Strong Caixan PMI leads USD lower overnight

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- Chinese Caixan Manufacturing PMI for August beats expectations, 53.1 vs 52.6.

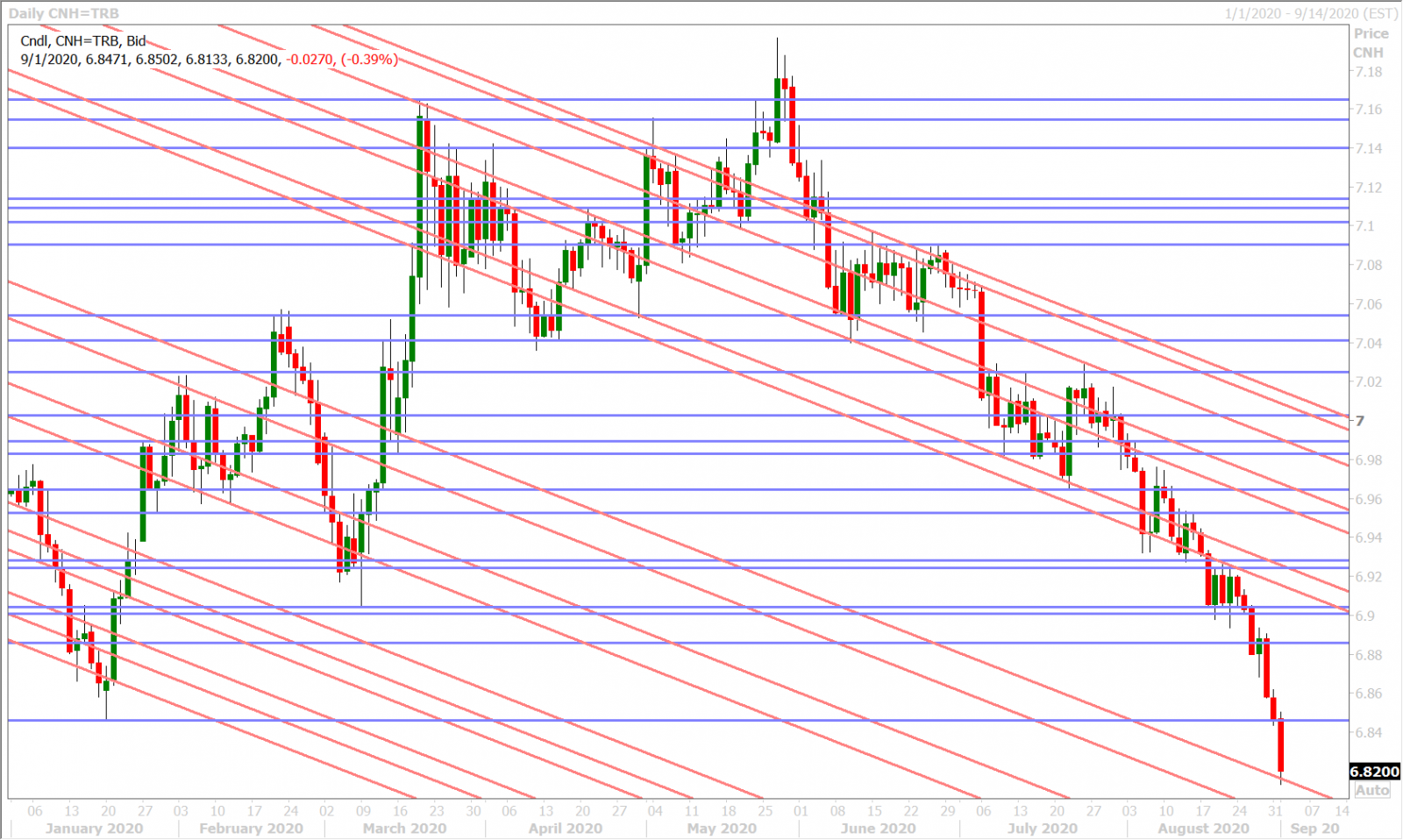

- USDCNH decline leads USD lower in Asia. New 15-month low for USDCNY fix.

- Weaker than expected flash HICP & 1.20 barrier defense caps EURUSD.

- Reserve Bank of Australia keeps rates and 3yr yield target in place overnight.

- US ISM Manufacturing report for August up next, 54.5 expected vs 54.2 in July.

- Fed’s Brainard to speak at 1pmET. BOE’s Bailey to speak at 9amET tomorrow.

ANALYSIS

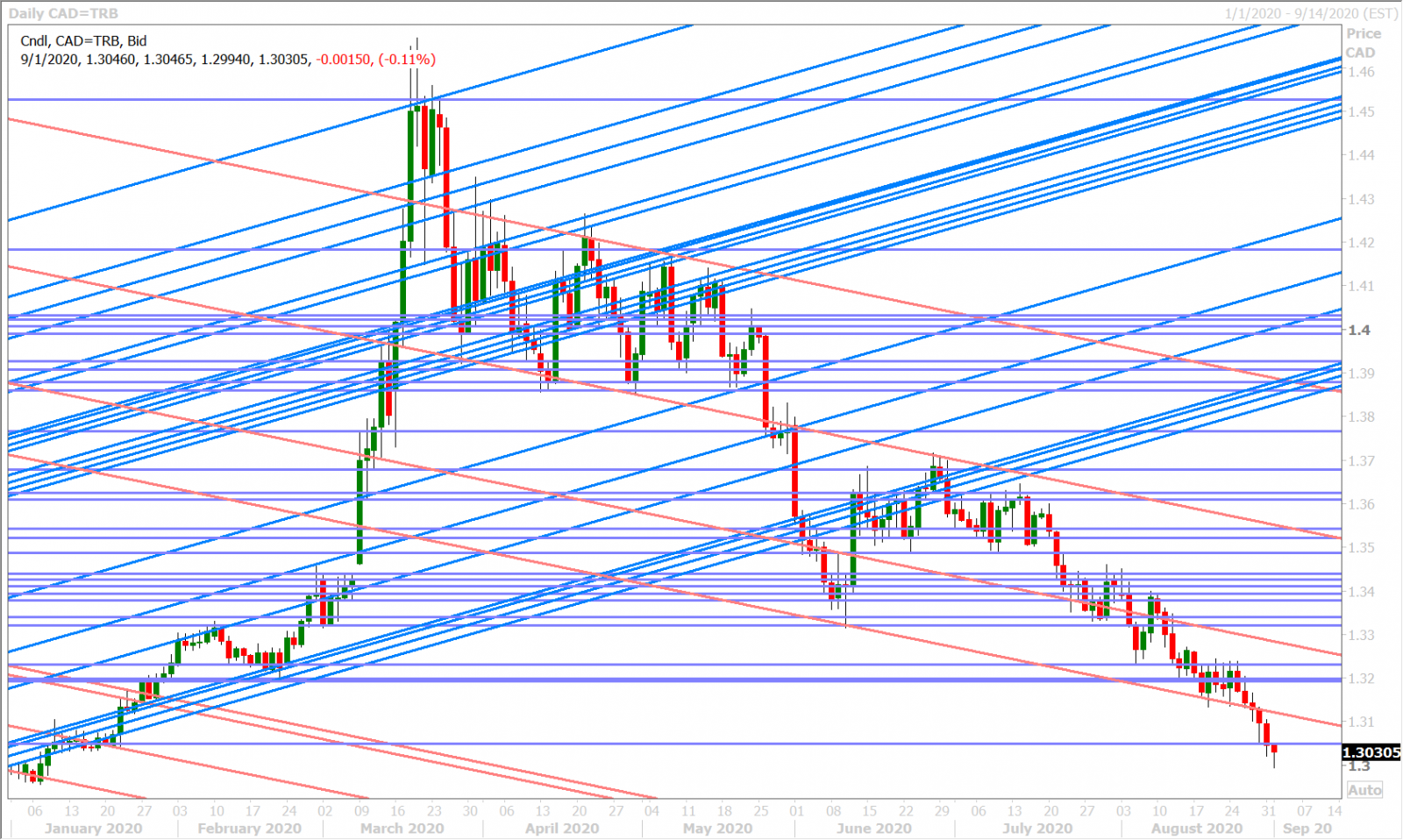

USDCAD

The broader USD closed NY trade in poor technical shape yesterday and its recent decline extended in Asia last night on the back of China’s better than expected Caixan Manufacturing PMI for August, another 15-month low for the USDCNY fix, and the un-disruptive RBA meeting. This morning’s in-line to slightly weaker than expected final August Manufacturing PMI reads out of Europe, the Eurozone’s weaker than expected flash HICP for August, and talk of 1.2000 option barrier defense seems to have capped EURUSD, which is helping USDCAD hold the 1.30 handle for now.

Today’s NY session will feature the US ISM Manufacturing PMI for August at 10amET (54.5 expected vs 54.2 in July) and a speech from the Fed’s Lael Brainard at 1pmET on the “economic outlook and monetary policy”.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

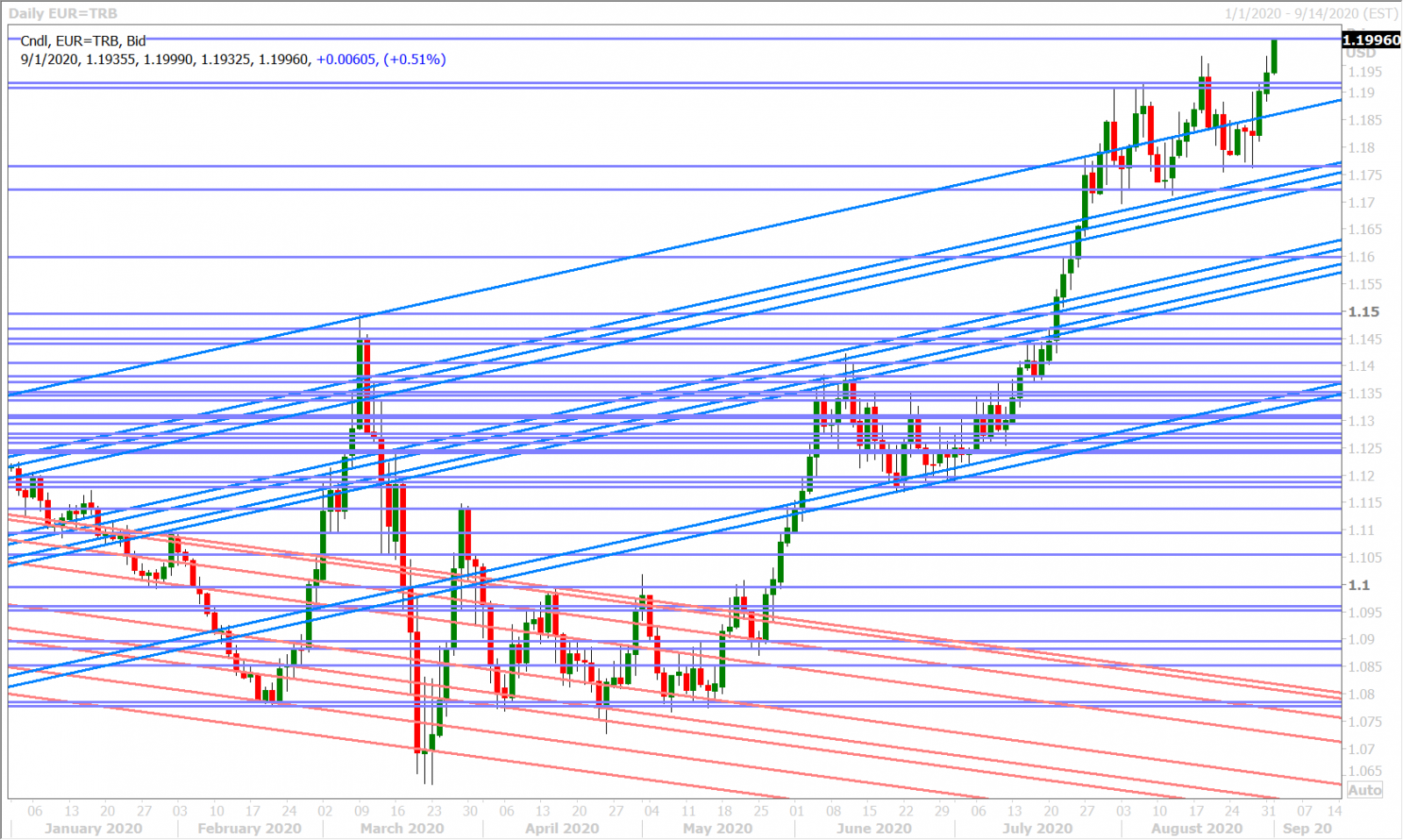

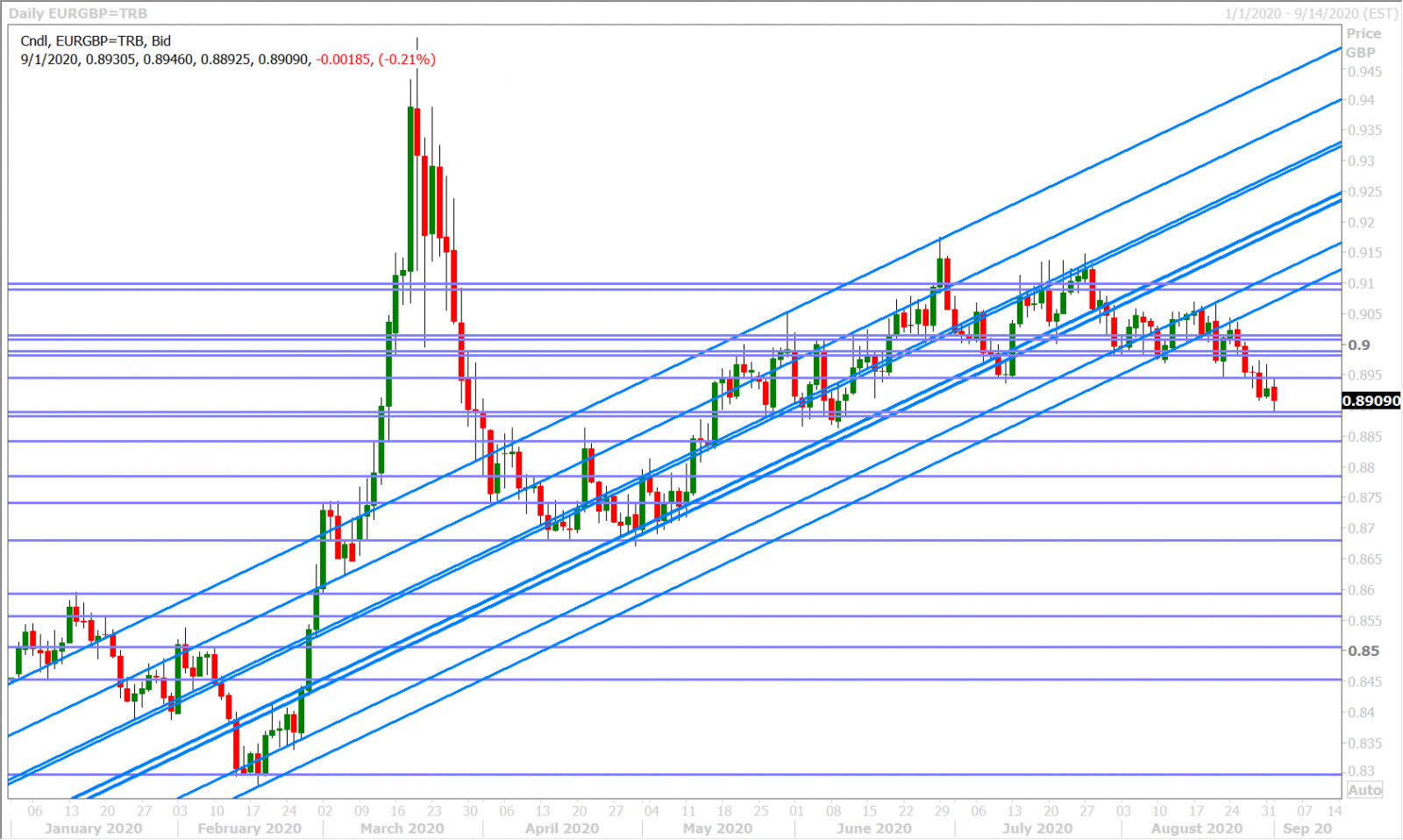

EURUSD

Euro/dollar is hovering just below 1.2000 as NY trade gets underway and we continue to hear talk of selling in the spot market to defend a EURUSD barrier option at the figure. This temporary weight could be removed very shortly though given this morning’s event risks (US ISM at 10amET and Philip Lane’s speech at 12pmET).

There is very little chart resistance and option coverage above the 1.20 mark at this point, which could exacerbate EURUSD buying should the market break above it on a closing basis, however Friday’s huge 2.7BLN option expiry tells us traders might not want to get too carried away ahead of the August Non-Farm Payrolls report.

EURUSD DAILY

EURUSD HOURLY

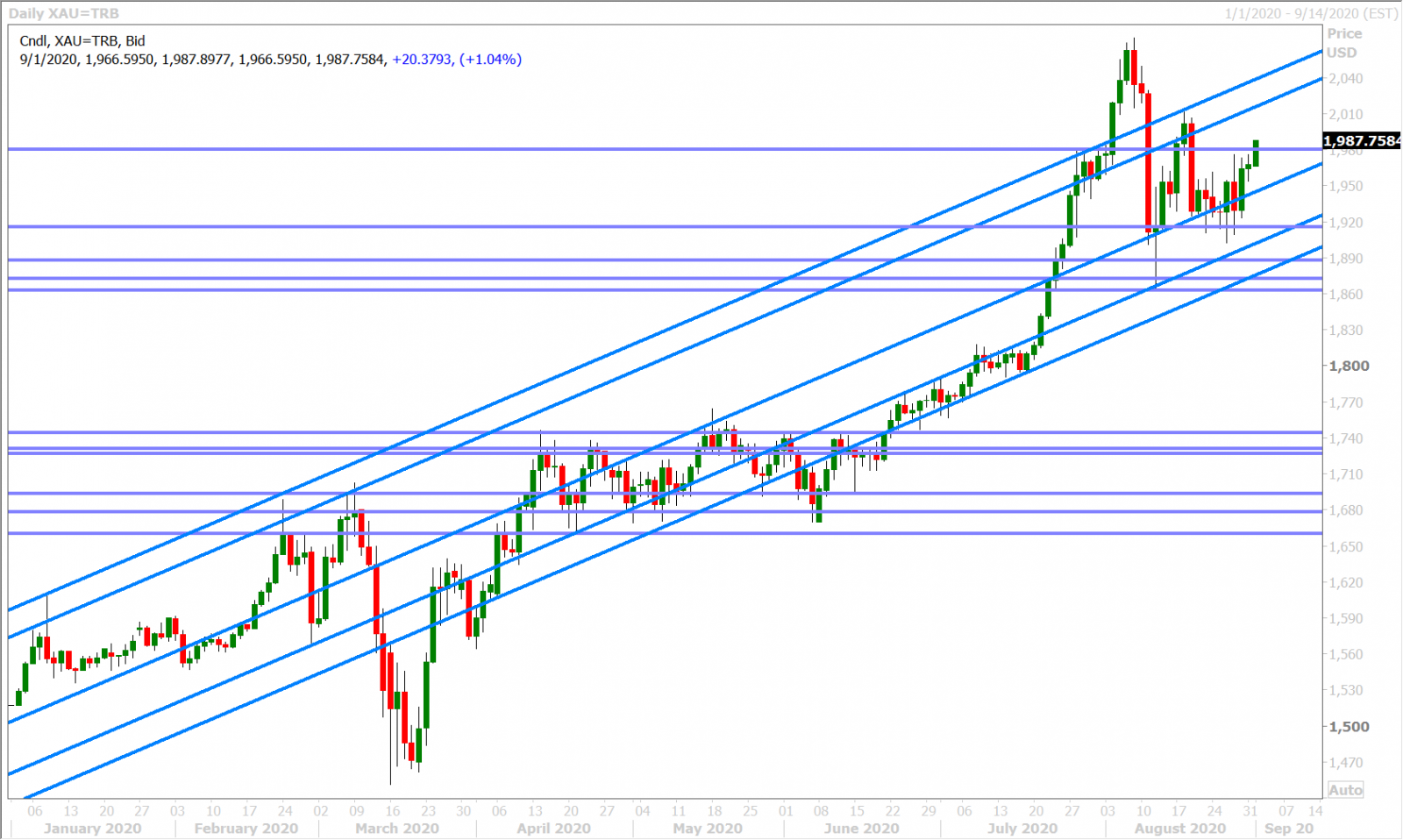

SPOT GOLD DAILY

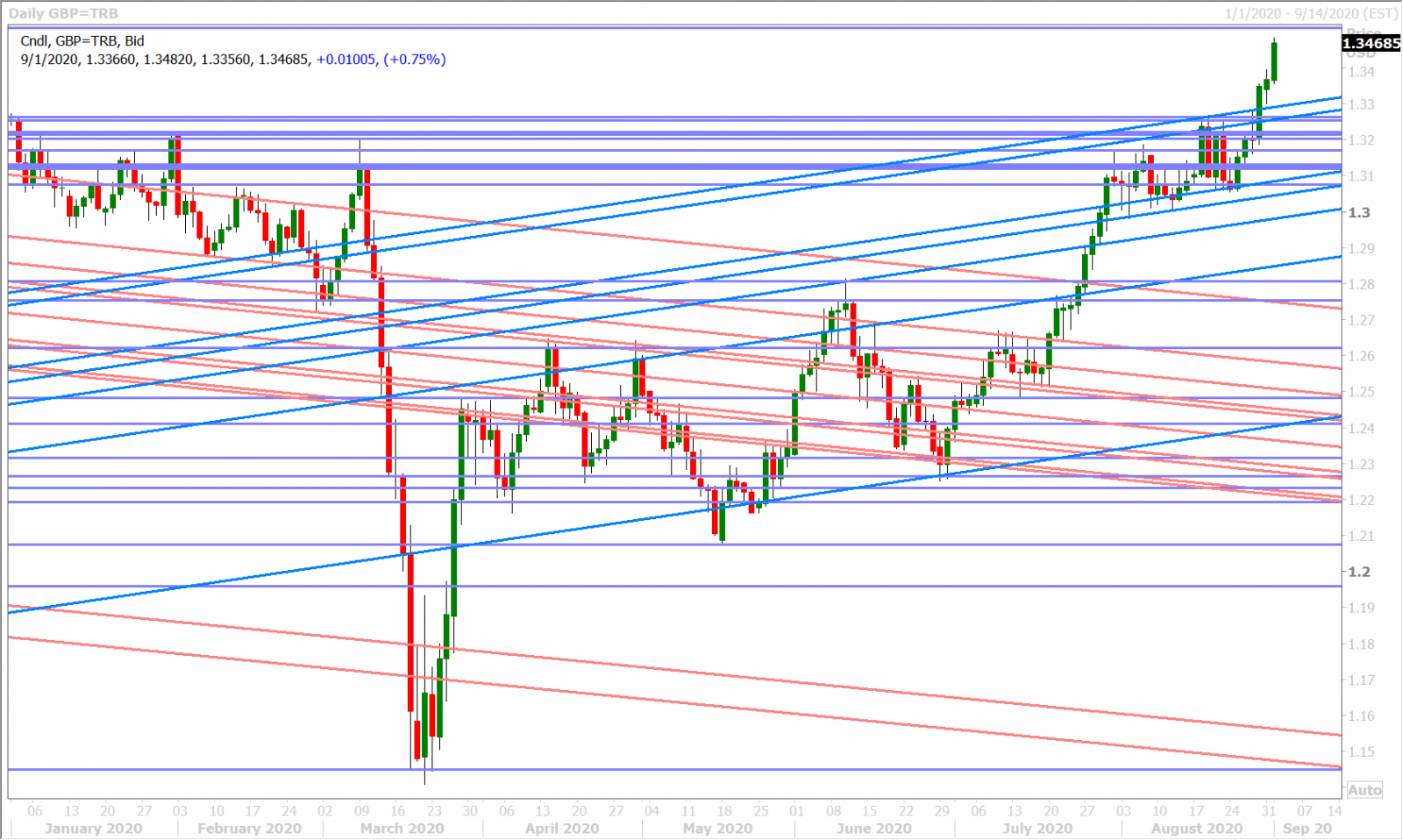

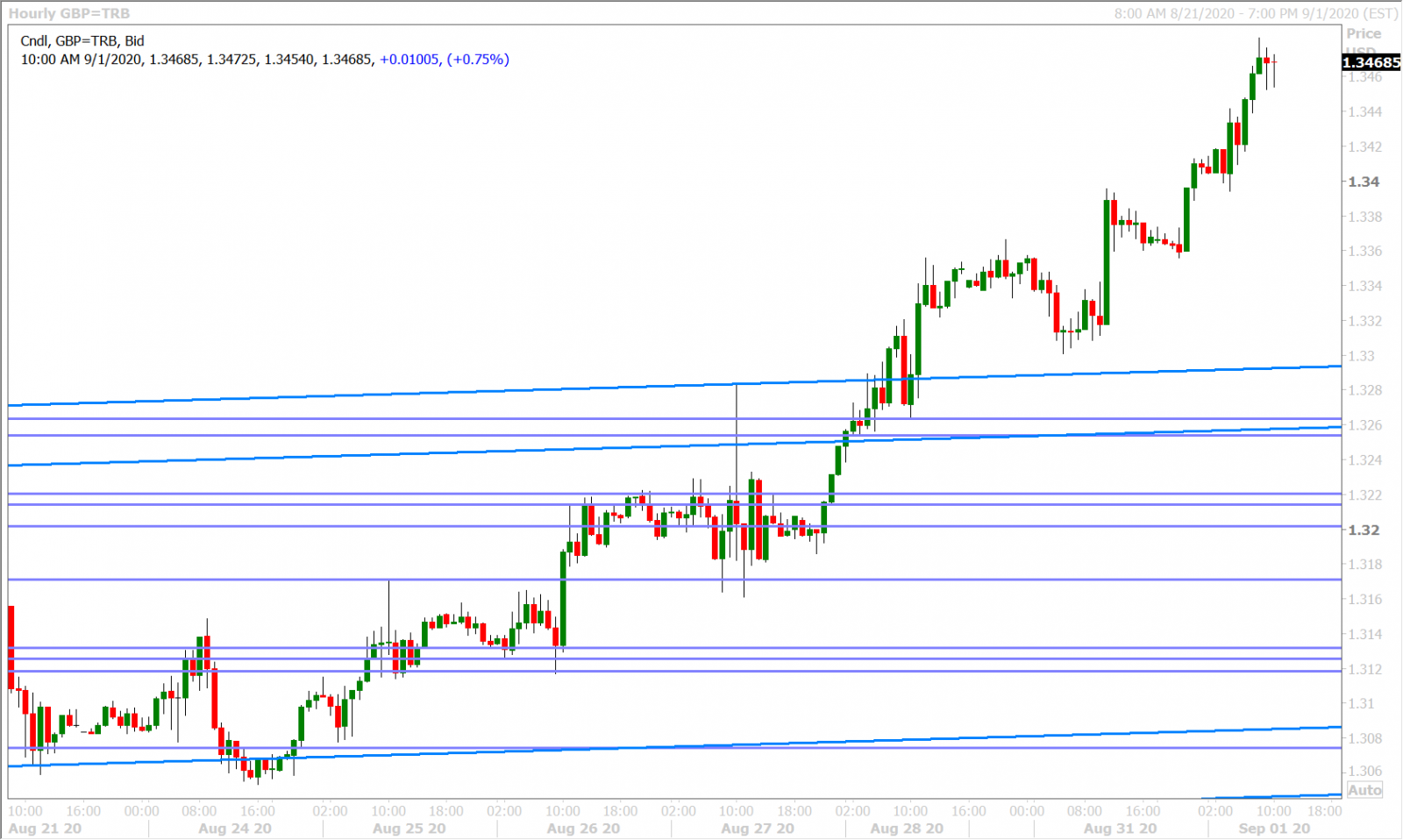

GBPUSD

Sterling is ripping higher towards its December 2019 highs in the low 1.35s this morning as a lack of meaningful chart resistance simply allows for it in the context of broad USD selling. It’s quite remarkable how last Tuesday’s arguably “phony” US/China phone call rescued this market and we’re now trading higher over 400pts higher on a combination of month-end USD selling and uber Fed dovishness post Jackson Hole.

We felt BOE Governor Bailey added a little fuel to the fire on Friday when he didn’t express any serious interest in negative UK rate policy. He’s due to speak again tomorrow at 9amET, in front of the parliament’s Treasury Select Committee.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

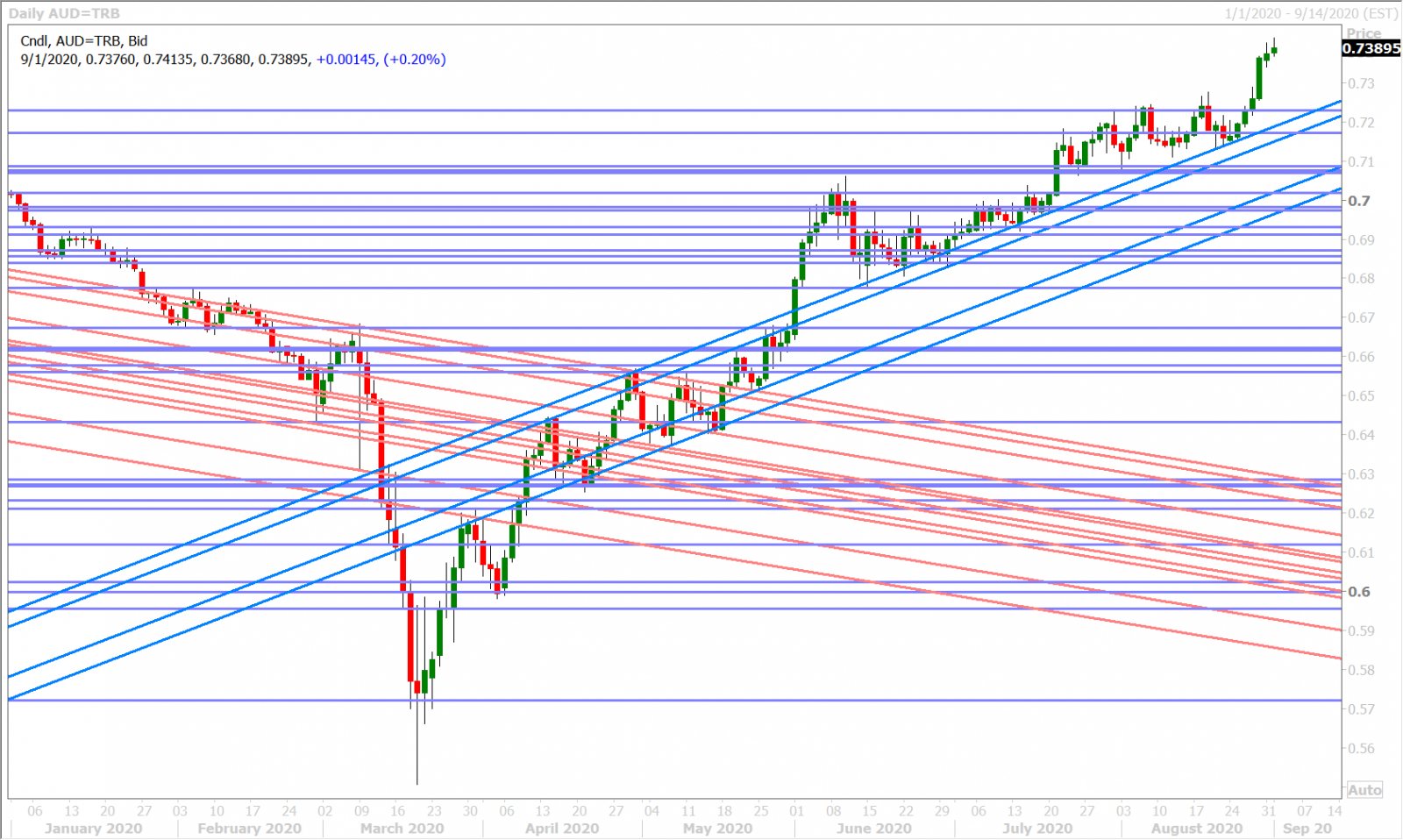

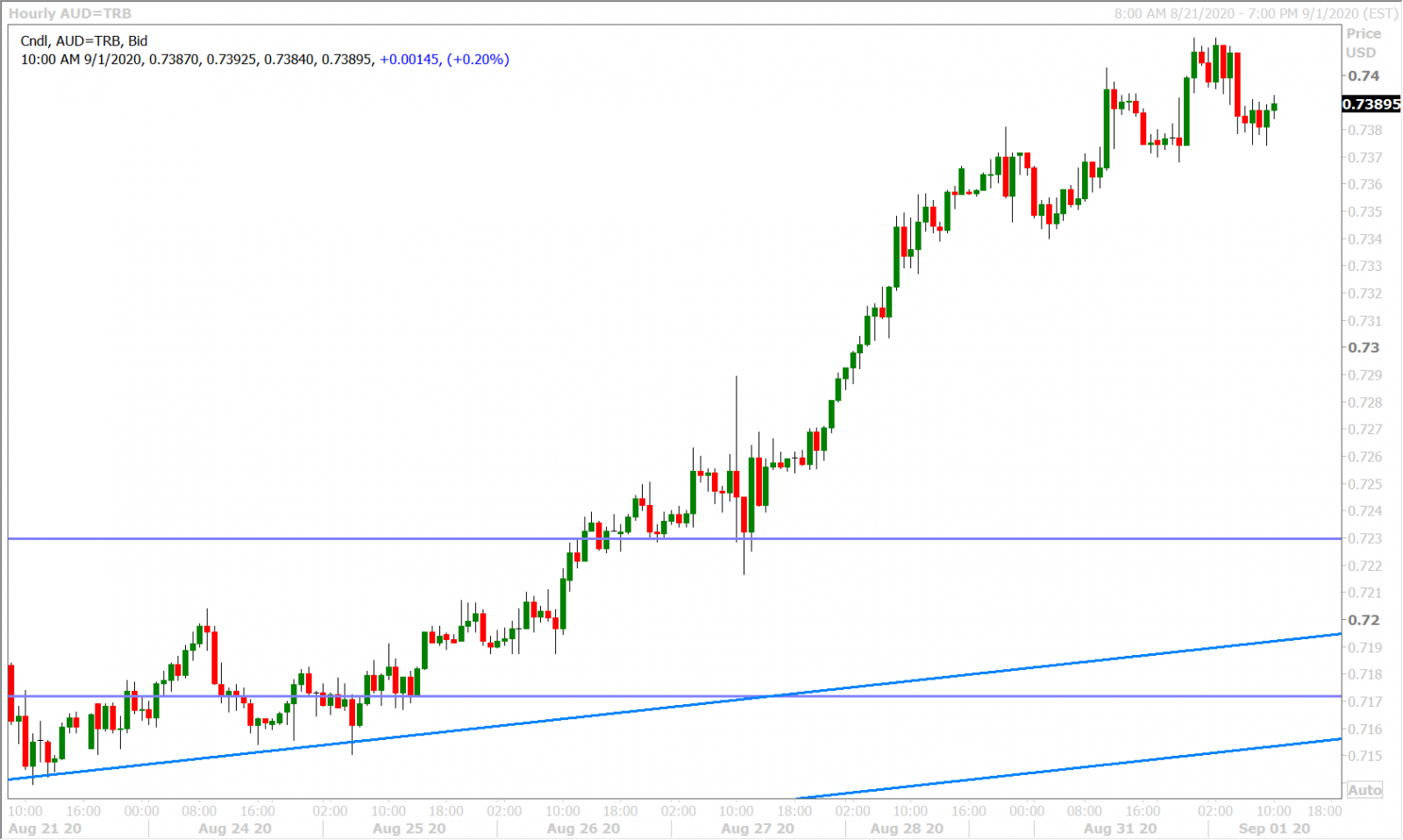

AUDUSD

The Reserve Bank of Australia kept its overnight cash rate and 3yr bond yield targets in place last night and, while it increased the size of its term funding facility for banks, this was really not all that surprising in the context of the open-ended support other central banks are offering in their local repo/money markets.

The Australian dollar followed the Chinese yuan higher in Asia last night, largely brushed off the uneventful RBA meeting and now seems to be pulling back mildly with EURUSD this morning. Traders are looking for -6.0% QoQ in tonight’s Q2 Australian GDP report, which comes out at 7:30pmET, however this “old news” should be a non-event as well for the market.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

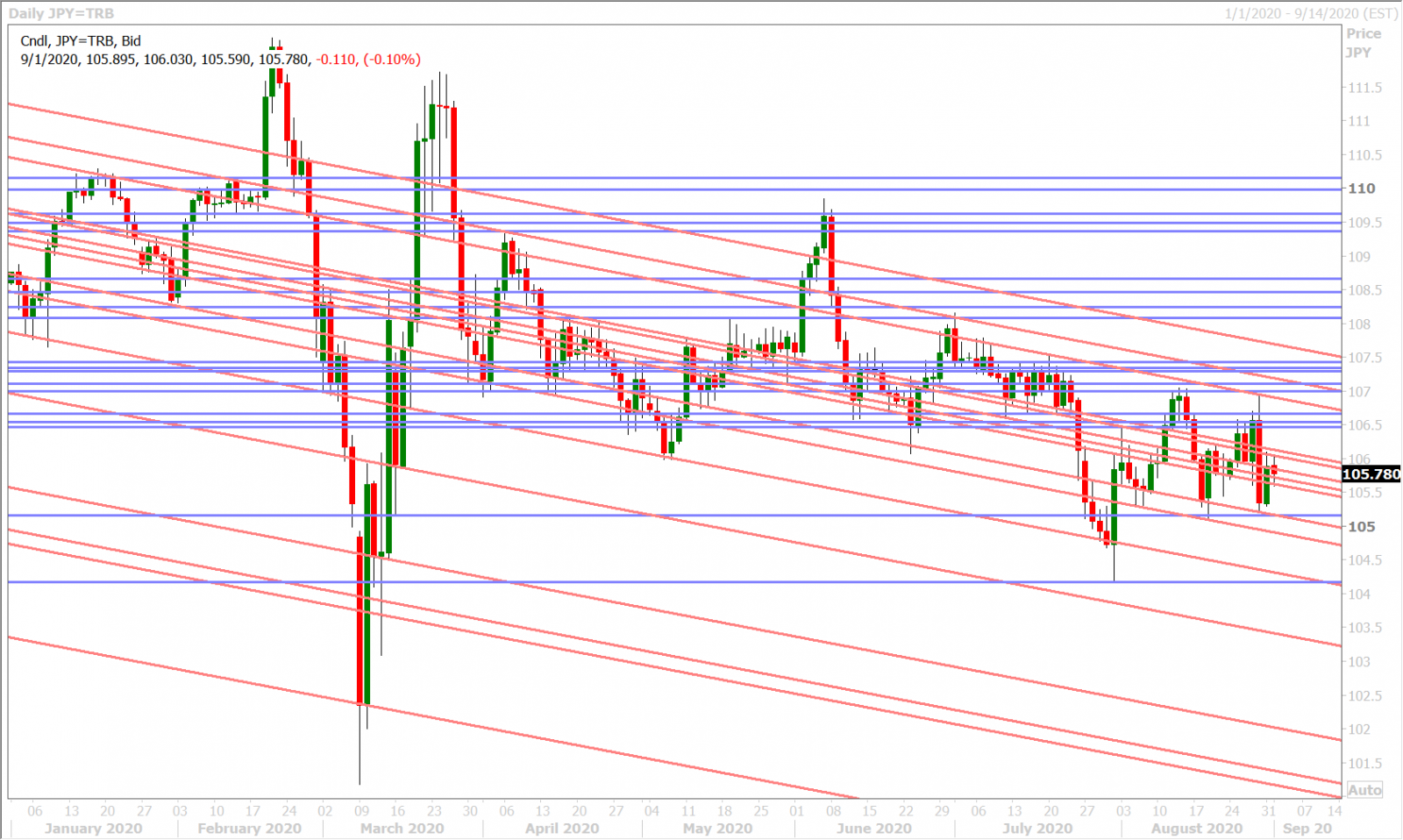

There was growing talk overnight that Shinzo Abe’s right hand man, the "Abenomics"- friendly chief cabinet secretary Yoshihide Suga, is now favored to become the next Japanese prime minister when the LDP party chooses its new leader on September 14, and we think this partly explains the “buy-the-dip” mentality we’ve seen in USDJPY overnight. It was hard for the market to avoid the broad USD selling we saw after the Caixan PMI was released but we get the sense now that traders are developing narratives that argue for a reversal of last Friday’s over-reaction to the downside in USDJPY.

Yesterday’s failure on the part of buyers to get the market back above the 106.10s was technically disappointing though, and so we think these USDJPY dip buyers are going to want to see a stronger than expected US ISM report this morning.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com