Case Study: Streamline your international wires operations with CXI to modernize your international department solutions

This case study is part of our case studies and resources series. For more insights from CXI visit our resources and news page. Contact us now to partner with CXI.

Customer

The financial institution is a publicly held, state-chartered commercial bank located in Massachusetts, with over $8 billion in assets and approximately 50 full-service locations.

Their primary focus is to create solutions driven by technology and built through tailored relationships to meet the needs of each of their customers.

Challenge

The financial institution was experiencing a very manual processing environment and lengthy processing times to send international wires to their customers.

The financial institution identified the international payments service as an opportunity to increase fee income, while better servicing its customers’ needs with increased efficiency.

This prompted the financial institution to seek a partner that could implement integrated industry-leading solutions that could enhance the international payments process, increase their revenue and provide an automated regulatory solution for international consumer wires.

Solution

The financial institution needed to partner with an experienced provider that has an extensive track record in processing and sending international wire payments.

With CXI, the financial institution received comprehensive foreign exchange solutions with one provider, one platform.

CXI utilized its proprietary software with robust reporting and compliance functionality to allow the financial institution to directly grow their foreign exchange business through a streamlined platform that is fast and secure.

This gave the financial institution the ability to provide a high-quality customer service experience for their clients.

Solution Specifics

The financial institution chose to partner with CXI as their preferred partner for international wire processing solutions. CXI worked closely with the institution during their discovery session to understand the financial institution's existing challenges and future goals.

The financial institution then leveraged CXI’s specialized foreign exchange experience and system capabilities to design a workflow that streamlined their international wire process for sending and receiving international payments. This was done by automating previously manual work, increasing the integrity and transparency of the process, and strengthening its customer service.

Upon implementation, CXI provided the financial institution with complimentary access to its proprietary online platform, CXIFX, which eases processing burdens by integrating with automated core banking systems. This allowed the financial institution to easily initiate, approve, track, and release wires directly into the platform. All wire actions include clear audit trails and real-time reporting helping to ensure customer service and compliance tasks are simple and transparent.

CXI quickly set up the online foreign exchange platform within three weeks and customized the system to match the workflow agreed upon and designed to meet the financial institution's needs. Immediately after implementation, international payments activity increased and feedback both from customers and staff was exceptional. The financial institution's personnel confirmed the entire wire process, from the time they first entered the wire information to pulling daily reports, was very simple.

Now wires take minimal time to complete and the integrated wire tools make processing them easier. These are the solution specifics that were implemented for the financial institution:

1. Complete access to CXI’s online platform (CXIFX) to initiate international payments:

- Outgoing & Incoming International Payment Capabilities

- SWIFT gpi – full end-to-end tracking visibility on all wires

- Integrated Reg E disclosures

- Access to live exchange rates to quote their customers in real-time

- Dual control capabilities to align with industry best practices

- Numerous compliance components built-in for back office OFAC clearing

- Validations for the beneficiary bank, IBAN, and country-specific data requirements

- Robust reporting capabilities for easy account management

2. Added service for customers and new revenue stream:

- In a revenue share arrangement, the financial institution successfully captured significant revenue while offering their customers competitive pricing

- Full Payments support team & dedicated account manager

- Same-day processing & same-day settlement

- Transparent tracking of wires

Results

By partnering with CXI, the financial institution is now initiating international wire payments directly into the CXIFX platform with increased efficiency and access to Reg E disclosure in the system for their staff to complete wires promptly for their clients. The compliance, reporting, and validation tools have reduced the amount of returned payments and requests for more information that previously slowed down its wire operations team.

Along with the streamlined process improvements, the financial institution sends quick and thorough responses to all client inquiries received. This has been noticed by customers who have reported very positive feedback about their experience.

Prior to engaging CXI and CXIFX for international payments, the financial institution partnered with CXI and CXIFX for its banknote services for 3 years. Adding CXI as their international payments processor gave the financial institution the advantage of having their international services with one platform, one provider.

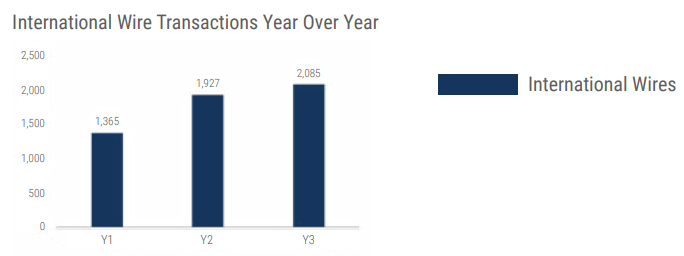

2,000+

International wires transactions annually

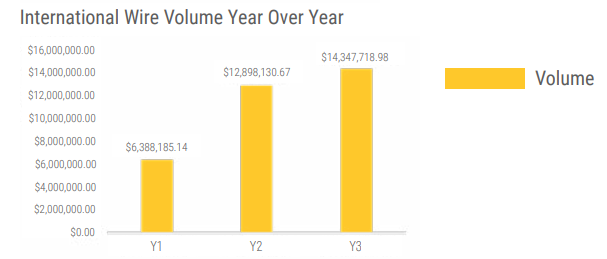

$14mm+

Total volume of $14,347,718.98 sent annually in international wires

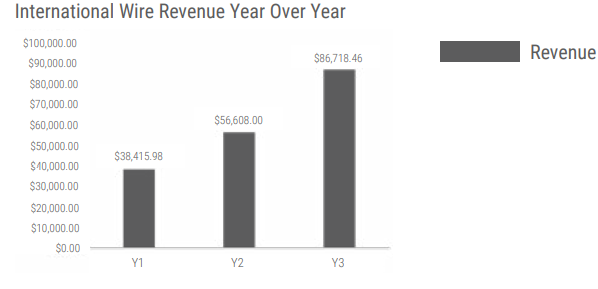

125%

Increase in international wire revenue after three years of switching to CXI

2x

Increase in international wires processed, volume sent, and revenue generated since partnering with CXI

Customer Testimonial

“Prior to engaging with CXI, we had several different providers for our retail and commercial FX payment streams. The providers were made up of traditional legacy correspondent banking relationships and were not price competitive. As a result of not having a single platform, the bank was not able to fully maximize our revenue potential.

Since partnering with CXI, we have been able to consolidate our flows to one provider covering our banknote, consumer international, check collection, cash letter, and commercial wire payments. The cooperation and guidance from the CXI team have been integral in developing and expanding our capabilities while increasing our revenue to become a significant revenue contributor.”

- VP FX Director - A top 100 US FI

International Wire Transactions Year Over Year

International Wire Volume Year Over Year

International Wire Revenue Year Over Year

SWIFT GPI

Moving money between countries and currencies can be fast and easy. Quickly get a currency rate for immediate settlement and send an international payment to more than 200 countries. Tap into SWIFT gpi to increase the speed of payments and allows for end-to-end tracking.

INTERNATIONAL RECEIVABLES

Managing all of your payments with one provider reduces the time spent searching for your funds. Send or receive money from around the world with one bank specializing in foreign exchange.

COMPLIANCE VERIFICATION SYSTEM

CXI’s proprietary Compliance Verification System (CVS) is built into the core of its platform and is designed to allow your institution to comply with all applicable foreign currency regulations in real-time including Dodd-Frank Reg. E requirements.

CORE BANKING SYSTEMS

CXI connects with some of the most popular core banking systems as well as proprietary systems. Integrations include Fiserv’s Payments Exchange, Jack Henry, and Juniper Payments, and CXI is always adding more.See our resources page >

Subscribe to currency insider >

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Learn how financial institutions can improve their international wire operations.

Learn how financial institutions can improve their international wire operations.