenced after the US reported slightly weaker than expected US CPI numbers yesterday. We think today’s slip in yields is due to a little angst/skepticism surrounding today’s US/China “phase one” deal signing. We also think the weaker than expected core US PPI numbers for December, which were just released, will now add further pressure to trend-line chart support in the 1.78-1.79% area. All of this is putting upside pressure on EURUSD chart resistance in the 1.1150s; pressure that we could see intensifying if the bond market starts to freak out about what’s not in this phase one trade deal.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Yesterday’s positive NY close above 1.3010s chart resistance was good enough to help GBPUSD inch higher in Asian trade last night, but some more weak UK data smacked the market lower at the start of European trade today. The UK CPI figures for December were reported at flat MoM vs expectations of +0.2%, leading January 30th BOE rate cut bets to climb to 64% and GBPUSD to fall back to chart support in the 1.3080s. Some broad USD selling is coming to the rescue now as jitters start to increase ahead of the US/China phase one deal signing. The BOE’s Michael Saunders stuck to his rate cut view when speaking earlier today, but he’s a known dove on the MPC and so we’d argue his comments didn’t come as a surprise for GBP traders. More here from Reuters.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

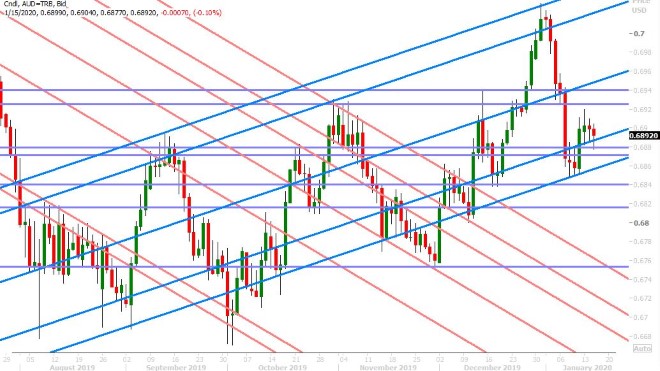

AUDUSD

Large option expiries around the 0.6900 strike continue to have anchoring effect on spot AUDUSD prices this week. Over 1.1blnAUD comes off the board shortly between 0.6905 and 0.6920; and we think this is helping the market deal with some pre-phase one deal signing jitters. Chart support in the 0.6870-80s is holding for now. We think the US bond market reaction to this morning trade deal details will set the tone for the broader USD today. We’re a little bit surprised that USDCNH is not trading higher frankly.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is holding up rather well this morning, despite yesterday’s fade off the 110.10s resistance level and the continued slump in US yields this morning. We’re still on guard for a potential “buy the rumor…sell the fact” market reaction to the signing of the phase one US/China trade deal this morning, perhaps with the initial reaction still being positive (because of the headline scanning algorithms).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com