Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

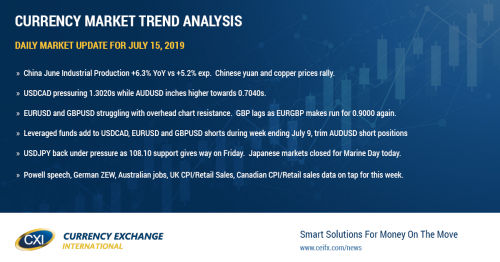

• China June Industrial Production +6.3% YoY vs +5.2% exp. Chinese yuan and copper prices rally.

• USDCAD pressuring 1.3020s while AUDUSD inches higher towards 0.7040s.

• EURUSD and GBPUSD struggling with overhead chart resistance. GBP lags as EURGBP makes run for 0.9000 again.

• Leveraged funds add to USDCAD, EURUSD and GBPUSD shorts during week ending July 9, trim AUDUSD short positions

• USDJPY back under pressure as 108.10 support gives way on Friday. Japanese markets closed for Marine Day today.

• Powell speech, German ZEW, Australian jobs, UK CPI/Retail Sales, Canadian CPI/Retail sales data on tap for this week.

ANALYSIS

USDCAD

Commodity currencies are enjoying a bid to start the week after China reported upbeat Industrial Production data for June last night, but overall FX price movement has been muted so far as Japanese markets were closed for the Marine Day holiday. Dollar/CAD continues to pressure trend-line chart support in the 1.3020s but a broad, albeit mild, bid for USD appears to be creeping in as NY trading gets underway. The funds at CME continued to add to their new net short position in USDCAD during the week ending July 9 (according to the latest COT report from the CFTC released Friday afternoon) as we think leveraged players are now looking for a collapse below 1.3000 at some point this month. This week’s North American calendar features US June Retail Sales and a speech from Fed chairman Powell in France (tomorrow), Canadian CPI for June (Wednesday) and Canadian Retail Sales for May (Friday). We’ll also get more Fed-speak from the likes of Williams (today), Bostic, Bowman and Evans (tomorrow), the Beige Book report (Wednesday) and from Bullard and Rosengren on Friday.

USDCAD DAILY

USDCAD HOURLY

AUG CRUDE OIL DAILY

EURUSD

Euro/dollar saw a mild bid to start early European trade today after USDCNH slipped below trend-line chart support in the 6.8770s (call it a delayed reaction to the positive Chinese IP data), but the market has been struggling at a confluence of chart resistance levels in the 1.1280s ever since. The German bund yield is trading lower this morning after last week’s rip higher and we think this is contributing to the offered tone as NY trading commences today. The funds at CME starting re-accumulating short positions during the week ending July 9 (perhaps because of the swift move back below the 1.1300 handle, which erased the market’s break out attempt post Fed meeting). Mind you, these new positions are likely underwater now given the 50pt bounce in the market since Tuesday and we think EURUSD needs to stay below the 1.1280-1.1300 area in order to keep these new short positions from bailing. This week’s light European calendar features the German ZEW Survey for July (tomorrow), and Italian Industrial Orders/Sales for May + Eurozone CPI for June (Wednesday).

EURUSD DAILY

EURUSD HOURLY

AUG GOLD DAILY

GBPUSD

Sterling is lagging the rest of the bunch to start the week as it too struggles with overhead chart resistance (in the 1.2570s). The EURGBP cross has regained the 0.8970 chart support level in what looks like a renewed push for the 0.9000 handle. The funds at CME increased their net short position in GBPUSD yet again during the week ending July 9, making leveraged money the most short GBP it has been since last summer. This week’s calendar features a slew of important economic reports for the UK, including the Employment Report for May (tomorrow), June CPI (Wednesday) and June Retail Sales (Thursday). It now looks like Boris Johnson will win the Tory leadership race, according to the latest polls, when 160k party members vote next Monday. More here from the Guardian. The UK parliament will enter its summer recess from July 25 to September 3.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar, like the Canadian dollar, is enjoying a bid on the back of last night’s better than expected Industrial Production data out of China. September copper prices are loving it too; rallying 1% higher and back above the 2.70 mark this morning. We think AUDUSD is also being helped by Friday’s swift move back above the 0.7000 level (which seemed to be flow related heading into the London fix). The next stop is chart resistance in the 0.7040s in our opinion and the next scheduled headline to digest will be the RBA Minutes, which come out at 9:30pmET tonight. The funds at CME reduced their net short position for the 2nd week in a row, during the week ending July 9, which tells us leveraged money is already re-positioning for a rally higher. We think a break above the 0.7040 level could very easily prompt more short covering that could lead us into the 0.71s. Australia reports its June Employment Report on Wednesday night ET and traders are looking for a gain of just 10k jobs.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen has had a very quiet start to the week as Japanese markets were shut for a holiday, but chart support in the 107.80s is holding. This level became the target for traders on Friday after broad USD selling and a pullback in US yields saw the 108.10 support level give way. The US bond market still appears to be grappling with what last week’s hotter than expected US June CPI and PPI data means when it comes to the Fed’s outlook for monetary policy. We still believe the Fed is looking past domestic data and is more focused on what is making money markets so nervous. The LIBOR curve out to 12months remains inverted to start the week and the Eurodollar interest rate futures for December expiry continue to imply an effective Fed funds rate of 2.00% by years end. The funds at CME added marginally to long positions during the week ending July 9, leaving them ever to slightly net long USDJPY.

USDJPY DAILY

USDJPY HOURLY

DEC 3-MONTH EURODOLLARS DAILY

Charts: TWS Workspace

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

About Currency Exchange International

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.

This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.