Financial Times says ECB worried about rising Euro

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Article helps broader USD extend bounce into early European trade.

- Better European final Services PMIs for August help EURUSD recover.

- Final UK Services PMI for August misses expectations, GBP lagging.

- Weekly US Jobless Claims report beat consensus, +881k vs +950k.

- Resulting risk-on sees USD downtick, but S&P rally now looks tired.

- US Non-Manufacturing ISM (Aug) narrowly misses with mixed internals.

ANALYSIS

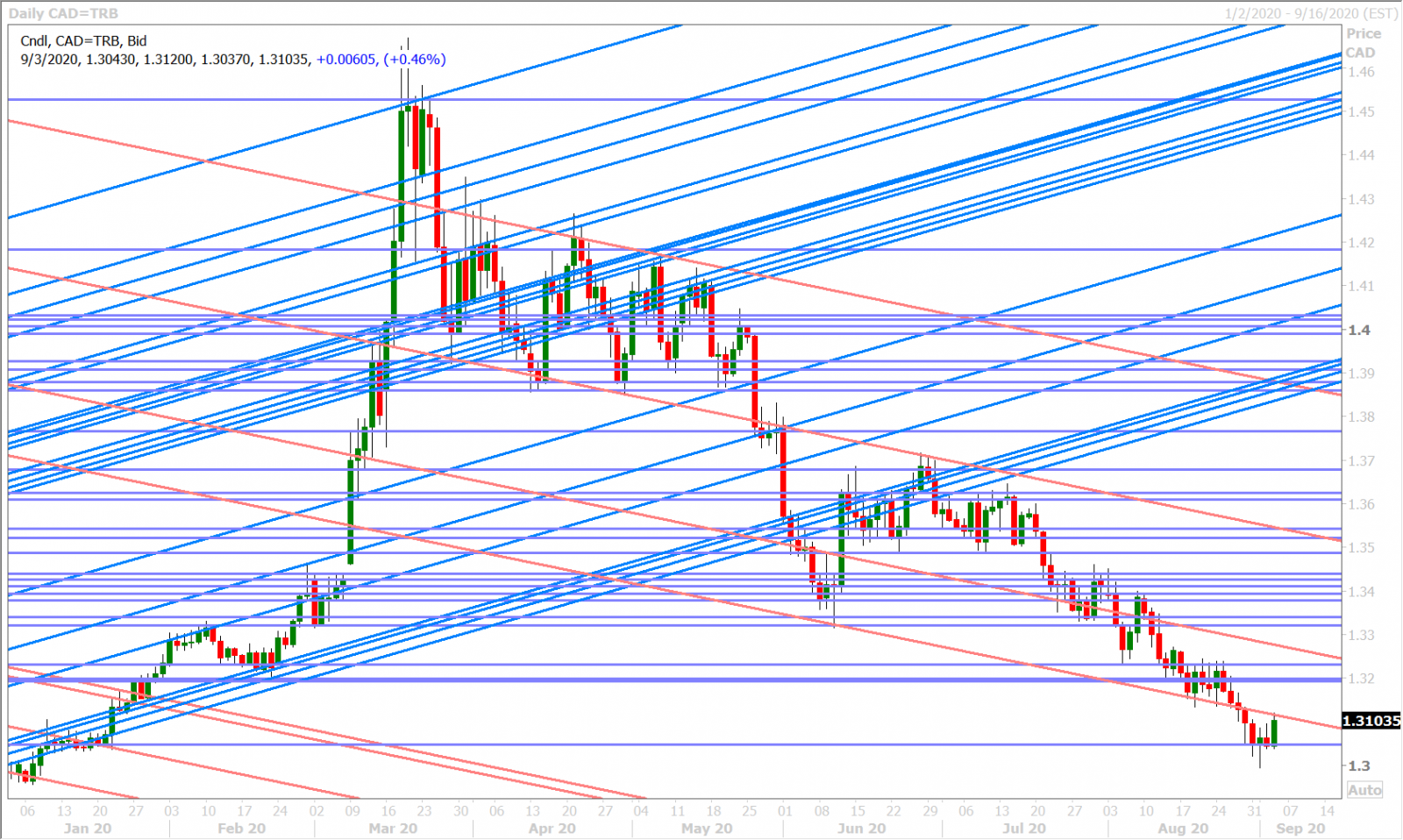

USDCAD

The bulk of yesterday’s NY session was frustratingly range-bound for the broader USD as the boat load of central bank speak turned out to be a whole lot of hot air. The Bank of England’s Ramsden, who delivered testimony to the UK’s Treasury Select Committee alongside Governor Bailey, said he’s comfortable with where inflation expectations are at the moment and the BOE’s Broadbent echoed this an hour later when he stated that there are no signs of inflation expectations drifting away from target. The Fed’s Williams said “how the new framework translates to actual monetary policy will depend on the circumstances”, although the Fed’s Mester reiterated Clarida’s preference for the increased usage of forward guidance and the balance sheet. Long story short, the Bank of England doesn’t appear in a rush to do anything new (as expected) and the Fed continues to be ambiguous/clueless as to what it’s going to do differently to generate the inflation it can’t ever seem to produce. The US Factory Orders report for July beat expectations (+6.4% MoM vs +6.0%) and the Fed’s Beige Book said that the overall outlook among its contacts was modestly optimistic, but these releases had a negligible impact on the USD as well. The only real directional move came towards the close when a CDC vaccine headline sparked another breathtaking ramp to all-time highs for the S&Ps and some mild, risk-on, dollar selling.

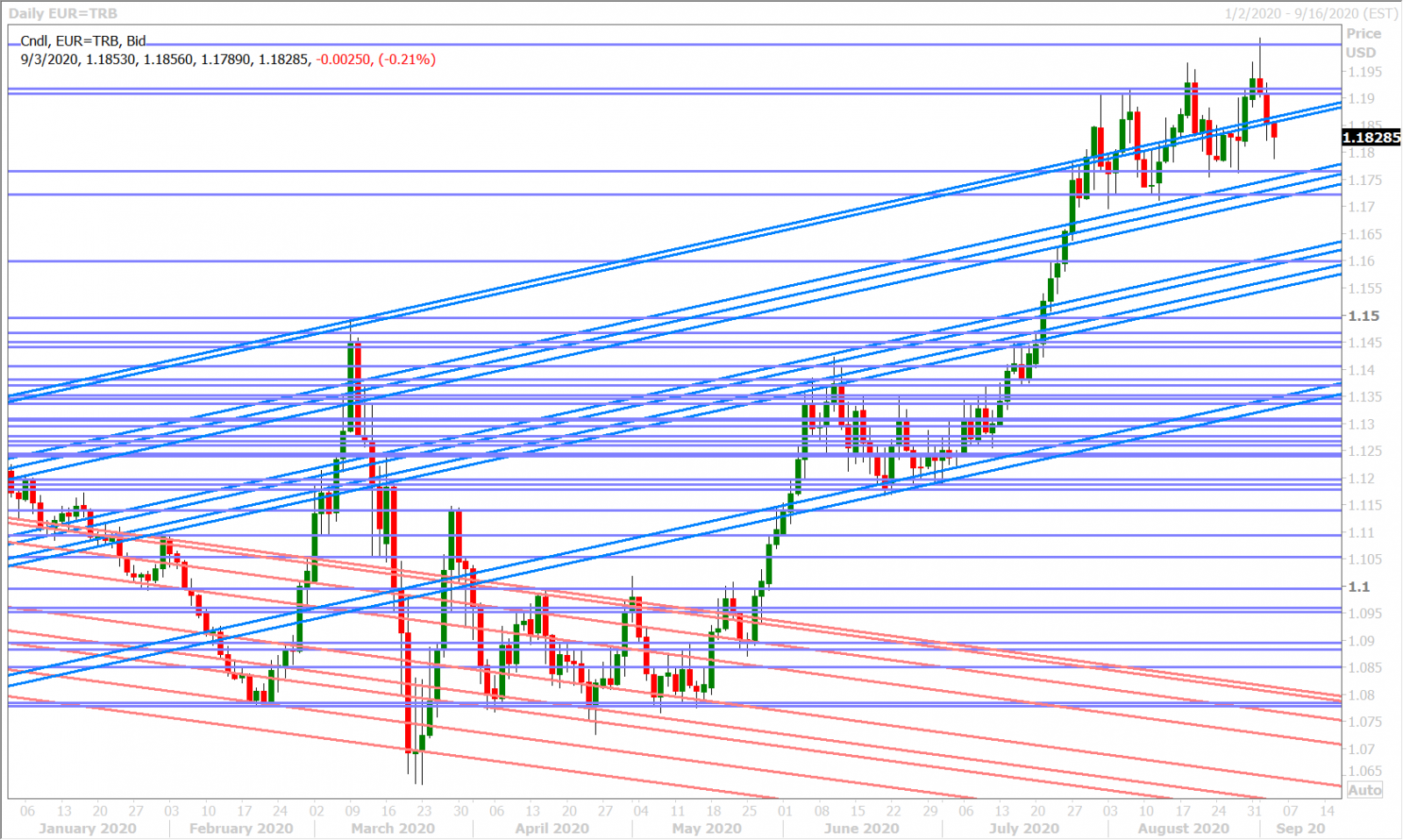

The Fed’s Daly seemed to help the USD reverse higher in early Asian trade when she expressed no pressing need to give further forward guidance on the rate path and this move picked up some steam into early European trade after the Financial Times released an article titled: Rising euro stokes ECB worries over falling prices. See here. This morning’s better than expected final August Services PMIs out of Europe and today’s 1.2BLN option expiry at 1.1825 has diverted the market’s attention, but the resulting EURUSD bounce has not seriously dented the broader dollar’s upward momentum since Asia.

Risk sentiment got a mild boost in early NY trade today after the US reported less new jobless claims than expected for the week ending August 29 (+881k vs +950k), and while this brought about some risk-on USD selling at chart resistance (1.3110s vs CAD, 0.7280s vs AUD, 106.50 vs JPY, and 1.3250s resistance vs GBP), the S&Ps look exhausted and are now trading at session lows (-1.3%)…which could help the dollar further if a stock market selloff ensues. The US Non-Manufacturing ISM report for August narrowly missed expectations (56.9 vs 57.0), and the internals were mixed (stronger prices but weaker orders/employment). We’ll hear from the Fed’s Bostic at 12pmET and the Fed’s Evans at 1pmET.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar is looking shaky today as two successive days of selling, producing poor NY closes, has damaged the market’s bullish chart structure somewhat. Yesterday’s move below the 1.1860s and last night’s failure to regain it was a bearish technical development going into European trade, but today’s Fed-speak could easily reverse the negative momentum. Huge option bets are also in play ahead of tomorrow’s August Non-Farm Payrolls report (3.1BLN at 1.1800 and 3.6BLN at 1.1900) and so we would get too excited about the downside just yet.

EURUSD DAILY

EURUSD HOURLY

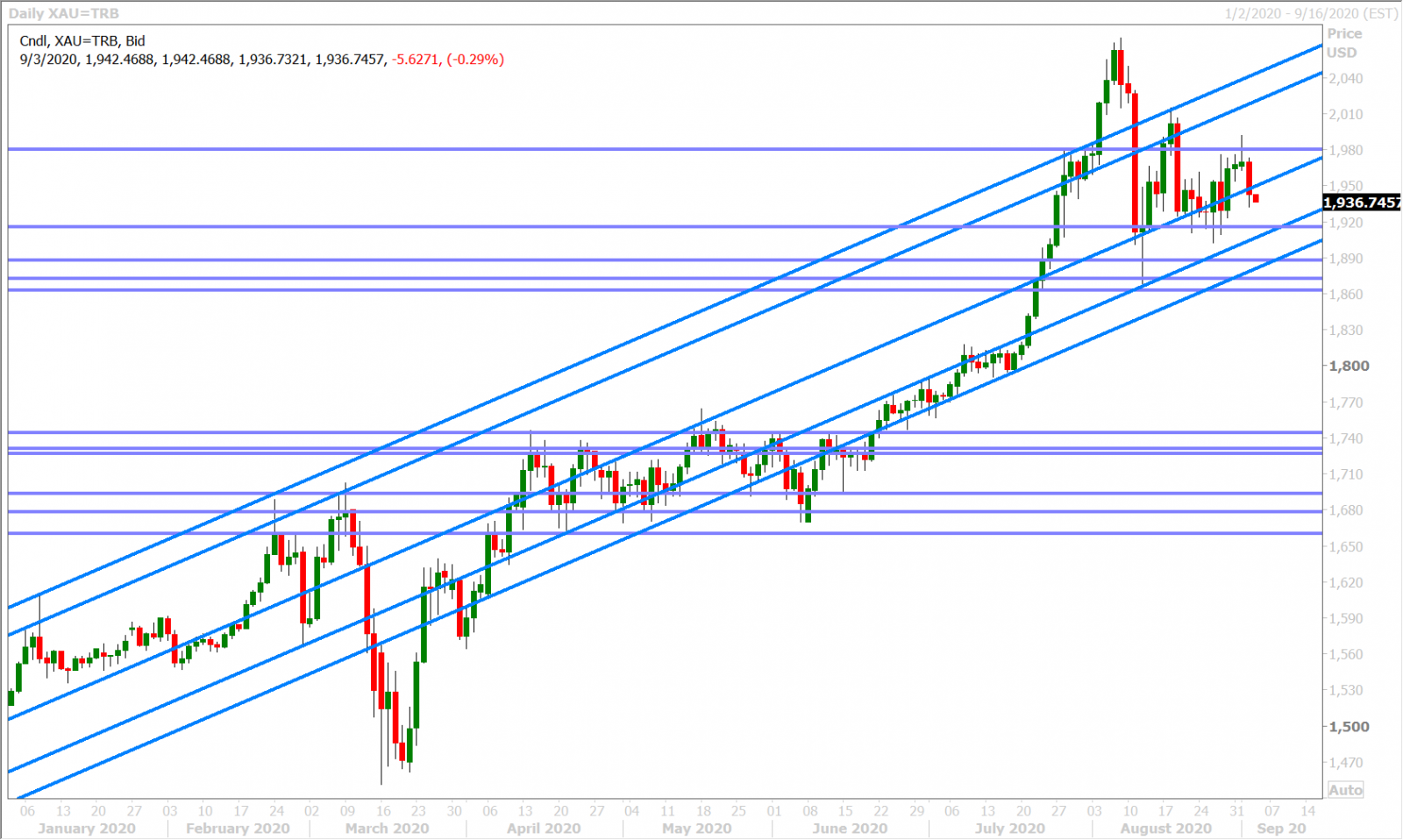

SPOT GOLD DAILY

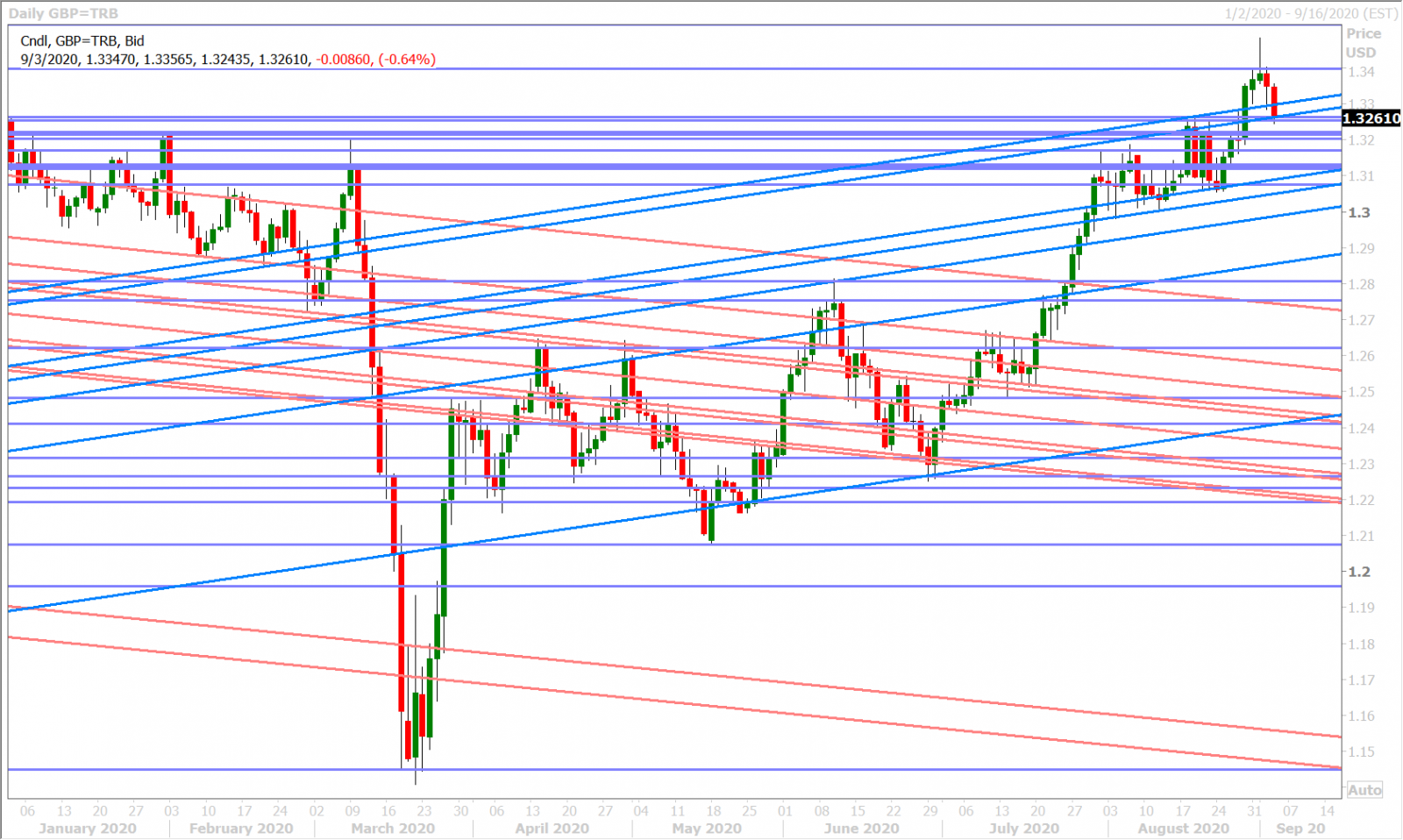

GBPUSD

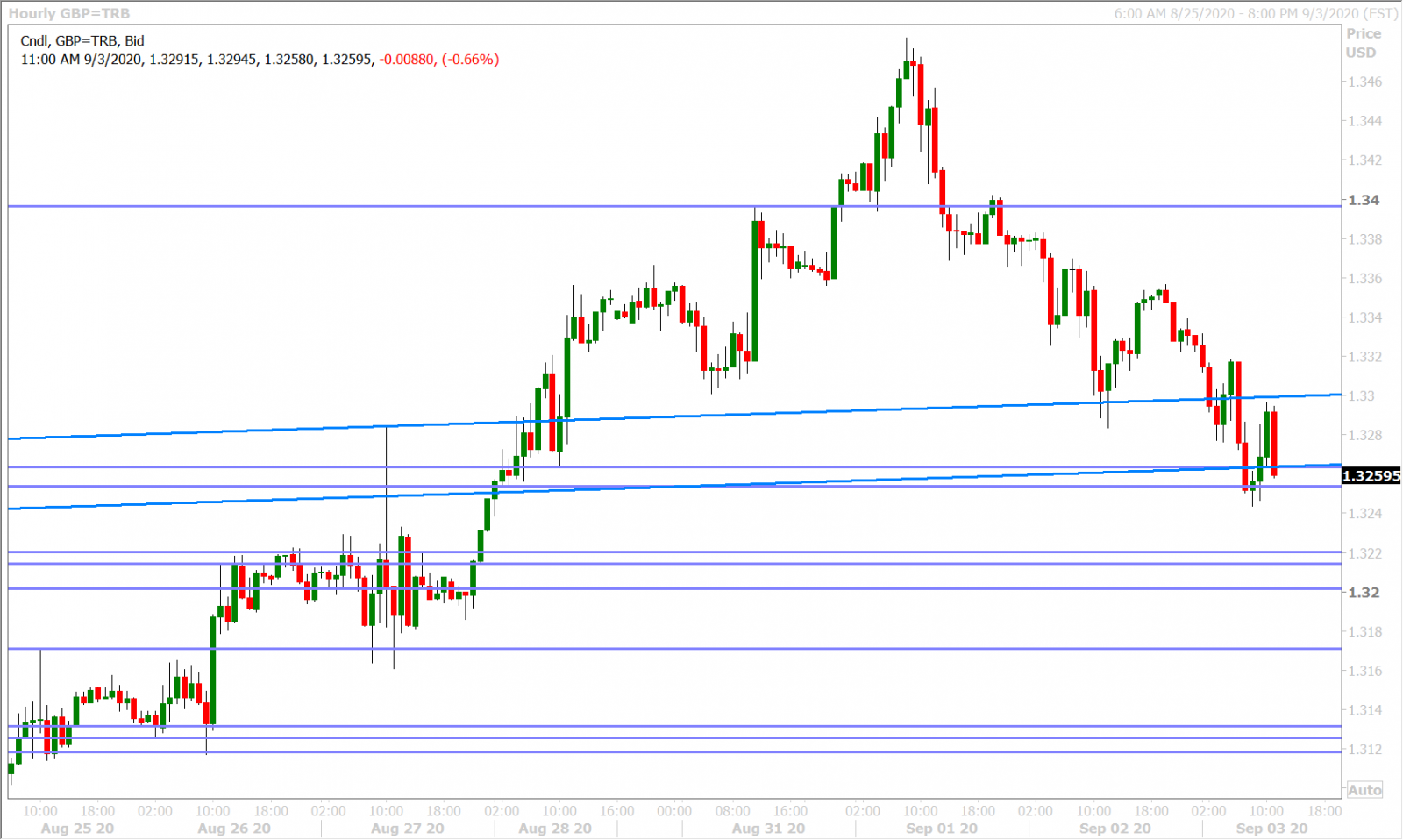

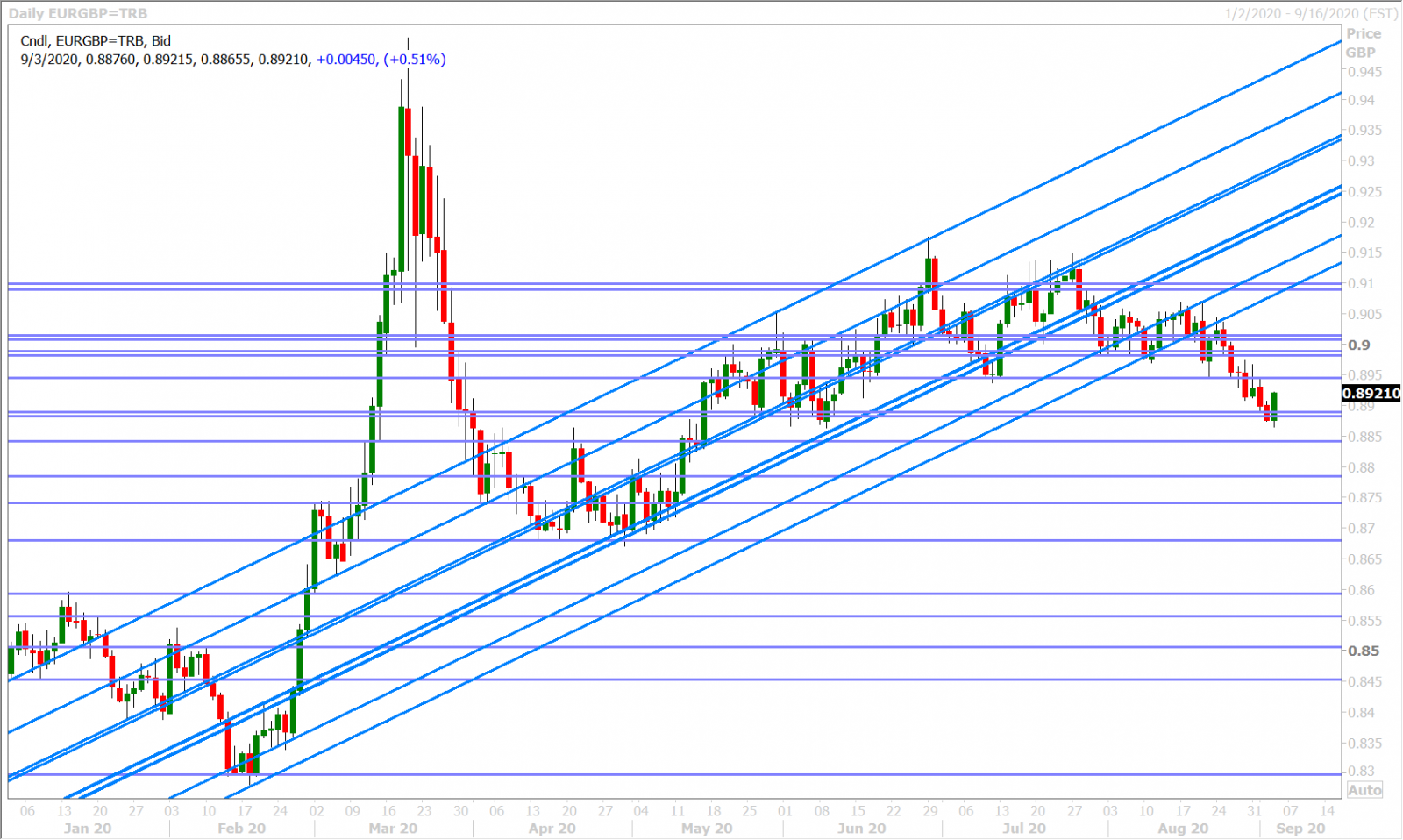

Sterling is under-performing today as the UK’s final August Services PMI actually missed expectations; in contrast to the rest of Europe’s. This brought about some strong EURGBP buying earlier this morning, with the cross now regaining the 0.8880s support level it lost yesterday, and we saw GBPUSD lose the 1.33 handle as a result. Risk-on flows following this morning’s better than expected US Jobless Claims data helped sterling/dollar bounce off the 1.3250s, but these have now evaporated following the US Non-Manufacturing ISM report. The BOE’s Bailey and Ramsden are speaking again now, but at separate events.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

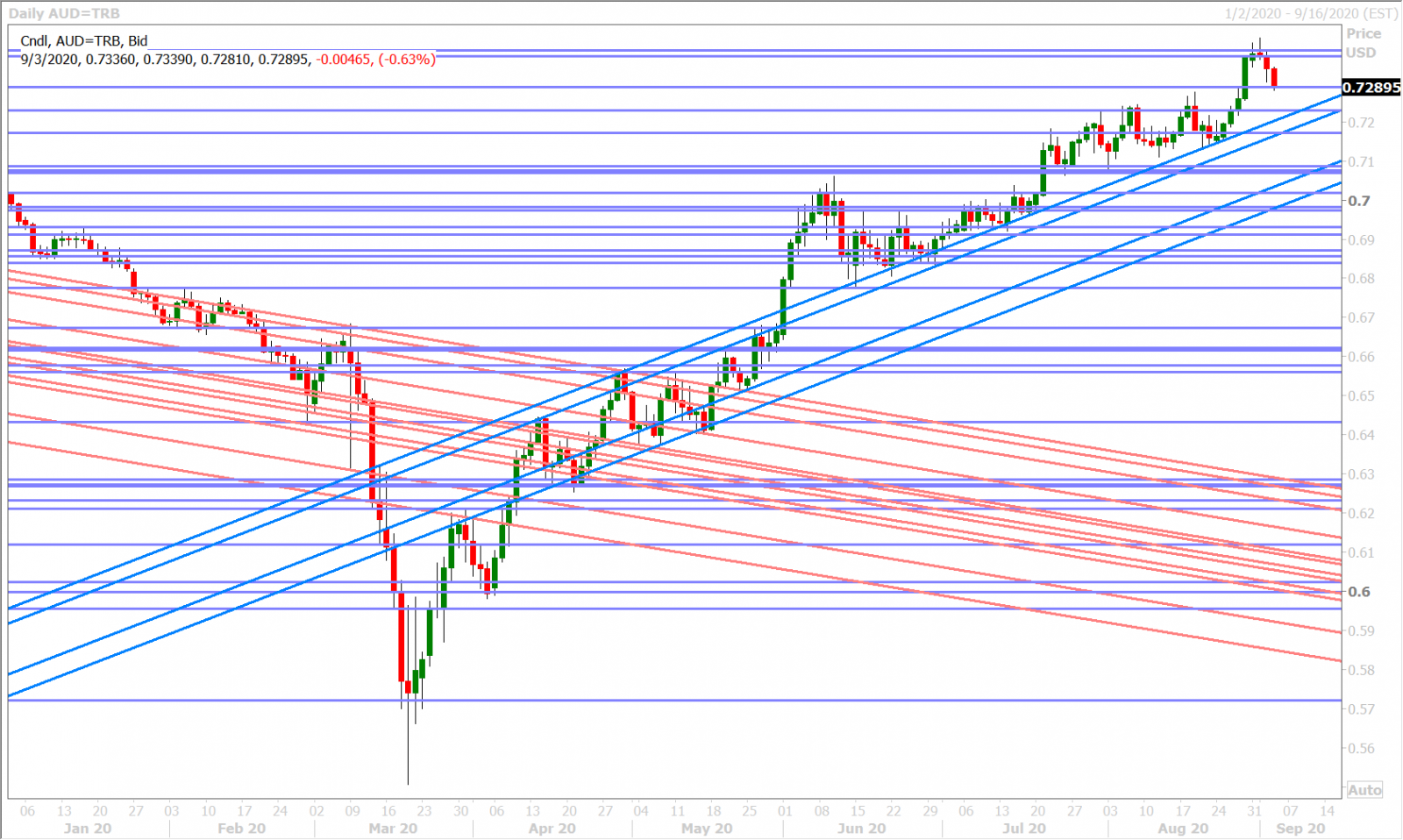

AUDUSD

The Australian dollar bounced off the 0.7280s support level as NY trade got underway today. There were some good vibes following the better US Jobless Claims report, but the S&P rally is looking really tired here and we don’t think this morning’s mixed Non-Manufacturing ISM report is going to help liven things up. We wonder if some plain-old profit taking is now in store for the stock market…and that should hurt the Aussie if it happens.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

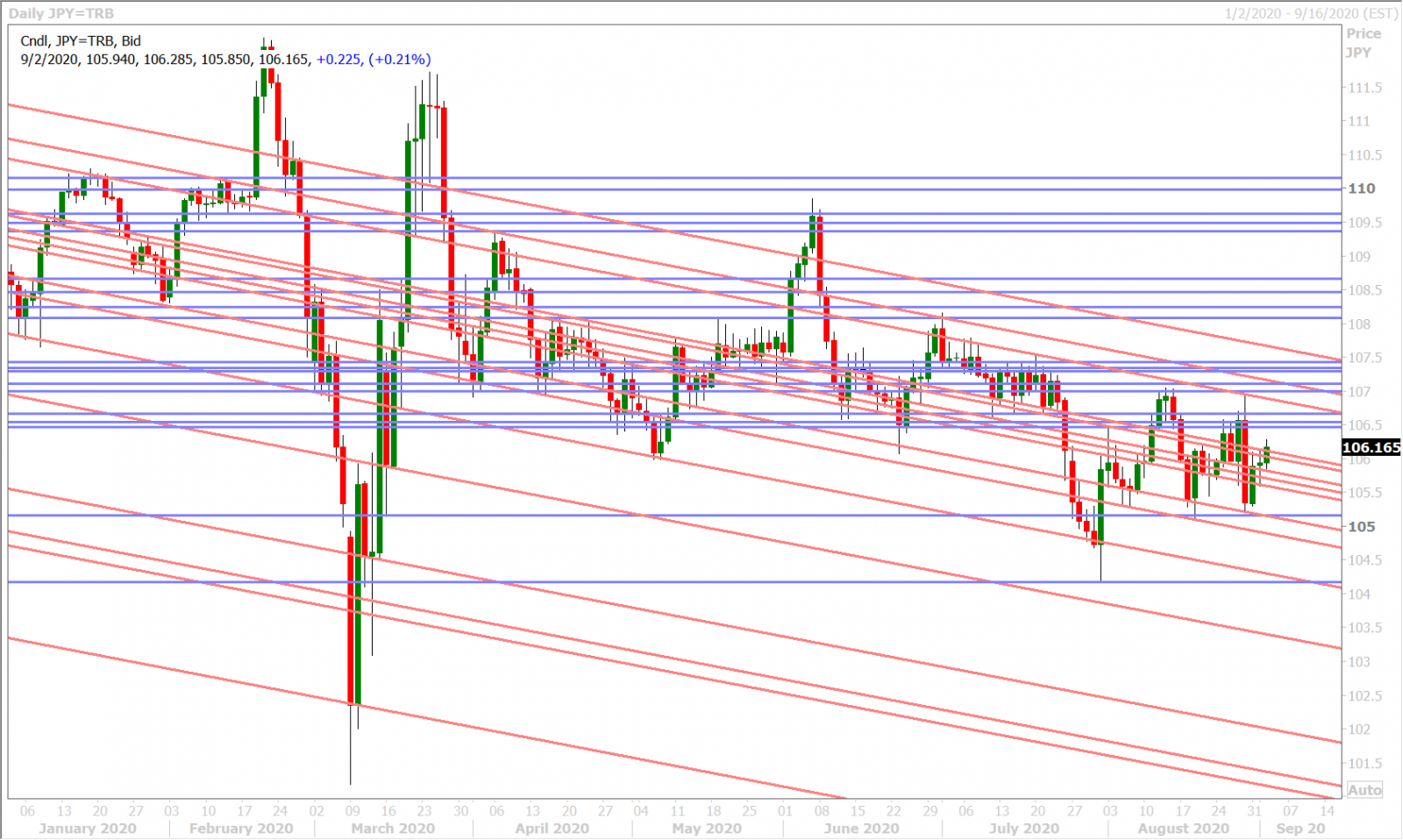

Dollar/yen continued to trade higher with the broader USD overnight and we believe that this morning’s 900M 106.50 option expiry had a magnetizing effect to some degree. The market pulled back off 106.50s resistance following the better US Jobless Claims number and it seems to have stabilized now following the mixed Non-Manufacturing ISM report. Over 3.5BLN in options will be expiring between the 106.50 and 106.75 strikes tomorrow…just 90 minutes after the Non-Farm Payrolls report is released at 8:30amET.

USDJPY DAILY

USDJPY HOURLY

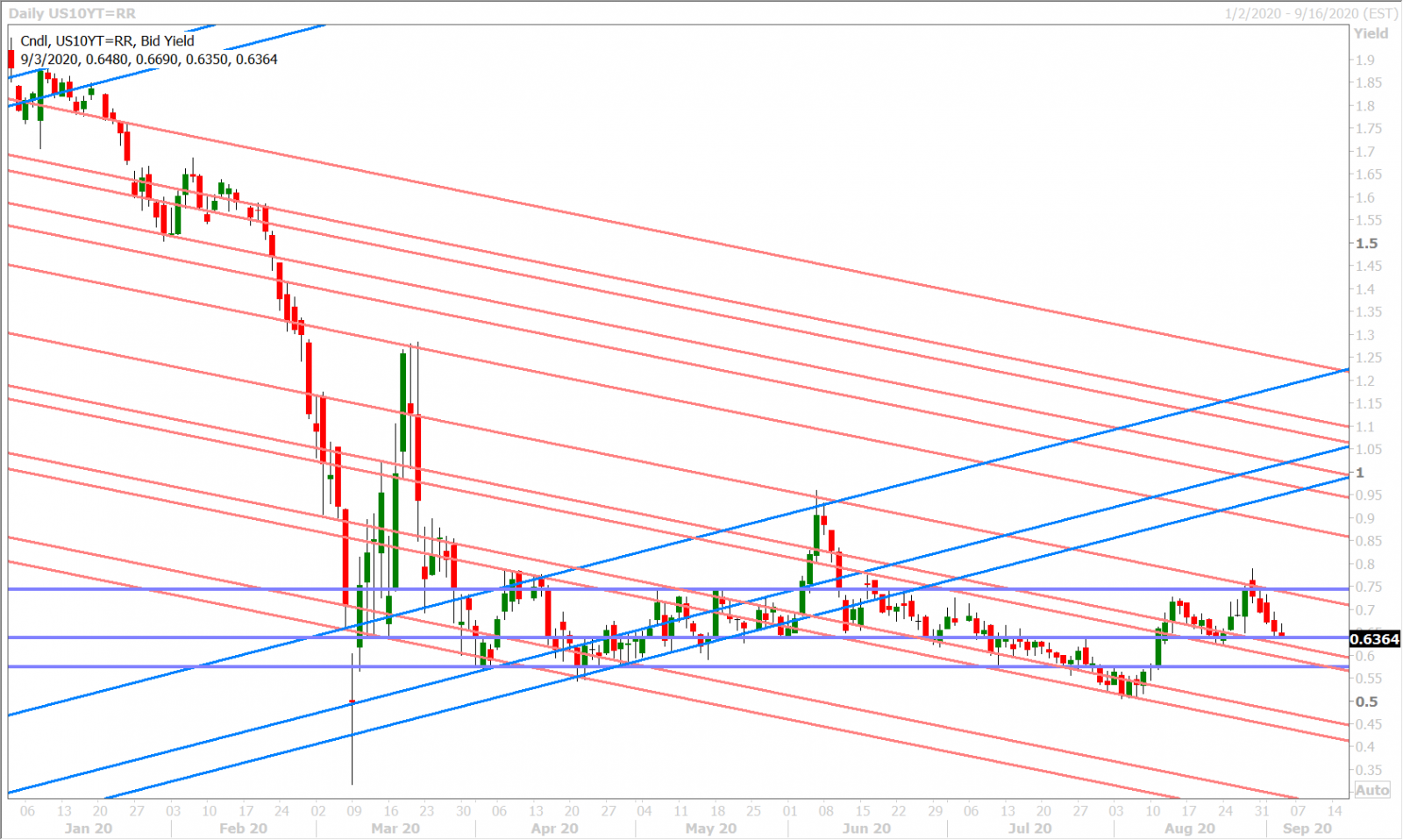

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com