Dollar goes offered again in overnight trade

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Risk-on USD sales emerge after positive US/China phone call.

- Europe plays catchup, ignores slightly better German GDP/Ifo.

- Bond market selloff likely exaggerated by looming US supply.

- EURUSD, GBPUSD, WTI gains lead USD lower into NY trade.

- Will traders begin to front-run predicted month-end USD sales?

- Two Fed members + BOC’s Schembri to speak later today

ANALYSIS

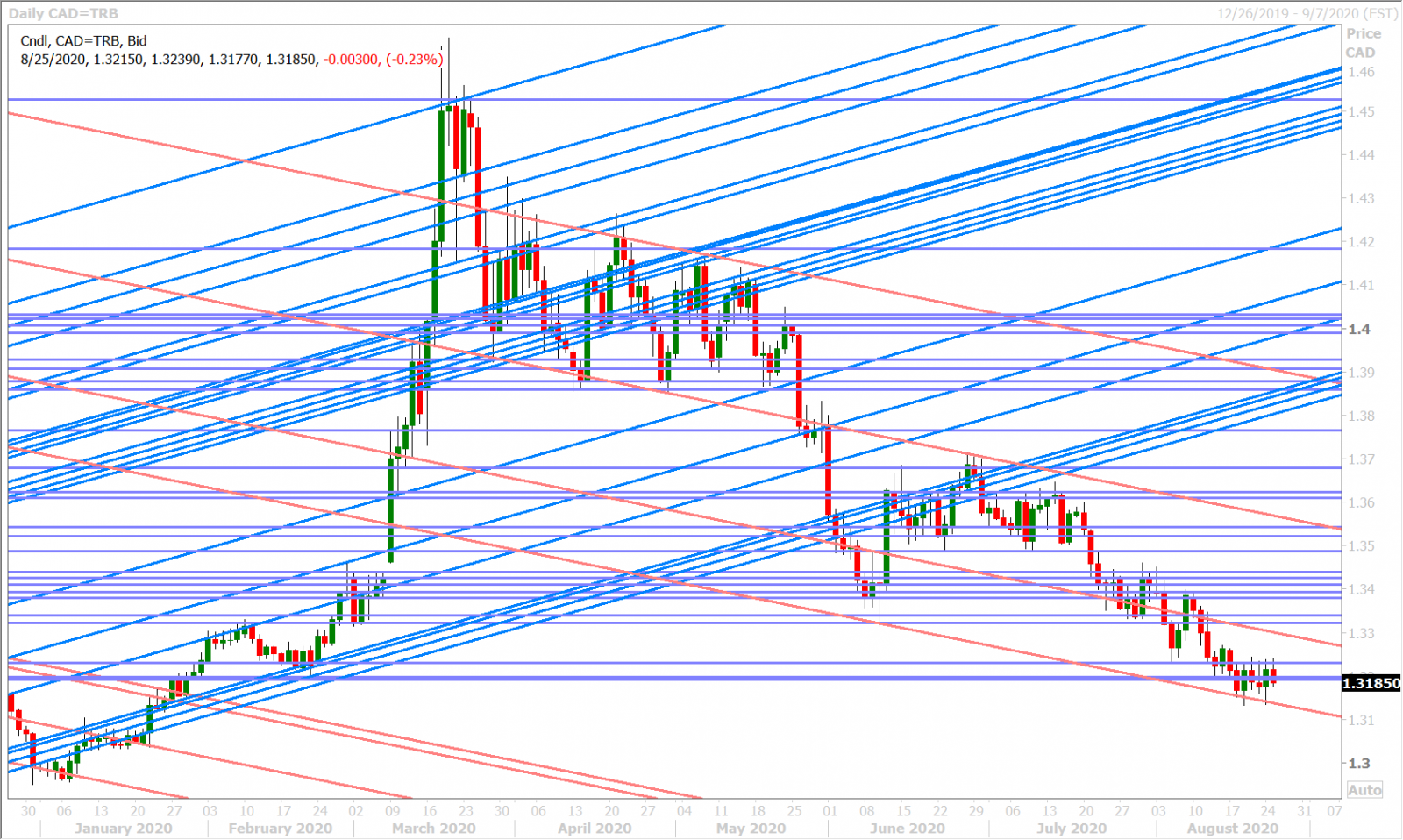

USDCAD

Dollar/CAD is slumping back below the familiar 1.3190-1.3200s this morning. The catalyst seems to have been last night’s surprise phone call between US Trade Representative Lighthizer, US Treasury Secretary Mnuchin and China’s Vice Premier Liu where all parties agreed that progress was being made towards implementation of the Phase 1 trade deal. The S&P futures extended their gains to yet another all-time high in Asia, USDCNH threatened a break below the 6.9000-6.9030 support zone and USDCAD resisted the 1.3230s once again after failing to break above this level in NY trade yesterday.

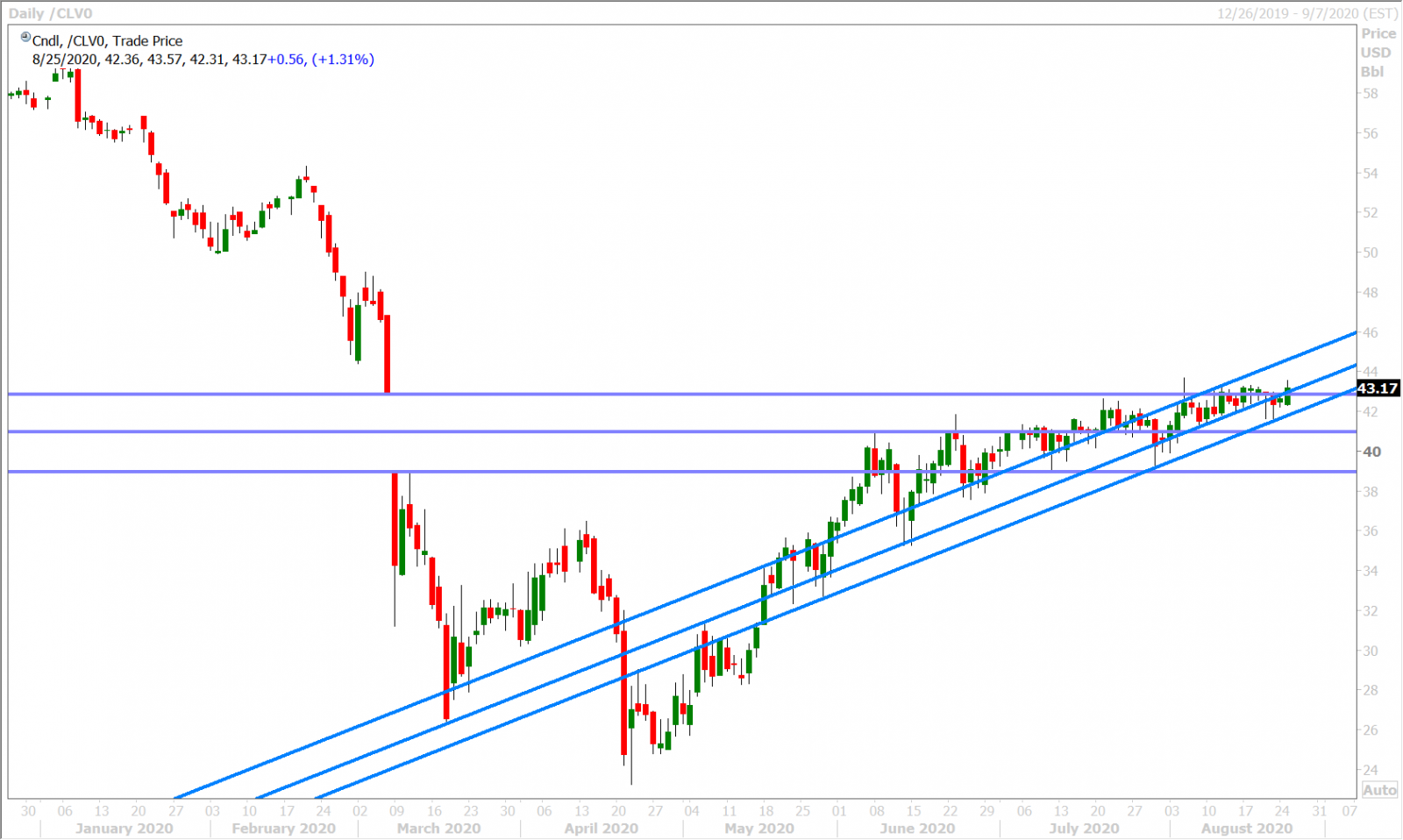

The risk mood was a little more mixed in Europe this morning, with European stocks playing catchup to Asia’s bid, the S&Ps pulling back and with EURUSD showing a non-directional response to Germany’s slightly better than expected Q2 GDP revision and MoM increase for its IFO survey. However, we’ve seen a strong 1.8% rally in October WTI prices as tropical storm Laura gets upgraded to a category 1 hurricane (CAD positive) and traders are also talking about Citibank’s prediction for USD selling at month-end (perhaps some people are starting to front-run this) and we think both can explain USDCAD’s weakness this morning. German bunds and US treasuries have noticeably sold off, but we suspect part of this could be the marketplace making room to absorb $148bln of new short term US supply over the next three trading sessions (hence why it hasn’t been broadly USD positive).

Today’s North American session will be devoid of major economic data and so we think FX traders will focus on US yields and EURUSD’s reaction post NY-options cut (10amET) and pre-London fix (11amET). The market will also have some central bank speak to digest (Fed’s Barkin at 11:30amET, BOC’s Schembri at 1:30pmET and Fed’s Daly at 3:25pmET).

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

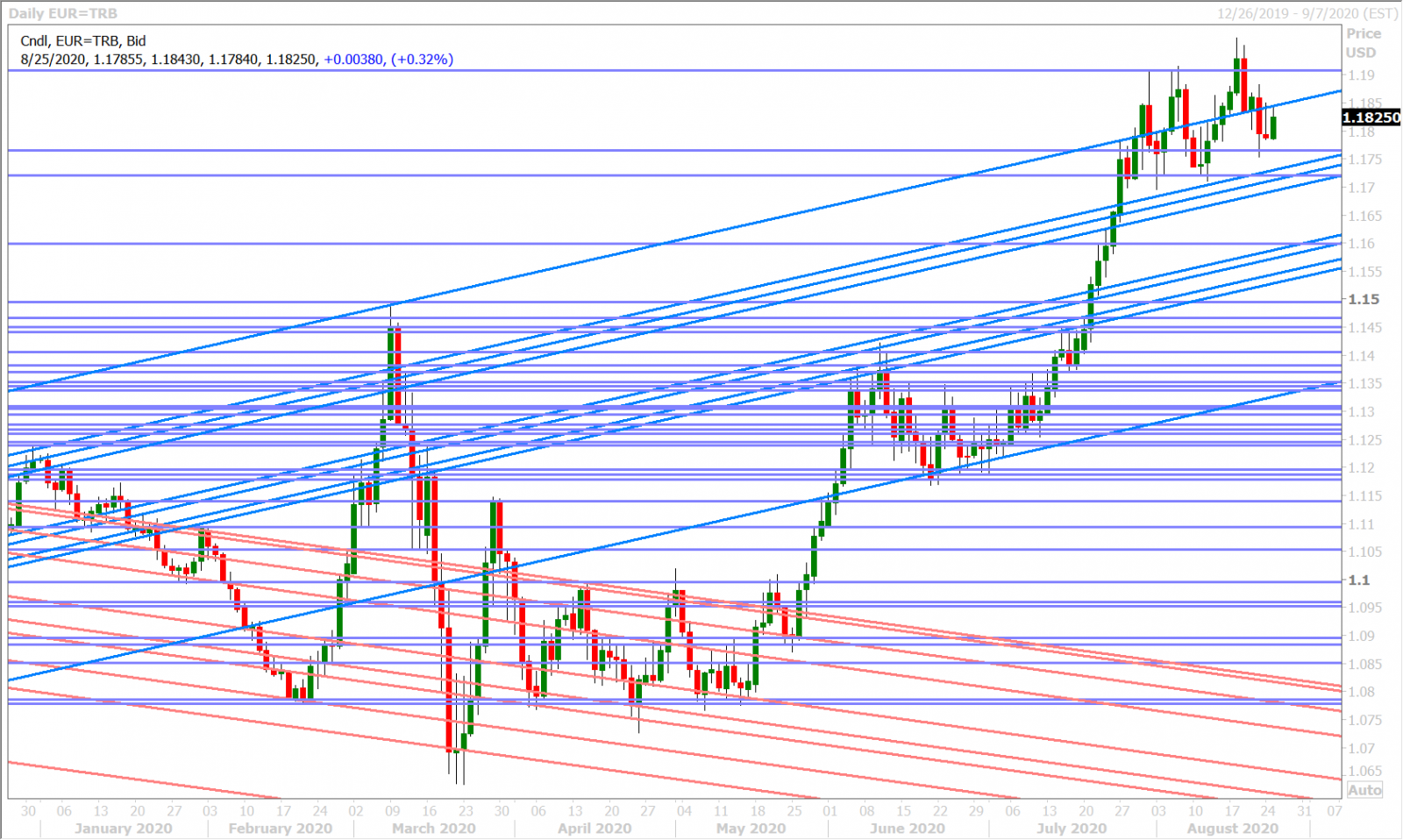

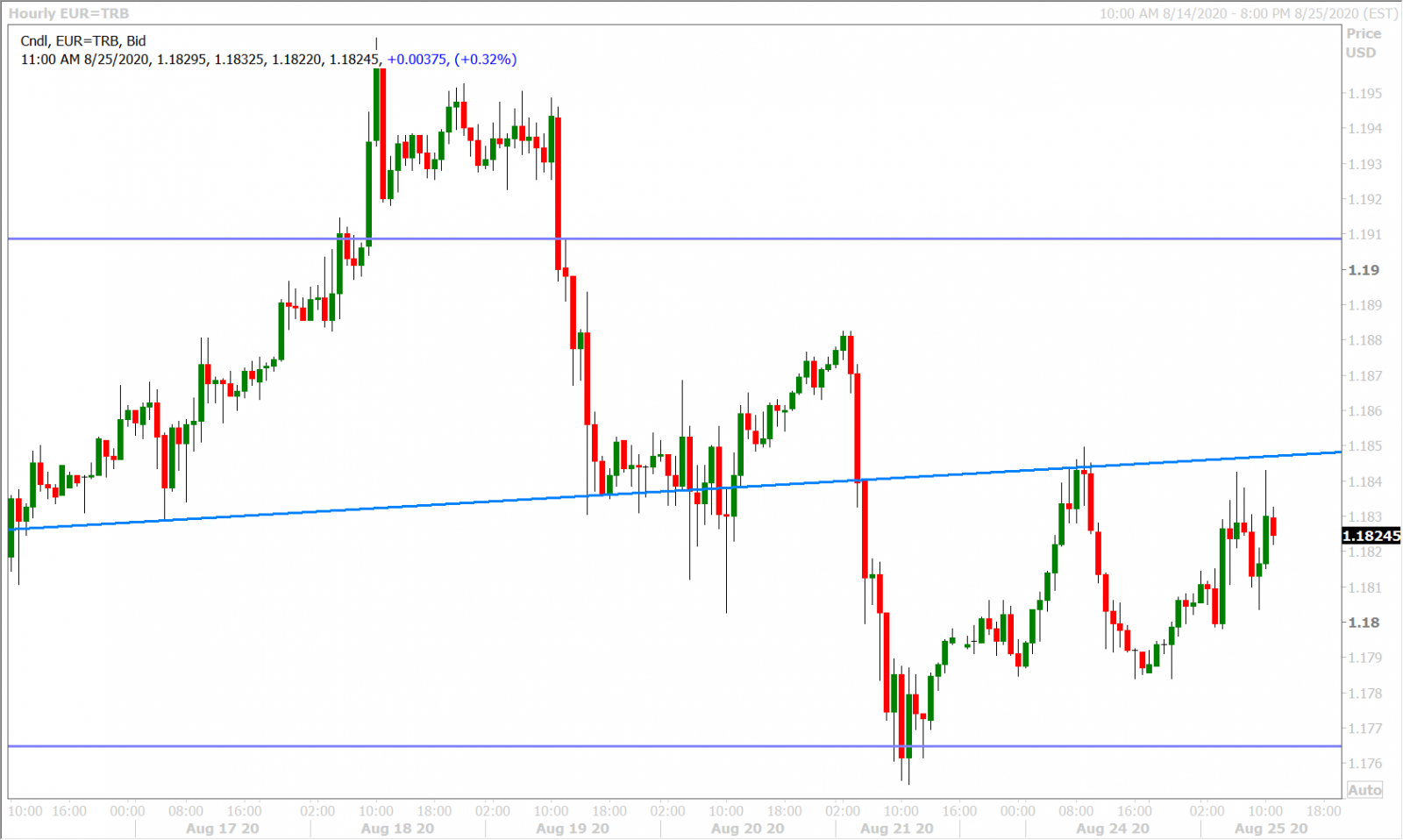

EURUSD

Euro/dollar has recovered most of yesterday’s NY session losses overnight on the back of positive US/China trade headlines and what feels like hedging ahead of this morning’s 1blnEUR expiry at the 1.1850 strike. It will be interesting to see afterwards if FX markets re-focus on rising US yields (USD positive) or the possibility for front-running of Citibank’s predicted month-end USD selling flows into the London fix (USD negative). We’d argue that this morning’s German data didn’t have much of an effect on the marketplace.

German Q2 GDP Detailed QQ SA, -9.7%, -10.1% f'cast, -10.1% prev, -2.0% rvsd

German Aug Ifo Business Climate New, 92.6, 92.1 f'cast, 90.5 prev, 90.4 rvsd

German Aug Ifo Current Conditions New, 87.9, 86.9 f'cast, 84.5 prev

German Aug Ifo Expectations New, 97.5, 98.0 f'cast, 97.0 prev, 96.7 rvsd

EURUSD DAILY

EURUSD HOURLY

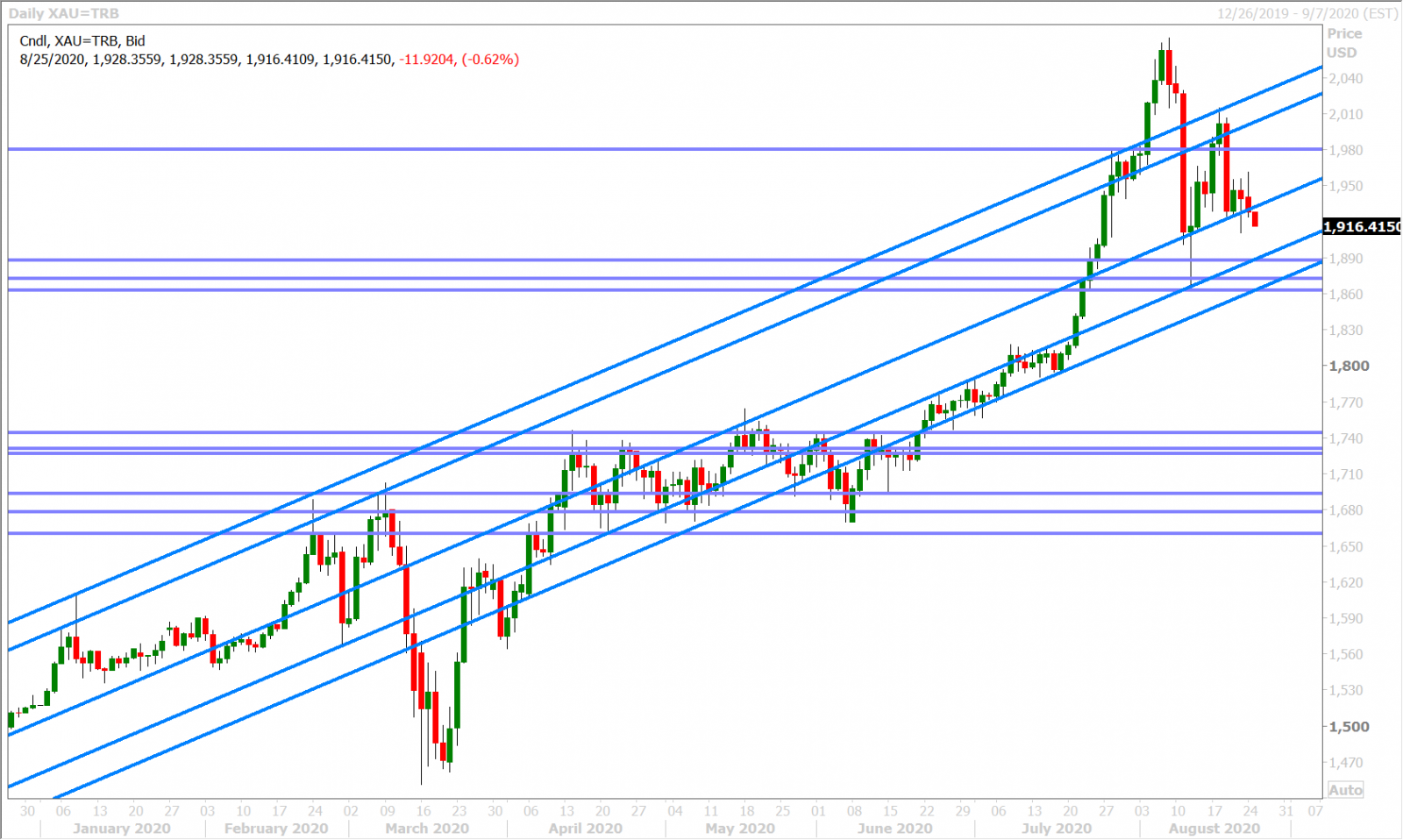

SPOT GOLD DAILY

GBPUSD

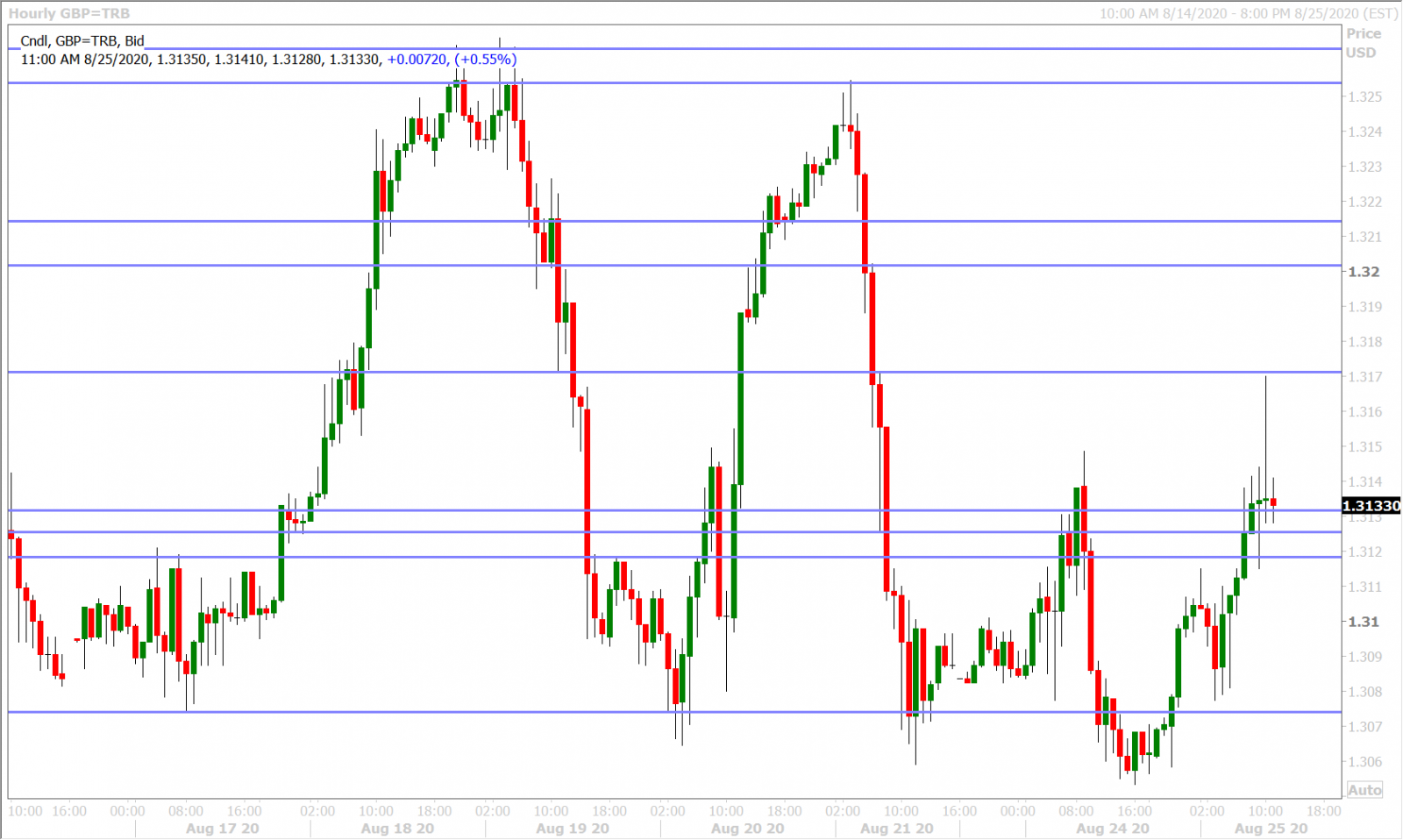

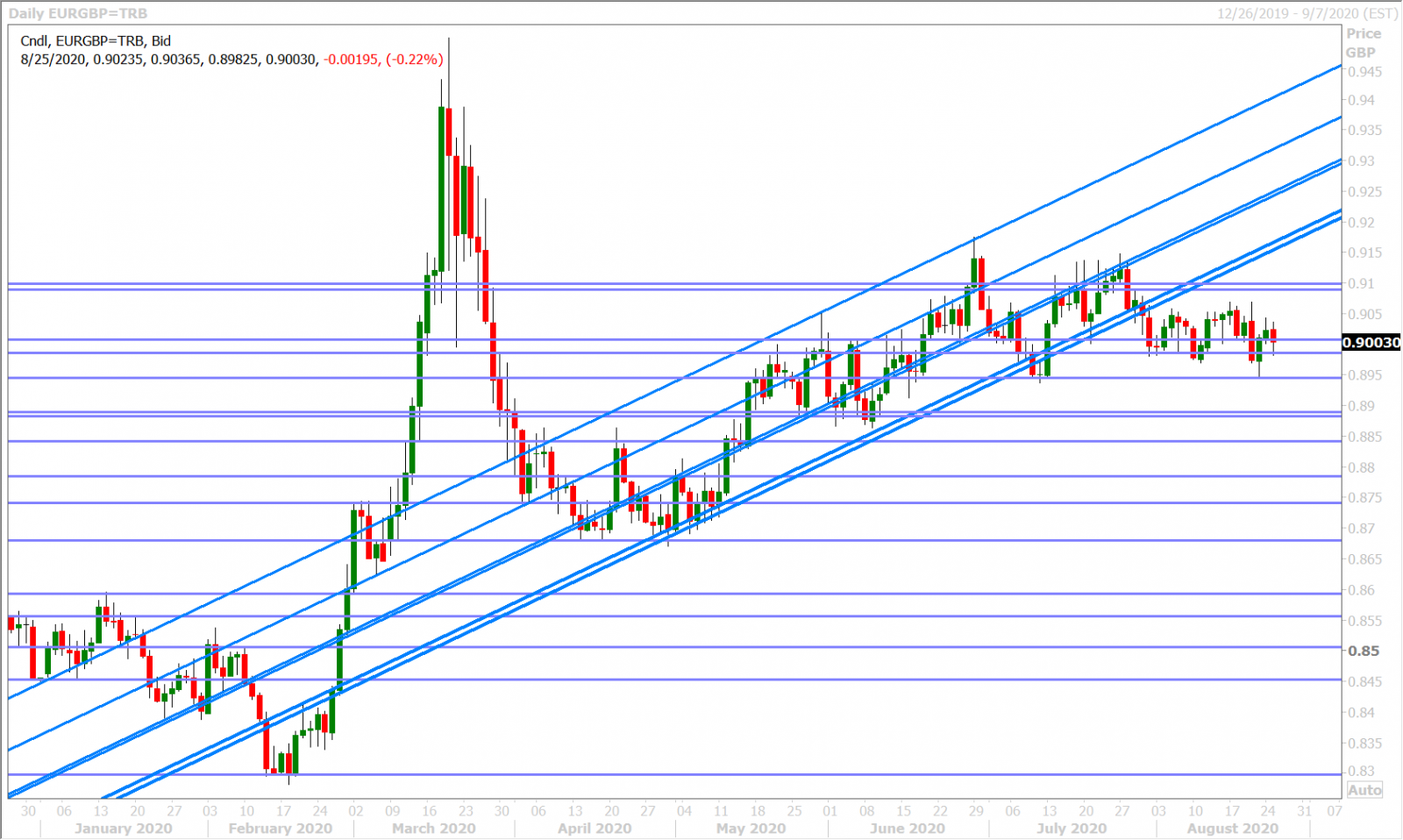

Sterling has vaulted over 100pts higher this morning; making a mockery of yesterday’s rather bearish NY close below the 1.3070s support level. Last night’s positive US/China headlines saw GBPUSD quickly regain this level and strong EURGBP selling seems to be the theme behind sterling's outperformance this morning, although the underlying catalyst is unclear. GBPUSD looks like it just tripped buy stop orders above last week’s pivotal 1.3120-30s level because traders have quickly faded the pop to chart resistance in the 1.3170s.

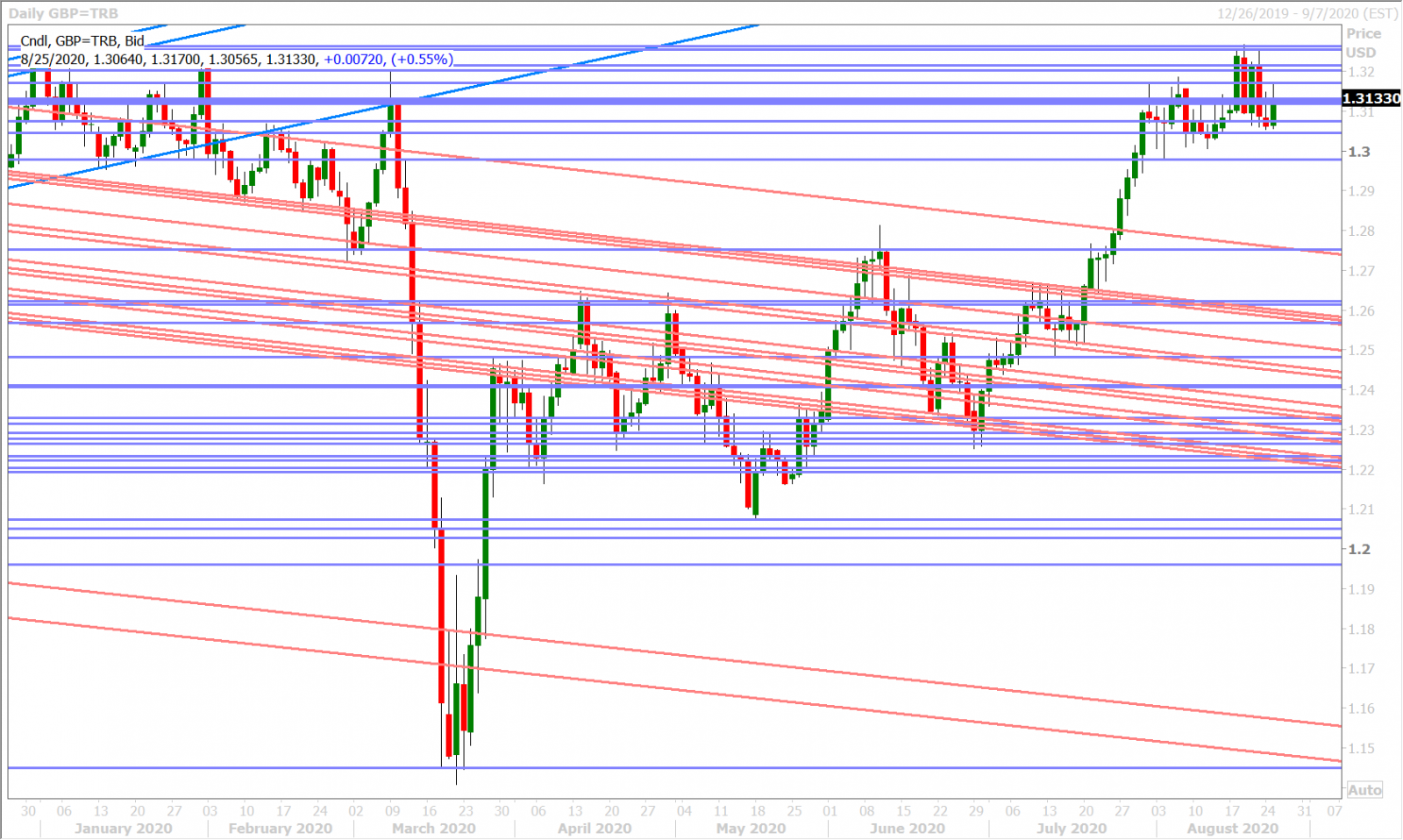

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

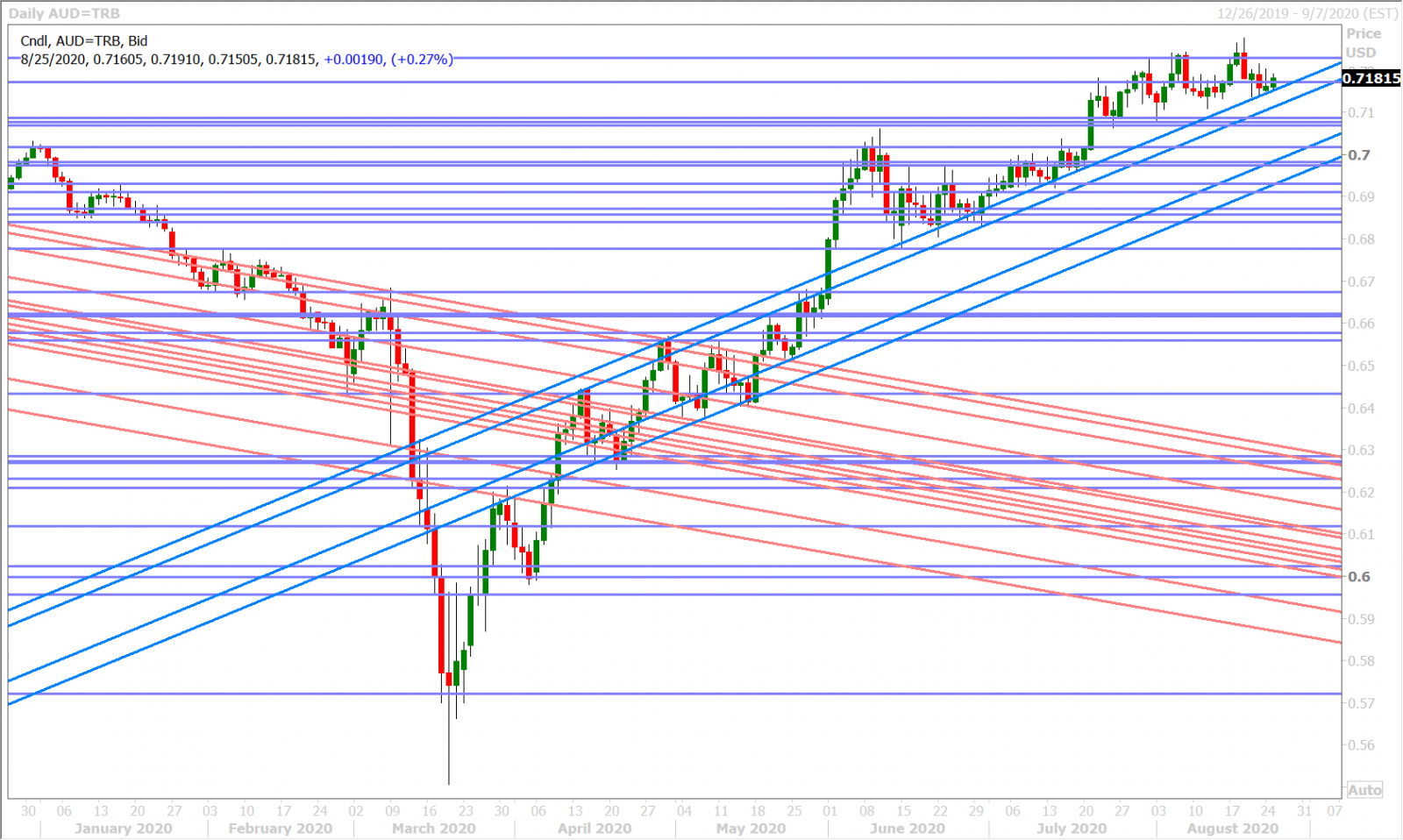

AUDUSD

The Australian dollar is trading higher with its G7 peers this morning but it’s been a struggle. Last night’s risk-on bid from the positive US/China phone call proved short lived and USDCNH ultimately held the key 6.9000 support level in European trade. The market also saw nervous-looking AUDUSD sales during the 4amET which re-challenged a key uptrend line in the 0.7150s. Some oil-driven buying of the Canadian dollar in London trade seems to have come to the rescue heading into NY trade, but the Australian dollar continues to look shaky here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

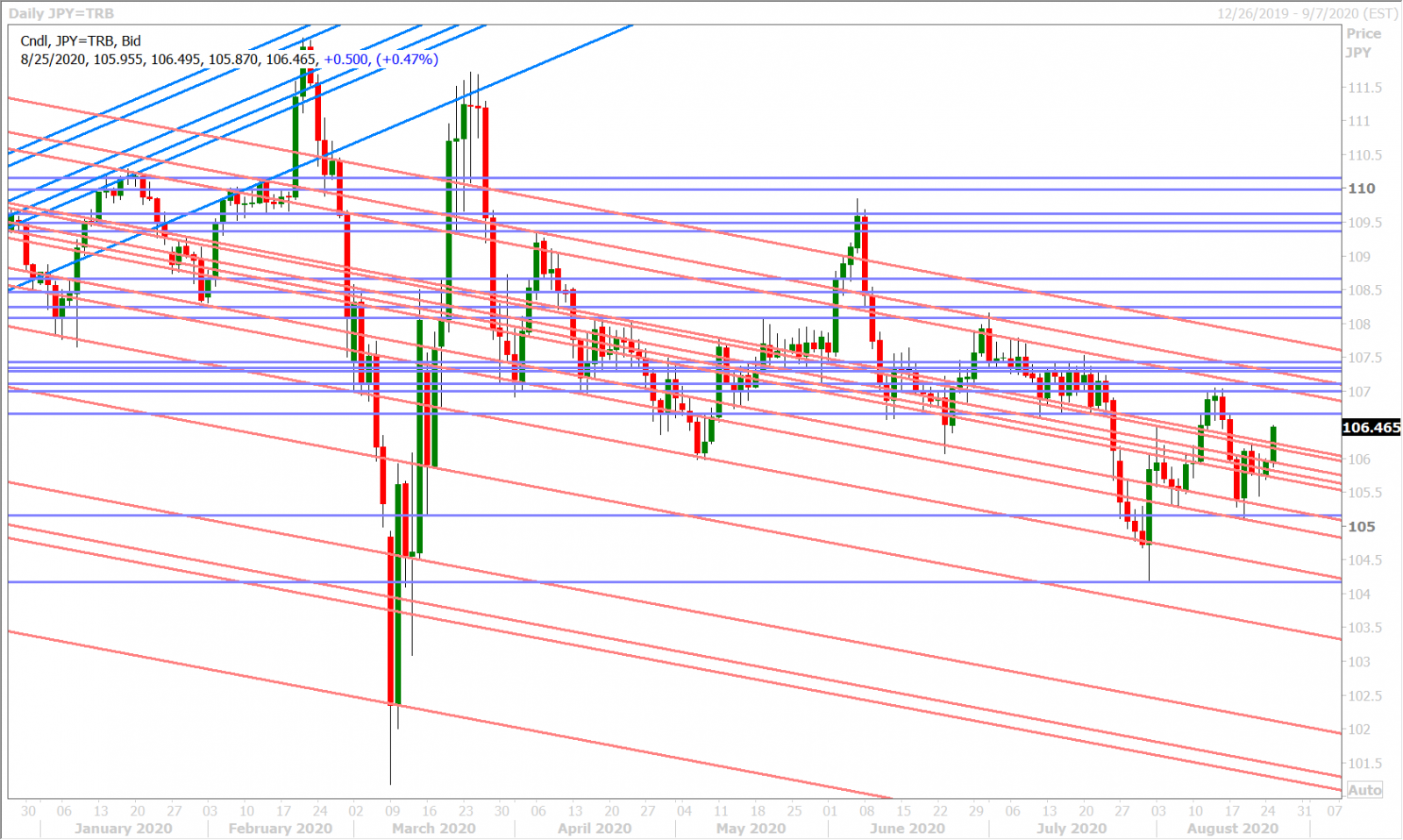

USDJPY

Dollar/yen rallied 50pts higher in Europe this morning on the back of strong selling in German bunds and US treasuries. It’s a bit hard to tell what’s driving this bond market sell-off (catchup to Asia’s risk-on or upcoming US auction supply?) but we’d note that this is only helping USDJPY right now and not the broader USD. We think the market’s move above 106.10-20 now gives it some upward momentum and we see the next major chart resistance level at the 106.60s. Tomorrow’s massive 105.00 option expiry now appears too far away to be influential.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com