Bank of England holds rates unchanged, but two dissenters wanted cuts now.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD has fallen back from familiar chart resistance in the 1.3180-90s this morning after Bloomberg reported that “China and US have agreed to cancel existing tariffs in different phases”. More here. Upon closer inspection of the story however, there appears to be a couple of big “ifs” in there.

“If China, U.S. reach a phase-one deal, both sides should roll back existing additional tariffs in the same proportion simultaneously based on the content of the agreement, which is an important condition for reaching the agreement,” spokesman Gao Feng said.

“If confirmed by the U.S., such an understanding could help provide a road-map to a deal de-escalating the trade war that’s cast a shadow over the world economy”.

This is shoddy reporting in our opinion. There's obviously no trade deal yet because there's no content of the agreement yet. It doesn’t sound like the US has confirmed anything regarding tariff relief. This is simply China reiterating their position (which we know already). You can’t tell that to the trading algorithms however, which are still incapable of sniffing out nonsense. The S&P 500 futures have shot up to new all time highs on these headlines, the US 10yr yield has taken out Tuesday’s highs to trade above 1.88%, the offshore Chinese yuan has collapsed back below the psychological 7.0000 level, and the USD is being sold against commodities currencies. It’s “risk-on” again.

The USDCAD market, in particular, has been relegated back to Tuesday’s trading range (which will likely come as a relief to the fund shorts). We think prices will gyrate quietly here ahead of the October Canadian employment report tomorrow. Support 1.3140-50s. Resistance 1.3170-80s.

USDCAD DAILY

USDCAD HOURLY

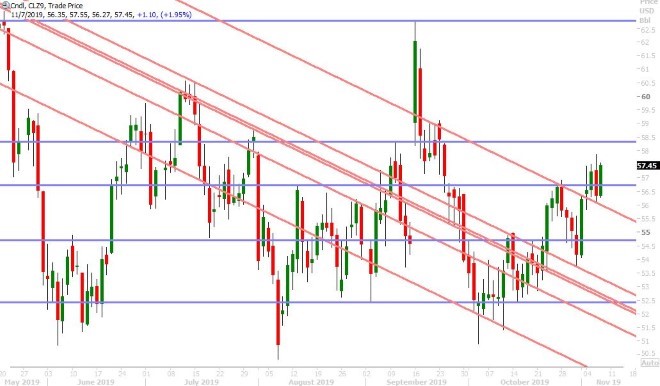

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar has de-coupled this morning from the inverse correlation to US yields that has been driving it lower so far this week, and it appears broad USD selling was the driver earlier today. Even today’s weaker than expected Industrial Output numbers out of Germany for September are getting ignored (-0.6% MoM vs -0.4%). The market regained trend-line support in the 1.1060s after USDCNH plunged lower during the 3amET hour, but it has since run into some chart resistance at the 1.1080s and some negative influence from GBP flows post the Bank of England meeting (more on this below). We think EURUSD will continue to struggle here.

EURUSD DAILY

EURUSD HOURLY

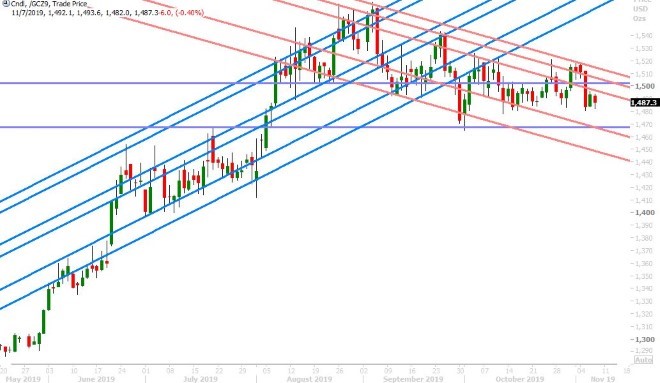

DEC GOLD DAILY

GBPUSD

The Bank of England surprised markets this morning with a rather dovish hold to interest rates. While the BOE’s monetary policy committee voted to keep rates on hold at 0.75%, the vote was not unanimous like it’s been for a long time. Two members, Saunders and Haskel, voted for a 25bp rate cut today saying that stimulus was needed now because of downside risks from the global economy and Brexit, and because data suggest the labour market is turning. Bank of England, Mark Carney, struck what we felt was a more balanced, but still dovish, tone in his press conference. He spoke positively about the recent Brexit deal and said “on balance we think the world economy is stabilizing", but at the same time he acknowledged growth is well below trend and close to where it starts to feel like a recession. We thought the following headline was notable, and it definitely reads more dovish than the "assumed successful Brexit/modest tightening" bias they’ve had up until now:

IF DOWNSIDE RISKS EMERGE TO UK ECONOMY, THERE MAY BE A NEED TO PROVIDE REINFORCEMENT BUT THIS IS NOT PRE-COMMITTING

So there we have it – a now more dovish BOE heading into an uncertain UK election season. GBPUSD has fallen back to chart support in the 1.2790-1.2810 area.

The EURGBP is trying to stage another rally off the all too familiar 0.8600 support level. The OIS market is now pricing in a 68% chance that the Bank of England cuts interest rates 25bp by this time next year.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

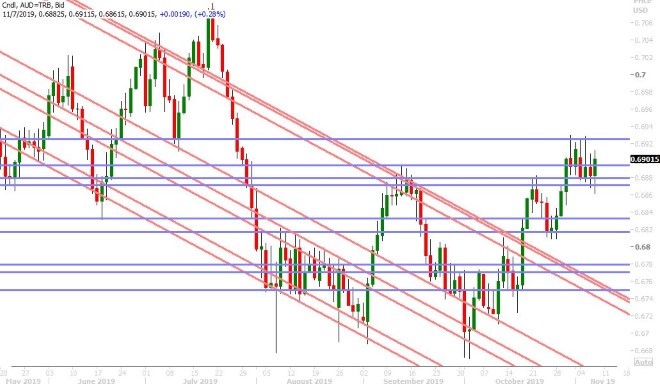

The Aussie has been a natural beneficiary to this morning’s comments out of China but, as we alluded to above, there is no new “news” here in our opinion. The market is now trading back above the pivotal 0.6895 level, which it lost in NY trade yesterday after reports that the signing of the phase 1 trade deal “could be delayed”. The move back above 0.6895 is technically positive, as it now opens up a potential rally to the 0.6930s, but the GBPUSD sales we’ve seen since the surprise vote split at the BOE meeting appears to be driving some broad USD strength for the moment. China reports its import/export data of October tonight (exact time unknown).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is trading right back up near yesterday’s session highs this morning as today’s positive US/China trade headline cancels out yesterday’s negative US/China trade headline. The US 10yr yield has rushed back above 1.83%, which now puts the 1.91-1.95% level on the radar in our opinion. Yes, this continued “risk-on”, “risk-off” type of market environment just never seems to go away, and we have a feeling this won’t change anytime soon. The US/China trade war is a convenient, and easy to understand, bogeyman for all the world’s problems and so long as it rages on global central bankers have their excuse to keep the global debt party going, the Trump administration can continue to dangle the thought of a hugely positive headline to come (which supports the stock market), and we can avoid the tough and more complicated discussion about what’s wrong in global funding markets.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com