Hedging and FX risk management solutions help your business manage and mitigate volatility in the foreign exchange market. We understand participating in the global market on any scale can bring great opportunities, while also introducing unique foreign exchange exposure. Whether purchasing machinery from vendors, selling parts to clients, or paying rent across borders, currency exchange rates can create uncertainty on your bottom line.

It is critical to devise a risk management plan that mitigates FX volatility risk by stabilizing cash flows and protecting budgeted rates. Foreign currency hedging can be likened to an insurance policy that protects against the impact of foreign exchange risk.

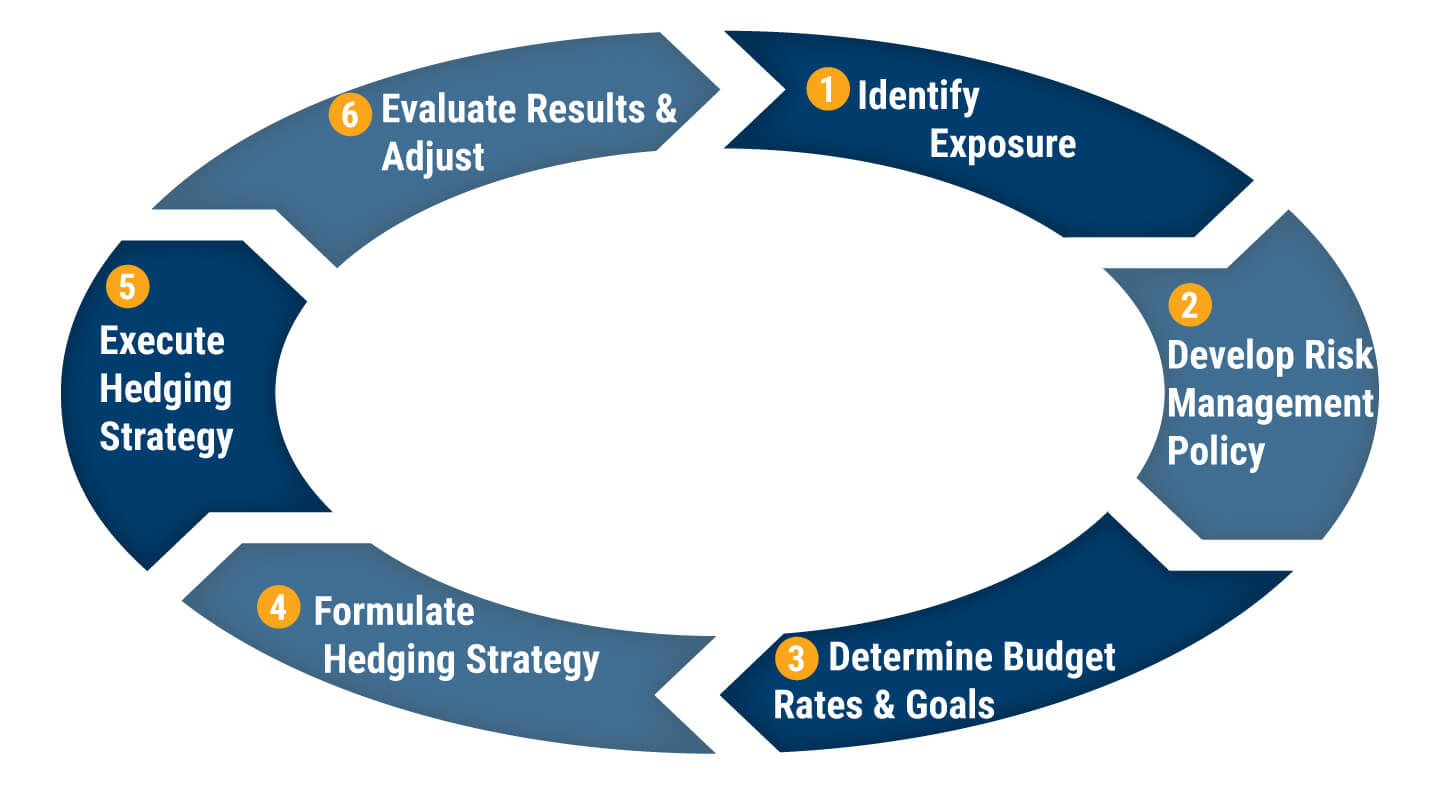

Develop your FX hedging process

Having a strategy to handle your FX risk starts with identifying your exposure. From there establishing a policy and determining your budget exchange rates and target goals can inform you when to act and under what market conditions. Here's a list of top concerns that could help you identify if FX forwards is right for your business.

- Managing against FX market volatility

- Ensuring profit margins

- Protecting balance sheets

- Enhancing cash flow

- Mitigating foreign exchange exposure

- Improving company positioning in international markets

- Affirming competitive pricing

Determine the right tools to hedge currencies

When you approach your currency hedging strategy, determining which tools such as - Fixed-Dated Forwards, Open-Dated Forwards, FX Swaps, and FX Spot Payments - should be deployed is important. Learn the difference between some of the tools you can use below.

Fixed-Dated Forwards

Open-Dated Forwards

FX Swaps

FX Spot Payments

Why CXI's FX Forwards in your hedging strategy?

Forward contracts often form the backbone of foreign exchange hedging strategies for both large corporations and small

businesses alike. Simply put, a forward contract allows you to lock in today’s rate, for settlement at a future point in time.

A trusted international bank group

FX risk strategies built for a volatile market

FX Expertise

A team that provides a strong FX strategy. Featured in major news publications such as CNBC, Reuters, MSN, and Yahoo Finance.

Dedicated Specialists

One-on-one support with trusted FX experts who proactively monitor and advise on relevant market conditions.

Customized Strategies

Choose from a variety of hedging tools: Fixed-Dated Forwards, Open-Dated Forwards, FX Swaps, or FX Spot Payments.

Digital Tools

Explore an intuitive, innovative, and secure FX trading platform, accessible 24/7.

FX Trading Desk

Get an FX focused specialist who delivers custom-fit strategies using our FX expertise.

Extension of Your Team

Help your treasury team better analyze the results and impacts of FX to build a program that best fits your business.

0 +

Direct relationships

0 +

Indirect relationships

0 +

Active software users

Testimonials

The Evolution of Hedging and Risk Management for Treasurers

Corporate Treasury Groups have evolved in the last 15 years from a less defined extension of Finance to the core of an organization’s financial risk management central nervous system.

Read More