Bank of Canada goes dovish again. ECB stands pat. Coronavirus spreads.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Bank of Canada lowers GDP forecasts, says “door is obviously open to an interest rate cut”. USDCAD spikes.

- ECB to adhere to current strategy until new strategy has been defined. Expected late 2020.

- Three Chinese cities now on lock-down as coronavirus spreads to almost 600 cases and kills 17.

- Chinese markets now closed for the Lunar New Year holiday, with USDCNH threatening upside break.

- Beijing to cancel holiday festivities. Macau may close casinos. WHO press conference eagerly awaited.

- AUDUSD bounces on decent Australian employment report for December.

- GBPUSD trying to hold yesterday’s CBI-driven gains, but market not seeing follow-through buying.

- US yields fall below 1.7550% support. USDJPY threatening break below 109.40s on “risk-off” sentiment.

ANALYSIS

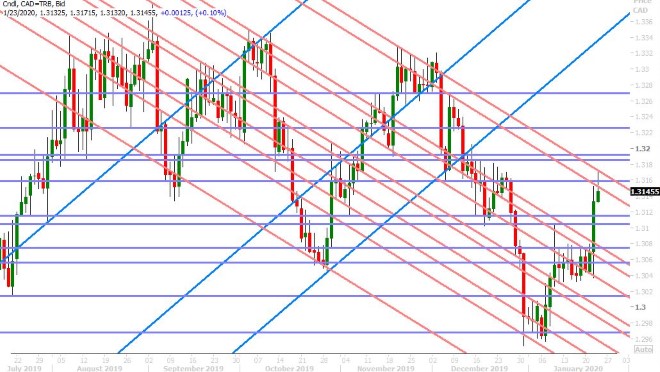

USDCAD

Dollar/CAD is riding high this morning after the Bank of Canada surprised markets with a more dovish than expected hold to interest rates yesterday. The statement noted a number on concerns about the Canadian economy; most notably that the output gap is now wider than expected, the economy is no longer operating close to capacity and that indicators of consumer confidence and spending have been “unexpectedly soft”. The Canadian central bank also lowered its GDP forecasts for Q4 2019, Q1 2020 and all of 2020 to 0.3%, 1.3% and 1.6% respectively in its Monetary Policy Report (MPR). USDCAD quickly surged back up through the key 1.3070s resistance level in response, and the OIS market began to start re-pricing for 2020 rate cuts once again (23% odds for March 4th).

Bank of Canada Governor Stephen Poloz tried to tone down the dovishness in the first half of his press conference yesterday by focusing on the positive data points, the central bank’s ongoing data dependency and by re-emphasizing that the current level of interest rates was appropriate, but towards the end he said the “door is obviously open to an interest rate cut” and that the “downside risks identified in October have clearly landed”. It was frankly a very confusing press conference to listen to, but we think traders still came out of it thinking that the next probable move for Canadian rates is lower.

USDCAD reached trend-line chart resistance in the 1.3150s by the early afternoon, and while we saw some EURUSD-driven USD sales pull the market a tad lower into the NY close, this level has now given way in the overnight session due to the continued weakness in crude prices. Tuesday’s bearish outside day pattern on the March futures chart was a negative omen for the oil markets and we’ve now seen the market break chart support in the mid 57s on the back of demand fears related to the coronavirus outbreak. A quick look at all the risk proxies this morning (lower US yields, USDJPY, CNH) suggests that this crisis gets worse before it gets better, and so we think USDCAD traders need to be on guard for today’s WHO press conference (time TBA) as a potential catalyst for even higher prices.

If we look at the technicals for USDCAD this morning, we would note the creation of a higher trading range (1.3070s to 1.3170s). Some are already saying that the market has broken out to a new uptrend, and while we’d argue yesterday’s breakout above the 1.3070s was technically significant and financially damaging for the fund net short position, we’d like to see a confirmed NY close above the 1.3170-90 region to confirm the optimism.

The EIA will report its weekly oil inventory report this morning at 11pmET, due to the MLK holiday on Monday. The Reuters poll estimate is looking for a - 1.009M barrels, vs -2.549M last week and +1.6M (vs +1.1M expected) from last night’s API report.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

The European Central Bank kept interest rates and its forward guidance on rate/asset purchases unchanged this morning, which was largely expected by market participants and so EURUSD prices barely moved around the 7:45amET press release time. It also announced the start of its strategic review, which was also expected given Christine’s Lagarde’s comments from the last ECB meeting. The ECB President caused a brief spike up in EURUSD at the start of her press conference by noting some signs of a moderate increase in inflation, but she’s now having a tough time keeping the mood optimistic. We found her comments about the ECB’s current strategy as particularly discouraging:

LAGARDE SAYS WILL ADHERE TO CURRENT STRATEGY, TARGET UNTIL NEW STRATEGY HAS BEEN DEFINED

LAGARDE SAYS STRATEGY WILL TOUCH ON HOW WE DELIVER AND MEASURE

LAGARDE SAYS EXPECTATION IS REVIEW WILL TAKE A YEAR

LAGARDE SAYS WE HOPE WE CAN AGREE ON NEW STRATEGY OF ECB AROUND NOV-DEC

ECB SAYS REVIEW WILL ENCOMPASS QUANTITATIVE FORMULATION OF PRICE STABILITY, MONETARY POLICY TOOLKIT, ECONOMIC AND MONETARY ANALYSES AND COMMUNICATION PRACTICES

ECB SAYS OTHER CONSIDERATIONS, SUCH AS FINANCIAL STABILITY, EMPLOYMENT AND ENVIRONMENTAL SUSTAINABILITY, WILL ALSO BE PART OF REVIEW

ECB SAYS EXPECTED TO BE CONCLUDED BY END OF 2020, REVIEW WILL BE BASED ON THOROUGH ANALYSIS AND OPEN MINDS, ENGAGING WITH ALL STAKEHOLDERS

While none of these headlines should come as a surprise to the markets, given the year-long timeline Christine Lagarde communicated at the last ECB meeting, it’s hard not to digest all this once again and conclude that the European Central Bank really doesn’t know what to do next. We’re not surprised to see EURUSD now trading to new one month lows as it completes its bearish “head & shoulders” pattern from last week.

Tomorrow is January flash PMI day across Europe (more on this below).

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling recorded a bullish NY close yesterday with prices managing to stay above chart resistance (turned support) in the 1.3110s. Who knew the better than expected quarterly business optimism component of the UK CBI survey would have such a significant impact on the market, but it appears everyone (ourselves included) is going to have to watch this data set more closely going forward.

Traders are now following EURUSD lower in the wake of the disappointing ECB meeting in our opinion. Tomorrow should be interesting for the markets, as we’ll hear from the BOE’s Haskel and we’ll get the UK’s latest flash PMI data for January (all at 4:30amET). The German and Eurozone flash PMIs for January will come out a little bit earlier (3:30am and 4:00amET respectively) and could influence GBPUSD as well.

The probability for a 25bp cut at next Thursday’s Bank of England policy meeting have up-ticked slightly to 55% today, from the 48% lows we saw yesterday. We think these coin-flip odds are now wreaking havoc on traders though. While GBPUSD has now technically arrested its downward momentum since Governor Mark Carney first started talking dovishly, we’re not seeing the follow-through buying that you want to see with bullish reversals.

Traders are expecting a slight bump to tomorrow’s UK flash PMIs:

Composite: 50.6 vs 49.3 prev

Manufacturing: 48.9 vs 47.5 prev

Services: 51.0 vs 50.0 prev

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

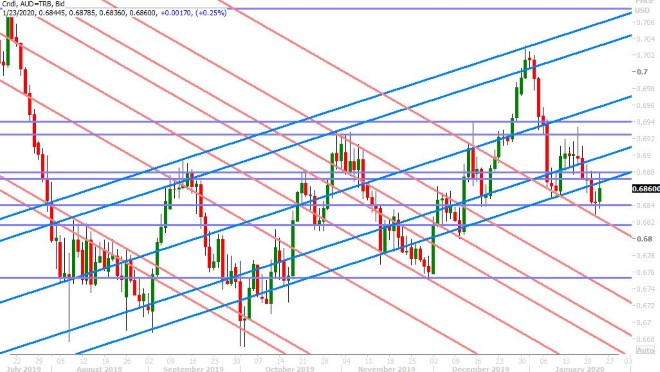

AUDUSD

The Aussie is enjoying a reprieve for punishment today after Australia reported a better than expected employment report for December last night. Headline job growth came in at +28.9k versus +15.0k expected. The unemployment rate ticked down 0.1% to 5.1%, versus expectations for it to remain steady at 5.2%. Some are criticizing the job gains as being largely influenced by seasonal part-time workers, but we think the Reserve Bank of Australia might not care. This is a small win for them and naturally we’ve now seen the OIS market reduce February 4th rate cut odds to 50% and AUDUSD bounce off yesterday’s chart support level in the 0.6830-40s.

Yesterday’s lockdown of Wuhan and today’s effective shutting down of Huanggang and Ezhou (three cities totalling 20 million in population) by Chinese authorities is now taking another leg out from underneath the Chinese yuan as liquidity evaporates into the Lunar New Year holiday. China’s PBOC has been adding liquidity to money markets for a couple of weeks now (which is what we normally see ahead of this holiday every year), but we have to imagine there’s a real risk of the Yuan collapsing should the coronavirus crisis escalate while the on-shore Chinese markets are closed until January 31st. Off-shore dollar/yuan (USDCNH) is now trading just shy of chart resistance in the 6.9310-30s. We think a break above this level could usher in a panicky move all the way up to the 6.99 level. Just something to keep an eye on.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

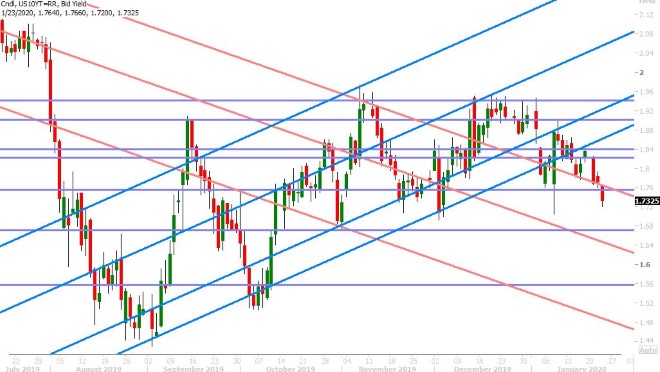

USDJPY

Dollar/yen is trading lower again this morning as the coronavirus spreads to almost 600 cases in China, killing 17 people now. Three cities are now on lockdown. Beijing has cancelled all public events for the Lunar New Year holiday. There is even talk circulating that Macau, a popular gambling destination for Chinese travelers during the festive season, may even close all their casinos as the territory recorded its second case of the coronavirus today.

The market is now threatening a break below chart support in the 109.40s. US 10yr yields have already broken chart support at the 1.7550% level, and now look set to erase the US/Iran de-escalation euphoria completely and begin a new downtrend. We think today’s expected press conference from the World Health Organization, and whether or not it declares the coronavirus to be a global health emergency, will be the next inflection point for overall risk sentiment.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com