Where were you when the oil market died yesterday?

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- May WTI falls historic 305% yesterday to close at -$37.63/barrel. We were capturing screenshots!

- June WTI loses $21.65 support after May went negative, continues -45% lower to $11.79 in Europe.

- USDCAD rallies to extended top end of recent range (1.4230-50). WTI now bouncing, USDCAD off highs.

- Kim Jung Un’s health in focus last night following US media reports, sparks safe-haven bid in USD and JPY.

- RBNZ’s Orr admits to being “open minded” on direct monetization of government debt. AUD lags.

- Germany’s ZEW Economic Sentiment survey for April blows away expectations, 28.2 vs -42.3.

- Sterling craters after 1.2430s chart support gives way. BOE Haldane’s speech not helping now.

ANALYSIS

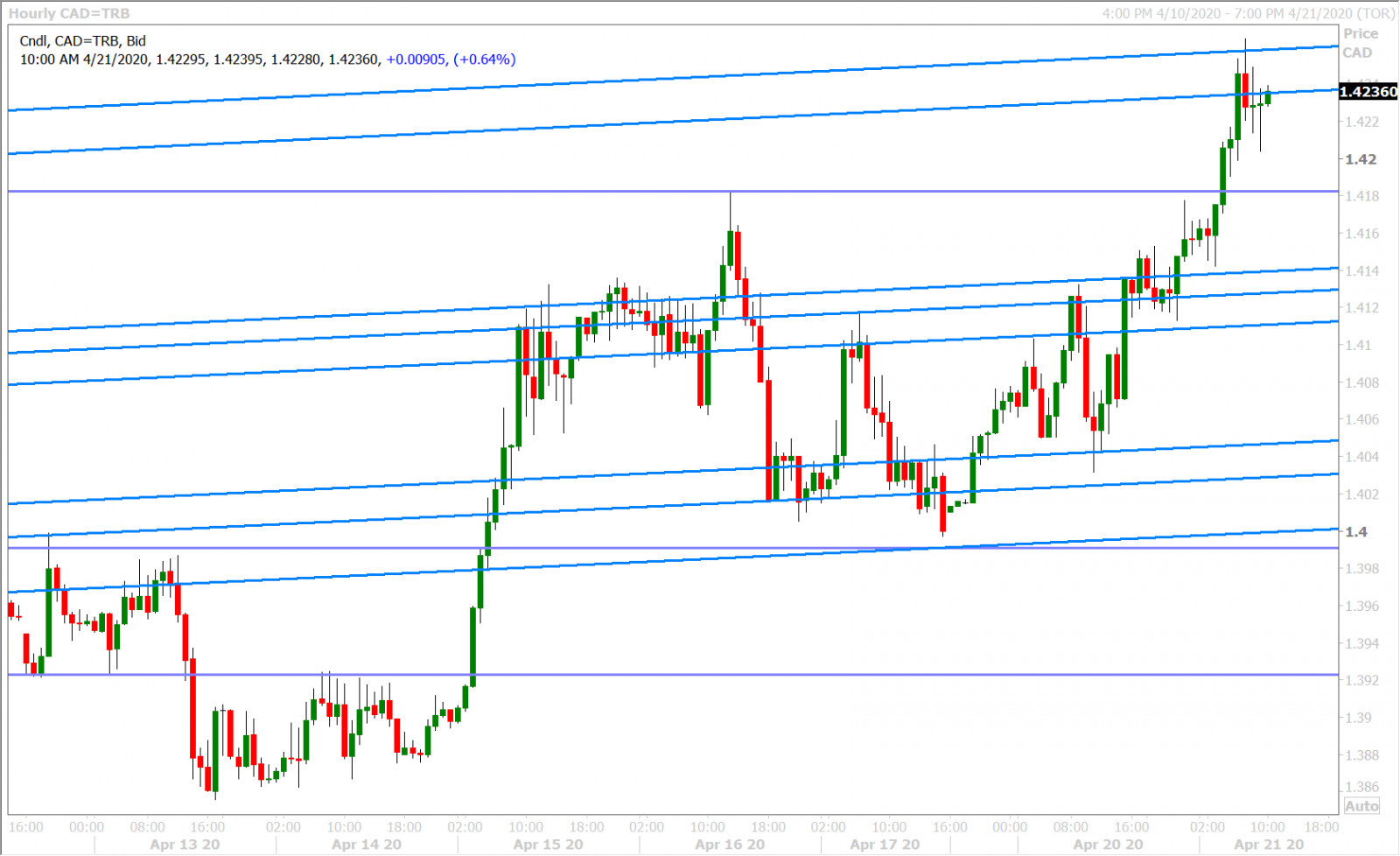

USDCAD

Dollar/CAD finally caught a bid yesterday but it wasn’t until oil prices went negative heading into the NYMEX close. The May WTI futures contract made history by closing down a whopping 305% to -$37.63/barrel as physical grades of US crude oil essentially became worthless to market participants who couldn’t find ways to store it. One could have made the argument that the fireworks in WTI was a temporary dislocation in the oil markets and that it would pass when the May contract expires today, but the June contract has since made a mockery of that narrative and the relative calm we saw in the broader risk tone yesterday. June WTI futures prices fell below key chart support at $21.65 shortly after the NYMEX close (the March 18th lows) and then proceeded to crash 45% lower to $11.79 at the start of European trade today!...if crude oil is worthless for May, why would it have any value for June?

Some concern about Kim Jung Un’s health caused some “risk-off” flows in Asian trade last night, which finally got USDCAD above the 1.4140s resistance level, but it was this morning’s continued oil rout that helped extend the market to the extended top end of its recent range (the 1.4230-50 level we talked about on Friday). This level is now serving as chart resistance as June WTI bounces 37% higher into NY trade. Canada just reported some mixed Retail Sales figures for the month of February (see below), but nobody cares.

CANADA FEB RETAIL SALES +0.3 PCT (VS +0.2% Exp) , EX-AUTOS -0.0 PCT (VS +0.3% EXP)

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

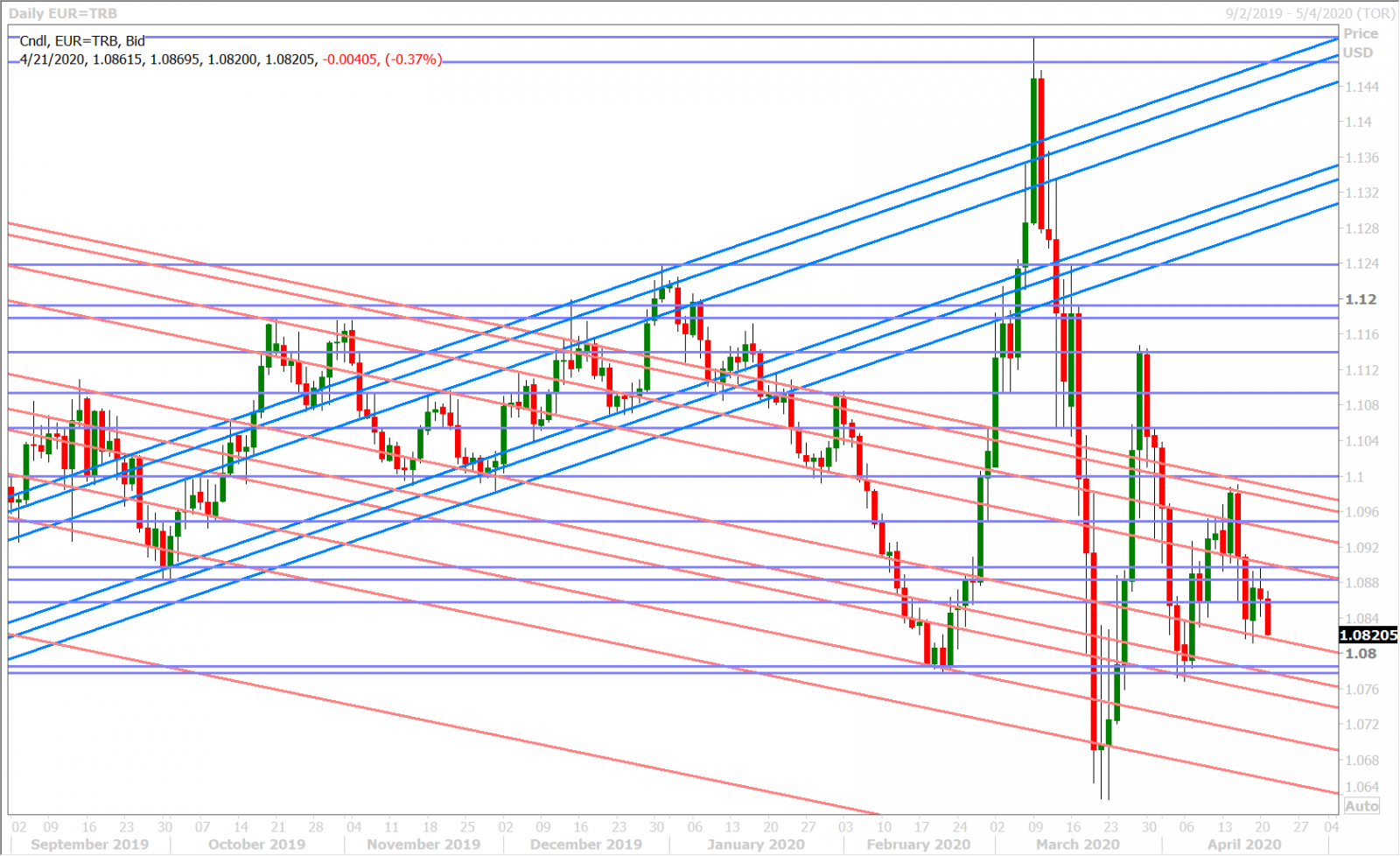

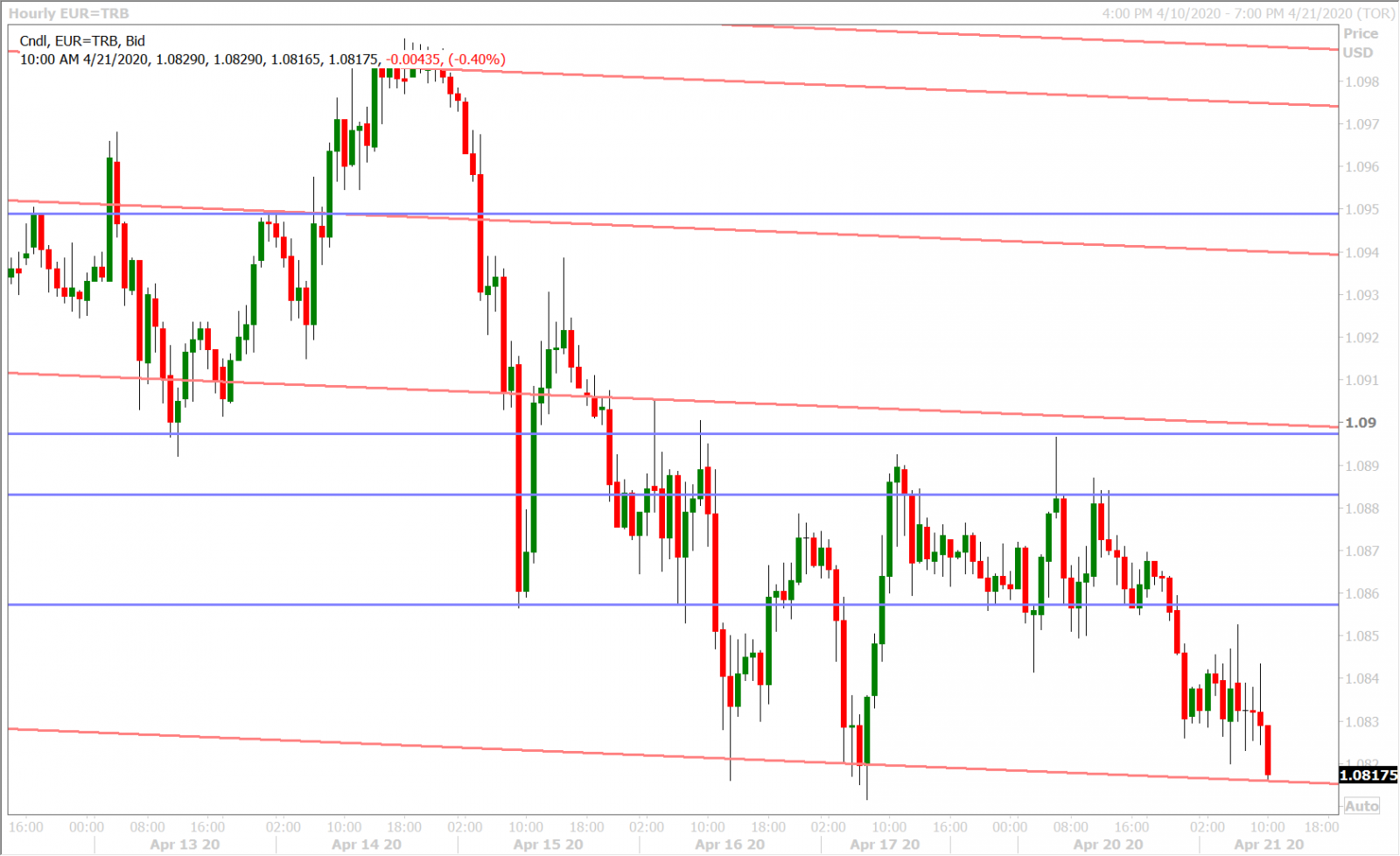

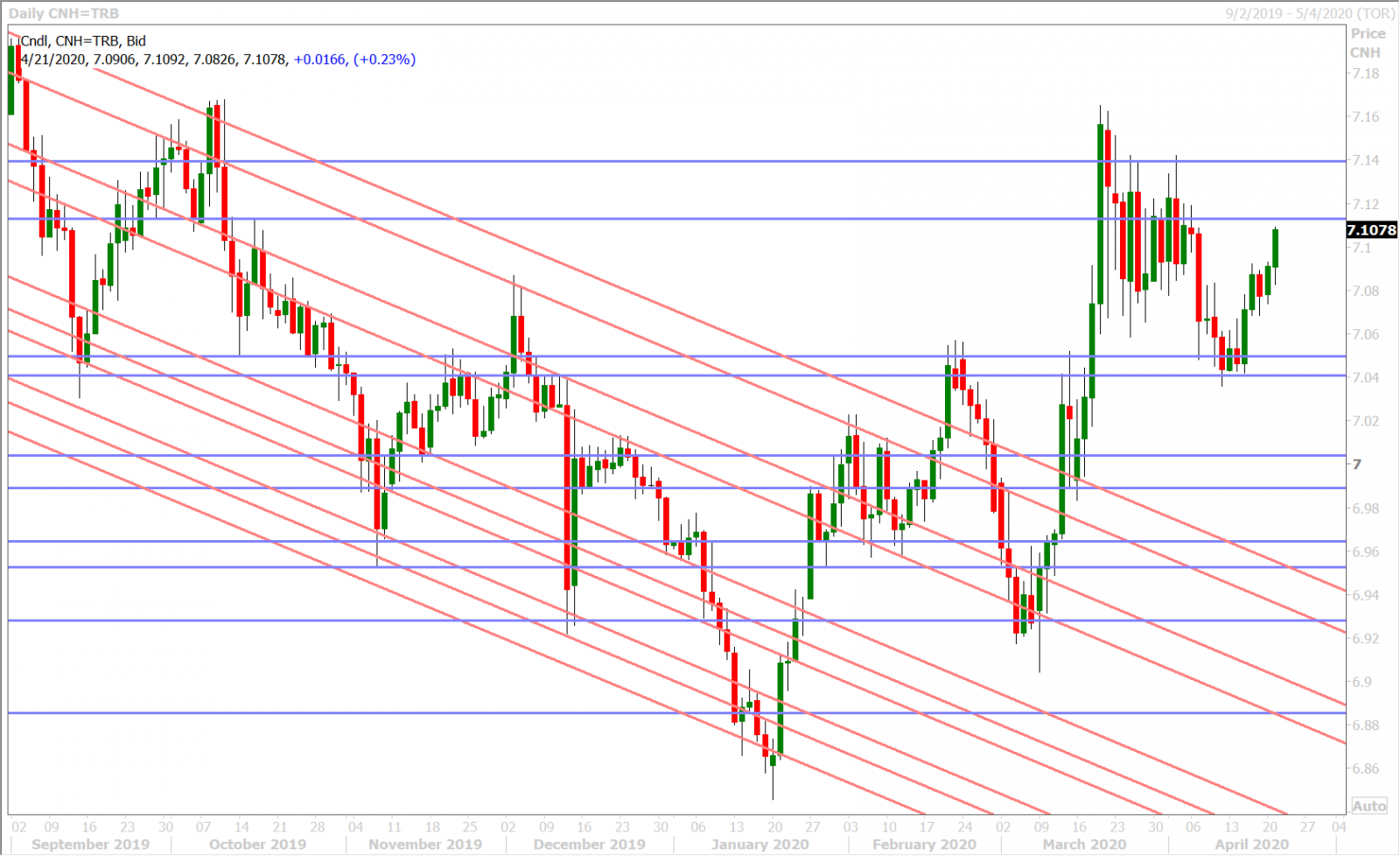

EURUSD

Euro/dollar lost chart support in the 1.0850s last night after CNN reported that Kim Jung Un was in “grave danger” after undergoing surgery, according to a US intelligence official with direct knowledge of the matter. South Korean and Chinese authorities later denied the reports, but it was too late when it came to unleashing some “risk-off” flows across markets as traders fretted about a power vacuum in North Korea. New Zealand’s central bank governor, Adrian Orr, didn’t help the broader risk mood by admitting (perhaps accidently) that he remained “open minded” on direct monetization of government debt.

Germany’s ZEW Economic Sentiment survey for April defied belief when it blew away expectations this morning (28.2 vs -42.3) and, while we think this was largely “wishful thinking” on the part of German businesses, we think this headline is helping EUR outperform relatively speaking today. It isn’t succumbing to the oil-driven demand for dollars nearly as much as what were seeing in AUD, CAD and GBP today. Perhaps the range trade for EURUSD can continue a little longer still. Chart support today checks in at the 1.0810s while the 1.0850s has now become resistance.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

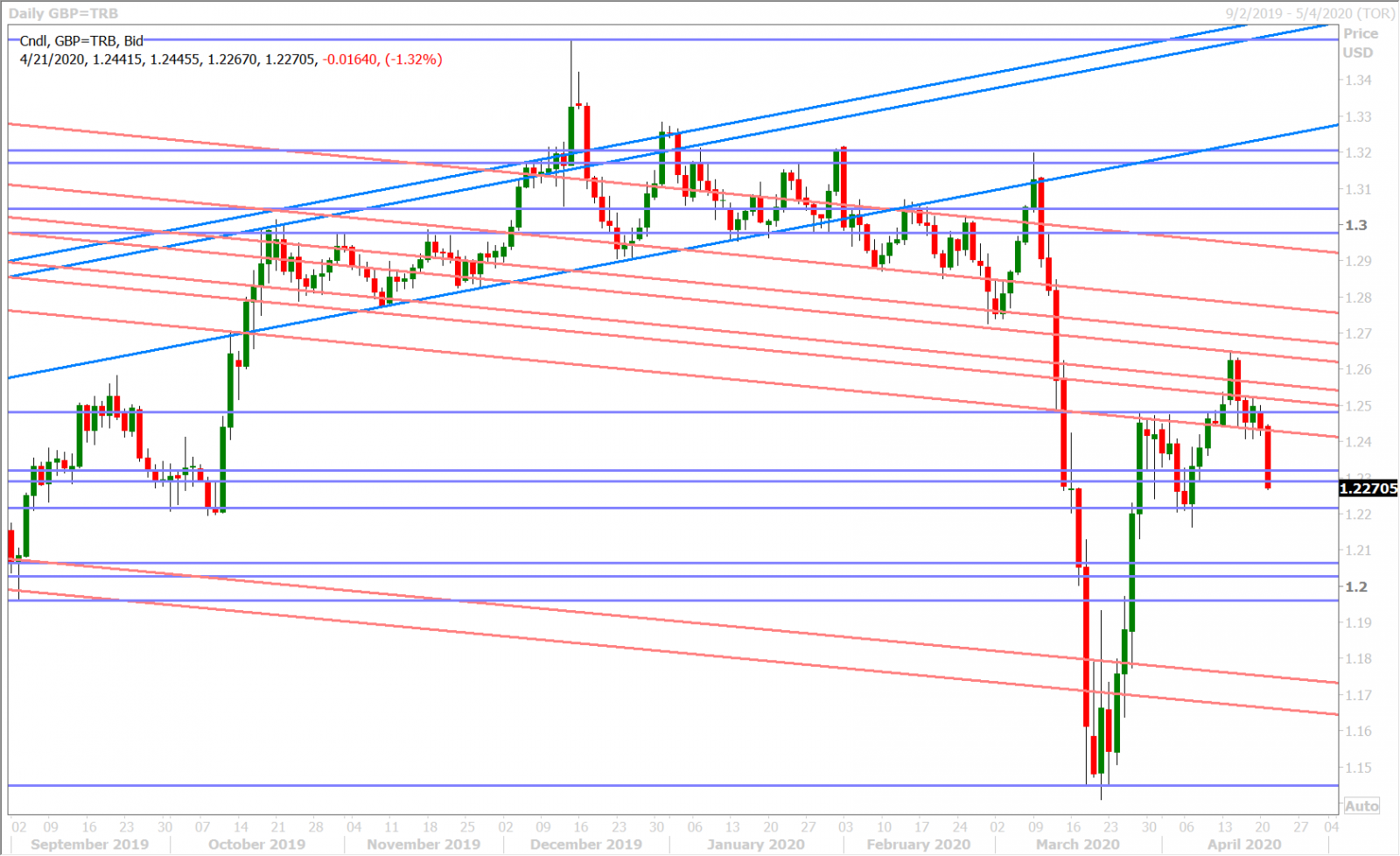

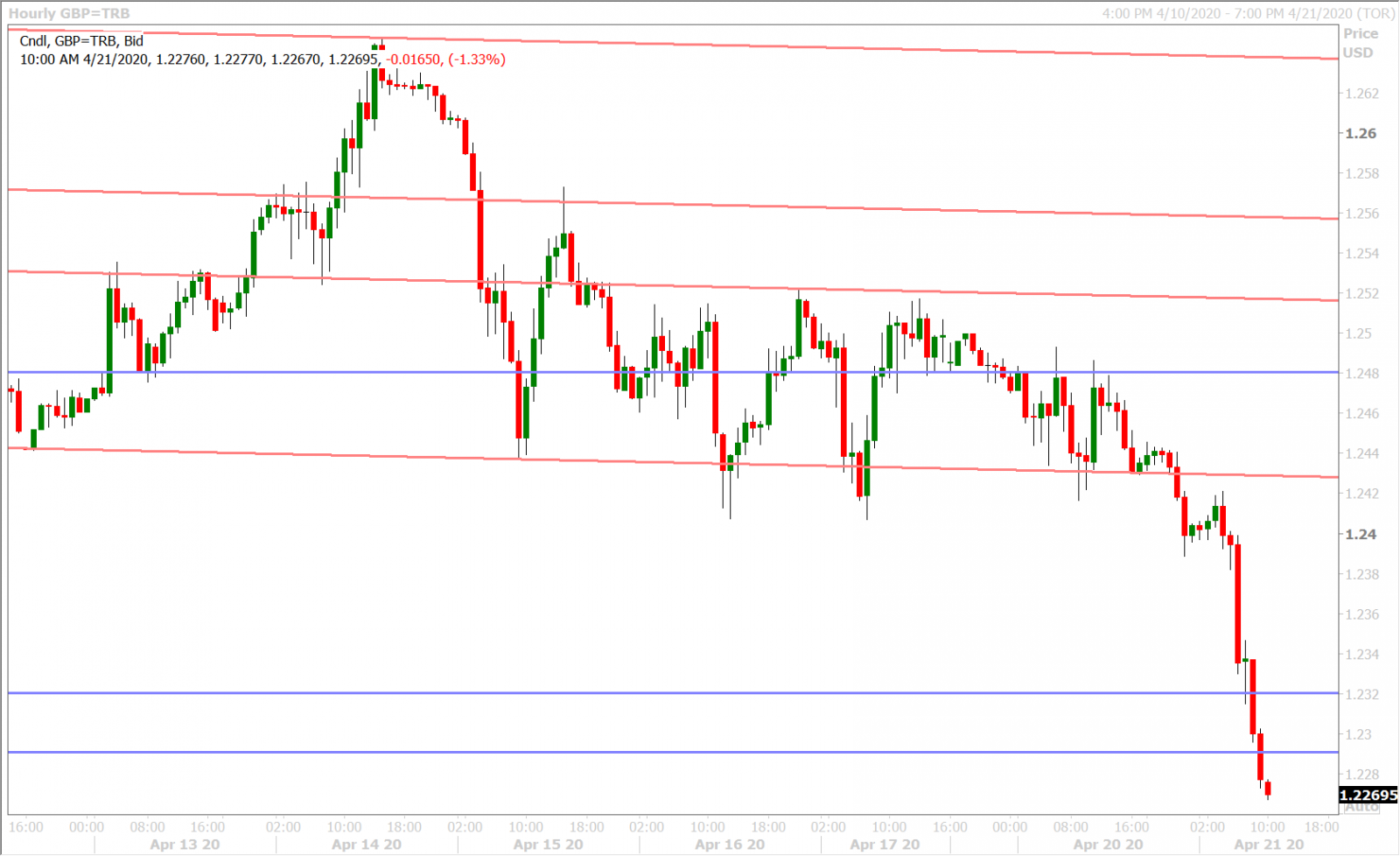

GBPUSD

Sterling has fallen apart today and it all started with GBPUSD losing chart support at the 1.2430s on the North Korean headlines last night. Matters were made worse at the start of European trade today when June WTI prices began to nosedive, leading to broad USD demand. The UK reported some outdated employment data for February this morning (+172k jobs and +2.8% 3M/Y growth in wages), but this is old news and not nearly as important as fresh sentiment data, like the German ZEW we saw earlier. The Bank of England’s Andy Haldane is now speaking and we have to admit he sounds downright depressed. Highlights below:

- BANK OF ENGLAND'S HALDANE SAYS FIRST HALF OF THIS YEAR IS LIKELY TO BE "VERY UGLY" FOR ECONOMY

- BANK OF ENGLAND'S HALDANE SAYS Q2 IS LIKELY TO BRING A VERY MUCH SHARPER CONTRACTION, SEEN ACROSS THE WORLD

- BANK OF ENGLAND'S HALDANE SAYS THERE ARE REAL LIMITS TO WHAT PUBLIC POLICY CAN DO TO OFFSET ECONOMIC EFFECTS OF CORONAVIRUS CONTAINMENT

- BANK OF ENGLAND'S HALDANE SAYS PEOPLE MIGHT BE RELUCTANT TO SPEND TOO VIGOROUSLY OR GO OUT AND SOCIALISE IMMEDIATELY AFTER CORONAVIRUS RESTRICTIONS ARE RELAXED

But fear not…

- BANK OF ENGLAND CHIEF ECONOMIST HALDANE SAYS TALK OF MONETARY FINANCING, HELICOPTER DROP IS MISPLACED, RISKS OF BOE LOSING CONTROL ARE HUGELY OVERBLOWN

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

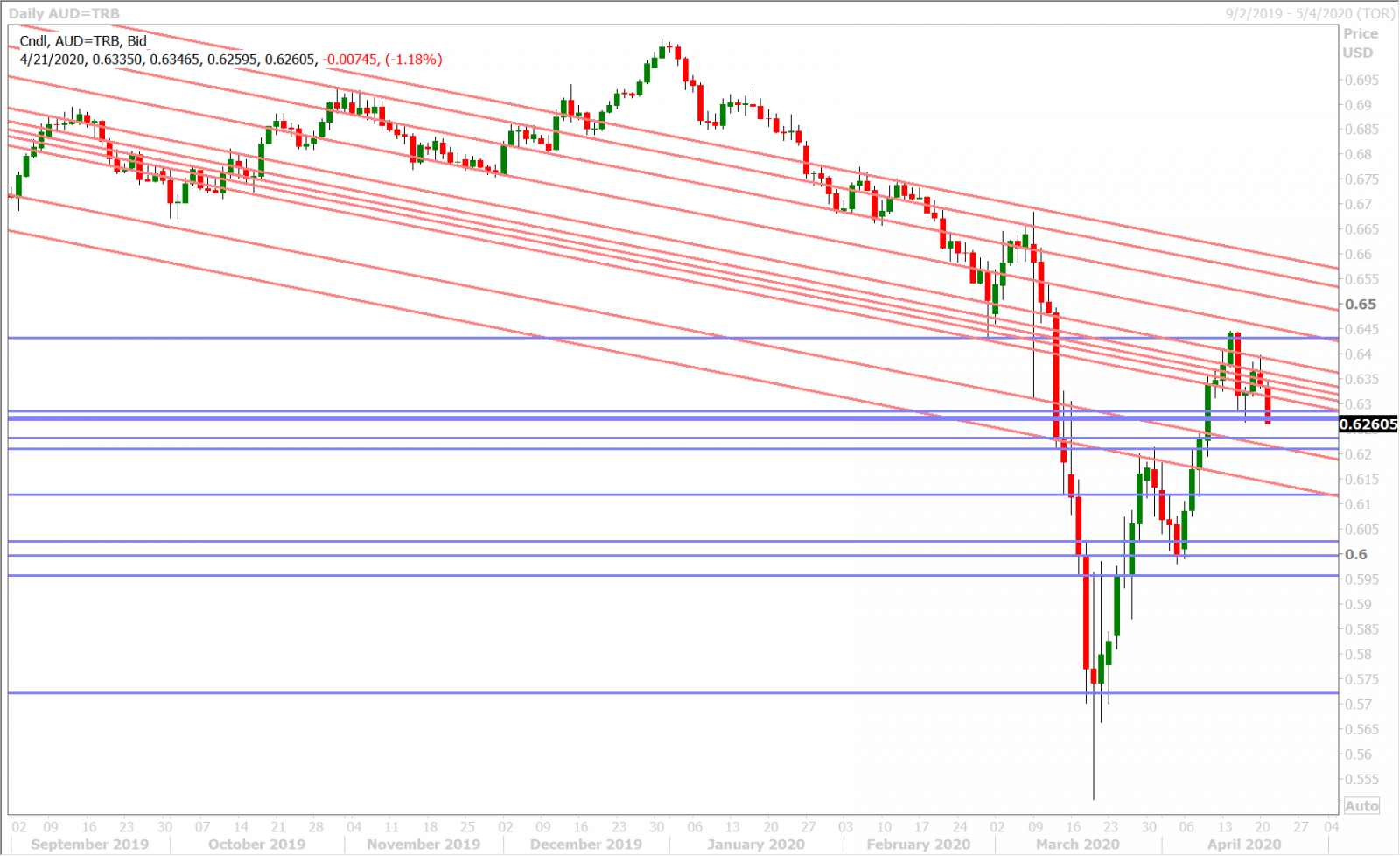

AUDUSD

The Australian dollar continued to lead everything higher into the London fix yesterday, but the market then struggled as trend-line resistance in the 0.6390 re-asserted itself and as May WTI ultimately went negative. The AUD mirrored the decline in CAD after the NYMEX close and it was made worse by the North Korean/RBNZ headlines last night. Traders are now trying to hold last Wednesday/Thursday’s lows in the 0.6270-80s this morning, but it’s not looking good so far. A move below this chart support level could open up a slippery slide to the 0.6210-30s.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

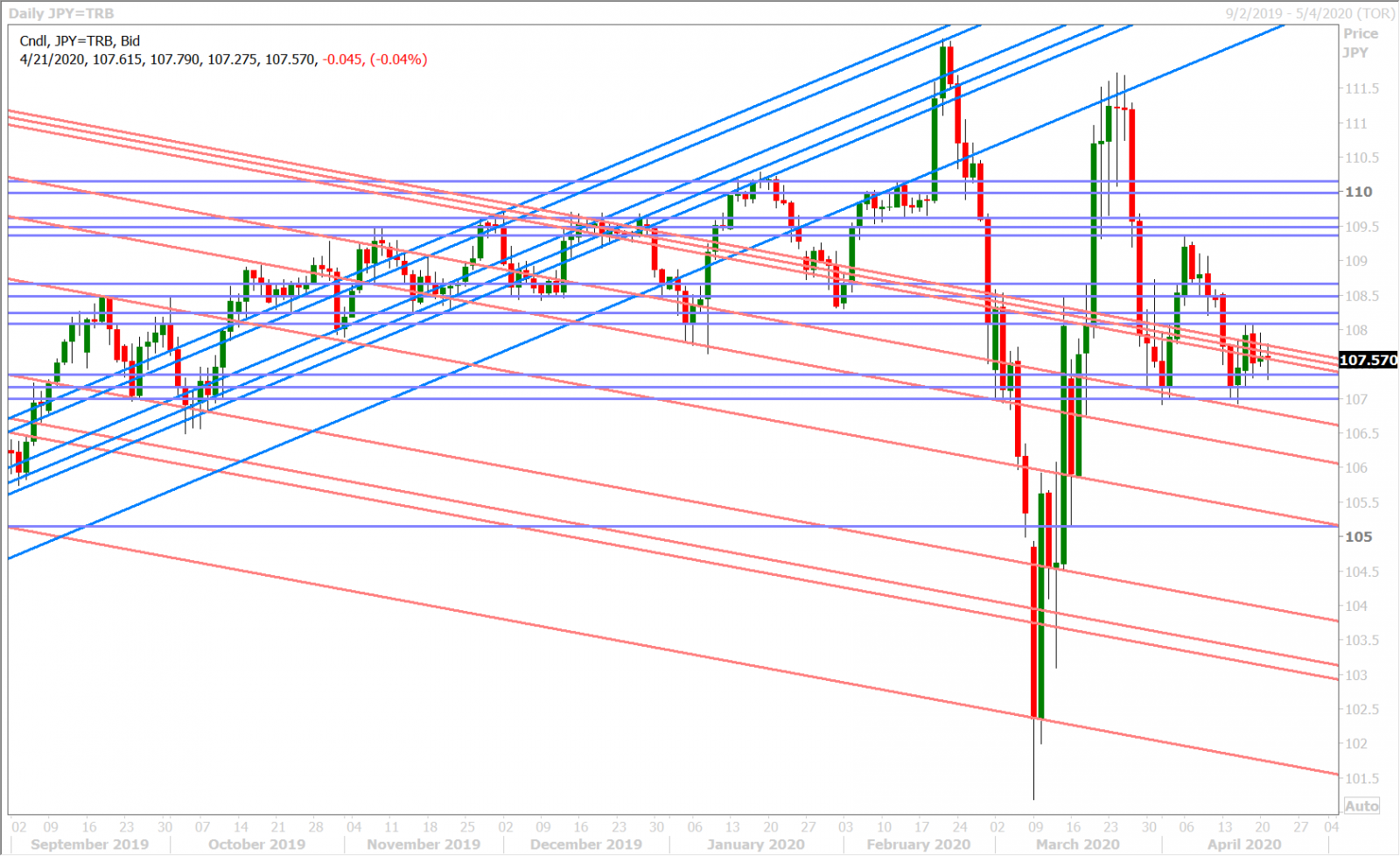

USDJPY

Dollar/yen slipped below its familiar 107.50-70 range last night after headlines circulated about North Korea’s leader being gravely ill. NBC News went so far as to claim that Kim Jung Un was “brain dead”, but then later deleted the tweet “out of an abundance of caution”. South Korean and Chinese authorities then denied the the reports out of the US media, but it was too late to deny the yen its traditional safe-haven bid off negative North Korean headlines.

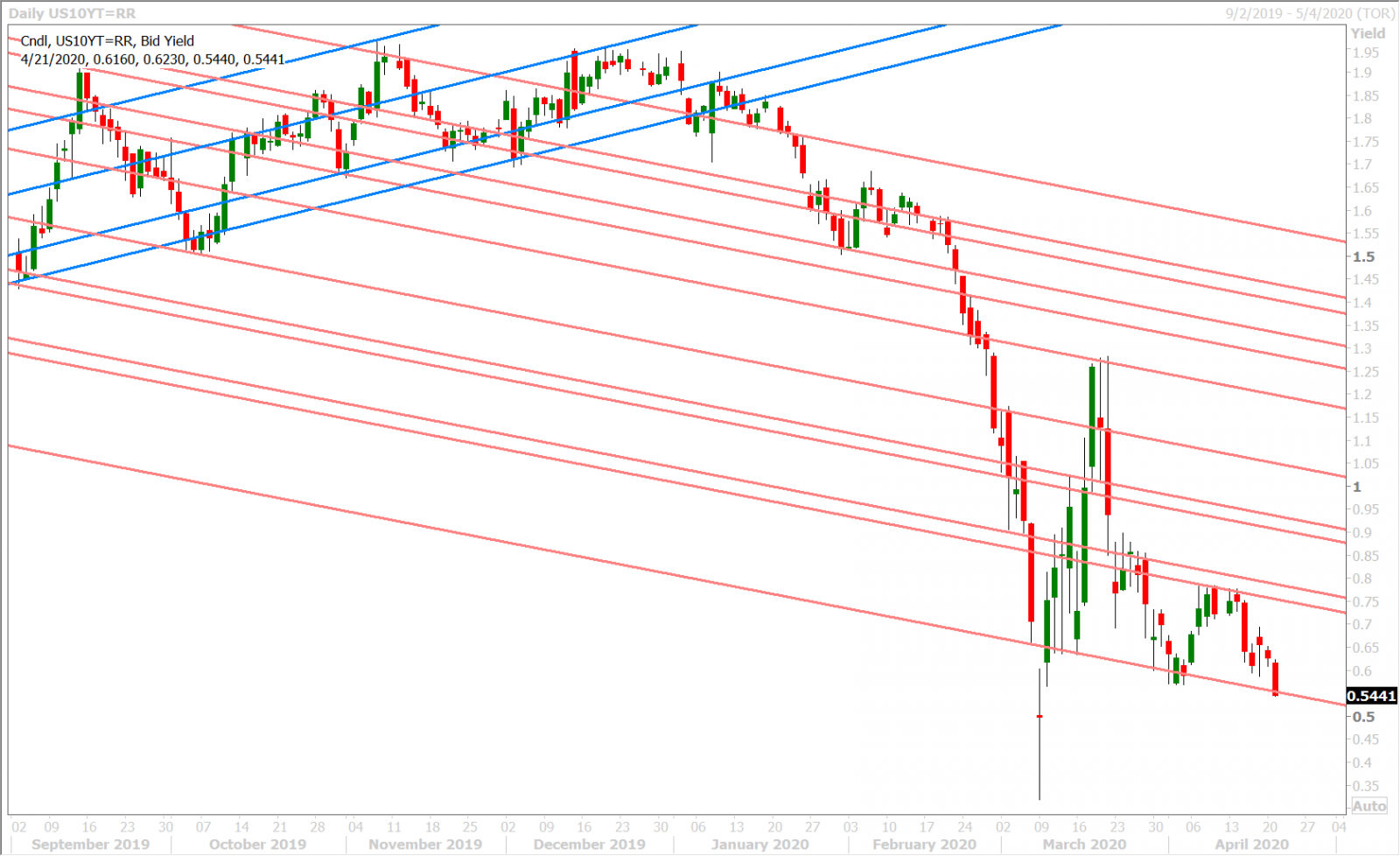

The market has since found a bid into NY trade as oil-driven “risk-off” flows permeate their way through the broader markets again. The US 10yr yield is re-testing key support at the 0.55% handle. The S&P futures are trading another 2% lower after falling 2% yesterday. The June WTI futures contract is currently trading -30% after being down 45% in early European trade this morning.

USDJPY DAILY

USDJPY HOURLY

US 10 YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.