Risk mood buoyant on more vaccine headlines

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Pfizer & BioNTech receive fast-track FDA approval for two vaccine trials.

- Large EURUSD option expiries could support market again this week.

- Three central bank meetings on deck: BOJ, BOC and ECB + EU Summit.

- USDJPY trading higher with yields after Friday “blow-off” top in bonds.

- USD still in downtrends against CAD and AUD, but momentum lacking.

- Sterling lagging but no notably negative Brexit headlines this morning.

ANALYSIS

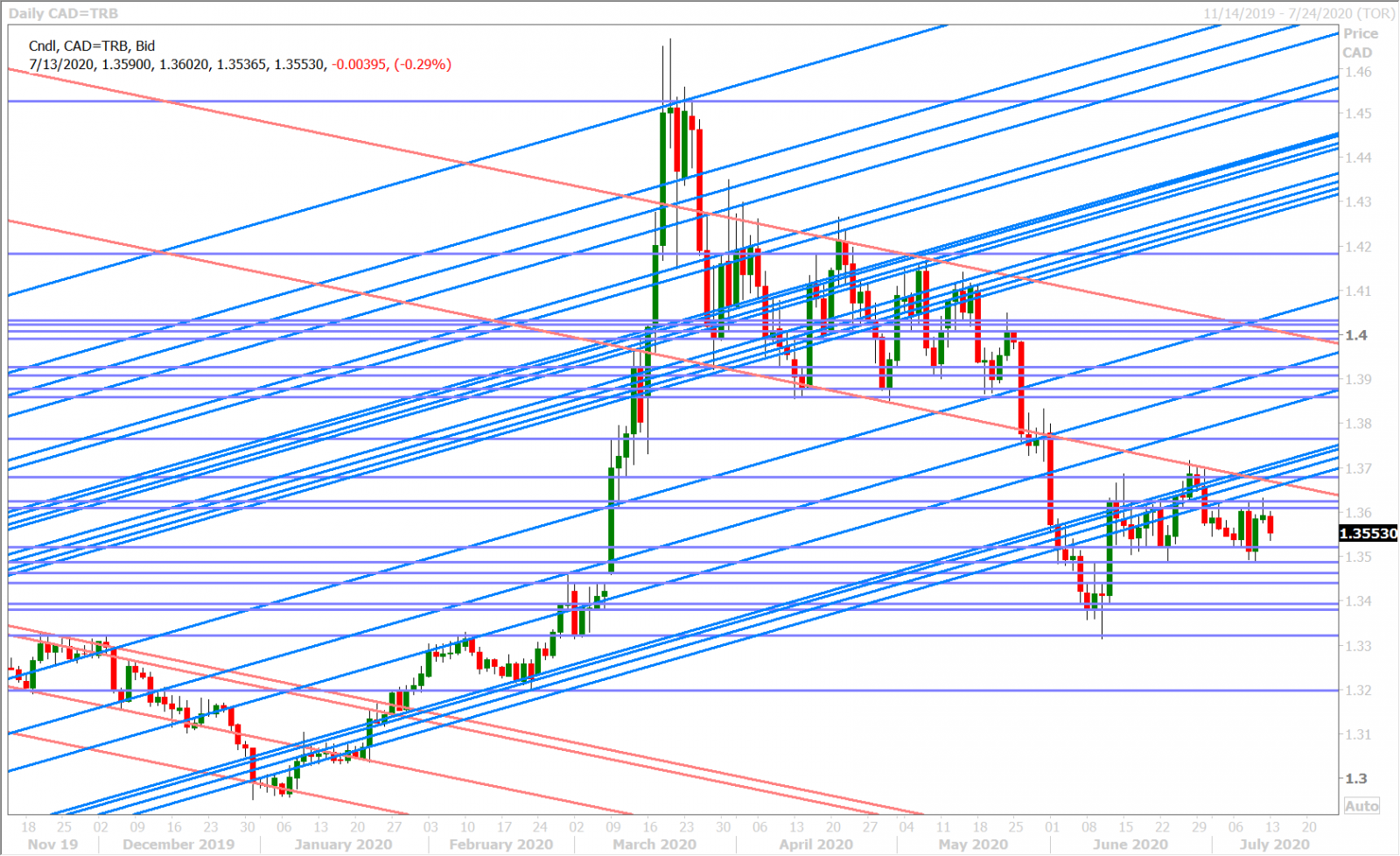

USDCAD

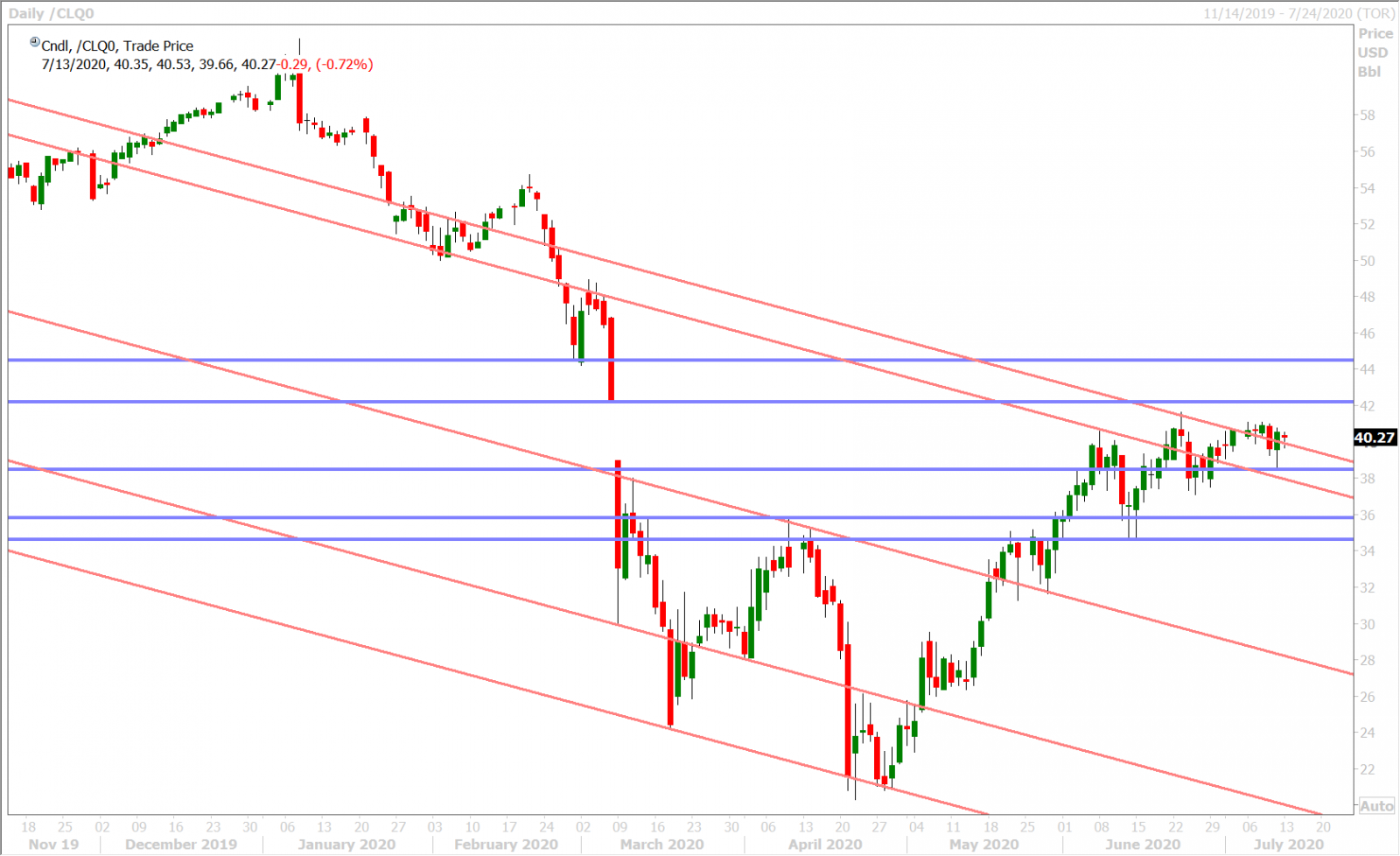

The USD started the week lower last night as Asian markets played catchup to Friday’s Remdesivir rally on Wall Street. The weekend COVID updates out of Florida were discouraging once again (new one-day record of 15k new cases) but this negativity has been tempered back after both Pfizer and BioNTech received fast-track FDA approval to proceed with two vaccine trials. August WTI oil prices are lagging today (-1.4%) on chatter that this week’s JMMC meeting will recommend an easing of current OPEC+ production cuts. Dollar/CAD is trying to steady in the mid-1.35s this morning but broad USD selling, which continues after the NY open, is making that difficult.

This week’s North American calendar features a bunch of US economic figures from June (CPI, Industrial Production, Retail Sales, Housing Starts), some fresh US sentiment data for July (Philly Fed, University of Michigan), the Bank of Canada’s latest monetary policy meeting (no changes expected), and perhaps most importantly the start of the Q3 corporate earnings season in the US. We think there’s a good chance that earnings-driven equity market volatility could influence FX volatility, especially if we see positive surprises to the lowered expectations going into many of these quarterly reports.

The latest Commitment of Traders (COT) report released by the CFTC showed the leveraged funds adding new short USDCAD positions for the fourth week in a row during the week ending July 7; which had the net effect of reducing their net long USDCAD position down to now roughly half of what it was in early May. Dollar/CAD is still trading in a downtrend by virtue of prices remaining below the 1.37 handle, but the strength of the Powell-induced short term bottom of June 10-11 has derailed the market’s downward momentum somewhat. We think the bears can more forcibly assert themselves with a NY close below the 1.3480-90s.

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

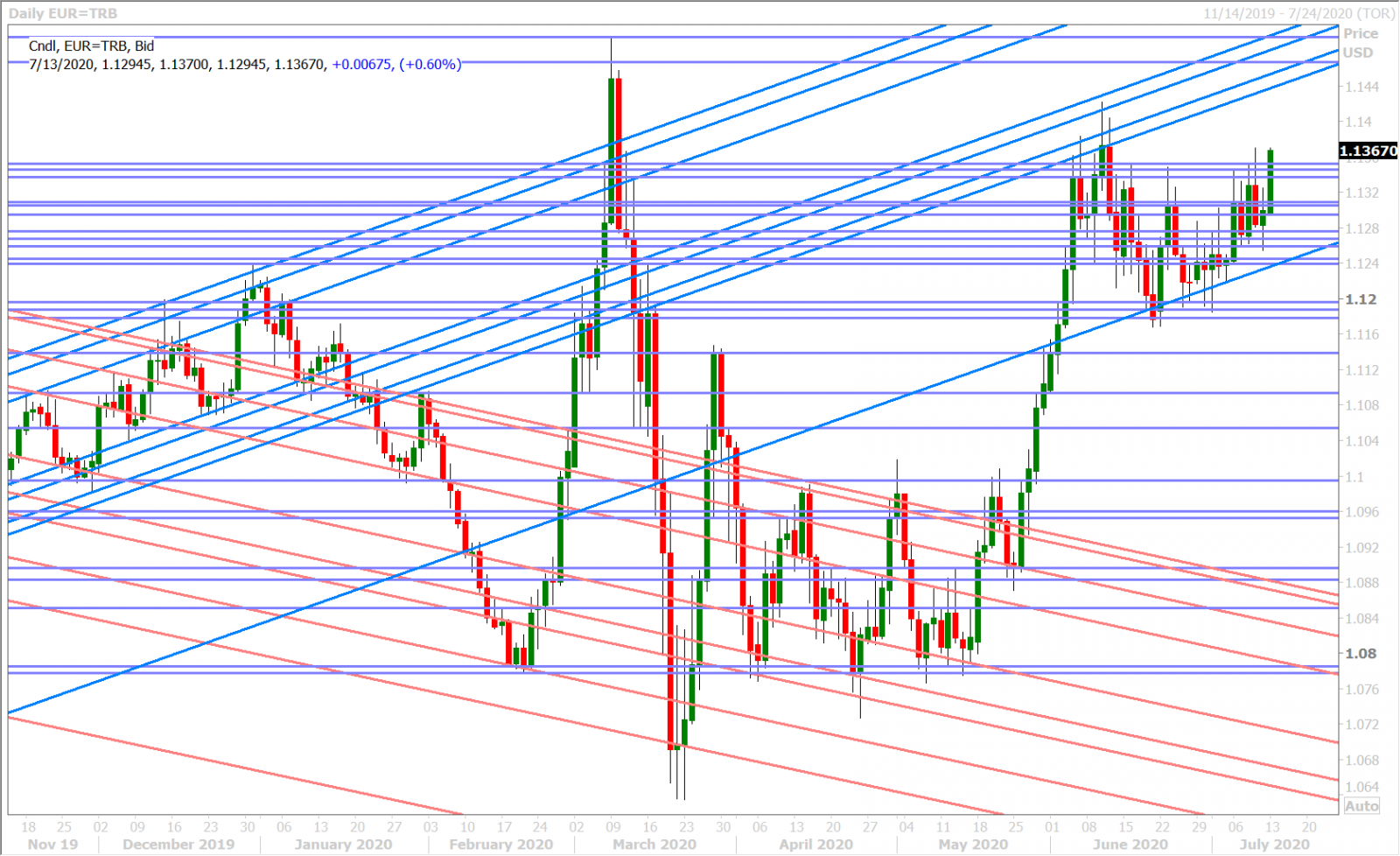

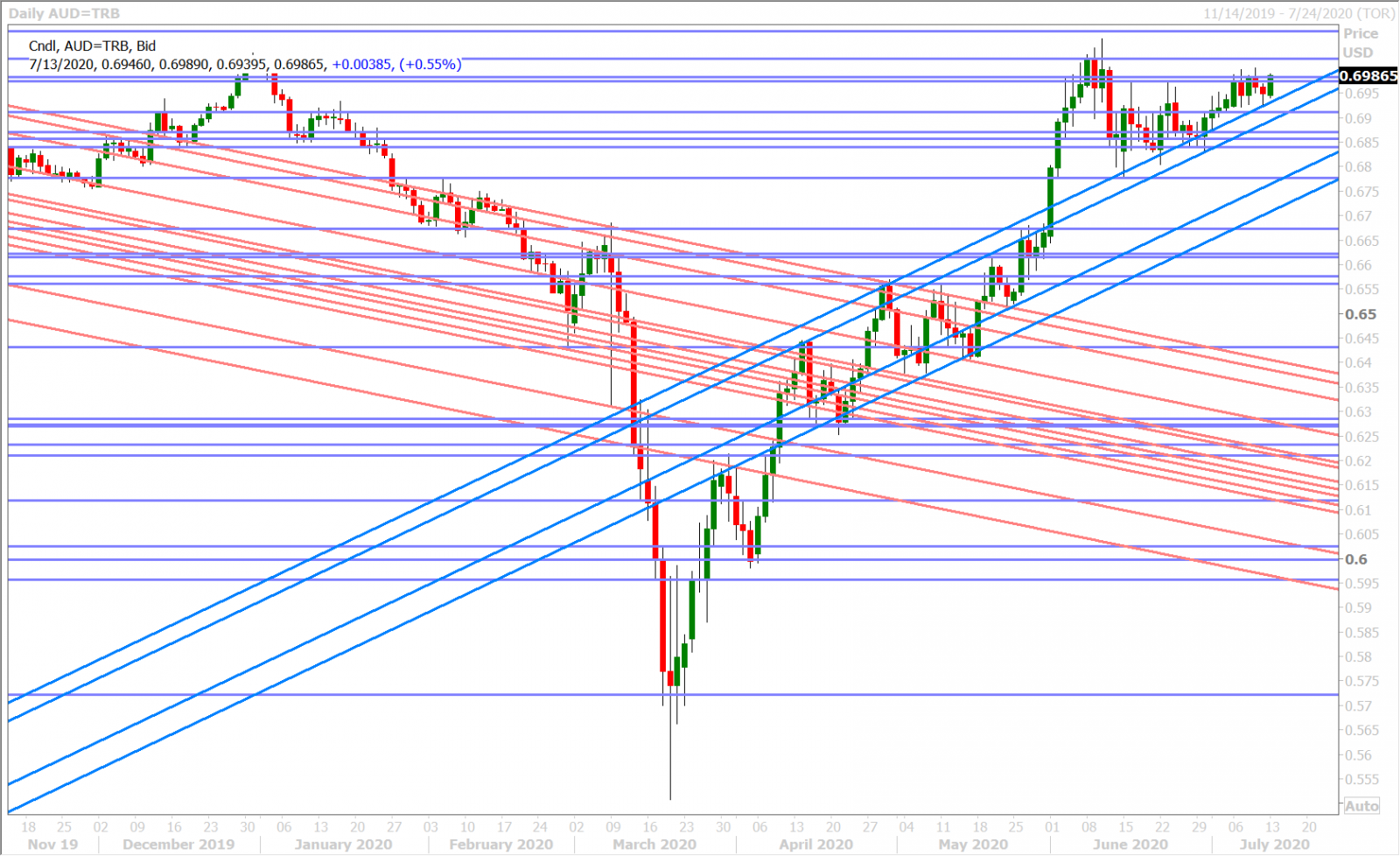

EURUSD

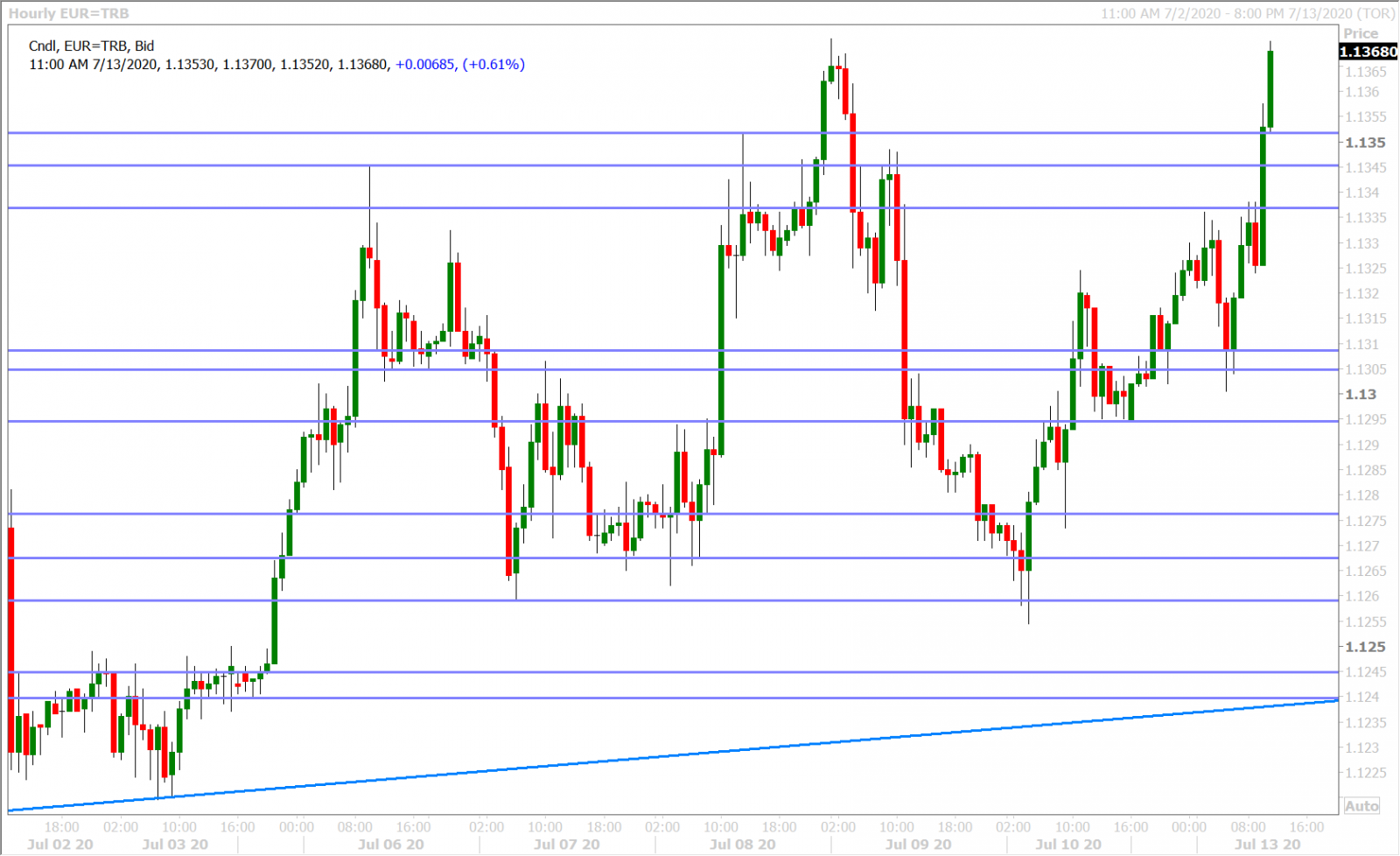

Euro/dollar is trading back above the 1.1300 mark to start the week as broad market risk sentiment maintains its buoyancy from Friday’s session. While this week’s ECB meeting (Thursday) and EU Summit (Friday) are the obvious features on the European calendar, not much is expected from either event and so we think the sheer amount of option expiries could prove more influential in terms of the road map for spot EURUSD prices (much like it did last week). Over 5blnEUR worth of options will go off the board at 1.1300-1.1325 tomorrow; over 2blnEUR on Wednesday between 1.1350 and 1.1400, and another 4blnEUR at 1.1325-1.1400 for Thursday.

Germany reports its July ZEW sentiment survey tomorrow at 5amET, with traders expecting a read of 60.0 versus 63.4 in June. The leveraged funds added marginally to their net long EURUSD position during the week ending July 7; which correlates well with the market’s recent interest in topside option strikes.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

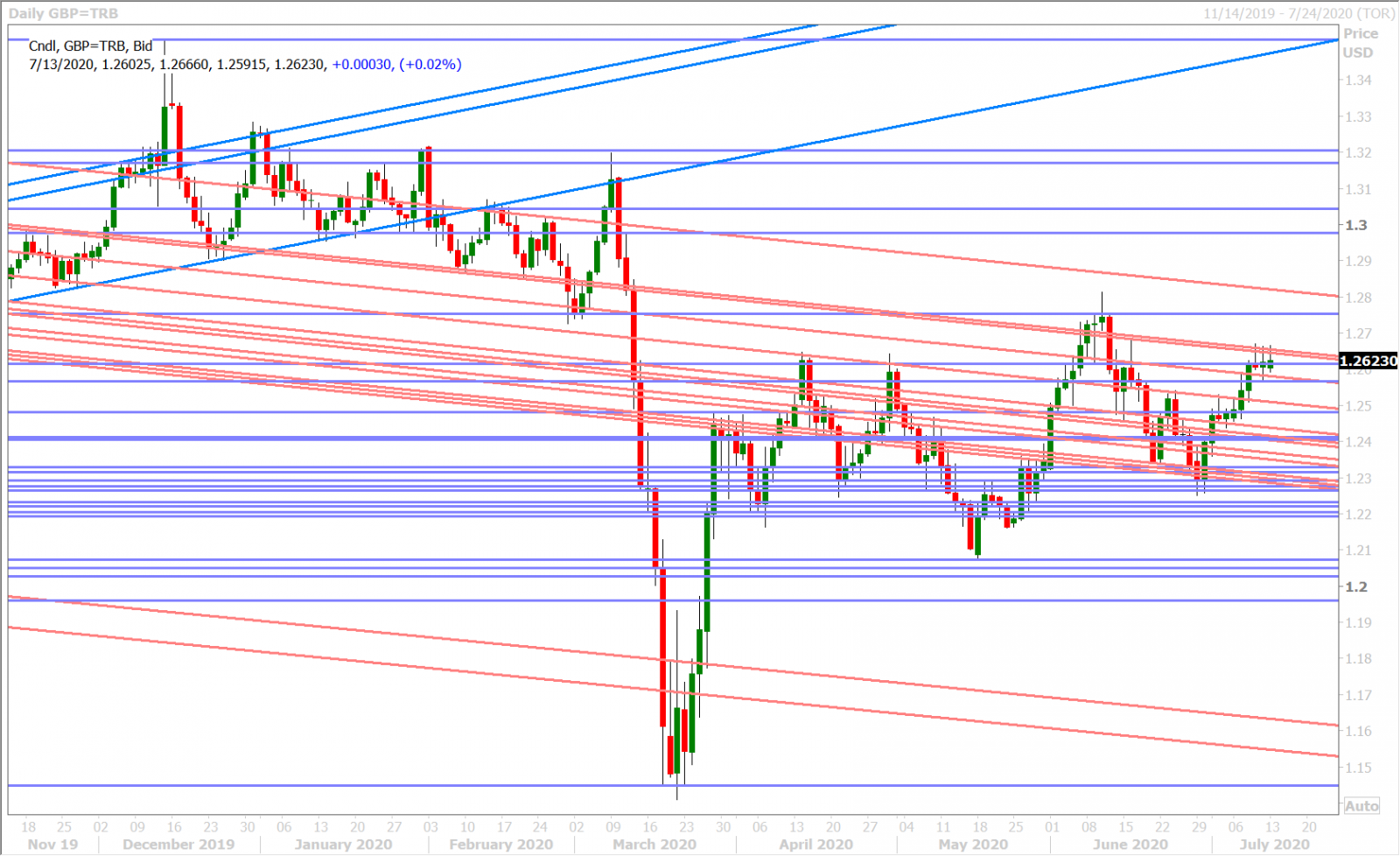

GBPUSD

Sterling is not really benefiting from this morning’s buoyant risk tone as EURGBP buyers try to repair some of the damage done to the daily chart last week. We haven’t come across a negative Brexit headline per se to explain the move but we would note that it has once again caused GBPUSD buyer failure in the 1.2660s (3rd time in as many trading sessions).

The leveraged funds at CME added more long GBPUSD positions than short positions during the week ending July 7; which had the effect of marginally reducing their net GBPUSD short back to early June levels. Bank of England Governor Andrew Bailey said this morning that we are seeing the UK economy get somewhat back to normal but he said “there is a long way to go” and that he’s “very worried about jobs”. The UK will be reporting a bunch of dated economic data this week. See below:

Tuesday: May GDP, Industrial Output, Manufacturing Output, Trade Balance

Wednesday: June CPI

Thursday: May Employment Report, June Claimant Count

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

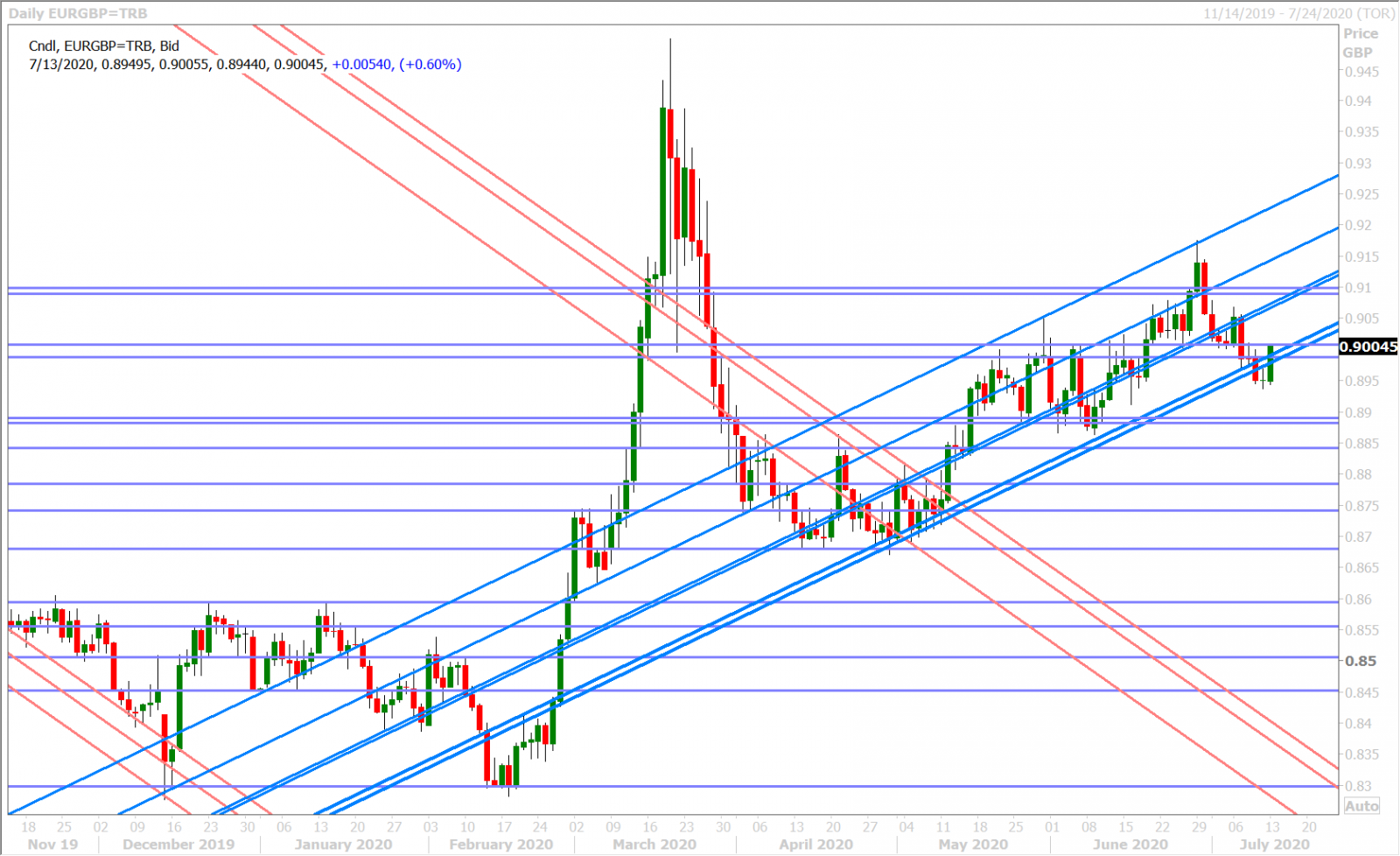

AUDUSD

The Australian dollar is trading higher with the upbeat risk tone this morning, and traders have finally punched through the pivotal 0.6970-80s; an all too familiar level for the market over the last week. Australia reports its June Employment Report on Wednesday night ET and the speculative funds have now reduced their net short AUDUSD to just under 1k contracts during the week ending July 7. We think a strong NY close above the 0.6970-80s this week would do much to reinforce AUDUSD’s recent uptrend.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

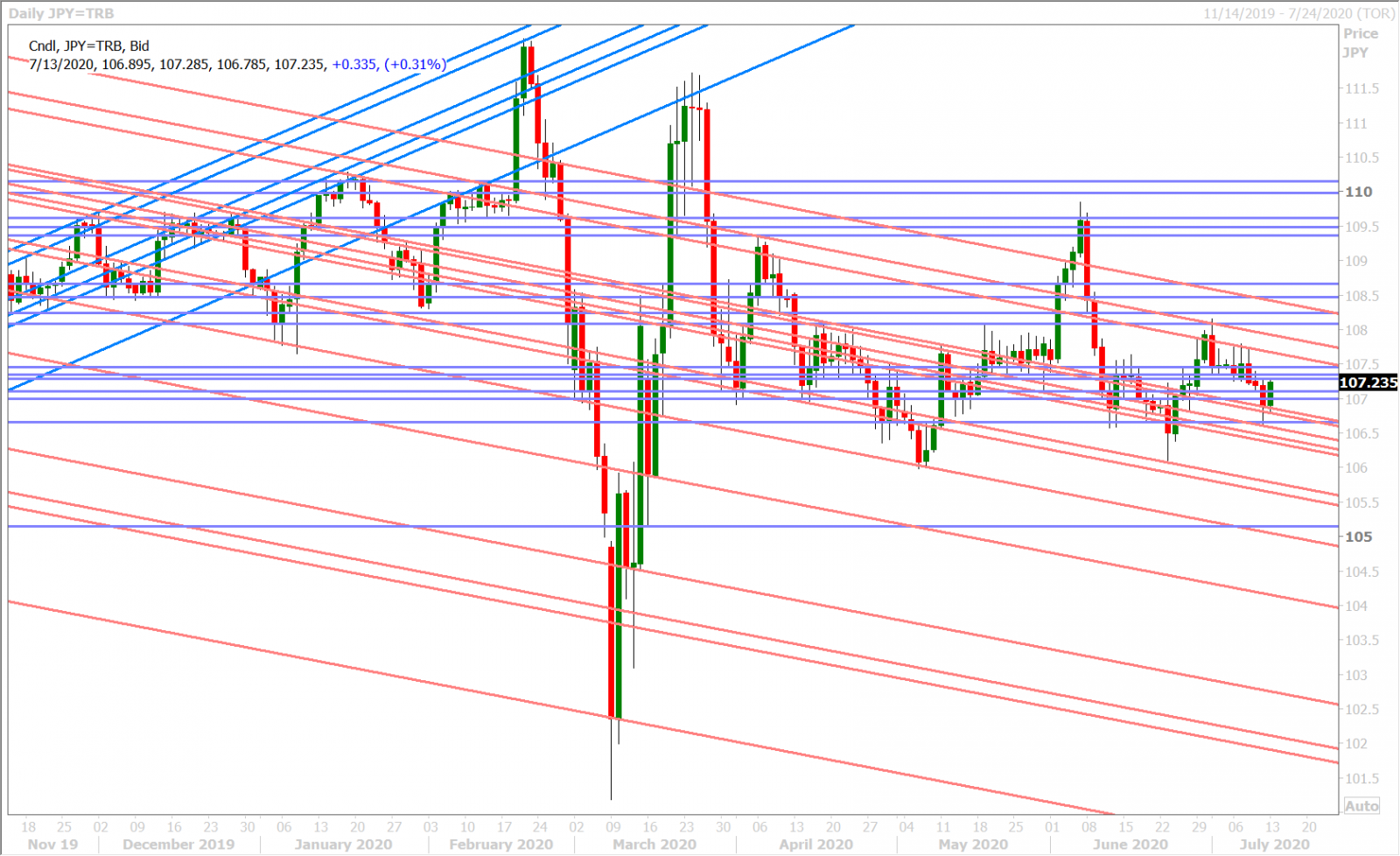

USDJPY

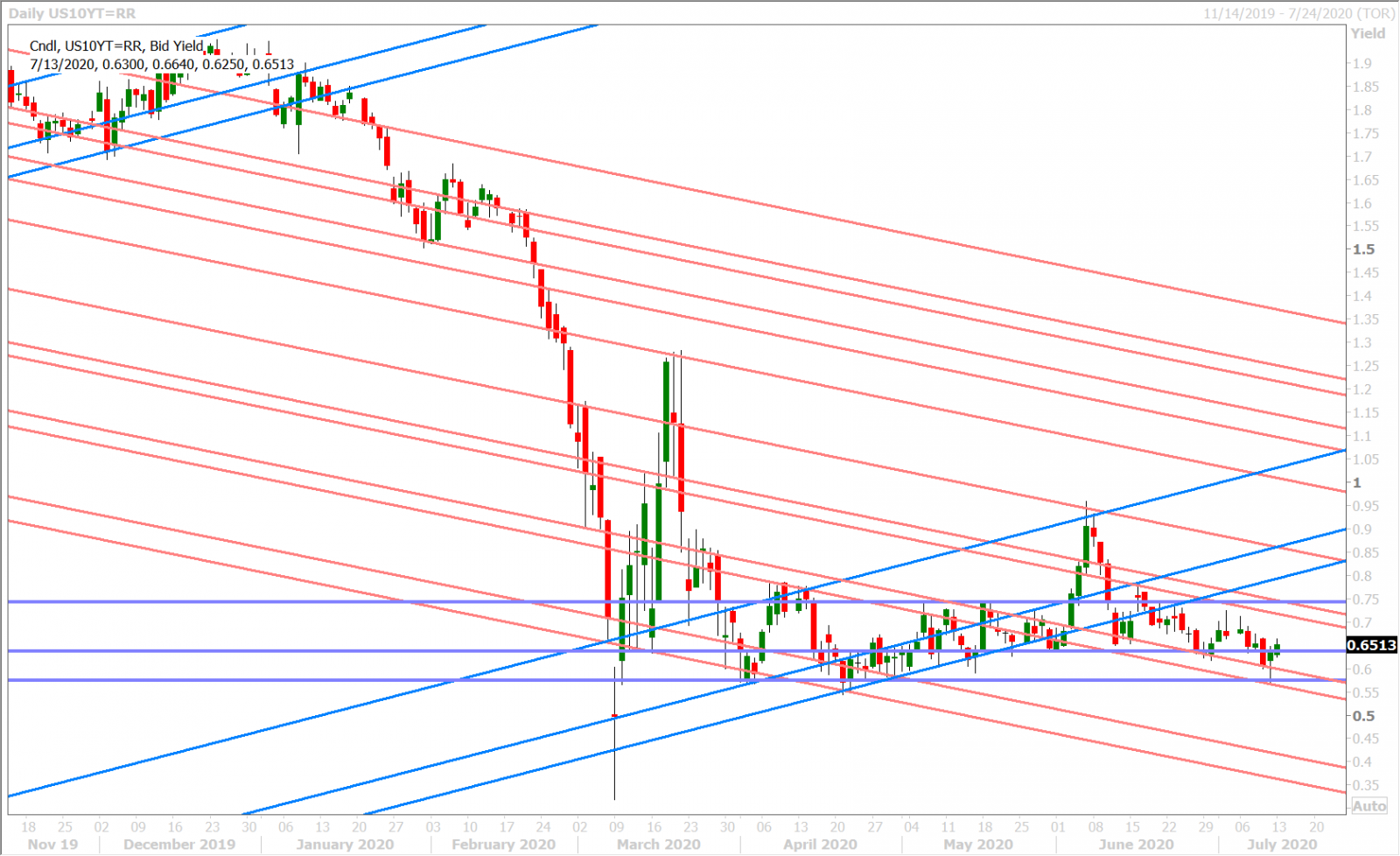

Dollar/yen is bouncing strongly this morning as European bond markets play catchup to Friday’s rise in US yields. Friday’s “risk-on” rally was a head scratcher to be honest but we like one bond trader’s explanation about how last week’s stellar US bond auctions caused a FOMO-type “blow-off top” for bonds. After re-testing trend-line support in the 106.70s last night, USDJPY has now vaulted back onto a 107 handle. Some light selling is coming in now at resistance in the 107.20s as US yields back off session highs. The Bank of Japan meets Tuesday night ET, although no change to monetary policy is expected.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com