US yields rise again ahead of more supply

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- US 10s trade back above 0.70% overnight ahead of $51bln 5yr auction.

- Yield rise seems to help USD in Europe. Correlation strong after US data.

- US Durable Goods for August beat expectations, +11.2% MoM vs +4.3%.

- Yields now fading into NY trade, WTI reverses higher, USD falling broadly.

- USD looking technically weak again against risk currencies GBP, AUD, CAD.

- Jerome Powell speaks at 9:10amET tomorrow morning at Jackson Hole.

ANALYSIS

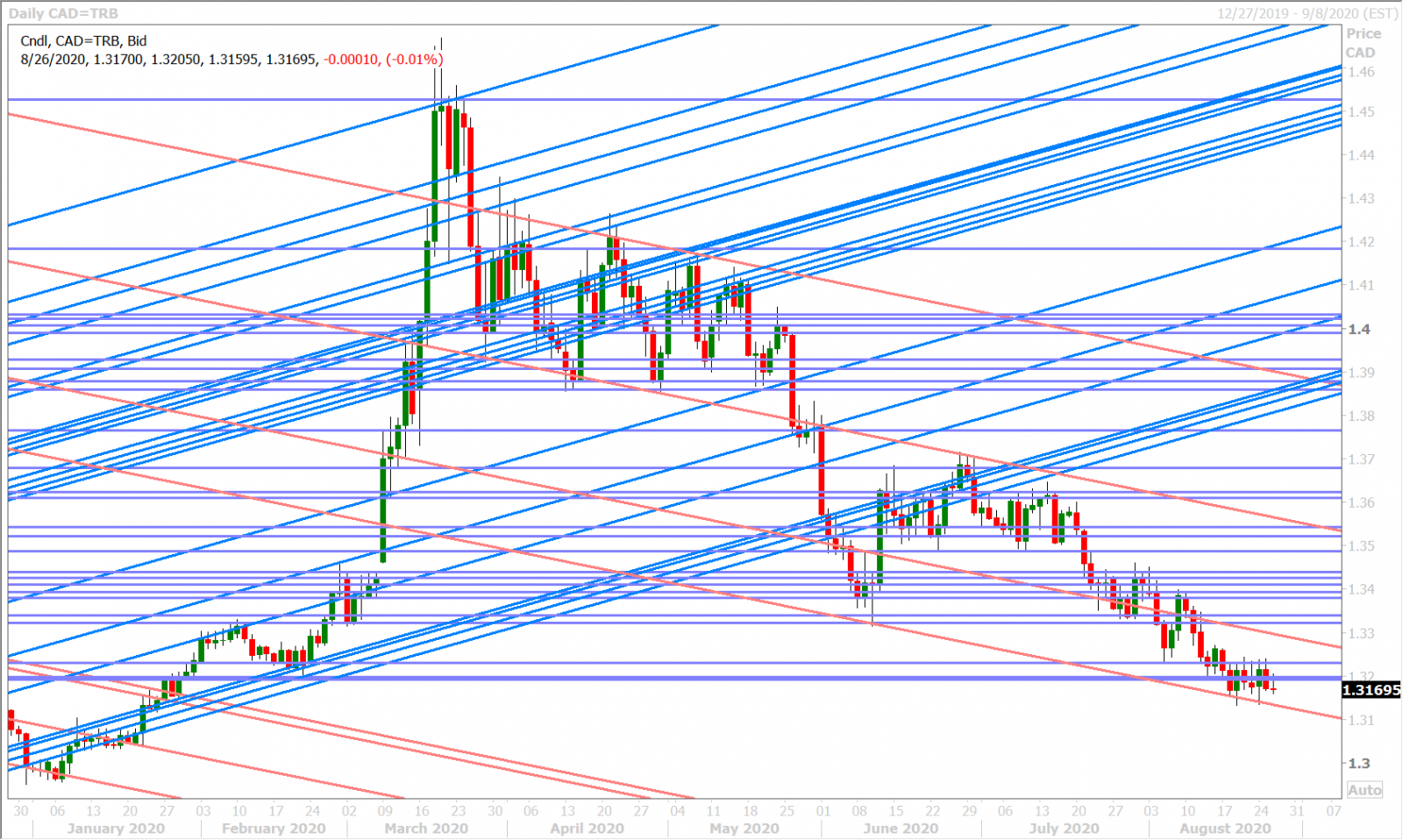

USDCAD

Yesterday’s NY session turned out to be rather dull affair for the broader USD after the NY options cut. We didn’t see any meaningful month-end USD sales into the London fix; US yields calmed down after a strong US 2yr auction; and the central bank speak from Barkin, Daly and Schembri was uneventful. If we had to focus on one thing, we’d note the S&Ps non-sensical ramp into the NY close and how it brought about some broad, albeit mild, USD selling.

A lower than expected USDCNY fix seemed to be the catalyst for USDCNH losing the 6.9000 support level last night in Asia, but the broader USD held up relatively well considering the lingering risk-on tone from the end of NY trade. Rising yields are in focus again this morning as the bond market seemingly braces for more US supply ($51bln in 5yr notes today) and, while we don’t want to read too much into what this means for the broader USD ahead Powell’s speech at Jackson Hole tomorrow, we’d note a close correlation between the two after the US reported much better than expected Durable Goods data for the month of July (+11.2% vs +4.3%).

Dollar/CAD is still struggling to regain the 1.3190-1.3200 level it lost early yesterday and we think this morning’s positive reversal in October WTI (perhaps on negative hurricane Laura developments?) is contributing to that.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

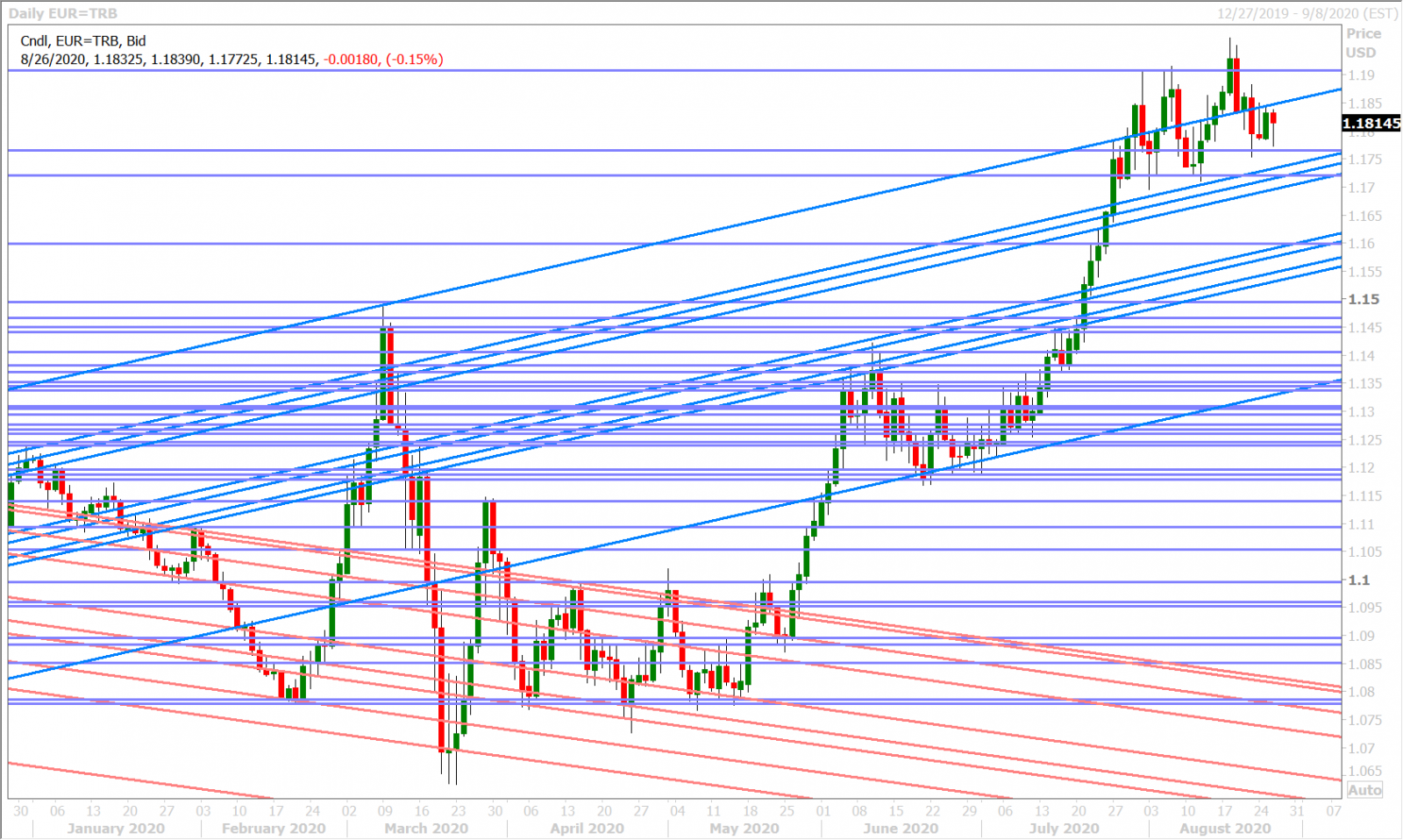

EURUSD

Euro/dollar has slumped back below the 1.18 handle this morning as the marketplace seems to be refocusing on rising US yields as a USD-positive, but like we said above, we don’t to read too much into this ahead of Jackson Hole. The broader risk mood is otherwise neutral today and we also have a large downside EURUSD option expiry at the 1.1750 strike for tomorrow, an event that could already be attracting some hedging flows.

EURUSD DAILY

EURUSD HOURLY

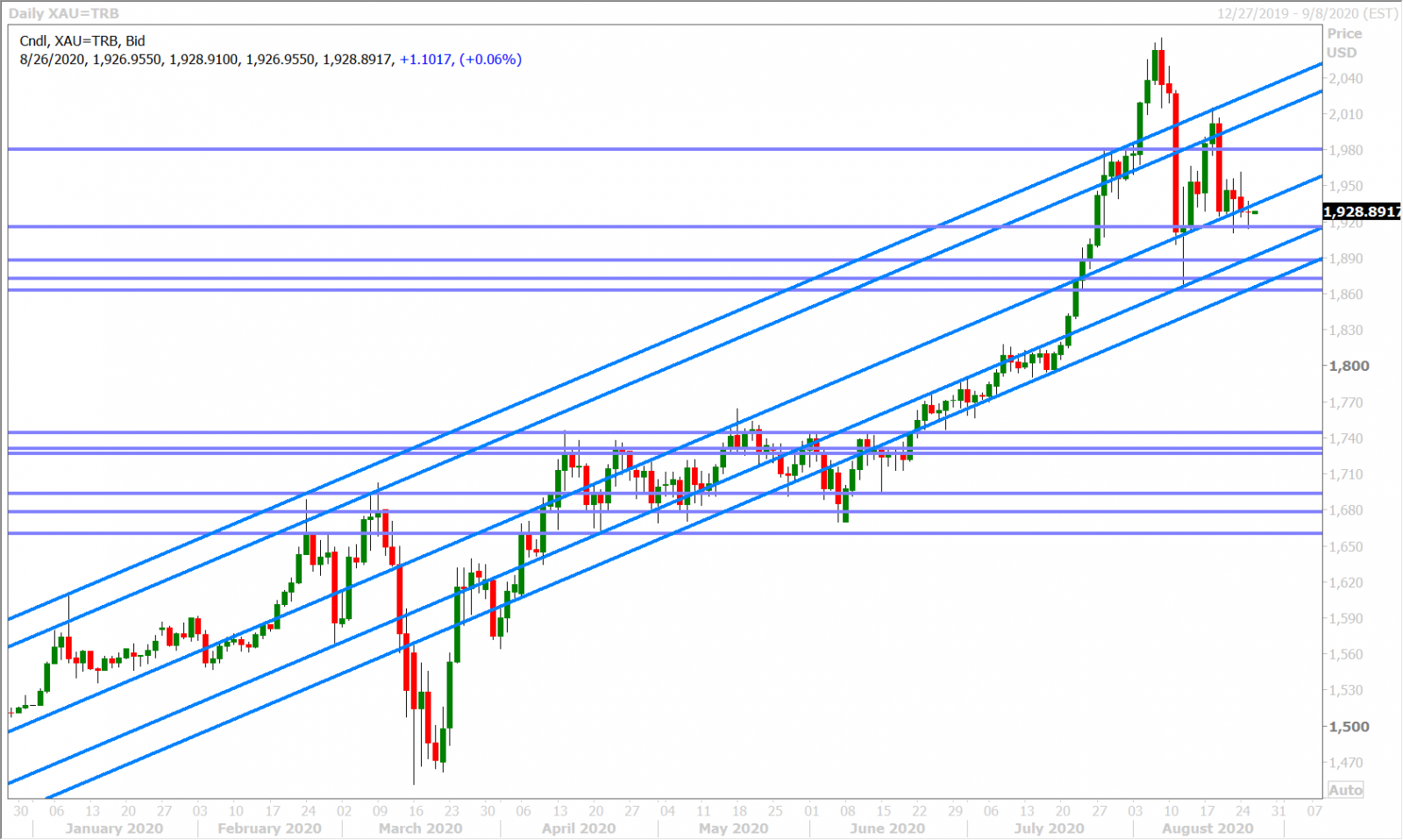

SPOT GOLD DAILY

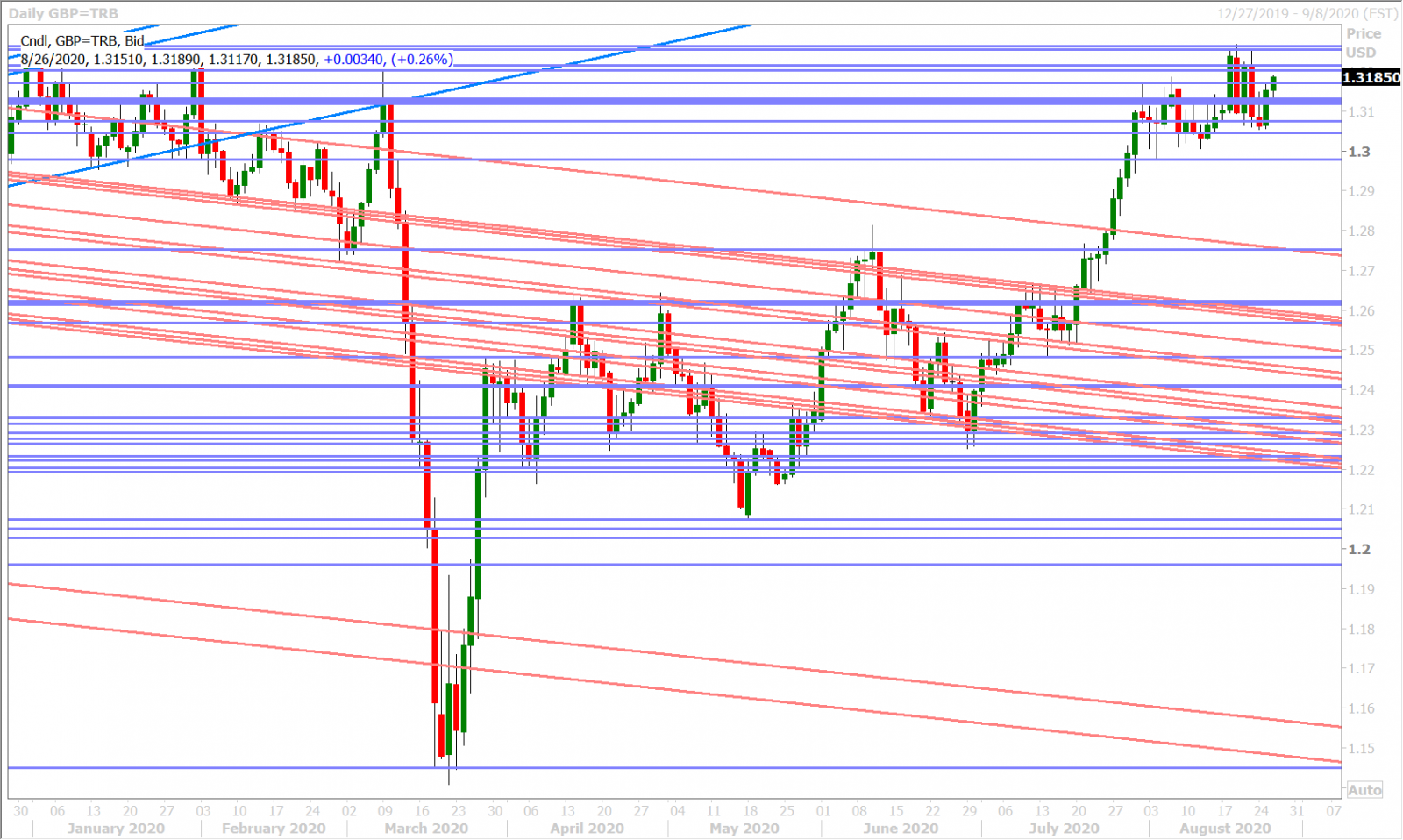

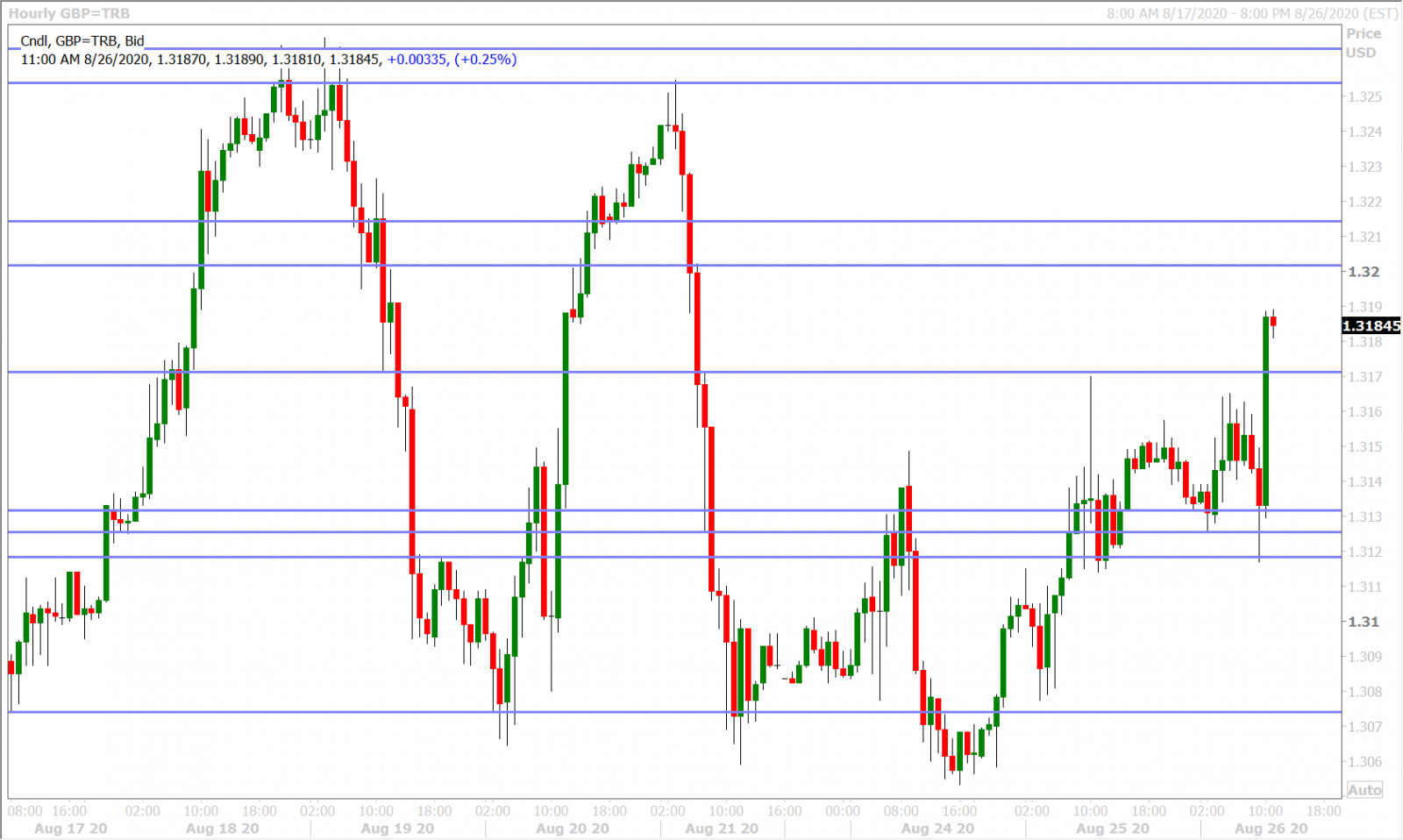

GBPUSD

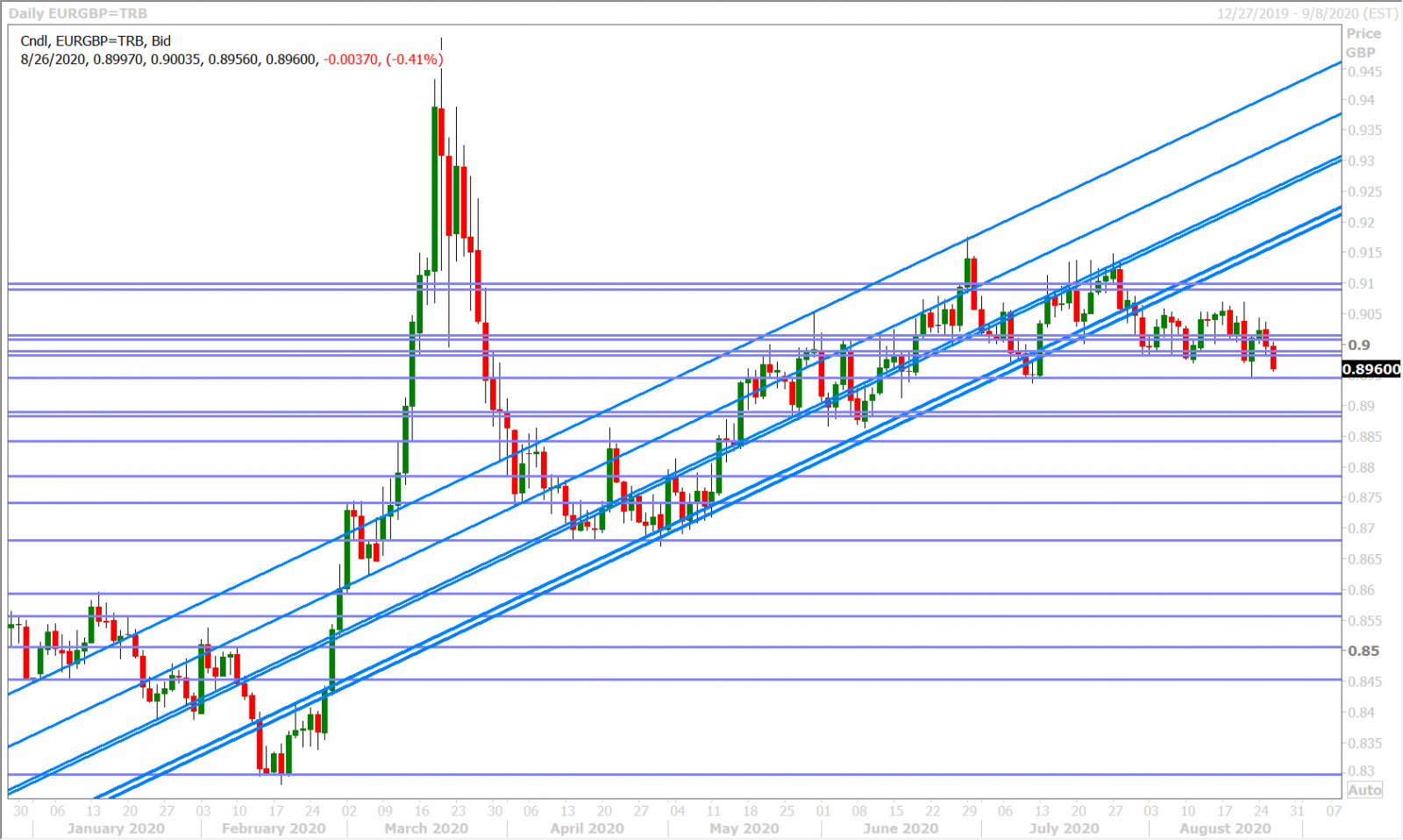

Sterling is outperforming the euro again this morning, but the strength appears largely technical in nature as GBPUSD buyers defend the 1.3120-30 level they broke the market back above yesterday and as EURGBP sellers give up the 0.8980s. This morning’s strong US Durable Goods number was a nervy moment for GBPUSD as the US 10yr yield up-ticked to 0.72%, but this bond market move has completely reversed, and then some…which has helped sterling roar back here.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

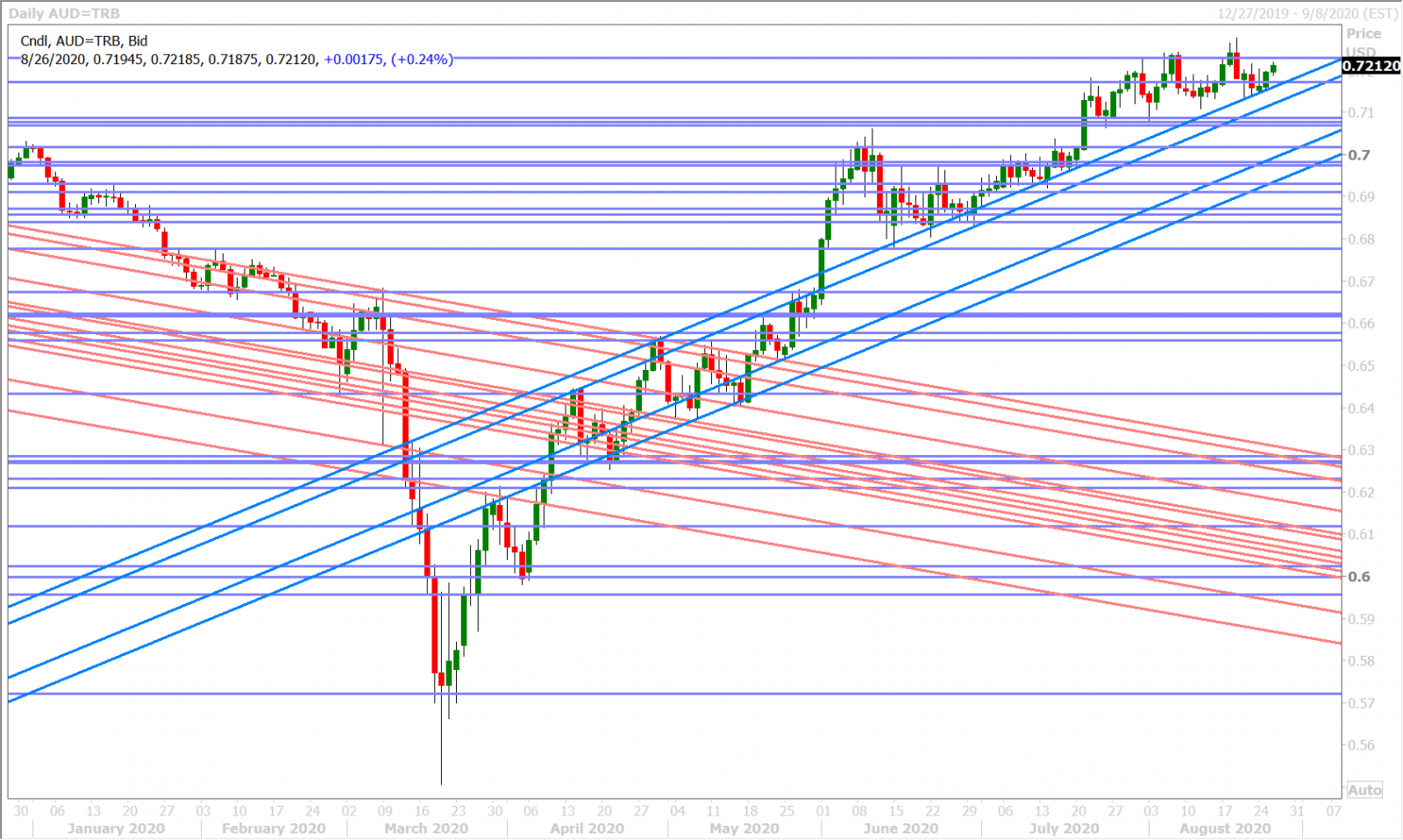

AUDUSD

The Aussie’s out-performance in Europe today was a little bit hard to explain amidst the USD buying we saw elsewhere, although we’d note a buoyant overall risk tone following yesterday’s US stock market close, a strong showing for September copper futures (+1%), new 7-month highs for the off-shore Chinese yuan, and talk that tomorrow’s Australian bill auctions could attract strong foreign demand yet again. We think AUDUSD could drift a little higher here if today's US 5yr auction goes well and US yields retreat off their session highs like they did yesterday.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

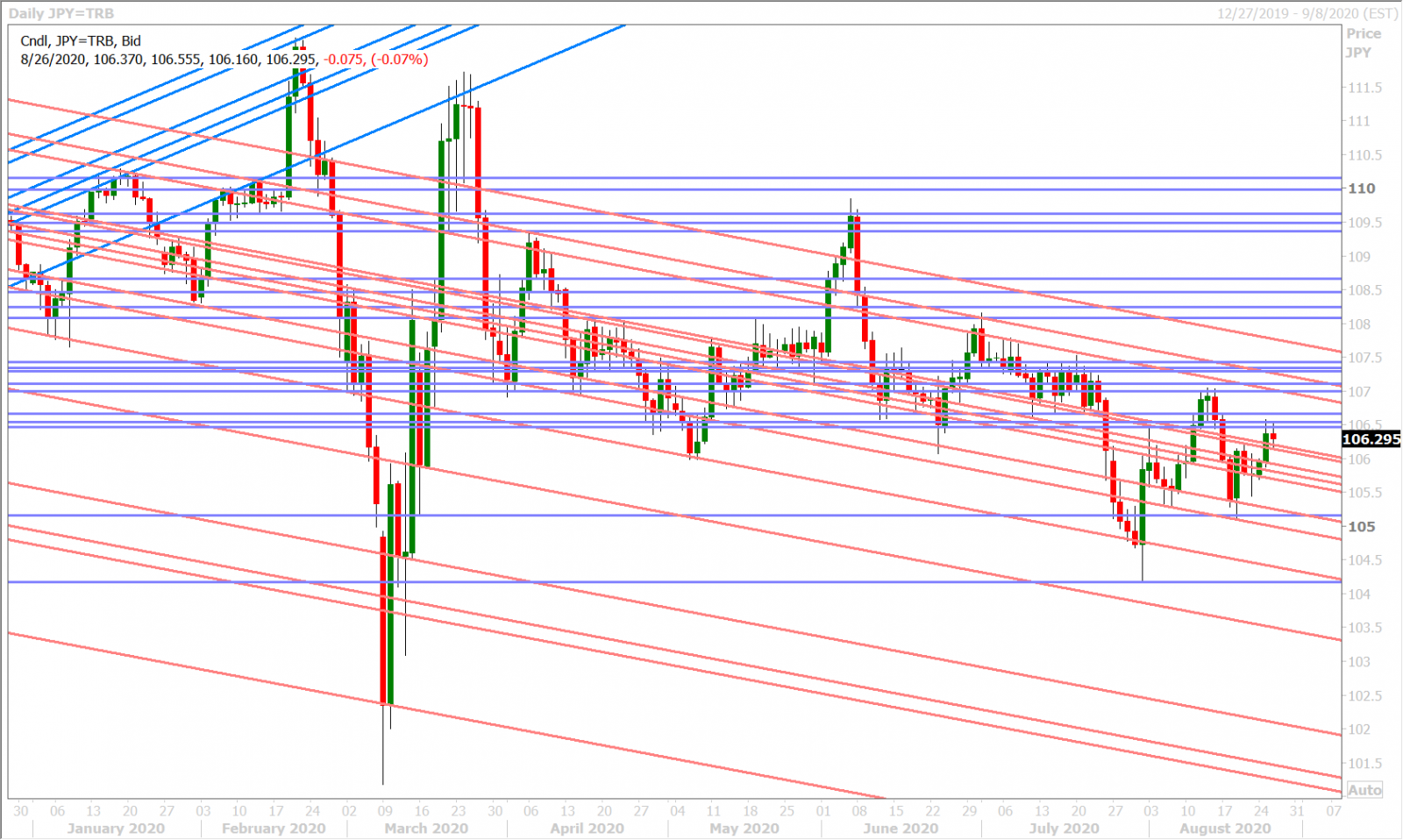

USDJPY

Dollar/yen lost its upward momentum in Asia last night after a lower than expected USDCNY fix saw traders reassert yesterday morning’s chart resistance in the 106.40-50s. This technical disappointment seemed to break the market’s correlation with US yields earlier this morning, but the market’s reaction post-US Durable Goods seems to have repaired that. Dollar/yen is now re-testing the 106.10-20 support level as the US 10yr yield pulls back over 2 basis points from its session highs.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com